Smart Retail Market Size, Share, Trends and Forecast by Offering, Retailer Size, Application, End User and Region, 2025-2033

Smart Retail Market Size and Share:

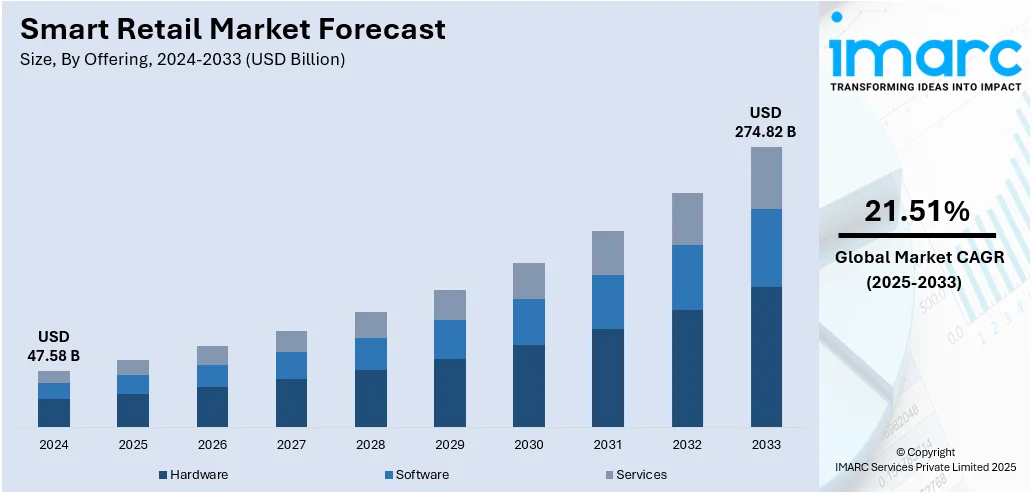

The global smart retail market size was valued at USD 47.58 Billion in 2024. The market is projected to reach USD 274.82 Billion by 2033, exhibiting a CAGR of 21.51% from 2025-2033. North America currently dominates the market, holding a market share of 34.7% in 2024. Innovations in technology, changing user expectations, rising automation trends, and the increased product adoption due to personalization, convenience, and seamless shopping experiences are some factors propelling the smart retail market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 47.58 Billion |

| Market Forecast in 2033 | USD 274.82 Billion |

| Market Growth Rate (2025-2033) | 21.51% |

At present, the smart retail market is growing due to the rising demand for personalized and seamless shopping experiences. Retailers are using technologies like artificial intelligence (AI) and data analytics to gain insights into customer behavior and enhance decision-making. Smart shelves, mobile payments, and digital displays make shopping faster and more convenient. The popularity of e-commerce is leading physical stores to adopt smart tools for staying competitive. Omnichannel strategies help retailers connect online and offline services. Real-time inventory tracking and automated checkouts reduce wait times and increase efficiency. Chatbots and augmented reality (AR) tools improve customer support and product interaction.

To get more information on this market, Request Sample

The United States has emerged as a major region in the smart retail market owing to many factors. Rising demand for convenience, personalization, and fast service is offering a favorable smart retail market outlook. Retailers are adopting advanced technologies like AI and machine learning (ML) to analyze customer data, track buying patterns, and enhance in-store and online experiences. According to IMARC Group, the United States AI market size reached USD 37,029.9 Million in 2024. The popularity of mobile shopping and digital payments is encouraging stores to offer smart checkout systems and app-based services. Labor shortages are also enabling retailers to automate operations using robots and self-service kiosks. Omnichannel strategies allow seamless integration between physical and digital platforms, improving customer satisfaction. Retailers are utilizing real-time inventory systems to minimize stock issues and enhance supply chain efficiency.

Smart Retail Market Trends:

Changing User Expectations

The evolution of user expectations is stimulating the smart retail market growth, driven by the desire for convenience, personalization, and seamless shopping experiences. Changing customer expectations are encouraging retailers to provide omnichannel services, personalized suggestions, convenient and secure payment methods, and efficient order fulfillment. An industry survey found that in 2024, 71% of shoppers expected brands to understand their purchasing behaviors, 77% were inclined to buy with suitable product suggestions (83% among Millennials), and 90% desired more individualized communication. In response, retailers are employing technologies to meet these evolving demands. By utilizing the Internet of Things (IoT) and data analytics, retailers can analyze customer information to deliver personalized experiences, improve inventory management, and streamline operations.

Insights from Data Analysis

Through the adoption of technologies, retailers can gather customer data from various touchpoints. Analyzing this data provides insights into user behavior trends and preferences. These insights allow retailers to make decisions based on data analysis results. According to industry reports, in 2024, organizations that were dependent on data were 23 times more probable to draw in new clients, six times more likely to keep them, and 19 times more probable to earn a profit. Smart retail tools also assist in tailoring marketing strategies as per evolving preferences, optimizing inventory levels efficiently, and managing the operations for smooth customer experiences. Data-oriented insights are among the major smart retail market trends, as they enable retailers to pinpoint areas for enhancement and streamline operational processes effectively.

Rising Automation Trend

Retail stores are implementing automated checkout systems, robotic fulfillment centers, self-driving delivery vehicles, and inventory management robots. Honeywell’s AI in Retail Survey indicated that as of January 2025, over 80% of retailers aimed to broaden automation and AI use, with 35% of leading retailers planning to considerably increase their AI spending. These advanced technologies and smart retail market recent developments help refine accuracy and streamline processes. It allows human workers to focus on valuable tasks. By employing inventory management systems, retailers can precisely monitor stock levels, prevent shortages, and reduce inventory. This optimization leads to cost savings, better inventory turnover rates, and increased customer satisfaction. This, in turn, is driving the smart retail market recent price.

Smart Retail Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart retail market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on offering, retailer size, application, and end user.

Analysis by Offering:

- Hardware

- RFID Tags and Labels

- Scanner/Readers

- Mobile Computers

- Point of Sale (POS) Terminals

- Others

- Software

- Retail Management Software

- POS Software

- Inventory Management

- Others

- Services

- Integration and Deployment Services

- Consulting Services

- Support and Maintenance Services

Hardware (RFID tags and labels, scanner/readers, mobile computers, point of sale (POS) terminals, and others) held 66.2% of the market share in 2024. It forms the physical backbone of smart retail solutions. Hardware devices are essential for implementing automation and real-time data tracking in stores. These tools help retailers monitor inventory, track customer behavior, and enable faster checkouts, improving operational efficiency and enhancing the shopping experience. As the demand for seamless and contactless services is growing, retailers are investing heavily in hardware to support mobile payments, automated checkout, and security systems. The integration of AI and IoT with hardware components is further boosting their role by enabling smart analytics and responsive in-store experiences. Hardware also supports the functioning of software and services, making it a necessary starting point for digital transformation. As per the smart retail market forecast, with businesses focusing on physical upgrades to keep pace with rising customer expectations, hardware will continue to dominate the market.

Analysis by Retailer Size:

- Small and Mid-sized Retailers

- Large Retailers

Small and mid-sized retailers are employing smart retail tools to stay competitive, improve efficiency, and enhance customer engagement. They are wagering on cost-effective tools like digital signage and inventory management software. These retailers focus on personalized service and local customer needs, using smart technologies to optimize limited resources. Cloud-based platforms and scalable solutions support their digital transformation.

Large retailers hold a significant portion of the market due to the presence of greater financial resources and advanced infrastructure. They are implementing robotics and big data analytics to automate operations, manage large inventories, and deliver personalized shopping experiences at scale. These retailers often integrate omnichannel strategies, offering seamless service across physical stores and digital platforms. Their wide customer base and global presence are encouraging continuous innovations.

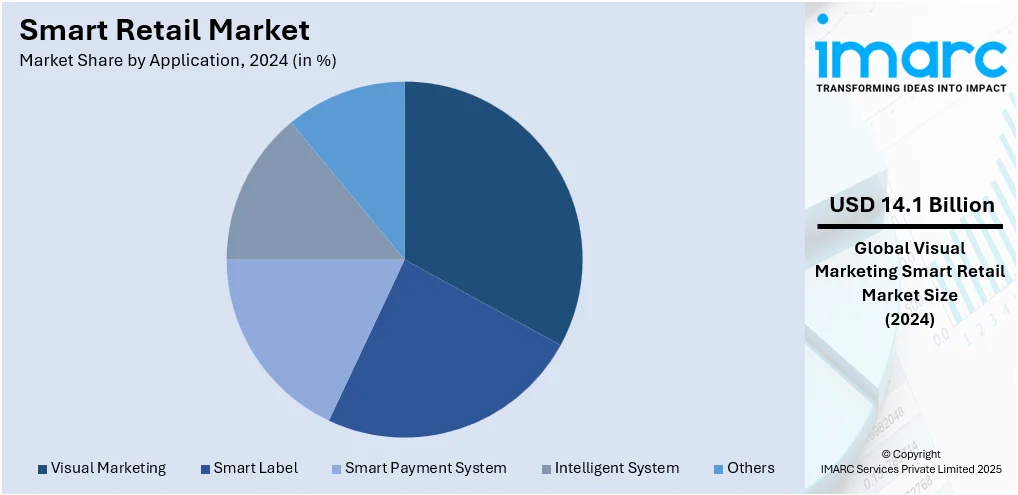

Analysis by Application:

- Visual Marketing

- Smart Label

- Smart Payment System

- Intelligent System

- Others

Visual marketing accounts for 29.6% of the market share. It plays a key role in capturing customer attention and influencing purchase decisions. Retailers are using digital displays, interactive screens, AR, and smart signage to create engaging and immersive shopping experiences. These tools showcase product features, promotions, and personalized offers in real time, making marketing more dynamic and effective. Visual content is easier to process and more memorable for individuals, helping brands stand out in a competitive environment. It also supports storytelling and emotional connection, which increases customer loyalty and conversion rates. With the growing demand for personalized and visually appealing shopping environments, retailers are investing more in visual marketing tools powered by data and AI. These solutions adapt content based on customer behavior and preferences, making in-store and online marketing more relevant. As smart retail is evolving, visual marketing is becoming essential in creating a seamless, connected, and attractive customer journey.

Analysis by End User:

- Supermarkets

- Hypermarkets

- Specialty Stores

- Department Stores

- Others

Supermarkets are adopting smart retail solutions to manage fast-moving consumer goods efficiently. They use technologies like automated checkout systems, real-time inventory tracking, and digital price tags to speed up operations and reduce human error. Smart shelves and mobile apps help track stock levels and guide customers within the store. Supermarkets also employ data analytics to understand user buying behavior and create personalized promotions.

Hypermarkets are implementing smart retail technologies to handle their large-scale operations and vast product variety. They are using robotics, AI, and IoT to automate inventory management, enable smart checkout, and provide real-time data insights. Digital signage and targeted promotions help enhance in-store marketing. Hypermarkets benefit from customer flow analysis tools and heat maps to optimize store layout and improve shopping efficiency.

Specialty stores are using smart retail solutions to offer highly personalized shopping experiences. They are implementing tools like AR displays, AI-based recommendation engines, and smart fitting rooms to engage customers and highlight product uniqueness. Digital signage and loyalty programs based on customer data help improve brand interaction. Inventory management systems ensure that niche products are always available.

Department stores continue to rely on smart retail solutions to manage multiple product categories under one roof. They are employing AI-oriented analytics, interactive kiosks, and smart mirrors to assist customers and enhance the shopping journey. Real-time stock management ensures product availability and reduces shrinkage. Department stores also utilize data to offer personalized promotions across departments. These technologies improve in-store navigation, streamline operations, and create a connected shopping experience that encourages cross-selling and higher customer satisfaction across various product segments.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for a share of 34.7%, enjoys the leading position in the market. The region is noted for strong technological infrastructure, high digital adoption, and the presence of major retail and tech companies. Retailers in the region are quickly adopting modern technologies like AI and big data analytics to enhance customer experience and streamline operations. As per industry reports, the North America big data analytics market size reached USD 113.4 Billion in 2024. People in North America are showing high readiness for digital shopping, mobile payments, and self-checkout systems, encouraging retailers to invest in smart solutions. The region also benefits from a strong economy, high internet penetration, and well-established e-commerce platforms. Government support for digital innovations and favorable business policies is further stimulating the market growth. Leading companies are continuously collaborating, driving competition and moving the market forward. The demand for personalized services, efficient supply chains, and fast delivery options is adding to the need for smart retail technologies.

Key Regional Takeaways:

United States Smart Retail Market Analysis

The United States holds 88.40% of the market share in North America. The market is primarily driven by the increasing adoption of contactless shopping technologies as people are seeking faster, safer, and more convenient in-store experiences. In accordance with this, the ongoing deployment of IoT inventory systems, which improves tracking and efficiency, is impelling the market growth. The introduction of 5G networks is enabling seamless data transmission and supporting advanced retail applications. An industry report indicated that by late 2024, the US and Canada exceeded 182 Million 5G connections, indicating close to 20% growth each year. By early 2025, US 5G standalone networks achieved median download speeds of 388.44 Mbps, surpassing speeds noted in Japan and China. Similarly, the rapid integration of edge computing, which enhances in-store analytics by enabling faster data processing at the source, is driving the market expansion. The growing emphasis on energy-efficient and sustainable retail operations is accelerating the adoption of smart lighting and heating, ventilation, and air conditioning (HVAC) systems. In addition, the increasing use of robotics for automated restocking and shelf monitoring is streamlining store operations and stimulating the market appeal.

Europe Smart Retail Market Analysis

The European smart retail market is experiencing growth due to the region’s robust digital transformation programs, backed by national and EU-level funding initiatives. In line with this, the increasing adoption of electronic shelf labels, which improve pricing precision and reduce manual labor costs for large retail chains, is positively influencing the market. Similarly, the rising popularity of cashier-less stores and frictionless checkout models is transforming the convenience retail landscape. The heightened awareness about sustainability is driving smart energy use and circular practices, facilitating market expansion. Additionally, rapid urbanization, coupled with the broadening of smart city projects, is leading to significant investments in connected retail ecosystems. The widespread utilization of mobile wallets and contactless payments is streamlining transactions, elevating shopper convenience and enhancing market accessibility. An industry report showed that in 2023, almost 50% of German shoppers employed digital wallets for online purchases, and 33% used them for bill payments, showcasing the increasing acceptance of this payment option. Besides this, strategic collaborations between retailers and technology firms are enabling the rollout of sophisticated retail automation systems across the region.

Asia-Pacific Smart Retail Market Analysis

The Asia-Pacific market is largely driven by rapid urbanization activities and the growing base of tech-savvy middle-class users seeking advanced shopping experiences. Furthermore, the widespread adoption of smartphones is encouraging the use of mobile shopping and digital payment platforms across the region. Industry analysis demonstrated that as of June 2025, China was at the forefront worldwide in smartphone users, boasting 974.69 Million users and a penetration rate of 68.4%, nearly 1.5 times greater than the customer base of any other nation. Similarly, strong government initiatives to develop digital infrastructure are supporting investments in connected retail technologies. The region’s competitive e-commerce landscape is motivating traditional retailers to adopt smart solutions to maintain their market share. Additionally, the rising integration of AI-oriented chatbots and virtual assistants is improving customer engagement and operational efficiency. Moreover, the heightened focus on supply chain transparency and product authenticity is driving the adoption of blockchain and IoT tracking, thereby encouraging trust and standards in the regional retail landscape.

Latin America Smart Retail Market Analysis

In Latin America, the market is growing owing to the rising adoption of digital payment solutions, which are streamlining traditional checkout processes and enhancing transaction efficiency. The Brazilian Central Bank reported that digital transactions held over 80% of all banking operations in 2023, indicating a notable rise from 54% in 2014. In addition to this, the increasing use of smartphones, which is driving mobile commerce and contactless payments, is bolstering the market growth. The rising investments by retailers in smart logistics and automated warehousing systems to strengthen inventory management and operational control are positively influencing the market. Furthermore, expanding internet connectivity across urban and rural regions is supporting the implementation of omnichannel retail strategies, bridging online and offline experiences and providing people with broader access to advanced shopping technologies.

Middle East and Africa Smart Retail Market Analysis

The market in the Middle East and Africa is significantly influenced by the widespread use of mobile payments and digital wallets, which is reshaping both in-store and online shopping experiences across the region. Similarly, rising demand for sophisticated security and surveillance systems in retail environments is promoting the integration of AI-based monitoring and analytics. The Middle East is also experiencing a surge in digital transformation within the retail sector, driven by increased investments and technological advancements. A key example of this growth is BirdEye, a Saudi Arabia-based startup that raised USD 586,000 in a pre-seed round to fuel its expansion across the region. Launched in late 2024, BirdEye provided a user-friendly platform aimed at assisting small and medium-sized enterprises (SMEs) in managing their activities and staying competitive in a progressively digital landscape. Moreover, the growing need to optimize supply chain operations is motivating retailers to adopt smart inventory management solutions.

Competitive Landscape:

Key players are investing in advanced technologies and innovative solutions. They are developing and deploying tools like AI-based analytics, smart shelves, digital signage, and automated checkout systems that improve customer experience and operational efficiency. These companies are also forming partnerships with retailers to offer customized solutions based on business size and customer needs. Key players are actively promoting omnichannel integration, enabling seamless shopping across online and offline platforms. They provide training, support, and continuous upgrades to aid retailers in adapting quickly to digital transformation. Their focus on research and development (R&D) activities is leading to the introduction of new features that attract both businesses and individuals. By setting industry standards and creating scalable solutions, key players are supporting the market expansion and influencing adoption across various retail segments. For instance, in December 2024, Walmart finalized its USD 2.3 Billion purchase of Vizio, incorporating its SmartCast platform to enhance Walmart Connect’s retail media functions. Vizio's ad-supported platform, boasting more than 19 Million active accounts, expanded Walmart's reach and enhanced its product discovery capabilities. Vizio functioned as a fully owned subsidiary of Walmart.

The report provides a comprehensive analysis of the competitive landscape in the smart retail market with detailed profiles of all major companies, including:

- Adroit Worldwide Media Inc.

- Amazon.com Inc.

- Cisco Systems Inc.

- Google LLC (Alphabet Inc.)

- Honeywell International Inc.

- Ingenico

- Intel Corporation

- NCR Corporation

- NVIDIA Corporation

- NXP Semiconductors N.V.

- PTC

- Samsung Electronics Co. Ltd.

- Zippin

Latest News and Developments:

- June 2025: The Swedish retailer Stadium collaborated with Visual Art to create a smart retail media network utilizing real-time information from Aspace sensors. The update involved offering advertising space to brand partners and considering in-store digital displays as a performance-focused channel, improving Stadium's data-centric retail media approach.

- May 2025: 365 Retail Markets launched modular smart store solutions for its PicoCooler Vision. Features added consist of ambient cabinets, age checks for alcohol purchases, and adjustable layouts. These AI-oriented solutions improve unattended retail by integrating cold, ambient, and soon freezer units, broadening possibilities in hospitality, healthcare, and convenience industries.

- March 2025: Huawei and SOLUM unveiled an integrated IoT retail solution at MWC Barcelona. It simplified the deployment of electronic shelf labels by combining Bluetooth, SD-WAN, and IoT modules into a single network. The system cut store setup time by 30% and reduced operational expenses by 50%, facilitating more intelligent, large-scale retail change.

- March 2025: At Embedded World, MulticoreWare and AMD launched an AI-oriented intelligent checkout system. Leveraging AMD Ryzen Embedded 8000 processors, the solution integrated computer vision, Gen AI, and theft detection to boost retail security and productivity. It facilitated real-time AI processing for automated, fast, self-service shopping experiences.

- December 2024: Cantaloupe, Inc. introduced the Smart Store Series, including models 600 and 700. These secure, self-service retail units utilized weighted shelves and cameras for 99.9% precision, assisting in minimizing labor requirements, theft, and losses. Retailers, such as GALLS and Barrett Vending, were already utilizing them.

Smart Retail Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered |

|

| Retailer Sizes Covered | Small and Mid-sized Retailers, Large Retailers |

| Applications Covered | Visual Marketing, Smart Label, Smart Payment System, Intelligent System, Others |

| End Users Covered | Supermarkets, Hypermarkets, Specialty Stores, Department Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adroit Worldwide Media Inc., Amazon.com Inc., Cisco Systems Inc., Google LLC (Alphabet Inc.), Honeywell International Inc., Ingenico, Intel Corporation, NCR Corporation, NVIDIA Corporation, NXP semiconductors N.V., PTC, Samsung Electronics Co. Ltd., Zippin, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart retail market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global smart retail market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart retail industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart retail market was valued at USD 47.58 Billion in 2024.

The smart retail market is projected to exhibit a CAGR of 21.51% during 2025-2033, reaching a value of USD 274.82 Billion by 2033.

Retailers are investing in automation, smart shelves, digital signage, and mobile payment systems to improve efficiency and enhance customer engagement. The expansion of e-commerce and omnichannel strategies is encouraging traditional retailers to adopt smart solutions to stay competitive. Additionally, real-time stock control and refined customer service through chatbots and AR tools are contributing to the market growth.

North America currently dominates the smart retail market, accounting for a share of 34.7% in 2024, because of strong digital infrastructure, high adoption of technology, presence of key market players, and early use of AI, IoT, and automation to improve customer experience, operational efficiency, and retail innovations.

Some of the major players in the smart retail market include Adroit Worldwide Media Inc., Amazon.com Inc., Cisco Systems Inc., Google LLC (Alphabet Inc.), Honeywell International Inc., Ingenico, Intel Corporation, NCR Corporation, NVIDIA Corporation, NXP semiconductors N.V., PTC, Samsung Electronics Co. Ltd., Zippin, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)