Smart Port Market Size, Share, Trends and Forecast by Technology, Throughput Capacity, Port Type, and Region, 2025-2033

Smart Port Market Size and Share:

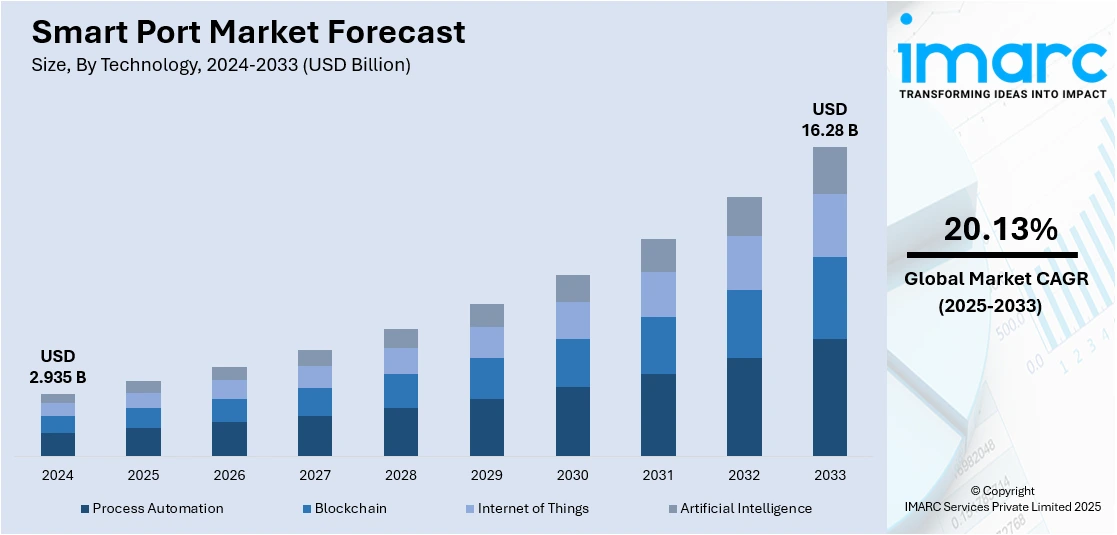

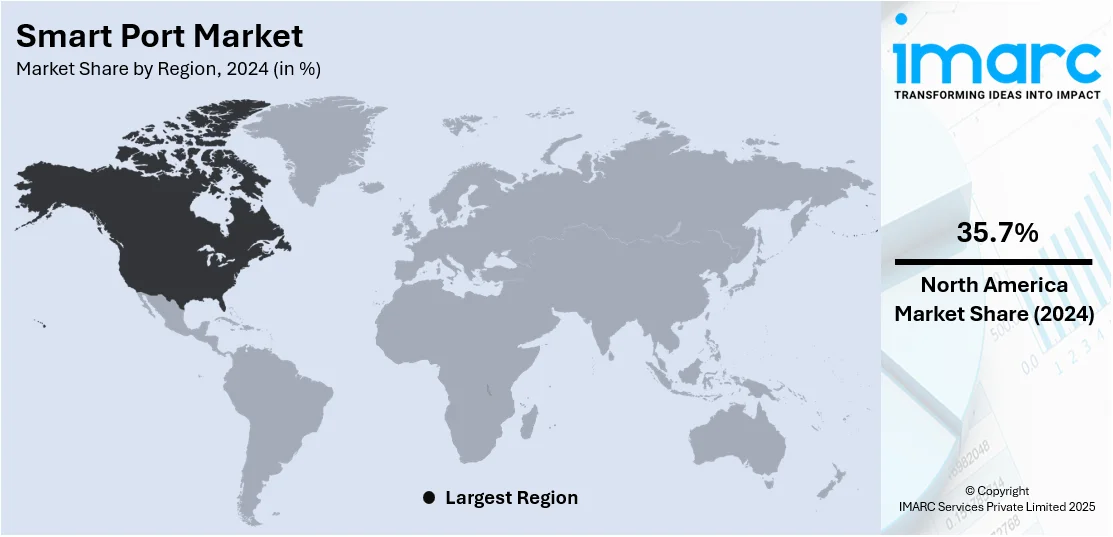

The global smart port market size was valued at USD 2.935 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 16.28 Billion by 2033, exhibiting a CAGR of 20.13% from 2025-2033. North America currently dominates the market, holding a market share of 35.7% in 2024. The market entails increasing demand for operational effectiveness, cost savings, and enhanced cargo handling to deal with increasing global trade volumes. Artificial intelligence (AI), automation, the Internet of Things (IoT), and real-time data analytics are some of the solutions that enable predictive maintenance, reduce downtime, and optimize resource use, which results in faster turnaround times and lower operating costs. Furthermore, the adoption of smart port market share is being driven by government interventions, investments in digital infrastructure, and pressure on sustainability through energy-efficient processes and emission-cutting programs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.935 Billion |

|

Market Forecast in 2033

|

USD 16.28 Billion |

| Market Growth Rate 2025-2033 | 20.13% |

One of the key drivers of the smart port market is the rising demand for operational efficiency and cost reduction as global trade volumes continue to grow. Ports must handle increasing cargo loads swiftly and accurately, driving the adoption of smart technologies like IoT, AI, and automation. These innovations enable real-time monitoring, predictive maintenance, and optimized resource allocation, thereby reducing human error and unplanned downtime. Notably, ports leveraging IoT analytics have achieved up to a 15% increase in container throughput and over 20% reductions in equipment downtime through predictive maintenance. Such advancements streamline cargo handling, enhance berth and yard operations, and reduce energy consumption, resulting in lower operational costs. Improved efficiency not only enhances competitiveness but also attracts more shipping lines and cargo owners, fueling smart port market growth.

The U.S. plays a crucial role in shaping the smart port market, driven by its strong technological infrastructure and commitment on modernizing port operations. Major ports are increasingly adopting IoT, AI, and automation to streamline cargo handling, enhance security, and boost operational efficiency. These digital solutions enable real-time monitoring, predictive maintenance, and optimized logistics, allowing ports to manage increasing trade volumes seamlessly. In line with sustainability goals, the U.S. government has launched a $3 billion federal Clean Ports Program, supporting 55 ports in deploying zero-emission equipment, shore power facilities, and electric infrastructure aimed at reducing 3 million metric tons of CO₂ emissions. Combined with private sector investments and collaborations with technology providers, these initiatives are propelling the development of smarter, greener, and more competitive port facilities across the nation.

Smart Port Market Trends:

Integration of IoT and Real-Time Data Analytics

One of the most significant trends in the smart port industry is increasing adoption of IoT devices and real-time data analytics. Intelligent sensors, RFID tags, and networked devices are being increasingly used across port infrastructure to track cargo movement, equipment condition, and weather conditions. This integration enables operators to have real-time visibility into port operations so that they can make decisions more quickly and address problems proactively. Predictive analytics also assists in planning for maintenance, minimizing downtime and preventing expensive repair. Ports are increasingly using data-driven insights to improve procedures like berth allocation, container stacking, and cargo tracking, which boosts overall operational efficiency. This reflects the industry's movement toward intelligent, automated port environments that enhance safety, minimize human error, and optimize resource use.

Adoption of Automation and Robotics

Automation and robotics are significantly transforming port operations by reducing manual labor while boosting handling speed, precision, and safety. Modern ports are increasingly using automated cranes, driverless trucks, and robotic container movers to streamline the loading, unloading, and transport of goods. A prime example is the Port of Tianjin, where crane productivity rose by 33%, increasing container moves per hour from 15 to 20, showcasing the impact of automation on operational efficiency. These technologies not only lower operational costs and minimize the risk of human-related accidents but also ensure consistent performance under high workload conditions. Automation allows ports to handle rising trade volumes without needing to expand their physical infrastructure, making smarter use of existing space. With global investment in robotics rising, ports are embracing intelligent systems to meet growing demands for faster turnaround times and higher service quality.

Emphasis on Green and Sustainable Port Solutions

Sustainability has become a key focus in the smart port market as operators work to reduce environmental impacts and meet global emission standards. Ports are increasingly adopting renewable energy sources, such as solar and wind, to power operations in an eco-friendly manner. Notably, in Europe, green shore power reduces port emissions by over 90%, and nearly 100% when supported entirely by renewable energy. Shore power facilities allow docked ships to plug into the local grid, minimizing the need for polluting auxiliary engines. Additionally, ports are implementing energy-efficient lighting, electric vehicle fleets, and advanced waste management systems to lower carbon footprints. Environmental monitoring systems track air and water quality, ensuring regulatory compliance. These green initiatives not only safeguard the environment but also strengthen ports’ reputations, making sustainable operations a defining factor in the future of global port development.

Smart Port Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart port market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, throughput capacity, and port type.

Analysis by Technology:

- Process Automation

- Blockchain

- Internet of Things

- Artificial Intelligence

According to the smart port market forecast, the process automation has the largest market share of 33.8% due to increasing demand for efficiency, precision, and cost cutting across all industries. By removing complicated and repetitive activities, automation technologies lower human error rates while increasing operational consistency and productivity. Process automation is essential to sectors including manufacturing, shipping, and energy in order to optimize resource use, improve product quality, and meet large volume requirements. Additionally, advancements in automation, artificial intelligence, and the Internet of Things have improved the adaptability and effectiveness of automated systems, allowing businesses to quickly adapt to market shifts. The demand for real-time data monitoring, predictive maintenance, and intelligent decision-making equally increases the demand for automation solutions. Together, all these benefits propel the leading market share of process automation.

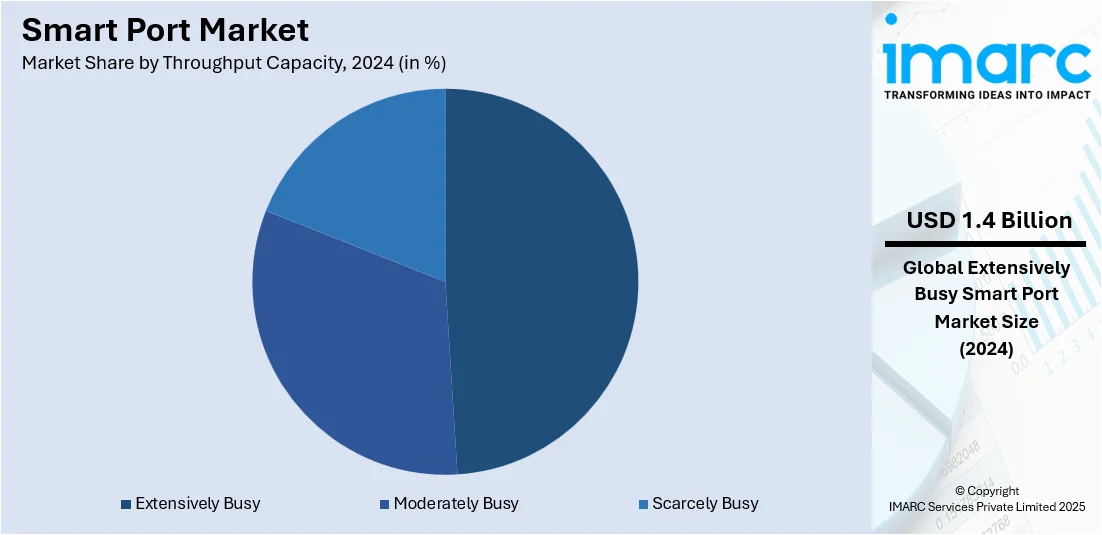

Analysis by Throughput Capacity:

- Extensively Busy

- Moderately Busy

- Scarcely Busy

According to the smart port market outlook, the extensively busy segment dominates the market with a 48.3% share due to the high operational demand and continuous activity in this category. These ports or terminals handle a large volume of cargo traffic, passenger movement, and logistical operations throughout the year, making them central to international trade and transport networks. Their strategic locations in economically vital regions attract significant commercial shipping lines and freight services. Moreover, such facilities are equipped with advanced infrastructure, automated systems, and robust connectivity to road, rail, and inland transport networks, enabling efficient handling of high cargo throughput. Continuous upgrades and expansion projects further enhance their capacity, ensuring smooth, large-scale operations. These factors collectively contribute to the segment’s substantial market dominance.

Analysis by Port Type:

- Seaport

- Inland Port

Seaports hold the largest market share of 70.3% because of their pivotal position in international trade and logistics. They are major centers for import and export, and they process high cargo volumes efficiently compared to airports or land terminals. Seaports provide cheap movement for bulk goods like oil, coal, grain, and manufactured items, which is vital for foreign trade. Their strategic coastal position enables direct access to principal shipping lanes, making trade connectivity between regions more efficient. Furthermore, ongoing investments in port infrastructure, automation, and smart technologies enhance the capacity for handling as well as operational efficiency. These benefits render seaports ineliminable to global supply chains, which explains their overwhelming market share.

Analysis by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America enjoys the top market share of 35.7% based on its well-established technological infrastructure, large consumer purchasing power, and dominance of prominent industry players. The region is endowed with tremendous investments in research and development, which has nurtured innovation across diversified sectors like healthcare, automobiles, and information technology. Also, supportive government policies, strong distribution channels, and early embrace of new technologies such as AI, IoT, and 5G further support market expansion. The market for smart devices, renewable energy solutions, and personalized services is also greater in North America than in the rest of the world. These together place North America in a dominant position to stay competitive and grab a sizeable market share for itself in the world.

Key Regional Takeaways:

United States Smart Port Market Analysis

The United States smart port market is witnessing robust growth driven by increasing digital transformation initiatives across maritime logistics. Emphasis on improving port security, automation, and operational visibility has led to the integration of IoT, AI, and advanced data analytics. The adoption of digital twins and blockchain for cargo tracking and customs management is also gaining traction. Furthermore, federal initiatives encouraging green infrastructure have accelerated investments in energy-efficient port operations and electrified cargo handling systems. According to the Infrastructure Report, recent federal investments nearly doubled annual funding levels for programs such as the Port Infrastructure Development Program to USD 450 Million per fiscal year, allowing America’s ports to more robustly assess, balance, and address their waterside and landside needs. Port authorities are actively modernizing terminal management through cloud-based platforms to streamline logistics. In addition, rising e-commerce and inland logistics demand are encouraging ports to evolve into intelligent logistics hubs. Post-pandemic, supply chain resilience is boosting the need for smart port solutions. Drone surveillance, robotics, real-time ship movement monitoring, and digital integration with rail and road freight systems to improve port surveillance and intermodal efficiency. As trade volumes grow, digital interoperability and automation drive the evolution of the U.S. smart port ecosystem.

Europe Smart Port Market Analysis

The European smart port market is evolving rapidly as sustainability becomes central to port modernization strategies. Ports are adopting smart grid solutions and automated energy management systems to achieve carbon neutrality targets. The focus on decarbonizing maritime transport has prompted the implementation of shore power systems and automated mooring technologies. Europe’s emphasis on digital transparency in logistics has encouraged the adoption of integrated data-sharing platforms, enabling real-time collaboration among port stakeholders. Notably, the European Investment Bank (EIB) has signed a USD 54 Million loan agreement with the Port Authority of Málaga to finance the port’s expansion and electrification, underscoring institutional commitment to smart and sustainable infrastructure. The deployment of AI-driven cargo flow prediction tools is further improving berth scheduling and turnaround time. Ports are implementing autonomous shipping support, environmental monitoring, predictive maintenance, and smart integration of road, rail, and inland waterway systems. Public-private partnerships and EU-backed innovation programs support interconnected, digitally managed port ecosystems, creating a dynamic environment for smart port growth.

Asia Pacific Smart Port Market Analysis

Asia Pacific’s smart port market is expanding rapidly due to rising maritime trade volumes and the need for port efficiency. Regional ports are leveraging automated gate systems, RFID-based tracking, and AI-powered traffic management to handle increasing vessel calls and container throughput. Investments in cloud infrastructure and edge computing enhance decision-making capabilities in real time. According to the Ministry of Ports, Shipping, and Waterways, USD 732 Million have been allocated to upgrade, modernize, and automate Indian port operations to upscale efficiency reflecting the region’s strong commitment to digital transformation. Additionally, integration with urban logistics through smart transport links is optimizing cargo movement beyond port gates. The region is implementing autonomous cranes and automated container handling systems, utilizing advanced analytics to optimize port labor and equipment usage. Environmental monitoring tools are crucial for regulatory compliance and ecosystem preservation. Machine learning models forecast congestion and allocate berthing space, enhancing operational competitiveness and service excellence.

Latin America Smart Port Market Analysis

The Latin American smart port market is gaining momentum due to increasing demand for digital efficiency in port operations, including real-time asset tracking and cloud-enabled logistics systems. Emphasis on transparency and visibility has led to wider adoption of centralized data platforms that integrate port and hinterland operations. According to a report, the Ministry of Ports and Airports announced a strategic investment plan worth USD 3.8 Billion for the country’s port sector, slated for completion by 2026, which is expected to further boost smart port initiatives in Brazil and influence regional modernization efforts. Additionally, automated access control and AI-driven analytics are being deployed to optimize terminal traffic and improve safety. Smart technologies are being utilized by ports to improve throughput and operational predictability, with government-backed digitalization initiatives accelerating this shift toward data-driven port ecosystems.

Middle East and Africa Smart Port Market Analysis

The Middle East and Africa's smart port market is thriving due to strategic investments in digital trade infrastructure and AI-based fleet management tools. The implementation of IoT-enabled equipment enhances cargo handling precision and minimizes human intervention. According to the 2024 progress report, 75,000 vessels were connected to the network last year, and this number continues to soar in the UAE. Smart lighting, energy management, and surveillance systems are also being introduced to elevate port efficiency and security. With growing emphasis on trade diversification and regional logistics hubs, digital platforms are being utilized for synchronized port-community coordination. This regional push for operational modernization is fostering the development of agile, connected port ecosystems.

Competitive Landscape:

Technology adoption and the growing need for automated, efficient port operations are driving the market's rapid and dynamic changes. In order to increase operational efficiency, reduce costs, and guarantee improved safety, industry players give careful consideration to developing and implementing cutting-edge solutions such as IoT platforms, AI-based analytics, automation technologies, and digital twin platforms. Companies are investing in clean energy sources and emission-reducing technologies in response to the increased demand for sustainable and green port solutions. Technology providers, port authorities, and logistics companies are coming together to offer complete smart port ecosystems. The industry is constantly innovating, with companies competing to provide tailored, scalable solutions that can be fit to the unique needs of different port sizes and regional trade requirements, enabling competitive positioning in this emerging industry.

The report provides a comprehensive analysis of the competitive landscape in the Smart Port market with detailed profiles of all major companies, including:

- ABB Ltd

- Abu Dhabi Ports

- Accenture plc

- Awake.AI

- Ikusi Velatia (Velatia S.L.)

- International Business Machines Corporation

- Navis LLC

- Ramboll Group A/S

- Royal HaskoningDHV

- The Port of Rotterdam

- Trelleborg AB

- Wipro Limited

Latest News and Developments:

- May 2025: The Port of Ningbo-Zhoushan launched green corridor projects with Hamburg, Wilhelmshaven, and Valencia to promote zero-emission shipping. Efforts focused on shore power, clean fuel bunkering, and smart logistics. Despite global growth in such corridors, financial and policy barriers remained key challenges to the large-scale implementation of green maritime routes.

- May 2025: Fastweb and Vodafone launched a private 5G network at Italy’s Port of Ravenna, enabling autonomous vehicles, IoT systems, and real-time monitoring. Covering a 15km canal, the project enhanced logistics, safety, and sustainability, marking a major milestone in the port's €10 million digital transformation.

- February 2025: SANY Marine launched its 2025 electric intelligent product series in Zhuhai, showcasing energy-efficient equipment like reach stackers and forklifts. Highlights included a 5G-enabled remote-controlled forklift and smart control systems. SANY signed deals for 60 electric units, reinforcing its role in automating and decarbonizing port operations.

Smart Port Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Process Automation, Blockchain, Internet of Things, Artificial Intelligence |

| Throughput Capacities Covered | Extensively Busy, Moderately Busy, Scarcely Busy |

| Port Types Covered | Seaport, Inland Port |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd, Abu Dhabi Ports, Accenture plc, Awake.AI, Ikusi Velatia (Velatia S.L.), International Business Machines Corporation, Navis LLC, Ramboll Group A/S, Royal HaskoningDHV, The Port of Rotterdam, Trelleborg AB and Wipro Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart port market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global smart port market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart port industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Smart Port market was valued at USD 2.935 Billion in 2024

The smart port market is projected to exhibit a CAGR of 20.13% during 2025-2033, reaching a value of USD 16.28 Billion by 2033.

Key factors driving the smart port market include the need for enhanced operational efficiency, cost reduction, and improved cargo handling capacity. Adoption of IoT, AI, and automation enables real-time monitoring, predictive maintenance, and optimized logistics. Additionally, sustainability goals and government support for digital port infrastructure boost market growth

North America currently dominates the Smart Port market, accounting for a share of 35.7% due to its advanced technological infrastructure, strong investment in automation, and focus on digital transformation. Ports in the region adopt IoT, AI, and smart energy solutions to enhance efficiency, reduce emissions, and handle growing trade volumes, driving market dominance

Some of the major players in the smart port market include ABB Ltd, Abu Dhabi Ports, Accenture plc, Awake.AI, Ikusi Velatia (Velatia S.L.), International Business Machines Corporation, Navis LLC, Ramboll Group A/S, Royal HaskoningDHV, The Port of Rotterdam, Trelleborg AB and Wipro Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)