Smart Mobility Market Size, Share, Trends and Forecast by Technology, Solution, Element, and Region, 2025-2033

Smart Mobility Market Size and Share:

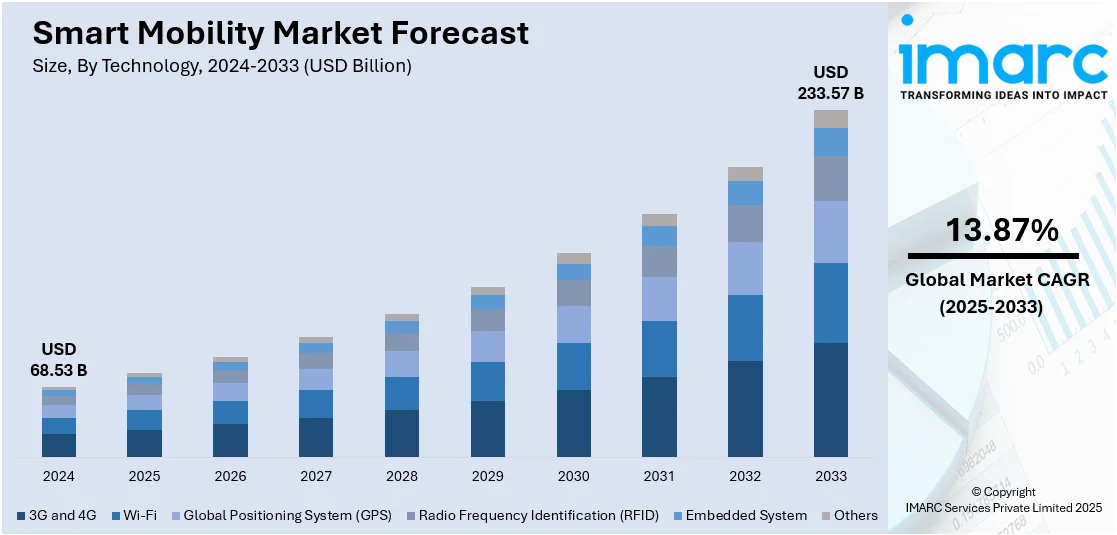

The global smart mobility market size was valued at USD 68.53 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 233.57 Billion by 2033, exhibiting a CAGR of 13.87% from 2025-2033. North America currently dominates the market, holding a market share of 40.5% in 2024. The market consists of swift urbanization, increasing environmental awareness, and increasing need for sustainable transportation services. According to rising traffic congestion and city pollution levels, electric vehicles, shared mobility solutions, and autonomous transport systems are being adopted. Government policies, including smart city initiatives and low-emission vehicle incentives, are propelling market growth. Moreover, the rise in digital technologies such as Internet of Things (IoT), artificial intelligence (AI), and fifth generation (5G) is increasing connectivity, efficiency, and security across different smart mobility solutions thereby boosting the smart mobility market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 68.53 Billion |

|

Market Forecast in 2033

|

USD 233.57 Billion |

| Market Growth Rate 2025-2033 | 13.87% |

One of the key drivers in the smart mobility sector is the accelerated urbanization and escalating need for eco-friendly transport solutions. As cities continue to get crowded, traffic, emissions, and energy consumption have to be minimized, creating the demand for efficient, green transport systems. Smart mobility technologies like electric vehicles (EVs), autonomous driving, and intelligent transport infrastructure solve these problems by providing cleaner, safer, and more convenient solutions. Also, government programs that encourage low-emission zones and smart city initiatives also enhance smart mobility market growth. It is a trend that mirrors a worldwide focus on decreasing carbon footprints and enhancing overall livability in cities through next-generation mobility options.

To get more information on this market, Request Sample

The U.S. is a major driver of the smart mobility market with 80.00% share owing to its emphasis on technological advancement and eco-friendly transportation solutions. The nation's initiative towards lessening carbon emission resulted in extensive use of electric cars, autonomous vehicle technologies, and intelligent public transport systems. Government policies, including clean energy policies and green mobility incentives, are driving the shift to intelligent and efficient urban transportation networks. Large technology firms and automakers are also heavily investing in Mobility-as-a-Service (MaaS), smart traffic management, and infrastructure modernization, setting the U.S. to be a leader in defining the smart mobility future.

Smart Mobility Market Trends:

Rise of Electric Vehicles (EVs)

A key trend shaping the smart mobility market is the rapid adoption of EVs, driven by growing environmental awareness and strong government policies promoting zero-emission transportation. Nearly 14 million new electric vehicles were registered worldwide in 2023, up 35% from 2022 and accounting for roughly 18% of all new automobile sales. This surge reflects both consumer and industry shifts towards cleaner mobility options. The expansion of EV charging infrastructure is making electric cars more practical and convenient, while continuous innovations in battery technology are extending driving ranges and reducing costs. Ride-sharing services and public transport operators are also transitioning to electric fleets to cut operational expenses and meet sustainability targets. As global decarbonization efforts accelerate, EVs are set to dominate future mobility ecosystems, supported by renewable energy integration and smart grid connectivity that enhance vehicle efficiency and environmental benefits.

Growth of Mobility-as-a-Service (MaaS)

Mobility-as-a-Service (MaaS) is revolutionizing the way people use transport by bringing different modes of transport buses, bicycles, trains, and ride-hailing into one digital platform. Users can plan, book, and pay for their entire trip using a single app, providing unparalleled convenience and flexibility. This trend encourages fewer cars to be owned, reducing traffic congestion and emissions. Cities are embracing MaaS solutions to make urban mobility more efficient while improving commuter experience. Technology firms are joining forces with transport operators to provide customized, data-based services. With advancing 5G and IoT technologies, MaaS platforms will provide real-time information, dynamic pricing, and route optimisation, making metropolitan travel intelligent, efficient, and sustainable, especially in expanding metropolitans having space and pollution issues.

Development of Autonomous and Connected Vehicles

Autonomous and connected car technologies are a major Smart Mobility trend. Artificial intelligence, sensors, and machine learning-powered autonomous cars offer safer, more efficient travel by eliminating human error. Connected cars, through Vehicle-to-Everything (V2X) communication, allow cars to exchange information with infrastructure, other vehicles, and the network, enhancing traffic and road safety. Automakers and technology companies are spending big on research and development (R&D) to leapfrog autonomous driving technology, particularly for city-based delivery and ride-hailing fleets. Regulatory policies are slowly changing to support these technologies. With the rollout of 5G connectivity, these cars will be integrated easily with smart city infrastructure, opening up the way for the future of autonomous public and private transport.

Smart Mobility Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart mobility market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, solution, and element.

Analysis by Technology:

- 3G and 4G

- Wi-Fi

- Global Positioning System (GPS)

- Radio Frequency Identification (RFID)

- Embedded System

- Others

Based on the smart mobility market forecast the radio frequency identification (RFID) holds the majority share in smart mobility technologies due to its effectiveness in enabling seamless, automated tracking and management of vehicles and transport assets. RFID systems are widely used in toll collection, traffic monitoring, and vehicle identification, providing real-time data without the need for manual intervention. This technology enhances operational efficiency, reduces congestion at toll booths, and improves the overall flow of urban transport systems. Additionally, RFID supports smart parking solutions, public transit fare collection, and fleet management by offering reliable, contactless communication. Its cost-effectiveness, scalability, and ease of integration with existing infrastructure make RFID a preferred choice in smart mobility projects, driving its widespread adoption and dominance in the market.

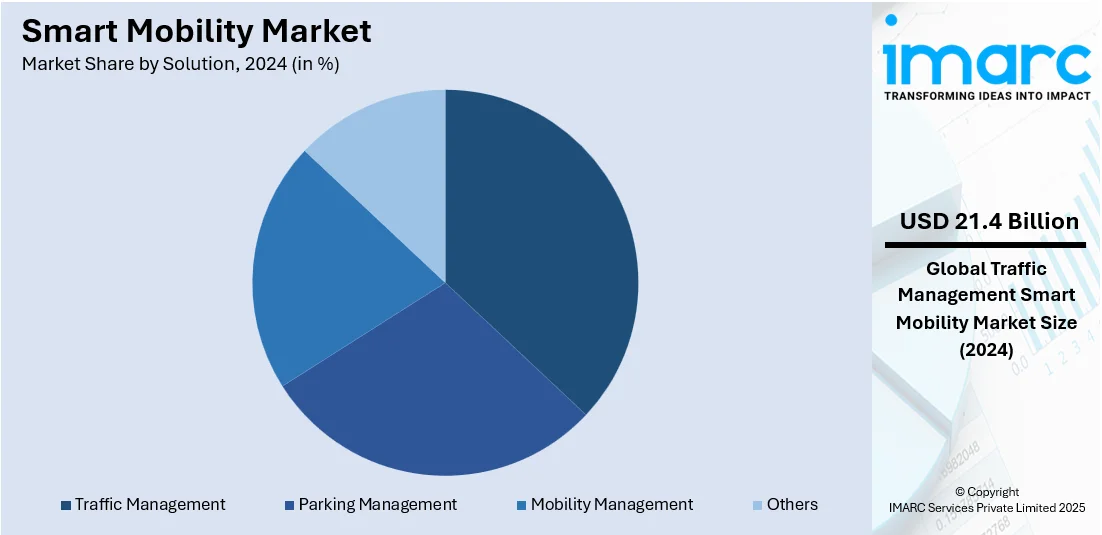

Analysis by Solution:

- Traffic Management

- Parking Management

- Mobility Management

- Others

Traffic management dominates the market demand with a 31.2% share owing to the urgent need for efficient urban mobility solutions that address rising congestion and road safety concerns. As cities become more densely populated, traditional traffic systems struggle to handle increasing vehicle volumes, leading to delays, pollution, and accidents. Smart traffic management systems leverage technologies such as IoT, AI, and big data analytics to monitor, predict, and control traffic flow in real-time. These solutions optimize signal timing, reduce idle times, and improve road utilization, enhancing commuter experience and fuel efficiency. Government initiatives aimed at developing smart cities and sustainable transportation infrastructure further boost demand, making traffic management a critical component in the overall smart mobility ecosystem.

Analysis by Element:

- Bike Commuting

- Car Sharing

- Ride Sharing

Ride sharing holds the largest market share of 36.8% in the smart mobility sector due to its affordability, convenience, and widespread acceptance among urban populations. As cities face increasing traffic congestion and limited parking space, ride-sharing services offer flexible and cost-effective alternatives to private vehicle ownership. Consumers, especially millennials and younger demographics, prefer on-demand mobility solutions that reduce the hassle and expense of maintaining personal vehicles. Additionally, ride-sharing platforms integrate advanced technologies like global positioning system (GPS), mobile apps, and real-time data analytics to enhance user experience, optimize routes, and reduce wait times. The growing emphasis on sustainability and reducing carbon emissions also supports ride sharing, as it promotes vehicle pooling and efficient resource utilization, further driving its market dominance.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds the leading position in the smart mobility market with a 40.5% share owing to its advanced technological ecosystem, strong emphasis on sustainable transport, and early adoption of EVs and autonomous vehicles (AVs). The region benefits from significant investments in smart city development, intelligent transportation systems, and charging infrastructure, creating a favorable environment for smart mobility solutions. Supportive government policies, including incentives for electric vehicles and clean energy initiatives, further accelerate market growth. Additionally, a highly urbanized population drives demand for MaaS platforms and connected transport options that reduce congestion and emissions. Collaboration between technology firms, automotive manufacturers, and public transport authorities also fosters innovation, solidifying North America's dominant role in shaping the global smart mobility market outlook.

Key Regional Takeaways:

United States Smart Mobility Market Analysis

The United States is experiencing ramping up smart mobility adoption as a result of increased coupling with AI, cloud-based technology, and the IoT into smart mobility solutions. AI improves route optimization, predictive maintenance, and autonomous mobility capabilities, while cloud-based platforms support fluid data management across mobility systems. IoT integration supports real-time monitoring and vehicle-to-infrastructure and vehicle-to-vehicle connectivity for safer, more efficient transportation. This intersection of emerging technologies is reshaping mobility infrastructure, prompting stakeholders to embrace intelligent transportation ecosystems. Improved user experience and operational efficiency are motivating large-scale deployments along urban and interurban corridors. As governments and private industry invest in EV charging infrastructure, autonomous vehicles, and intelligent transportation systems, the region is stepping toward an efficient and environmentally friendly transportation future. Based on reports, the United States is drawing almost a quarter of all disclosed worldwide EV investments.

Asia Pacific Smart Mobility Market Analysis

Asia-Pacific is experiencing significant growth in smart mobility adoption, primarily driven by increasing government initiatives toward the development of smart cities. Public authorities are investing in next-generation transportation networks that align with broader urban modernization strategies. As of March 4, 2025, 7,504 projects (93 percent of all projects) totaling USD 18,106 million had been completed, and 559 projects totaling USD 1,715 million were still under progress in the 100 cities chosen under SCM since the Mission's beginning, according to the Smart Cities Mission dashboard. However, only 18 cities had finished all of their smart city projects as of March 2025. The focus is on reducing traffic congestion, minimizing emissions, and promoting sustainable transportation. As part of this shift, governments are deploying intelligent traffic management systems and enhancing public transit through digitization. These initiatives promote integration of various mobility modes to improve accessibility and user convenience. With continuous infrastructure investment, Asia-Pacific is becoming a hub for advanced transportation systems that align with smart city frameworks.

Europe Smart Mobility Market Analysis

Europe is embracing smart mobility at an accelerated pace due to growing environmental concerns among the masses. For instance, beginning in 2025, a 15% yearly decrease in CO2 emissions over 2021 values will be the goal for the 2025–2029 timeframe. People and authorities are supporting cleaner and more sustainable transportation options as a result of increased awareness of air pollution, carbon emissions, and climate change. The shift toward low-emission zones and stricter emission standards is encouraging the development of electric mobility, multimodal transport systems, and intelligent traffic control. Citizens are increasingly favouring eco-friendly mobility options, accelerating demand for integrated smart mobility solutions. These solutions support a greener urban environment while also enhancing mobility efficiency. Growing environmental consciousness among the population is encouraging collaborative efforts among private firms and governments to scale green transport infrastructure.

Latin America Smart Mobility Market Analysis

Rapid urbanization, ongoing advancements in the automotive sector, and substantial research and development (R&D) efforts are all contributing to the growing acceptance of smart mobility in Latin America. For example, according to Anfavea, production of light vehicles, such as cars and pickup trucks, is expected to rise by 8.4% to 2.58 million units in 2025. In 2025, it is anticipated that total production, including commercial vehicles, will reach 2.8 million units. Densely populated cities are encouraging modern transportation systems to manage traffic and pollution. Automotive advancements are leading to more connected and energy-efficient vehicles, while R&D efforts support the evolution of intelligent transport solutions.

Middle East and Africa Smart Mobility Market Analysis

Growing use of shared services and electronic vehicles (EVs) is driving smart mobility adoption throughout the Middle East and Africa. For example, it is predicted that by 2030, over 15% of new passenger cars and light commercial vehicles sold in the United Arab Emirates would be electric vehicles (EVs), and by 2035, that percentage will increase to 25%. Shared mobility platforms are becoming a preferred solution for urban transit, offering flexibility and cost savings. The rise in EVs contributes to eco-friendly transportation alternatives, pushing mobility transformation forward.

Competitive Landscape:

The competitive environment is vibrant and extremely innovative, underpinned by fast-paced technological progress and evolving consumer patterns. Businesses in the automotive, technology, and infrastructure industries are concentrating on creating end-to-end mobility solutions like electric vehicles, autonomous driving technologies, and connected transport platforms. The industry is defined by high research and development spending, collaborations between transport operators and technology providers, and coordination with governments for smart city initiatives. Both new entrants and existing players are vying to be champions in domains like MaaS, vehicle connectivity, and clean transport modes. The rivalry promotes ongoing improvement in service quality, convenience for users, and operational efficiency, carving out a future-proof, green, and connected mobility ecosystem.

The report provides a comprehensive analysis of the competitive landscape in the smart mobility market with detailed profiles of all major companies, including:

- Excelfore

- Ford Motor Company

- Innoviz Technologies Ltd

- Mercedes-Benz Mobility AG

- Mindteck

- QualiX Information System

- Robert Bosch GmbH

- Thales Group

- TomTom International BV

- Toyota Motor Corporation

Latest News and Developments:

- April 2025: Bosch launched its cloud-based Supply Chain Studio during the MPS Summit 2025 in Bengaluru, aiming to enhance India’s logistics efficiency through digital tools. Positioned within the smart mobility domain, the platform streamlined transport, warehousing, and B2B commerce by integrating ERP systems and fostering co-innovation through its ARC Partner Program.

- April 2025: Smart Mobility International signed a strategic partnership with IM Motors to introduce premium electric vehicles in the UAE and Saudi Arabia, beginning with the IM LS7 SUV. The agreement positioned Smart Mobility at the forefront of smart mobility in the region, highlighting its role in advancing intelligent transportation solutions across key Gulf markets.

- May 2025: Green and Smart Mobility officially launched its Xanh SM Platform in Laos and began distributing VinFast VF 3 and VF 5 models, marking Laos as its second international market after Vietnam. The smart mobility expansion followed over a year of operations in cities like Vientiane and Savannakhet, where users traveled 8 Million electric kilometers, aligning with GSM’s eco-friendly ride-hailing vision.

- May 2025: ZF inaugurated India's largest fleet technology hub in Bengaluru, reinforcing its commitment to smart mobility solutions. The state-of-the-art Digital Solutions Centre, spanning approximately 15,000 square feet, was designed to develop advanced fleet management and connectivity solutions, aiming to make commercial fleets leaner, greener, and safer.

- March 2025: Smart Mobility International launched plans to bring Range-Extended Electric Vehicles (REEVs) to the UAE, expanding its smart mobility offerings with the AVATR 07 featuring KUNLUN technology. By adding REEVs alongside its BEV lineup, the company addressed range concerns and supported UAE drivers with more flexible, sustainable options.

Smart Mobility Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | 3G and 4G, Wi-Fi, Global Positioning System (GPS), Radio Frequency Identification (RFID), Embedded System, Others |

| Solutions Covered | Traffic Management, Parking Management, Mobility Management, Others |

| Elements Covered | Bike Commuting, Car Sharing, Ride Sharing |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Excelfore, Ford Motor Company, Innoviz Technologies Ltd, Mercedes-Benz Mobility AG, Mindteck, QualiX Information System, Robert Bosch GmbH, Thales Group, TomTom International BV, Toyota Motor Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart mobility market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global smart mobility market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Smart Mobility industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart mobility market was valued at USD 68.53 Billion in 2024.

The smart mobility market is projected to exhibit a CAGR of 13.87% during 2025-2033, reaching a value of USD 233.57 Billion by 2033.

Key factors driving the smart mobility market include rising urbanization, increasing demand for sustainable and eco-friendly transport solutions, and advancements in technologies like IoT, AI, and 5G. Government policies promoting low-emission vehicles and smart city initiatives also fuel growth. Additionally, the shift towards shared mobility services, such as ride-hailing and car-sharing, supports the market by offering convenient, cost-effective, and flexible transportation alternatives to private vehicle ownership.

North America currently dominates the smart mobility market, accounting for a share of 40.5% due to its strong technological infrastructure, early adoption of electric and autonomous vehicles, and significant government support for sustainable transport initiatives. The region’s well-established automotive industry, advanced research and development (R&D) capabilities, and investments in smart city projects further drive market growth. Additionally, consumer demand for connected, efficient, and eco-friendly mobility solutions fuels the rapid expansion of this sector.

Some of the major players in the smart mobility market include Excelfore, Ford Motor Company, Innoviz Technologies Ltd, Mercedes-Benz Mobility AG, Mindteck, QualiX Information System, Robert Bosch GmbH, Thales Group, TomTom International BV and Toyota Motor Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)