Smart Lock Market Size, Share, Trends and Forecast by Lock Type, Communication Protocol, End-User, and Region, 2025-2033

Smart Lock Market Size, Share Analysis & Industry Forecast:

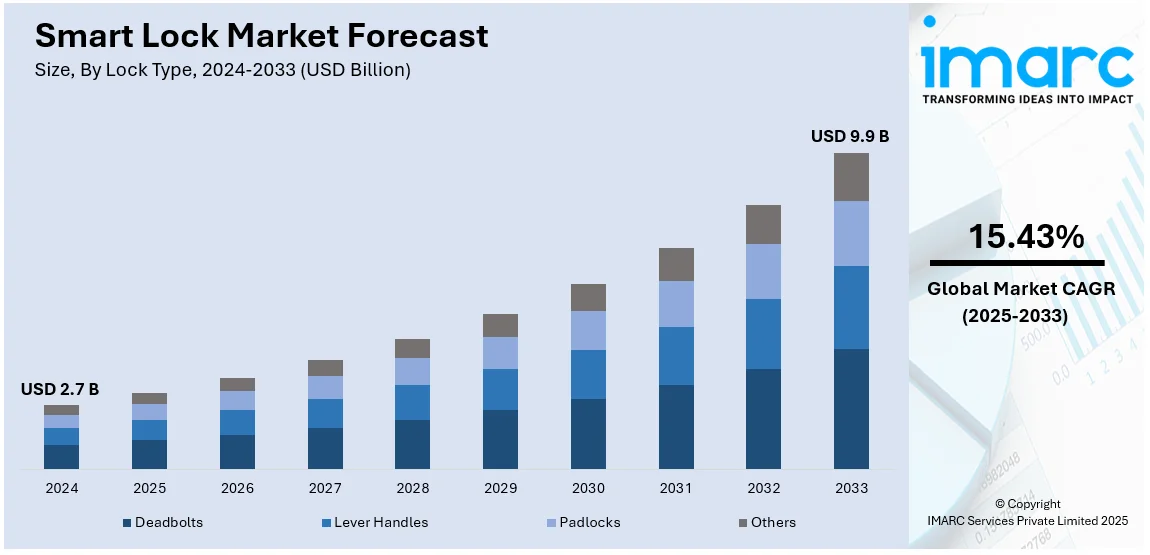

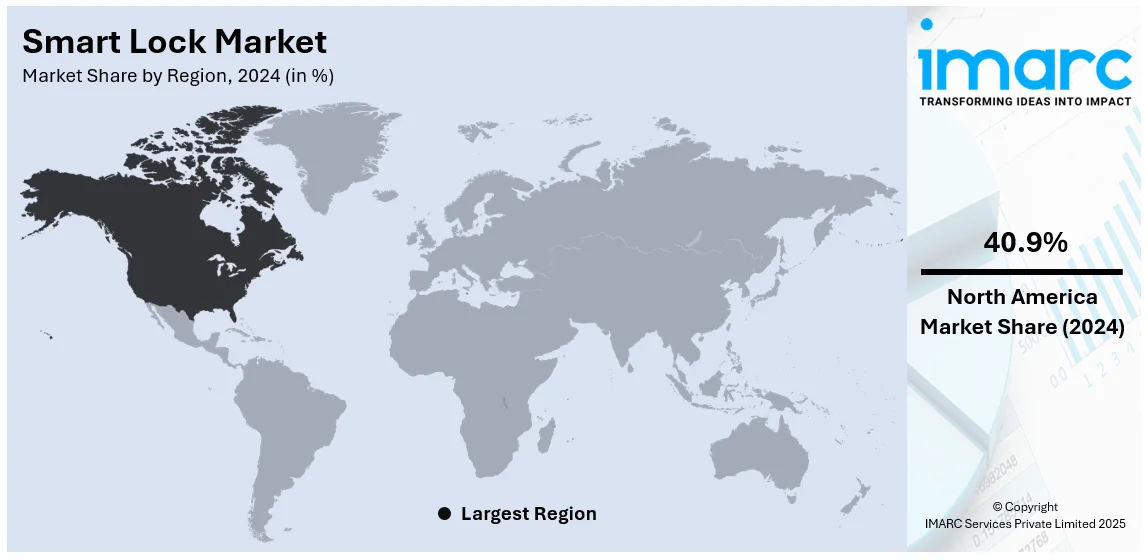

The global smart lock market size was valued at USD 2.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.9 Billion by 2033, exhibiting a CAGR of 15.43% during 2025-2033. North America currently dominates the market, holding a significant market share of over 40.9% in 2024. The smart lock market share is primarily driven by growing concerns regarding safety, increasing consumer awareness about the benefits provided by smart locks, rising integration with smart home systems across the globe, and continual technological advancements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.7 Billion |

|

Market Forecast in 2033

|

USD 9.9 Billion |

| Market Growth Rate (2025-2033) | 15.43% |

The global smart lock market growth is primarily driven by the rising demand for enhanced security and convenience in both residential and commercial properties. The increasing adoption of smart homes and the integration of Internet of Things (IoT) technologies are also significantly boosting market growth. According to the IMARC Group, the global Internet of Things (IoT) market size reached USD 1,022.6 Billion in 2024 and is projected to reach USD 3,486.8 Billion by 2033, exhibiting a CAGR of 14.6% during 2025-2033. Additionally, rising concerns over security breaches and thefts are prompting consumers to seek advanced locking systems. The widespread use of smartphones and mobile apps for remote access is also propelling the demand for smart locks.

To get more information on this market, Request Sample

The United States has emerged as a key regional market for smart locks, driven by the increasing demand for home automation and smart security systems. The rise in security concerns and the desire for enhanced convenience are encouraging homeowners and businesses to adopt smart locks. Additionally, advancements in technologies such as biometrics, voice recognition, and artificial intelligence are also enhancing the functionality of smart locks. As per a report published by the IMARC Group, the United States artificial intelligence market is forecasted to reach USD 97,084.2 Million by 2032, exhibiting a CAGR of 12.8% during 2024-2032. Besides this, the growing popularity of IoT-enabled devices and mobile apps for remote access to locks is further propelling market growth.

Smart Lock Market Trends:

Technological advancements and integration with smart home systems

The rapid rate of technological innovation is one of the major factors driving the smart lock market demand. The incorporation of numerous improved connectivity options, such as Bluetooth, Wi-Fi, and Zigbee, with other home automation systems in the smart locks is significantly supporting the market. Along with this, recent developments are allowing smart locks to integrate seamlessly with Amazon Alexa, Google Assistant, and Apple HomeKit voice-activated systems. This is offering users the convenience of remote control over locks from their smartphones and smart hubs at home. Reports indicate that in 2024, there were an estimated 4.88 Billion people globally using smartphones, representing nearly 60.42% of the world’s population. For instance, such interoperability improves user convenience and raises the perceived value of smart locks as part of a comprehensive smart home ecosystem. Moreover, advanced features such as biometric authentication, geofencing, and real-time notifications are improving both the security features and the user experience of these locks. Hence, this is attracting more customers. As these technologies become more sophisticated and pervasive, their adoption is creating a positive smart lock market outlook.

Growing concerns about security and safety

The smart lock market trends indicate that the rising concerns about home and office security are significantly propelling the demand for smart locks. Consumers across the globe are adopting smart locks over traditional locks. Most traditional locks can be picked or opened with other methodologies, but the advanced security features of smart locks are more difficult to breach. Functions such as live alerts, access logs, and remote control are empowering users to a great extent in observing and managing entry points, significantly improving the safety of residential and commercial premises. According to the India Brand Equity Foundation, India's real estate sector is expected to expand to USD 5.8 Trillion by 2047, contributing 15.5% to the GDP from an existing share of 7.3%. In addition, the ability to generate temporary or permanent virtual keys for guests, service personnel, or family members adds convenience while maintaining stringent access control. Moreover, the accelerating demand for secure and complex locking systems among consumers and businesses due to the growing crime rates and rising concerns about personal safety is supporting the market. Customer awareness about the benefits of smart locks is fostering adoption, further driving smart lock market growth.

Rising urbanization and increasing adoption of smart homes

Rapid urbanization and the increasing popularity of smart home technology are also creating a positive smart lock market outlook. Urban areas, with a high population density and more residential and commercial building populations, depict a larger demand for developed security solutions. The United Nations reports that the global population increased from about 2.5 billion in 1950 to 8.0 billion by mid-November 2022. The increasing number of individuals moving to urban centers is creating a demand for efficient and effective security measures. Apart from this, the convenience, security, and energy efficiency integrated solutions are gaining increasing consumer interest, further favoring market growth. Smart locks are another vital constituent in the smart home system that allows for seamless integration with lights, cameras, and thermostats. The ease of having the ability to monitor everything via a single interface is accelerating smart lock demand among customers who require both safety and ease of use.

Smart Lock Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart lock market, along with forecasts at the global and regional levels from 2025-2033. The market has been categorized based on lock type, communication protocol, and end-user.

Analysis by Lock Type:

- Deadbolts

- Lever Handles

- Padlocks

- Others

Deadbolts stand as the largest component in 2024, holding around 72.6% of the market. The popularity of deadbolts is supported by their enhanced security features and widespread consumer trust. Deadbolts offer optimum security against break-ins compared to traditional latch-based locks. As a result, they are highly preferred in both residential and commercial property sectors. Moreover, technological advancements in smart home integration, such as remote locking, real-time monitoring, and user access control, are driving smart deadbolt adoption. Along with this, the demand for the product is also growing as it offers the mechanical reliability expected by the ordinary consumer, combined with modern digital convenience. Furthermore, continuous innovation by manufacturers in deadbolts, including advanced functionalities such as biometric verification and voice control, meet the demand for smarter and safer home solutions. The smart lock market forecast indicates that smart deadbolts will continue to show strong growth and remain the leading lock type in the market.

Analysis by Communication Protocol:

- Bluetooth

- Wi-Fi

- Others

Bluetooth leads the market with around 60.3% of market share in 2024. Bluetooth dominates the communication protocols segment in the market as it has wide adoption and is easy to use. Bluetooth provides a reliable, low-power solution that bridges smart locks with smartphones and other devices, hence allowing remote control of locks without configuration issues or the need for always-on internet connectivity. Bluetooth is also preferred among a large consumer base due to the ease and simplicity of its use with most devices. Moreover, Bluetooth-enabled locks offer proximity-based unlocking, whereby the lock automatically disengages when the range set on the authorized user's smartphone is reached, thus enhancing convenience and security. By including seamless connectivity to other devices, including smart home devices, manufacturers further increase the popularity of the device using Bluetooth. According to the smart lock market dynamics, the low power consumption and inherently strong security protocols of Bluetooth technology are adding to its dominance in the market, making it an attractive option for both consumers and developers. Thus, Bluetooth remains the principal communication protocol in the market as a result of the rising demand for smart home technologies.

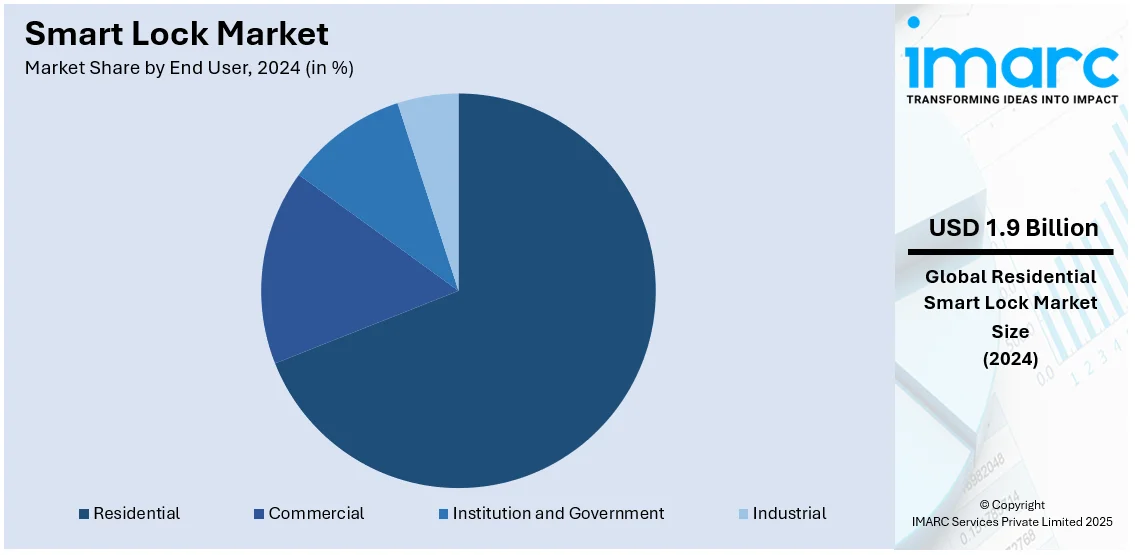

Analysis by End User:

- Commercial

- Residential

- Institution and Government

- Industrial

Residential represents the leading market segment in 2024, accounting for 69% of market share. This segment is expanding due to the growing consumer demand for higher security in homes and easier access. Increasing adoption is witnessed among homeowners, who are replacing traditional locks with smart locks, majorly due to features such as remote access, real-time monitoring, and temporary access to guests or visitors and servicemen. Along with this, the appeal of these solutions is further enhanced by their ability to be integrated into larger home automation systems, where most aspects of home security can be monitored and managed through a single interface. According to the smart lock market insights, increasing smart home adoption driven by improvements in technology and declining prices of smart devices is considerably fueling market growth in the residential sector. Additionally, smart locks provide an additional level of safety by including features such as biometric verification and personal access codes, making them particularly interesting to families and individually living customers who are concerned about their safety. Furthermore, the demand for smart locks in residential applications, with urbanization and seeking modern connected living environments, is increasing and further cementing this segment's lead in the market.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of over 40.9%. The market in this region is driven by its advanced technological infrastructure and high consumer adoptability of smart home technologies. The United States contributed considerably to this with its technology-savvy population and inclination toward home automation and security solution technologies. The North American market is highly aware of the benefits that smart locks have to offer in terms of security, convenience, and integration with other smart home devices. Besides this, the presence of major industry players, combined with continuous innovation in the development of smart lock technology, is further fueling market expansion. Robust internet connectivity and widespread usage of smartphones are also providing the perfect environment for the adoption of Bluetooth and Wi-Fi-enabled smart locks. Furthermore, growing concerns over home security, coupled with a higher disposable income, allow North American consumers to spend more readily on improved security solutions. Therefore, North America is dominating the market, supported by continuous technological development and high demand from consumers for smart home innovations.

Smart Lock Market Regional Takeaways:

United States Smart Lock Market Analysis

The development of interconnected urban ecosystems has heightened the demand for enhanced security solutions, leading to an increased focus on advanced locking systems. Urban infrastructure projects increasingly integrate connected devices for streamlined access control, fostering interest in technology-driven security innovations. According to the Cybersecurity and Infrastructure Security Agency, United States, investment in smart city technology reached USD 22 Billion in 2018 in the United States alone, with USD 80 Billion globally. Moreover, the public and private sectors are deploying systems tailored to modern residential and commercial needs, which is a catalyst for innovative locking mechanisms. High awareness about automation and robust investment in technology also facilitates the integration of advanced access control systems. Furthermore, smart locking solutions cater to sustainability goals and energy efficiency, aligning with evolving design requirements for futuristic urban environments. Integration with surveillance systems for enhanced safety also fuels growth in this segment. Besides this, multifunctional locks, equipped with remote operation and biometric authentication, are emerging as preferred options for securing urban spaces, adding to the adoption momentum.

Asia Pacific Smart Lock Market Analysis

Rising population densities and rapid expansion of metropolitan areas are fueling the need for sophisticated security solutions, propelling the demand for innovative locking systems. For instance, India’s population, growing at an unsustainable pace, is expected to exceed 1.5 billion by 2030 and reach 2 billion by 2050. Moreover, urban housing and commercial developments increasingly prioritize safety features, integrating advanced locking mechanisms. The growing middle class is also driving consumer interest in convenience-focused security technologies. Moreover, multifunctional devices, such as locks with remote control and real-time notifications, meet evolving lifestyle requirements. The shift toward vertical housing and smart apartment projects has also introduced scalable solutions that cater to densely populated urban centers. As a result, developers and facility managers are investing in networked systems that offer centralized control and seamless management. Technological advancements, paired with cost-effective production capabilities, make these systems more accessible. A preference for integrated devices that complement automation efforts has positioned advanced locking mechanisms as integral to modern infrastructure.

Europe Smart Lock Market Analysis

Expanding manufacturing hubs and logistical operations emphasize the need for secure access management, driving the adoption of sophisticated locking solutions. Industrial facilities increasingly require advanced systems to manage employee access, secure sensitive areas, and enhance operational safety. As per industry reports, manufacturing accounted for 25% of the EU’s business economy net turnover, totaling 8.3 trillion, marking a 16% rise in comparison with 2020. Moreover, high-security locking systems designed for warehouses and production floors support compliance with stringent safety standards. The focus on automating industrial processes has also encouraged the integration of remote-controlled and biometric-enabled locks. Enterprises are leveraging these systems to streamline access across multiple locations, ensuring operational efficiency. Enhanced connectivity solutions allow seamless integration with existing building management systems. Furthermore, the emphasis on energy-efficient and durable solutions aligns with sustainability goals in the industrial landscape. Besides this, innovations such as tamper alerts and advanced encryption technology bolster the appeal of these systems. Rising awareness about facility security also drives demand for versatile locking mechanisms tailored for diverse industrial applications.

Latin America Smart Lock Market Analysis

Increasing discretionary spending on technology-centric home improvement is driving the demand for modern locking solutions. Rising ownership of connected devices, including smartphones, has enabled the seamless integration of advanced locks into everyday living. According to GSMA, 418 Million people in Latin America (65% of the population) used mobile internet – an increase of 75 Million over the last five years. Consumers are now seeking enhanced convenience through devices offering remote management, one-touch access, and customizable security features. The growing trend of smart homes also complements the rising adoption of automated locking solutions, which provide both functionality and aesthetic appeal. These systems cater to diverse security requirements while supporting user-friendly operations. Technological awareness among smartphone users further accelerates interest in innovative locking mechanisms, making them a viable option for enhancing residential and commercial security.

Middle East and Africa Smart Lock Market Analysis

The rise in infrastructure developments, including residential and commercial buildings, is driving the demand for technologically advanced locking systems. Modern construction projects prioritize integrated security features, including locking systems designed for automated operation and enhanced access control. According to reports, Saudi Arabia is witnessing rapid growth in its construction sector, with over 5,200 projects underway, valued at USD 819 Billion. Advanced locks offering conveniences, such as keyless entry and real-time monitoring, align with evolving construction design standards. Moreover, increased investment in large-scale developments is promoting the integration of solutions that cater to energy efficiency and sustainable construction practices. Customizable locking mechanisms tailored to meet specific project requirements add further value, making them essential in modern building ecosystems.

Leading Smart Lock Companies:

Key players in the smart lock market are driving growth through various strategic actions. Companies such as August Home, Yale, and Schlage are continuously enriching their offerings with the introduction of advanced technologies such as biometric recognition, voice control, and mobile app compatibility. The innovation in terms of convenience and security is thereby attracting more customers. Further, the market is expanding via collaborations with home automation systems such as Amazon Alexa and Google Assistant. Increased interest in smart home security solutions, along with efforts to make the installations easier and cost-effective, is further driving the market adoption. Marketing campaigns pointing out the benefits of smart locks also play a significant role in driving consumer interest.

The report provides a comprehensive analysis of the leading companies in the smart lock market with detailed profiles of all major companies, including:

- Assa Abloy

- Allegion Plc

- Dorma+Kaba Holding AG

- Spectrum Brands Holdings, Inc.

- Salto Systems S.L.

- Onity, Inc.

- Cansec Systems Ltd.

- Gantner Electronic GmbH

- Master Lock Company LLC

- MIWA Lock Co.

- Samsung Electronics Co., Ltd.

- Amadas Inc.

- Sentrilock, LLC

- Avent Security

- Dessmann

Latest News and Developments:

- August 2025: EZVIZ launched the Y3000FVP Plus smart lock featuring facial recognition, palm vein scanning, and a built-in 1080p night vision camera. Powered by a 12nm AI chip, it offers fast, secure access with multiple unlocking options and anti-theft features. Designed for global markets, it enhances smart home security via app control and biometric tech.

- June 2025: Yale launched its new Smart Lock with Matter technology designed for seamless integration with Google Home, featuring faster communication, enhanced security, and up to 12 months of battery life. The lock offers remote access and customizable guest profiles.

- June 2025: Mygate launched the Lock Pro 2.0, India’s first smart lock with a built-in door sensor and support for up to 100 fingerprints. It offers six unlocking methods, real-time notifications, and emergency power options. The lock enhances home security and convenience through the Mygate app and Wi-Fi Gateway for remote access.

- June 2025: Anker launched the eufy FamiLock E34, a smart door lock featuring a fast and highly accurate vein scanner for biometric unlocking, even with wet or dirty fingers. It supports remote control via Wi-Fi and integrates with Apple Home, Google Home, Alexa, and SmartThings through Matter. The lock offers multiple unlocking options, easy installation, and a long-lasting rechargeable battery.

- May 2025: Qubo launched five new smart door locks in India, including premium models Nova and Select, and budget-friendly options like Alpha and Optima, offering robust security and compatibility with wooden doors. These locks integrate with Qubo’s smart home ecosystem, allowing remote control and instant alerts via the Qubo app.

- March 2025: Nuki, Europe’s smart lock pioneer, launched three new products, including Smart Lock Go, Pro, and Ultra, with innovations like retrofittable designs and fast, powerful motors. The Pro model offers advanced features without requiring cylinder changes, while Go targets budget-conscious users.

- January 2025: U-tec has recently unveiled the Ultraloq Bolt Mission UWB+NFC, the world’s first smart lock using Ultra-Wideband (UWB) technology. This innovation offers enhanced security, precise spatial awareness, and hands-free access. By combining UWB with NFC, it redefines convenience and functionality in modern access control systems.

- January 2025: TCL has launched two innovative smart locks at CES 2025, namely Smart Lock D1 Pro, which uses AI to scan palm veins for secure unlocking, and Smart Lock D1 Ultra that offers a 4-in-1 solution with a built-in video doorbell and camera. These advancements highlight TCL's commitment to smart home security.

Smart Lock Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Lock Types Covered | Deadbolts, Lever Handles, Padlocks, Others |

| Communication Protocols Covered | Bluetooth, Wi-Fi, Others |

| End-Users Covered | Commercial, Residential, Institution and Government, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Assa Abloy, Allegion Plc, Dorma+Kaba Holding AG, Spectrum Brands Holdings, Inc., Salto Systems S.L., Onity, Inc., Cansec Systems Ltd., Gantner Electronic GmbH, Master Lock Company LLC, MIWA Lock Co., Samsung Electronics Co., Ltd., Amadas Inc., Sentrilock, LLC, Avent Security, Dessmann, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart lock market from 2019-2033.

- The smart lock market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart lock industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global smart lock market was valued at USD 2.7 Billion in 2024.

IMARC estimates the global smart lock market to exhibit a CAGR of 15.43% during 2025-2033.

The increased adoption of smart home technologies, rising demand for enhanced security solutions, integration with home automation systems, growing preference for keyless entry solutions, and advancements in mobile app and biometric technologies are the primary factors driving the global smart lock market.

North America currently dominates the global market driven by increased awareness about automation, rising concerns about home security and safety, and robust investment in technology.

Some of the major players in the global smart lock market include Assa Abloy, Allegion Plc, Dorma+Kaba Holding AG, Spectrum Brands Holdings, Inc., Salto Systems S.L., Onity, Inc., Cansec Systems Ltd., Gantner Electronic GmbH, Master Lock Company LLC, MIWA Lock Co., Samsung Electronics Co., Ltd., Amadas Inc., Sentrilock, LLC, Avent Security, Dessmann, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)