Smart Spaces Market Size, Share, Trends and Forecast by Component, Space Type, Application, End User, and Region, 2025-2033

Smart Spaces Market Size and Trends:

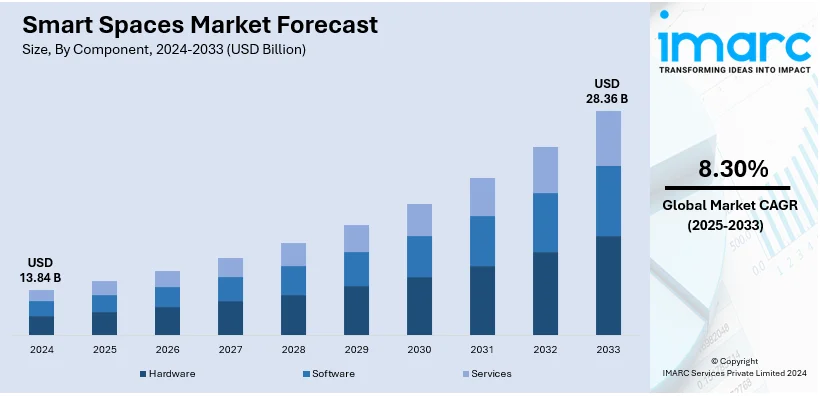

The global smart spaces market size was valued at USD 13.84 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 28.36 Billion by 2033, exhibiting a CAGR of 8.30% from 2025-2033. North America currently dominates the market, holding a market share of over 32.1% in 2024. The increasing shift towards remote work, With increasing demand for smart home technologies and connected office spaces, the rising adoption of smart HVAC systems and air purification technologies in residential and commercial spaces, and the escalating government incentives and rebates for energy-efficient and sustainable building solutions are some of the factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 13.84 Billion |

|

Market Forecast in 2033

|

USD 28.36 Billion |

| Market Growth Rate 2025-2033 | 8.30% |

Government initiatives and smart city projects are pivotal in propelling the growth of the smart spaces market. Globally, governments are investing substantially in smart city developments to tackle urban challenges such as traffic congestion, economic development, and public service efficiency. For example, the United States spent millions of dollars in smart city initiatives that seek to upgrade urban infrastructure and services. In India, the Smart Cities Mission, launched in 2015, aims to develop 100 smart cities to promote sustainable and inclusive urban development. As of July 2024, 7,202 out of 8,018 tendered projects have been completed, using ₹144,530 crores out of the total tendered amount of ₹164,163 crores. These substantial investments not only modernize urban infrastructure but also create a conducive environment for the adoption of smart technologies.

The US smart spaces market is developing as a key disruptor, accounting for 91.80% of the overall share. The smart spaces industry in the United States is expanding rapidly, thanks to a number of major drivers. Advancements in the artificial intelligence (AI), and Internet of Things (IoT), and smart sensors have increased connectivity and automation, resulting in more efficient and responsive settings. Urbanization has raised the need for smart infrastructure to efficiently manage resources, preserve energy, and improve quality of life. Government initiatives and large investments in smart city projects have accelerated the use of smart space solutions. For example, the United States smart cities market is expected to grow with a compound annual growth rate (CAGR) of 12.69% during 2024 to 2032. Furthermore, the growing use of smart devices has created an ecosystem that allows for greater control, monitoring, and automation of surroundings.

Smart Spaces Market Trends:

Emerging Trends of Automation and digitization

The emerging trends of automation and digitization are positively influencing the market. Automation, driven by advancements in artificial intelligence (AI) and the Internet of Things (IoT), revolutionizes how spaces function. According to Multidisciplinary Digital Publishing Institute, Automation systems in commercial buildings optimize resources, saving up to 30% in energy costs by adjusting lighting and HVAC systems based on occupancy patterns. Smart spaces are becoming increasingly automated, with the ability to self-regulate and adapt to changing conditions. For example, in commercial buildings, automation systems can optimize lighting, temperature, and energy consumption based on occupancy patterns, resulting in significant cost savings and sustainability benefits. In homes, smart appliances, voice-activated assistants, and integrated security systems are becoming commonplace, enhancing convenience and security for homeowners. Digitization is crucial in enabling these spaces' connectivity and data exchange. The expansion of sensors, devices, and data analytics platforms allows for real-time monitoring and control of various systems within a space. This data-driven approach enables predictive maintenance, efficient resource utilization, and improved user experiences. With growing recognition among organizations and individuals of the potential of automating and digitizing to augment productivity, energy efficiency, and quality of life, the market would be expected to grow substantially. This trend extends across various sectors, including smart homes, offices, healthcare facilities, and urban infrastructure, reshaping how we interact with and optimize our physical environments.

Rapid Advances in Data Analytics and Artificial Intelligence

Rapid advances in data analytics and artificial intelligence offer numerous market opportunities. The convergence of sophisticated data processing techniques and AI algorithms has unlocked unprecedented potential for these spaces to become more intelligent, responsive, and efficient. These technologies enable these spaces to gather and analyze vast amounts of real-time data from sensors, devices, and user interactions. For instance, in smart buildings, AI-driven analytics can optimize energy consumption by forecasting patterns and making data-driven adjustments, reducing costs and environmental impact. Additionally, AI-enhanced data analytics can predict maintenance needs, reducing operational costs by 15-20%, as per industry reports. Similarly, in smart cities, AI-powered systems can enhance traffic management, waste disposal, and public safety by processing and interpreting data from various sources. The capability to automate decision-making, predict maintenance needs, and enhance user experiences in residential and commercial settings is driving rapid adoption. As organizations recognize the transformative impact of AI and data analytics on operational efficiency and sustainability, the market is poised for sustained expansion, shaping the future of how we live, work, and interact with our environments.

Growing Awareness of Smart Space Benefits

The growing awareness of the benefits offered by these spaces is creating a positive outlook for the market. As more individuals, businesses, and governments become acquainted with the advantages of smart technology integration, the demand for these spaces increases. Smart home systems' convenience and energy-saving potential in residences, including automated lighting, thermostats, and security, are becoming increasingly evident. Similarly, the cost-efficiency, improved productivity, and enhanced occupant experiences made possible by smart office solutions are gaining recognition in commercial settings. Moreover, in the context of smart cities, the potential to optimize infrastructure, reduce energy consumption, and enhance public services such as transportation and security is becoming a focal point. Cities like Barcelona have already reduced energy costs by up to 30% through smart technology integration, which is further driving investment in the sector. This heightened awareness is prompting increased investment in smart space technologies, spurring innovation, and expanding the market. As the advantages of these technologies become increasingly tangible and widely accessible, the market is slated to grow steadily across each sector in a manner that will change how we live with and upgrade our built environments.

Smart Spaces Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart spaces market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, space type, application, and end user.

Analysis by Component:

- Hardware

- Software

- Services

Hardware leads the market with around 60.6% of market share in 2024. The market's exponential growth can be primarily attributed to the rapid advancements in hardware components. Innovations in hardware technologies, such as sensors, actuators, and IoT devices, have revolutionized physical spaces. These components enable the seamless integration of digital intelligence into various environments, including homes, offices, and public places, thus enhancing efficiency and user experiences. The deployment of cutting-edge hardware solutions like smart cameras, occupancy sensors, and smart thermostats has optimized resource utilization and bolstered security measures.

As organizations and individuals increasingly recognize the benefits of these hardware innovations, they are fueling the demand for smart space solutions, driving the growth of the entire market segment. The hardware segment's ability to provide the necessary infrastructure for creating intelligent, responsive spaces is propelling the market forward, promising a future where technology seamlessly integrates with our physical surroundings.

Analysis by Space Type:

- Smart Indoor Spaces

- Smart Outdoor Spaces

Smart indoor spaces lead the market with around 62.5% of market share in 2024. The expanding smart spaces market is experiencing remarkable growth, and this expansion is notably driven by the integration of smart technologies into indoor spaces. Adopting innovative solutions tailored for smart indoor spaces has revolutionized how we interact with and manage our enclosed environments. Within this space type, inclusion of latest hardware components in the form of sensors, smart lighting systems, and HVAC controllers has increased efficiency in energy usage, comfort, and overall performance within homes, offices, and public facilities. These advancements have increased demand for smart indoor space solutions as organizations and individuals seek to optimize their interior environments. As a result, the smart indoor space segment is emerging as a pivotal force behind the market's overall growth. Its capacity to transform indoor settings into responsive, intelligent domains is shaping the future of our built environments, promising heightened productivity, sustainability, and quality of life.

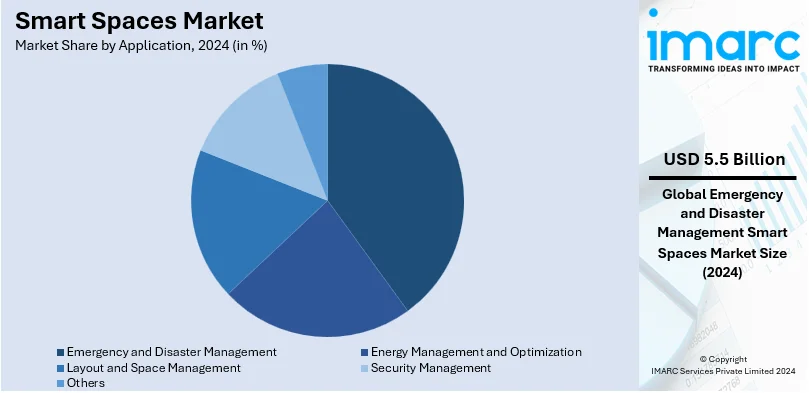

Analysis by Application:

- Energy Management and Optimization

- Layout and Space Management

- Emergency and Disaster Management

- Security Management

- Others

Emergency and disaster management leads the market with around 39.5% of market share in 2024. The dynamic growth of the market owes much to its applications, with one vital sector being emergency and disaster management. Within this domain, smart technologies are proving to be indispensable tools for enhancing preparedness, response, and recovery efforts in the face of unforeseen crises. By integrating sophisticated hardware components, such as real-time monitoring systems, predictive analytics, and communication networks, smart spaces enable more efficient disaster detection, immediate alerts, and rapid coordination of emergency responses. These advancements in disaster management applications are driving substantial investments and innovation in the market.

The ability to create resilient, adaptive environments that safeguard lives and assets is a major contributor to the market's overall growth trajectory. As the importance of effective emergency and disaster management continues escalating in our rapidly changing world, the smart spaces segment dedicated to this application is poised to play a pivotal role in ensuring safety and resilience for communities and organizations.

Analysis by End User:

- Residential

- Commercial

- Utility

- Transportation and Logistic

- Healthcare

- Education

- Retail

- Manufacturing

- Government

- Others

Commercial leads the market with around 64% of market share in 2024. Businesses, ranging from small to large corporations, increasingly embrace smart technologies to streamline operations, enhance productivity, and improve the overall customer experience. Smart space solutions encompass multiple applications within the commercial end-user category, including smart offices, retail stores, restaurants, and entertainment venues. These businesses deploy cutting-edge hardware and software components such as IoT sensors, data analytics, and automation systems to optimize space utilization, energy efficiency, and customer engagement.

The commercial end user is driving massive growth of the market through an excited adoption of smart spaces focused upon improving efficiency, lowering operating costs, and competitive gain. As organizations continue to experience hard and soft benefits of such technology, including increased revenue and improvement in customer satisfaction, commercial end-user remains a growth vital for the market. This encapsulates the transformation of traditional commercial environments into intelligent, data-driven environments that embody modern consumer needs and exigencies.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 32.1%. North America is an important region that is crucial in propelling its growth. The adoption of smart technologies is particularly robust and focuses on efficiency, sustainability, and quality of life across different sectors. Within this region, these solutions are being deployed almost everywhere-from smart homes and connected offices to intelligent transportation systems and beyond.

This commitment to innovative and technological development in the region has led to significant investments in smart space technologies and has driven the development of superior hardware and software components. Regulatory support and efforts in smart infrastructure and sustainability have also pushed forward the proliferation of smart spaces in this region.

North America continues to witness increasing demand for smart spaces, mainly because organizations and individuals recognize the advantages of these solutions in terms of energy savings, improved security, and enhanced convenience. Thus, it remains a major growth driver for the global smart spaces market, reflecting its commitment to the use of technology in developing more intelligent and responsive environments for its residents and businesses.

Key Regional Takeaways:

United States Smart Spaces Market Analysis

The United States smart spaces market is experiencing high adoption. In this space type, the adoption of cutting-edge hardware Industrial reports indicate that 45% of US internet households own at least one smart home device. At the same time, 18% of these households have six or more smart home devices, indicating a strong transition toward connected living. A mainstream adoption here is clearly indicative of an increasing middle market, leaving early adopters behind in terms of higher device counts. Companies are now tailoring strategies to the needs of households with 1-5 devices, ensuring accessible and user-friendly solutions. Industry events like the CONNECTIONS™ conference, annually held in Plano, Texas, further fuel market growth by highlighting advancements in smart home technologies and strategies for ecosystem integration. Players like Vivint, Alarm.com, and SmartThings are underlining the importance of seamless interoperability. With more and more households being connected, the U.S. continues to be one of the main drivers of innovation and expansion in the smart home market ecosystem.

Europe Smart Spaces Market Analysis

Europe's market for smart spaces is growing rapidly. Popular devices such as smart thermostats are driving energy efficiency; the number of EU homes equipped with such devices has surged from 4 million in 2017 to 22 million in 2020. Politecnico di Milano highlights that smart heating solutions can reduce household energy use by 28%, cutting over 54,000 tons of CO2 emissions annually in Milan alone, saving Euro 70 million (USD 73.45 Million) for citizens. Germany, the UK, and France lead the market, followed by Italy and Spain. The EU research projects, such as CITyFiED, have encouraged innovation by creating applications to monitor energy usage, such as that seen in Valladolid, Spain. However, only 15% of the consumers actively use the smart features of their devices, highlighting the requirement for improved education and usability.

Asia Pacific Smart Spaces Market Analysis

Asia-Pacific's smart home innovation is growing rapidly. One such instance is in Japan, where it has been shown to have homes fitted with almost 1,000 sensors to monitor the safety, health, and daily activities of its residents (article by murata). Such sensors take wide ranges of data and are thus integrated into IoT and AI, which can help to anticipate needs, optimize energy usage, and provide comfort. For instance, diverse sensors in homes may adjust temperatures automatically based on future forecasts for energy efficiency and comfort. This concept is in line with Professor Yasuo Tan's vision of an ideal smart home offering attentive support. Using cloud-based advanced information processing, these systems are designed to provide tailored solutions for disaster response, elderly care, and daily convenience without the need for high-powered computers in each home. As countries like Japan spearhead such innovations, this region leads the benchmark of how residential spaces are incorporated into the integration of IoT, AI, and decarbonization, thus creating ample opportunity for manufacturers and technology providers.

Latin America Smart Spaces Market Analysis

Latin America has an expanding smart spaces market and Brazil is the leader in the area, with an average 1.3 smart devices per household, close to the global average of 1.5, according to a news article. Mexico follows this trend, with higher adoption of smart technologies linked to the hybrid work model consumers are adopting to make houses more functional and comfortable. Devices such as Alexa, robot vacuum cleaners, and smart TVs are dominating the market, with more than 70% of units sold coming with connected functionalities. Categories like smart LED lighting account for only 3% of sales, which means there is much untapped potential. Matter is a universal standard that is addressing interoperability challenges, enabling seamless communication between devices across platforms like Alexa, Siri, and Google Assistant. Original equipment manufacturers and their enablers must collaborate to expand this ecosystem further. As the technological walls are broken, the region shows promising opportunities for smart device manufacturers to innovate and cater towards the growing demand of consumers in the region.

Middle East and Africa Smart Spaces Market Analysis

Smart home adoption in the Middle East is experiencing a very fast pace, with an emphasis in KSA and UAE. According to an industrial press release, within 2023 alone, customers using Alexa completed almost 130 million smart home actions across those countries, marking how voice-enabled automation continues to gain a more integrative role in that area. Examples of those include more than 24 million light-on/light-off cycles and almost 9 million air conditioner on/off commands. The popularity of connected devices is evident in the +50% YoY increase in smart home customers and a +90% YoY surge in connected devices. Over 70 million hours were streamed for music, Quran, and podcasts in Alexa-enabled homes that demonstrated lifestyle and technology integration. These trends reflect a strong appetite for automation and energy efficiency in the region, driven by rising digital literacy and enhanced IoT connectivity, further solidified by initiatives such as Saudi Vision 2030 and the UAE's smart city developments.

Competitive Landscape:

In today's competitive markets, top companies are boosting market growth with innovative ideas, strategic partnerships, and customer-centric solutions. These are the top companies that head the trend of developing next-generation cutting-edge technologies and systems which spearhead smart space adoption across industries. With these companies always investing in R&D for more advanced and efficient solutions, smart spaces will never be left behind in any technological advancement. In addition, their collaboration with other industry leaders like IoT device manufacturers and data analytics providers expands the ecosystem of smart space solutions, thus making them more robust and interconnected. In this regard, these companies are driving market growth and improving the overall user experience in these spaces, thus making them accessible and valuable to a larger audience. Their innovation, strategic partnership, and customer satisfaction characteristics place them firmly as leaders in the growing market.

The report provides a comprehensive analysis of the competitive landscape in the smart spaces market with detailed profiles of all major companies, including:

- ABB Ltd

- Cisco Systems Inc.

- Coor Service Management AB

- Eutech Cybernetic Pte. Ltd

- Hitachi Vantara LLC (Hitachi Ltd.)

- International Business Machines Corporation

- Microsoft Corporation

- Schneider Electric

- Siemens AG

- SmartSpace Software PLC

- Ubisense Limited

Latest News and Developments:

- October 2024: ABB and Zumtobel Group have collaborated to drive the development of smart building solutions and applications of DC technology. ABB's automation systems will be integrated with Zumtobel's lighting management, with emphasis on energy efficiency and reduction of CO2 in commercial, industrial, and institutional buildings.

- October 2024: WebexOne introduced AI-driven solutions for enhancing collaboration and employee experiences. New innovations include Cisco Spatial Meetings, Ceiling Microphone Pro, and enhanced Cisco AI Assistant features. These technologies simplify IT management while empowering employees and reimagining workspaces.

- June 2024: Schneider Electric launched its SMART Buildings Division in Canada. In this division, Schneider will help building owners in fulfilling their decarbonization and sustainability goals by improving energy efficiency, automating systems, ensuring proactive maintenance, and a focus on occupant comfort, all in line with the net-zero emissions target in 2050 for Canada.

- May 2024: Sign In Solutions announced strategic acquisition of SmartSpace Software PLC. In what would be its 7th acquisition since 2021, this strategic play looks to integrate SmartSpace's SwipedOn and Space Connect brands into enhancing visitor management solutions. Together, it expands capabilities at more than 36,000+ locations across the globe.

- September 2023: ABB Ltd partnered up to USD 2.9 Billion with Export Development Canada (EDC) to support ABB's customers with debt financing for key electrification and automation projects globally.

Smart Spaces Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Space Types Covered | Smart Indoor Space, Smart Outdoor Space |

| Applications Covered | Energy Management and Optimization, Layout and Space Management, Emergency and Disaster Management, Security Management, Others |

| End Users Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd, Cisco Systems Inc., Coor Service Management AB, Eutech Cybernetic Pte. Ltd, Hitachi Vantara LLC (Hitachi Ltd.), International Business Machines Corporation, Microsoft Corporation, Schneider Electric, Siemens AG, SmartSpace Software PLC, Ubisense Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart spaces market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global smart spaces market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart spaces industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Smart spaces are physical environments enhanced by technology to create an intelligent, interactive, and automated ecosystem. These spaces use the advanced technologies such as Internet of Things, artificial intelligence, sensors, and connectivity that facilitate smooth interactions between people, devices, and the environment.

The smart spaces market was valued at USD 13.84 Billion in 2024.

IMARC estimates the global smart spaces market to exhibit a CAGR of 8.30% during 2025-2033.

The market is growing rapidly due to the implementation of supportive government policies, growing awareness of smart spaces benefits, emerging trends of automation and digitization, and significant advances in data analytics and artificial intelligence.

In 2024, hardware represented the largest segment by component, driven by innovations in hardware technologies, such as sensors, actuators, and IoT devices, have revolutionized physical spaces.

Smart indoor spaces lead the market by space type owing to the incorporation of cutting-edge hardware components such as sensors, smart lighting systems, and HVAC controllers, which has significantly enhanced energy efficiency, comfort, and overall operational efficiency in homes, offices, and public facilities.

The emergency and disaster management is the leading segment by application, as smart technologies are proving to be indispensable tools for enhancing preparedness, response, and recovery efforts in the face of unforeseen crises.

The commercial is the leading segment by end user, as commercial sector is increasingly embracing smart technologies to streamline operations, enhance productivity, and improve the overall customer experience.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global smart spaces market include ABB Ltd, Cisco Systems Inc., Coor Service Management AB, Eutech Cybernetic Pte. Ltd, Hitachi Vantara LLC (Hitachi Ltd.), International Business Machines Corporation, Microsoft Corporation, Schneider Electric, Siemens AG, SmartSpace Software PLC, Ubisense Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)