Smart Hospitals Market Size, Share, Trends and Forecast by Component, Product, Service Offered, Connectivity, Technology, Application, and Region, 2025-2033

Smart Hospitals Market Size and Share:

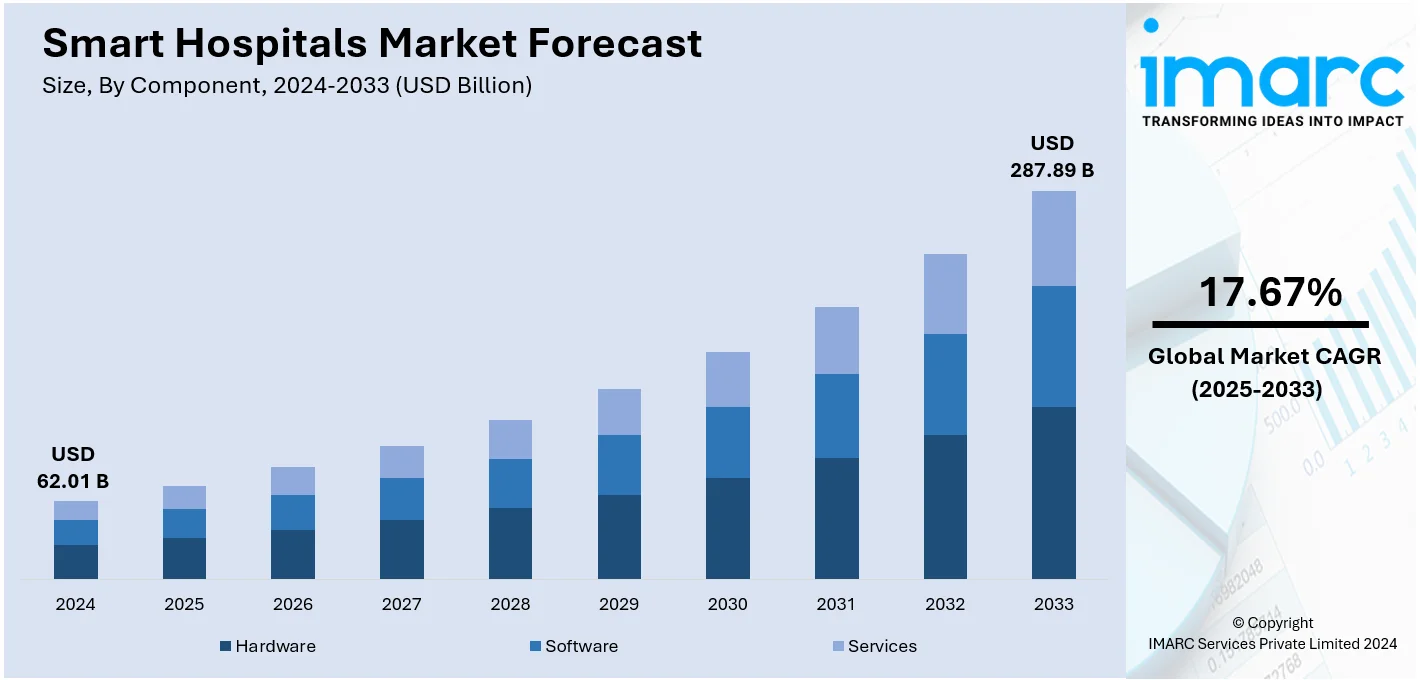

The global smart hospitals market size was valued at USD 62.01 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 287.89 Billion by 2033, exhibiting a CAGR of 17.67% during 2025-2033. North America currently dominates the market, holding a significant market share of over 35.8% in 2024. The increasing adoption of cloud computing and big data analytics, rising incidences of chronic diseases, and extensive research and development (R&D) activities by key players are some of the major factors propelling the smart hospital market share in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 62.01 Billion |

| Market Forecast in 2033 | USD 287.89 Billion |

| Market Growth Rate (2025-2033) | 17.67% |

Government initiatives and investments are building an ecosystem that encourages digital transformation in healthcare. Governments around the world are committing large sums of money, enacting policies, and forming partnerships to encourage the adoption of advanced technologies like artificial intelligence (AI), Internet of Things (IoT), and telemedicine in healthcare infrastructure. Regulatory frameworks and incentive programs are important drivers. Governments are directly investing in research and development (R&D) to improve smart hospital technology. Public-private partnerships (PPP) are encouraged to bring innovations of robotic surgeries, remote monitoring devices, and AI-based diagnostics into routine healthcare. Moreover, grants and subsidies help the smaller healthcare providers cross the high entry barriers of implementing smart technologies.

The emphasis on patient-centered care is a major factor influencing the United States market by transforming healthcare services to prioritize personalized, accessible, and effective treatment. As patient expectations for tailored services and convenience rise, hospitals are implementing cutting-edge technologies to improve patient experiences and results. Patient-focused care highlights the importance of proactive and preventive health measures. Smart hospitals in the US utilize wearable technology and remote monitoring systems to observe patients' vital signs in real time, facilitating early identification of health problems and prompt actions. Telemedicine platforms enhance this approach by enabling patients to meet with doctors from home, minimizing travel and waiting periods. For instance, in March 2024, Ringgold officially commenced the building of its new smart hospital in Battlefield Parkway (Georgia), incorporating advanced technology to improve healthcare services. The facility seeks to enhance patient care and enhance operational efficiency via the usage of digital tools and creative solutions.

Smart Hospitals Market Trends:

Rapid Technological Advancements and Digital Health Adoption

The market is driven by swift technological progress and the extensive utilization of digital health solutions. The combination of IoT devices, telehealth systems, electronic health records (EHR), and AI analytics transforms healthcare delivery. IoT devices facilitate immediate patient tracking and data gathering, improving diagnostic precision and treatment efficacy. Telehealth platforms enable virtual consultations, allowing healthcare providers to connect with patients from a distance, particularly in underserved regions. Based on a survey carried out by the United States Department of Health and Human Services, the highest percentages of telehealth visits were seen in individuals covered by Medicaid (28.3%) and Medicare (26.8%), as well as those whose income was below $25,000 (26.4%). EHR systems simplify the management of patient information, offering easy access to medical records and facilitating clinical decision-making. AI-powered analytics reveal trends in large datasets and facilitate predictive diagnostics and proactive patient management. These technologies work together to enable smart hospitals to deliver effective, data-informed healthcare services, enhancing resource distribution and improving patient results.

Rising Demand for Remote Patient Monitoring and Telehealth Services

Smart hospitals market forecast indicates a trajectory of continued growth, propelled by the escalating demand for telehealth and remote patient monitoring services, which are integral to enhancing healthcare delivery and patient management in smart hospital settings. The market is undergoing significant growth based on the expanding demand for telehealth services, as well as remote patient monitoring. According to the IMARC Group, in 2024, the market for remote patient monitoring reached approximately USD 1.7 Billion. The pandemic outbreak amplified the need to access healthcare through distance, bringing about a great surge in demand for telehealth solutions. Smart hospitals play an important role in this shift with remote patient monitoring platforms. For instance, by wearing wearable devices, patients can get their vital signs monitored so that the clinician can take early intervention once deterioration signs show up. Through telehealth, virtual consultations take place, cutting down on a physical visit or even hospital stays, saving healthcare cost while increasing convenience for patients. This demand further drives the development of smart hospital infrastructure to support seamless and secure remote healthcare delivery.

Increasing Focus on Healthcare Efficiency and Patient Experience

Smart hospitals prioritize healthcare efficiency and patient-centric experiences through data-driven strategies. Real-time data analysis and predictive analytics optimize resource allocation, reducing waiting times, and enhancing staff productivity. Patient experiences are improved through personalized care plans based on individual health data and preferences. The integration of technology streamlines administrative processes, from appointment scheduling to billing, reducing administrative burdens on both patients and healthcare staff. Reduced hospital stays, timely interventions, and enhanced communication between patients and healthcare providers lead to improved outcomes and patient satisfaction. Smart hospitals leverage data-driven insights to implement continuous quality improvement initiatives, ensuring that patient care remains at the forefront, thereby propelling the smart hospitals market growth.

Smart Hospitals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global breast implant market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, product, service offered, connectivity, technology, application, and region.

Analysis by Component:

- Hardware

- Stationary Medical Devices

- Implanted Medical Devices

- Wearable External Medical Devices

- Others

- Software

- Services

- Professional Services

- Managed Services

Services play a critical role in deploying, maintaining, and optimizing advanced healthcare systems. Smart hospitals, as they integrate IoT, AI, and robotics, require specialized services such as installation, system integration, and regular maintenance. Other managed services such as cloud management, cybersecurity, and data analytics ensure seamless operation and compliance with regulations. With the expansion of telemedicine, wearable devices, and smart diagnostics, even consulting services come into demand. These services not only guide a hospital in taking up technology for adoption and redrawing workflow systems but also maximize the efficacy and efficiency levels of investments brought in by providers. The massive cost of deploying smart hospital infrastructures also gives rise to relying on professional services to reduce time and address operational challenges at hand. Hence, the services segment continues to play a central role in making possible the transition toward and the sustainability of smart healthcare environments.

Analysis by Product:

- mHealth

- Telemedicine

- Smart Pills

- Electronic Health Record

- Others

Telemedicine stands as the largest component in 2024, holding around 35.8% of the market. Telemedicine has the largest smart hospital market share since it can revolutionize the delivery of care through remote and accessible services. In addition, the rapidly growing cases of chronic diseases and an increasingly aging population are raising the demand for telemedicine in facilitating regular checkups. Its popularity soared during the COVID-19 pandemic as safe alternatives to direct in-person interactions between patients and hospitals emerged. Telemedicine reduces the load on the hospital infrastructure as consultation services are performed virtually. The operational cost and the efficiency are thereby improved. Besides, the digital communication technologies, such as speed internet and mobile connectivity are increasing the feasibility and effectiveness of telemedicine. Hospitals are integrating telemedicine into their workflow in a way to reach distant and underserved locations. Telemedicine is also becoming important for mental health services and post-discharge follow-up. It, therefore, maximizes patient satisfaction and outcomes.

Analysis by Service Offered:

- General Services

- Specialty

- Super Specialty

General services dominate the market owing to their comprehensive nature and broad applicability in various healthcare settings. These services include cleaning, catering, security, and administrative support that are essential for the day-to-day functioning of hospitals. As smart hospitals implement advanced technologies, general services also evolve to support these systems, ensuring operational efficiency. For instance, automated cleaning and maintenance systems are integrated into hospital workflows, reducing manual effort while maintaining high standards of hygiene. Additionally, administrative support services like patient admission, discharge processes, and billing, leverage automation and data analytics to enhance accuracy and streamline operations. The demand for reliable security systems, including smart surveillance and access control, further improves the general services segment. Hospitals prioritize these services to improve patient safety and satisfaction, creating a robust market for their development and implementation.

Analysis by Connectivity:

- Wireless

- Wi-Fi

- Radio Frequency Identification (RFID)

- Bluetooth

- Zigbee

- Near Field Communication (NFC)

- Others

- Wired

The most preferred mode of connectivity in the market is wireless because of its flexibility, scalability, and the wide variety of smart devices that can be supported. The connection of IoT devices, wearables, sensors, and mobile applications through a wireless network ensures smooth data exchange and real-time communication in hospitals. It saves installation costs by removing extensive physical infrastructure, which adds to operational efficiency. As healthcare systems implement telemedicine, remote monitoring and mobile health solutions into the healthcare delivery chain, continuous and trustworthy data communication is becoming a critical aspect in wireless connectivity. Advanced wireless technologies like Wi-Fi 6 and 5G provide high-speed, low-latency connectivity, ideal for time-sensitive applications that involve remote surgeries and real-time diagnostics. They also support large-scale data processing required by electronic health records and analytics, which form the backbone of smart hospital operations.

Analysis by Technology:

- Artificial Intelligence

- Internet of Things

- Cloud Computing

- Big Data

- Others

AI plays a crucial role in the market by enabling advanced diagnostics, predictive analytics, and personalized treatment plans. Machine learning algorithms process vast amounts of data to identify patterns, aiding in early disease detection and improving decision-making. AI-powered tools like chatbots streamline administrative tasks, while robotic systems enhance surgical precision. Its integration into healthcare reduces errors, optimizes resource allocation, and enhances patient care quality, driving significant adoption in smart hospitals.

IoT is a cornerstone of smart hospitals, connecting medical devices, sensors, and systems to provide real-time monitoring and data sharing. IoT-enabled wearables track patient vitals continuously, allowing timely interventions. It improves operational efficiency by automating tasks, which include equipment tracking and inventory management.

Cloud computing underpins the data management capabilities of smart hospitals, offering secure storage, easy access, and scalability. It supports the integration of EHRs, telemedicine platforms, and analytics tools, enabling healthcare providers to collaborate efficiently. Cloud solutions reduce infrastructure costs and support disaster recovery, ensuring uninterrupted operations.

Big data analytics empowers smart hospitals to obtain actionable insights from vast datasets, thereby enhancing decision-making and care delivery. By analyzing patient histories, hospital performance metrics, and population health trends, hospitals can predict demand, reduce readmissions, and enhance personalized care. Big data also supports research and innovation, enabling the development of new treatments and optimizing healthcare resources.

Analysis by Application:

- Remote Medicine Management

- Electronic Health Record & Clinical Workflow

- Outpatient Vigilance

- Medical Connected Imaging

- Medical Assistance

- Others

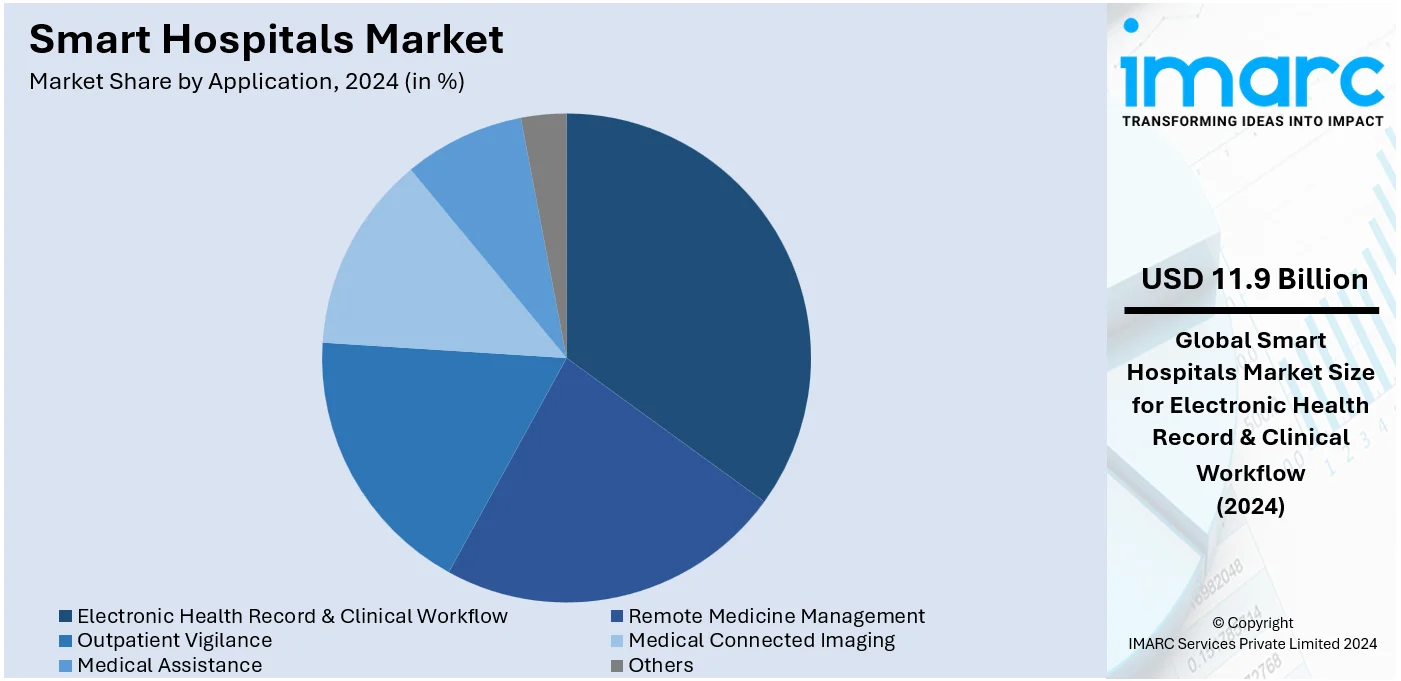

In 2024, Electronic Health Record (EHR) and Clinical Workflow solutions represent the biggest segment, accounting for approximately 19.2% of the market. Electronic Health Record (EHR) and Clinical Workflow solutions lead the market as they play a crucial role in enhancing efficiency, patient care, and decision-making. EHR systems consolidate patient information by offering immediate access to medical records, test outcomes, and treatment strategies for healthcare providers. This ability greatly minimizes mistakes and duplications, enhancing clinical processes. Advanced hospitals merge EHR systems with cutting-edge technologies, such as AI, IoT, and data analytics, facilitating predictive insights and tailored treatment strategies. Automated clinical workflows improve efficiency by optimizing resource distribution, minimizing administrative workload, and facilitating smooth collaboration between departments. This integration enhances adherence to regulatory standards by guaranteeing precise record-keeping and reporting. EHRs facilitate interoperability, enabling data sharing among various healthcare providers, which is important for maintaining continuity of care.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Others

In 2024, North America remains the biggest segment, capturing approximately 35.8% of the market. North America commands the largest portion of the market owing to its sophisticated healthcare infrastructure and significant investment in healthcare IT. The area's focus on embracing advanced technologies, such as EHR, telemedicine, and IoT devices, has resulted in the swift incorporation of intelligent hospital solutions. Policies and initiatives from the government that promote healthcare digitization and interoperability enhance the adoption of these technologies. Additionally, the rising need for enhanced patient outcomes, efficient operations, and affordable healthcare models in North America drives the adoption of smart hospital solutions. They improve decision-making based on data, tailored patient care, and distance monitoring. Consequently, North America's advancement in adopting cutting-edge healthcare technologies supports the expansion of smart hospitals in the area. In July 2024, AGFA HealthCare and Corista introduced a unified solution for digital pathology in North America. The platform employs Corista's DP3 system to enhance digital workflows, improving efficiency, teamwork, and data management.

Key Regional Takeaways:

United States Smart Hospitals Market Analysis

The United States hold 80.00% of the market share in North America. The United States is experiencing notable growth in the use of smart hospital technologies, fueled by progress in digital healthcare and heightened investments in infrastructure. As healthcare expenses hit USD 4.9 Trillion in 2023, the U.S. stands at the leading edge of adopting intelligent hospital technologies. The combination of IoT, AI, and big data analytics in hospitals improves patient care, streamlines hospital administration, and lowers operational expenses. Government incentives and the transition to value-based care are motivating hospitals to implement smart technologies to enhance diagnostics, optimize workflows, and customize treatments. The increasing elderly population and the demand for effective healthcare management drive the uptake of smart hospital solutions. Additionally, the growing emphasis on bolstering patient safety, minimizing medical mistakes, and elevating the overall quality of care are essential factors in the US market.

Asia Pacific Smart Hospitals Market Analysis

The swift growth of healthcare facilities in the Asia Pacific area is a major factor favoring the smart hospitals market outlook. Nations, such as India, China, and Japan are progressively embracing advanced healthcare technologies because of the rising need for healthcare services. The area is witnessing substantial growth in the number of hospitals, as India is projected to rise from 43,500 hospitals in 2019 to 54,000 by 2024. This growth heightens the demand for intelligent hospital solutions to oversee extensive healthcare systems more effectively. Moreover, advancements in telemedicine, artificial intelligence, and patient monitoring tools are elevating healthcare service delivery, refining diagnostics, and streamlining resource management. Government programs and collaborations between the public and private sectors focused on upgrading healthcare infrastructure are increasingly driving the integration of smart hospital technologies across the region. The increasing emphasis on enhancing healthcare access and tackling the difficulties associated with a rising population also bolsters market growth. Furthermore, the increasing focus on medical tourism is prompting facilities to implement advanced infrastructure, such as automated logistics and digital twin technology to enhance patient outcomes. As per the PIB, the count of medical tourists who visited India in 2020 was 1.83 Lakhs, whereas in 2021, it reached 3.04 Lakhs.

Europe Smart Hospitals Market Analysis

Hospitals in Europe are actively implementing augmented reality (AR) and virtual reality (VR) solutions for advanced surgical training and therapy. This is providing an impetus to the market growth. In addition to this, the region is seeing an increase in cross-border collaborations for interoperable EHR systems to facilitate seamless patient care. Moreover, energy-efficient infrastructure is being prioritized, with smart lighting and HVAC systems ensuring sustainability compliance. This, in turn, is impelling the market growth. Furthermore, the widespread adoption of 5G is enhancing real-time data exchange between hospital departments, enabling faster clinical decision-making. According to the government of UK, the government’s target is for “all populated areas” in the UK, which includes rural communities, to have standalone 5G coverage by 2030. Also, hospitals are deploying robotic assistants for non-clinical tasks such as sterilization and supply chain management. Owing to this, the market growth is augmenting. European nations are providing grants for AI-driven research in hospital diagnostics, which is accelerating the pace of technology adoption.

Latin America Smart Hospitals Market Analysis

In Latin America, the adoption of smart hospital technologies is driven by the growing demand for efficient healthcare solutions, particularly in countries like Brazil and Mexico. With Brazil allocating 9.47% of its GDP to healthcare and over 62% of its hospitals being privately operated, there is a substantial push for digital transformation in the healthcare sector. The integration of Electronic Medical Records (EMRs) and the adoption of mobile health applications are enhancing patient data collection, leading to better diagnostics and personalized treatments. In addition, the need to improve healthcare accessibility, especially in rural and underserved areas, is catalyzing the smart hospitals market demand in the region.

Middle East and Africa Smart Hospitals Market Analysis

Hospitals in the Middle East are investing in advanced HVAC systems integrated with AI for maintaining optimal infection control environments. This, in turn, is impelling the market growth. Moreover, the adoption of hospital-wide RFID tracking systems is enabling better resource allocation and reducing equipment loss. This is providing an impetus to the market growth. Additionally, high investments in telemedicine are enhancing access to specialized care, particularly in rural and underserved regions. According to IMARC reports, the GCC telemedicine market size reached USD 1.7 Million in 2024.

Competitive Landscape:

Key players are driving the market through innovation, strategic partnerships, and investments in advanced technologies. They are focused on developing cutting-edge solutions like AI and IoT-enabled devices, alongside robotic systems and integrated healthcare platforms, to meet the changing demands of modern healthcare. Through their R&D efforts, they enhance the functionality and accuracy of smart hospital technologies. Collaboration with service providers and technology companies allows these players to scale their offerings and implement large-scale smart hospital projects. In April 2024, GE HealthCare Inc., LG Electronics, and Microsoft partnered to launch a smart hospital project in South Korea. It aims to combine state-of-the-art medical equipment with AI and cloud technology to improve health outcomes by streamlining healthcare. Many key players also offer end-to-end solutions including consulting, implementation, and maintenance services, ensuring seamless integration and operation of smart systems within healthcare facilities. Key contributors influence market dynamics by setting standards for data security, interoperability, and compliance with regulatory frameworks. Their efforts in promoting education and training for medical professionals and administrators also contribute to the smooth adoption of these technologies.

The report provides a comprehensive analysis of the competitive landscape in the keyword market with detailed profiles of all major companies, including:

- Adheretech Inc.

- Capsule Technologies, Inc. (Francisco Partners)

- Cerner Corporation

- GE Healthcare Inc. (General Electric Company)

- Intel Corporation

- Koninklijke Philips N.V.

- McKesson Corporation

- Medtronic, Inc. (Medtronic Public Limited Company)

- Microsoft Corporation

- SAP SE

- Siemens Healthineers AG (Siemens Aktiengesellschaft)

- STANLEY Healthcare (Stanley Black & Decker Inc.)

Latest News and Developments:

- December 2024: The Indian Medical Association (IMA) introduced the "IMA AMR Smart Hospital" certification program to address antimicrobial resistance (AMR). The program promotes advanced Antimicrobial Stewardship (AMS) and Infection Prevention and Control (IPC) strategies in hospitals, with four facilities already certified during the pilot phase.

- November 2024: The Alliance for Smart Healthcare Excellence was launched to accelerate the adoption of smart hospital technologies through the Smart Hospital Maturity Model (SHMM). The nonprofit organization promotes collaboration among healthcare providers and industry leaders to optimize care delivery and operations. Preliminary insights from the SHMM survey have already assessed the technological readiness of over 170 hospitals.

- November 2024: Sancheti Advanced Orthocare Hospital in Pune launched the city’s first AI-powered "Smart Ward" equipped with Dozee’s Remote Monitoring System and Early Warning System. The technology enables contactless tracking of vital signs and predicts patient deterioration up to 16 hours in advance, enhancing safety and outcomes. This initiative reflects a shift toward proactive and innovative healthcare.

- October 2024: South Korea's Ministry of Health and Welfare announced AI-driven smart emergency system projects, including regional patient transfer systems, under the ARPA-H initiative. These projects, part of a 1.2 trillion won ($830 million) funding plan, aim to enhance healthcare efficiency and innovation. Additional initiatives include updates to Korea's My Health Record app and advancements in digital health alliances in Hong Kong and Thailand.

- April 2024: LG Electronics, GE Healthcare Korea, and Microsoft Korea entered into an MOU to collaboratively create and enhance smart hospitals. This collaboration aims to provide advanced digital medical devices, solutions, and cloud systems, driving innovation in healthcare.

- April 2024: Healthgrate is set to launch smart hospitals across India. This is a monumental step towards revolutionizing healthcare delivery in India. Moreover, this will also solve common issues such as overcrowding.

Smart Hospitals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Products Covered | mHealth, Telemedicine, Smart Pills, Electronic Health Record, Others |

| Services Offered Covered | General Services, Specialty, Super Specialty |

| Connectivities Covered |

|

| Technologies Covered | Artificial Intelligence, Internet of Things, Cloud Computing, Big Data, Others |

| Applications Covered | Remote Medicine Management, Electronic Health Record & Clinical Workflow, Outpatient Vigilance, Medical Connected Imaging, Medical Assistance, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Turkey, Saudi Arabia |

| Companies Covered | Adheretech Inc., Capsule Technologies, Inc. (Francisco Partners), Cerner Corporation, GE Healthcare Inc. (General Electric Company), Intel Corporation, Koninklijke Philips N.V. , McKesson Corporation, Medtronic, Inc.(Medtronic Public Limited Company), Microsoft Corporation, SAP SE, Siemens Healthineers AG (Siemens Aktiengesellschaft), STANLEY Healthcare (Stanley Black & Decker Inc.) etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart hospitals market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global smart hospitals market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart hospitals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart hospitals market was valued at USD 62.01 Billion in 2024.

IMARC estimates the global smart hospitals market to exhibit a CAGR of 17.67% during 2025-2033.

The global market is driven by advancements in healthcare technologies like AI, IoT, and robotics, which improve efficiency and patient outcomes. Increasing demand for remote healthcare solutions, such as telemedicine, has surged with the rise of chronic diseases and aging populations. Government initiatives promoting digital healthcare transformation, such as funding for smart infrastructure and EHR adoption, play a significant role. Additionally, growing investments in automation and data-driven healthcare systems enable real-time monitoring and predictive analytics.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global home healthcare market include Adheretech Inc., Capsule Technologies, Inc. (Francisco Partners), Cerner Corporation, GE Healthcare Inc. (General Electric Company), Intel Corporation, Koninklijke Philips N.V., McKesson Corporation, Medtronic, Inc. (Medtronic Public Limited Company), Microsoft Corporation, SAP SE, Siemens Healthineers AG (Siemens Aktiengesellschaft), STANLEY Healthcare (Stanley Black & Decker Inc.) etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)