Smoke Ingredients Market Size, Share, Trends and Forecast by Type, Form, Application, and Region, 2025-2033

Smoke Ingredients Market Size and Share:

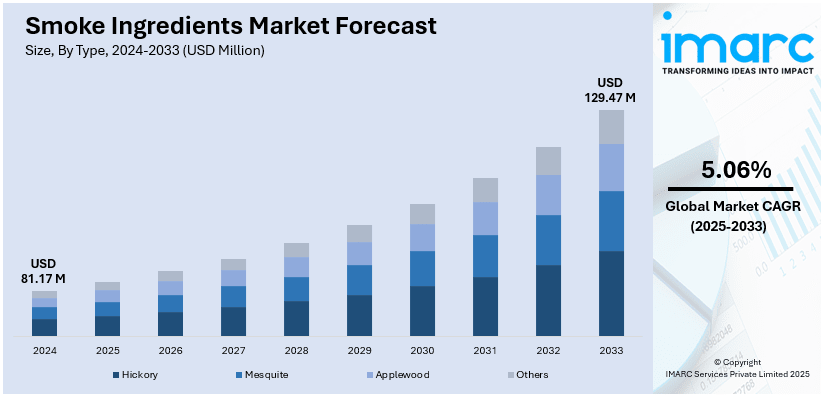

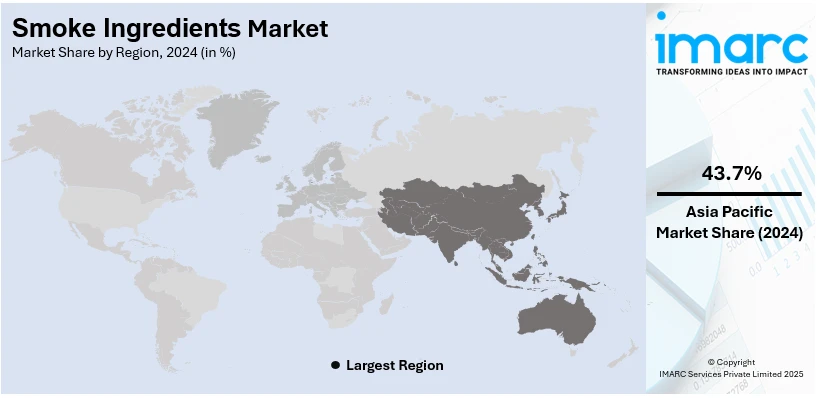

The global smoke ingredients market size was valued at USD 81.17 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 129.47 Million by 2033, exhibiting a CAGR of 5.06% from 2025-2033. Asia Pacific currently dominates the market, holding a smoke ingredients market share of over 43.7% in 2024. The growing demand for smoked food products, rising health consciousness among the masses, and the increasing adoption of traditional methods of cooking represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 81.17 Million |

|

Market Forecast in 2033

|

USD 129.47 Million |

| Market Growth Rate 2025-2033 | 5.06% |

One major driver in the smoke ingredients market is the rising demand for processed and ready-to-eat (RTE) foods. With busy lifestyles and limited time for home-cooked meals, consumers increasingly opt for convenient food products that offer rich, savory flavors. Smoke ingredients enhance the taste, aroma, and shelf life of processed meats, seafood, and snacks, making them more appealing to modern consumers. Additionally, these ingredients provide a cost-effective alternative to traditional smoking methods while maintaining the desired sensory profile. This trend is further supported by the food industry's focus on innovation and product diversification to cater to evolving consumer preferences.

The U.S. leads the smoke ingredients market with an 85.00% share fueled by heavy use of processed and smoked foods such as meats, sausages, and snacks. The nation's advanced food processing industry and consumption of convenient and flavorful food help fuel market growth. In 2021, the per capita consumption of chicken and beef was 68.1 pounds and 56.2 pounds, respectively, reflecting the robust demand for meat products. The move towards natural and clean-label ingredients has prompted companies to use naturally sourced smoke flavors. Technological advancements in food flavoring technologies and the increased popularity of barbecue and grill-themed cuisines are additional drivers of growth. The presence of leading food manufacturers and flavoring houses supports the U.S.'s dominant position in the international market for smoke ingredients.

Smoke Ingredients Market Trends:

Shift Toward Natural and Clean-Label Ingredients

One of the most prominent trends in the smoke ingredients market is the growing demand for natural and clean-label products. Consumers are becoming more conscious of ingredient transparency, seeking food items that are free from artificial additives, synthetic flavors, and chemical preservatives. As a result, food manufacturers are increasingly incorporating naturally derived smoke ingredients such as liquid smoke made from real wood chips. This trend is driving innovation in smoke flavor extraction methods that retain natural taste profiles while ensuring food safety. Regulatory support for clean-label declarations and the rising popularity of organic and minimally processed foods further reinforce this trend, encouraging companies to reformulate products using naturally sourced smoke ingredients without compromising flavor intensity or product appeal.

Increasing Popularity of Barbecue and Grill-Inspired Flavors

Barbecue and grill-flavored tastes are increasing in popularity across food categories such as snacks, sauces, condiments, ready meals, and meat substitutes. Consumers link smoky flavor profiles with comfort food and genuine culinary experiences, so food manufacturers try to recreate these flavors through the use of smoke ingredients. This trend is very pronounced in urban markets where outdoor grilling is not possible but demand for smoky flavors is still high. More than 70% of U.S. adults currently own a smoker or grill, and among the three leading options, gas grills lead (64%), followed by charcoal (44%) and electric (9%). Regional fusions like Texas-style smoked meat and Korean BBQ flavor innovation further widen the category. Producers are capitalizing on high-technology smoke flavoring methods in order to create unique signature formulas and add differentiation, keeping up with changing tastes among consumers.

Adoption of Liquid Smoke in Industrial Food Processing

The adoption of liquid smoke in industrial food processing is rapidly increasing due to its functional benefits and production efficiency. Liquid smoke offers a convenient and consistent alternative to traditional smoking methods, significantly reducing processing time while enhancing flavor and shelf life. It allows controlled application in marinades, coatings, or directly into products, offering versatility in food formulations. Moreover, it contributes to safer processing environments by minimizing exposure to carcinogenic compounds associated with conventional smoking. This trend is especially important for large-scale meat and seafood processors seeking to optimize production without compromising on flavor quality. The scalability, cost-effectiveness, and regulatory compliance of liquid smoke solutions make them a key component in modern food manufacturing practices.

Smoke Ingredients Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smoke ingredients market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, form, and application.

Analysis by Type:

- Hickory

- Mesquite

- Applewood

- Others

Hickory smoke ingredients are widely favored for their strong, bold, and hearty flavor, commonly used in red meats like beef and pork. Their rich aroma enhances traditional barbecue-style foods, making them popular among food processors seeking to deliver a classic smoked profile in various processed and RTE meat products.

Additionally, the mesquite smoke ingredients offer a distinctively intense, earthy, and slightly sweet flavor, often used in grilling and smoked meat recipes. They are especially popular in Southwestern and Tex-Mex cuisines. Their robust profile makes them ideal for enhancing stronger-tasting meats such as lamb and game, adding depth and complexity to culinary applications.

Besides this, the applewood smoke ingredients provide a mild, slightly sweet, and fruity flavor that complements lighter meats like poultry, fish, and vegetables. Its subtle taste appeals to consumers seeking delicate smoky notes without overpowering the natural flavors. Applewood is increasingly popular in gourmet and premium food products for its refined, balanced profile.

Also, the "Others" category includes cherrywood, oak, pecan, and alder smoke ingredients, each offering unique flavor characteristics. These variants are gaining popularity for niche applications and regional cuisines. Their growing use in artisanal and specialty foods reflects consumer interest in diverse smoke profiles and flavor customization across multiple food categories.

Analysis by Form:

- Liquid

- Powder

- Others

According to the smoke ingredients market forecast, the liquid smoke ingredients dominate the market demand owing to their versatility, ease of application, and efficiency in food processing. Unlike traditional smoking methods, liquid smoke allows precise control over flavor intensity, ensuring consistency across batches. It can be easily incorporated into marinades, brines, coatings, or directly injected into meat and seafood products, making it highly adaptable for industrial-scale processing. Moreover, liquid smoke contributes to improved shelf life and enhanced food safety by reducing harmful compounds typically formed during conventional smoking. Its cost-effectiveness, cleaner production process, and compatibility with clean-label formulations further boost its appeal among manufacturers. As consumer demand grows for smoky-flavored yet healthier and naturally processed foods, the preference for liquid smoke continues to strengthen its dominance in the market.

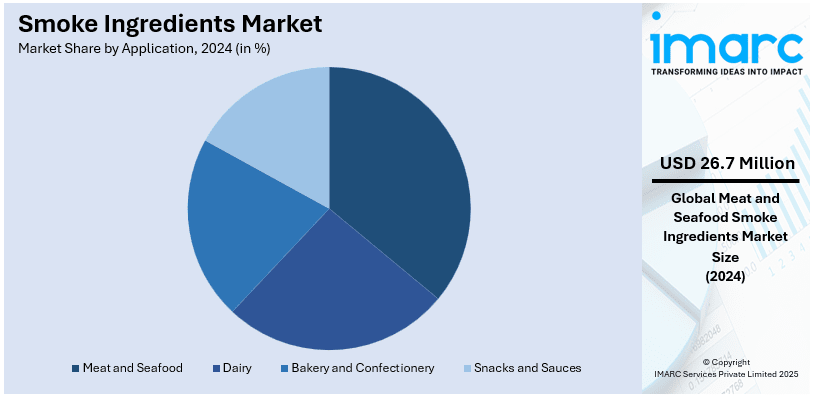

Analysis by Application:

- Dairy

- Bakery and Confectionery

- Meat and Seafood

- Snacks and Sauces

Meat and seafood segments account for the majority share of 32.9% in the smoke ingredients market due to the widespread use of smoky flavors to enhance taste, aroma, and shelf life. Traditional smoked meat and fish products remain highly popular across various cuisines, and the demand for smoked sausages, ham, bacon, and seafood is consistently rising. Smoke ingredients offer a convenient and cost-effective alternative to traditional smoking methods, allowing food producers to replicate authentic smoky profiles while maintaining food safety and production efficiency. Additionally, consumers increasingly prefer smoked meat and seafood in RTE and packaged forms, fueling the need for reliable smoke flavoring solutions. The segment’s dominance is further supported by continuous innovations in flavor infusion and product customization.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific holds the largest market share of 43.7% in the smoke ingredients market, driven by increasing consumption of processed and convenience foods across emerging economies such as China, India, and Southeast Asian countries. Rapid urbanization, rising disposable incomes, and changing dietary habits have led to a surge in demand for RTE meals and snack products enriched with smoky flavors. Additionally, the growing popularity of Western-style cuisines and barbeque-inspired food items further supporting the smoke ingredients market growth. The presence of a large food processing industry, along with expanding retail and foodservice sectors, is accelerating the adoption of smoke ingredients. Moreover, manufacturers in the region are increasingly embracing clean-label and natural flavoring solutions to cater to evolving consumer preferences and regulatory standards.

Key Regional Takeaways:

North America Smoke Ingredients Market Analysis

The North America smoke ingredients market continues to witness steady growth, driven by high consumption of processed, smoked, and RTE food products. The region’s well-established food processing industry and a strong consumer preference for bold, smoky flavors support widespread adoption of smoke ingredients across various applications, including meats, seafood, sauces, snacks, and bakery products. Increasing interest in barbecue and grill-style cuisines, especially in the U.S. and Canada, has significantly fueled demand for smoke flavors such as hickory, mesquite, and applewood. Moreover, the growing consumer inclination toward clean-label and naturally derived ingredients is prompting food manufacturers to incorporate liquid smoke and natural smoke extracts as safer and healthier alternatives to traditional smoking methods. Technological advancements in smoke flavor extraction and application methods are further enhancing production efficiency and product appeal. Additionally, the rise of plant-based meat alternatives and gourmet flavored products is creating new opportunities for smoke ingredient integration in innovative food formulations. The presence of leading flavor manufacturers and a robust distribution network across retail and foodservice channels solidifies North America’s prominent position in the global smoke ingredients market, contributing to its sustained expansion.

United States Smoke Ingredients Market Analysis

The growing smoke ingredients adoption is significantly influenced by the expanding e-commerce industry, which provides wider accessibility to various smoke ingredients for both individual consumers and food manufacturers. According to reports, e-commerce sales in the United States have been steadily increasing for over a decade, hitting a record high of USD 1.12 Trillion in 2023. That is a 330% increase from USD 260.4 Billion in 2013. The online availability of diverse smoke flavors and liquid smoke options has encouraged small-scale businesses and home-based food entrepreneurs to incorporate smoke ingredients into their products. The convenience of online shopping platforms has further accelerated bulk purchases of smoke ingredients, facilitating their use in meat and other food products. Additionally, digital marketing strategies have enhanced consumer awareness regarding the applications of smoke ingredients, driving demand from professional chefs and home cooks. The rapid growth of online grocery platforms has also enabled direct sales of smoke-infused seasonings and marinades, increasing their penetration into mainstream food products. As foodservice chains increasingly rely on digital supply channels, the accessibility and cost-effectiveness of purchasing smoke ingredients through e-commerce continue to rise, contributing to sustained market growth and innovation in product offerings.

Asia Pacific Smoke Ingredients Market Analysis

The growing smoke ingredient adoption is fueled by the increasing demand for smoked foods, which have gained popularity due to their distinct flavors and extended shelf life. As consumer preferences shift towards richer and more authentic taste profiles, the demand for smoked meats, seafood, and plant-based alternatives continues to rise. For instance, in 2024, per capita fish consumption increased 81.43%, from 4.9 kg to 8.89 kg, with a 4.05% annual growth rate in the last 15 years. Among fish-eating populations, annual per capita intake grew 66%. The increasing number of chain restaurants across various metropolitan areas has amplified the use of smoke ingredients in fast food, casual dining, and fine dining establishments. With restaurant operators seeking to enhance menu diversity and attract customers with innovative flavors, the incorporation of smoke ingredients into grilled and roasted dishes has become a key trend. Additionally, quick-service restaurant chains are leveraging smoke flavors in sauces, dressings, and RTE meals, further driving the demand for liquid smoke and smoked powders. The evolving food culture, influenced by global culinary trends, has strengthened the adoption of smoke ingredients in processed foods, snack items, and convenience meals, expanding smoke ingredients market demand.

Europe Smoke Ingredients Market Analysis

Growing consumer preference for authentic, smoky flavors and clean-label, natural ingredients has boosted the adoption of liquid smoke and smoke flavors as healthier alternatives to traditional smoking methods. Additionally, the rising popularity of plant-based and vegan smoked products has expanded the market, as manufacturers seek natural smoke ingredients to enhance the taste profile of meat substitutes. As of 2023, there were an estimated 6.62 million vegans in some parts of the EU; this figure is expected to increase to approximately 8.25 million. Stringent food safety and environmental regulations in Europe are also fueling the shift toward smoke condensates and controlled smoking processes, reducing polycyclic aromatic hydrocarbon (PAH) contamination. Moreover, technological advancements in smoke extraction and encapsulation are improving ingredient stability and efficiency, further supporting market growth. The expansion of the RTE and convenience food industry, coupled with the increasing demand for gourmet and artisanal food products, is expected to drive the sustained growth of the smoke ingredients market in Europe.

Latin America Smoke Ingredients Market Analysis

The growing smoke ingredients adoption is being driven by increasing disposable income, which has led to higher consumer spending on premium and specialty food products. According to reports, Latin America's total disposable income is expected to grow by nearly 60% from 2021 to 2040. As middle-class populations expand, there is a rising preference for smoked meats and gourmet condiments that offer unique flavor experiences. The affordability of processed, smoked foods has further encouraged their consumption across diverse demographics. Additionally, local food manufacturers are introducing innovative smoked seasonings and marinades, catering to the evolving palate of consumers. With the availability of convenient, ready-to-use smoke ingredients, food producers are enhancing their product offerings, leading to greater market penetration.

Middle East and Africa Smoke Ingredients Market Analysis

The growing smoke ingredients adoption is influenced by the increasing demand for snacks and sauces, as consumers seek enhanced taste experiences in packaged and RTE products. The rising popularity of smoke-infused flavors in traditional and modern snacks has expanded the use of smoke ingredients in seasoning blends and processed foods. Additionally, growing tourism has driven higher demand for smoked meat, seafood, and gourmet dishes, encouraging restaurants and hotels to incorporate smoke flavors into their menus. For instance, Dubai welcomed 14.96 Million overnight visitors from January to October 2024, marking an 8% increase compared to the same period in 2023, highlighting a strong growth in tourism. The evolving food culture, combined with the influence of global cuisines, is further supporting the expansion of smoke ingredients in the region.

Competitive Landscape:

The competitive landscape of the smoke ingredients market is characterized by the presence of several established players offering a wide range of flavor solutions. Companies are focusing on product innovation, natural formulations, and advanced processing technologies to meet evolving consumer preferences for clean-label and authentic smoky flavors. Strategic collaborations, partnerships, and expansion into emerging markets are key approaches adopted to strengthen market presence. Continuous investment in research and development is enabling producers to enhance flavor extraction techniques and improve application versatility across various food segments. The market also sees growing competition from regional producers catering to localized taste profiles. Overall, competition remains dynamic, driven by innovation, quality differentiation, and responsiveness to shifting food industry trends.

The report provides a comprehensive analysis of the competitive landscape in the smoke ingredients market with detailed profiles of all major companies, including:

- Azelis Holding S.A

- B&G Foods Inc.

- Besmoke Ltd

- Essentia Protein Solutions

- International Flavors & Fragrances Inc.

- Kerry Group plc

- Lallemand Inc.

Latest News and Developments:

- October 2024: Kellanova introduced Cheez-It Smoked, its first-ever smoked cracker line, featuring smoke ingredients for a bold flavor. The new lineup includes Cheez-It Smoked Cheddar with hickory and oak wood smoke and Cheez-It Smoked Gouda with hickory and maple wood smoke. Inspired by fans who smoke their own crackers, the flavors blend rich cheese with smoky notes. This launch expands the Cheez-It brand with a unique, adventurous snacking experience.

- August 2024: Barkworthies launched single-count options in its Hickory Smoked line, allowing pet owners to customize their dog's treats while staying budget-friendly. These chews are crafted with minimal smoke ingredients and smoked in small batches over real hickory wood for enhanced flavor. The expansion provides 10 varieties, including Duck Feet and Bully Sticks, with pricing starting under USD 2. Pet parents can also experience the rich hickory smoked aroma through new bulk merchandising displays.

- August 2024: Conagra Brands acquired Sweetwood Smoke & Co., the maker of FATTY Smoked Meat Sticks, expanding its better-for-you snack portfolio. FATTY Smoked Meat Sticks are crafted with premium pork and beef, using real hickory wood as smoke ingredients for rich flavor. Conagra aims to accelerate growth in the snacking segment through this premium addition. The financial details of the acquisition remain undisclosed.

- July 2024: Godshall’s launched its first-ever Hickory Smoked Uncured Pork Bacon at Fresh Thyme stores, expanding beyond turkey and beef bacon. Crafted from all-natural pork bellies, the bacon is slowly smoked with hickory wood to enhance its rich flavor. The product contains no added nitrates or nitrites and is made using only seven simple smoke ingredients. With this launch, Godshall’s aims to strengthen its presence in the premium bacon market.

- March 2024: Sensient Flavors & Extracts introduced SmokeLess Smoke™, a clean-label solution offering natural smoke ingredients without traditional smoke condensates. Designed to meet food safety regulations, it caters to consumer demand for authentic smoky flavors in meat, dairy, snacks, and beverages. The innovation aligns with sustainability and health-conscious trends while maintaining rich taste profiles. SmokeLess Smoke™ ensures compliance with vegan, non-GMO, Halal, and Kosher standards.

Smoke Ingredients Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hickory, Mesquite, Applewood, Others |

| Forms Covered | Liquid, Powder, Others |

| Applications Covered | Dairy, Bakery and Confectionery, Meat and Seafood, Snacks and Sauces |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Azelis Holding S.A, B&G Foods Inc., Besmoke Ltd, Essentia Protein Solutions, International Flavors & Fragrances Inc., Kerry Group plc, Lallemand Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smoke ingredients market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global smoke ingredients market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smoke ingredients industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smoke ingredients market was valued at USD 81.17 Million in 2024.

The Smoke Ingredients market was valued at USD 129.47 Million in 2033, exhibiting a CAGR of 5.06% during 2025-2033.

Rising demand for processed and RTE foods, growing consumer preference for smoky flavors, and increasing use of smoke ingredients in meat, seafood, and snacks are key drivers. Additionally, technological advancements in food processing and the shift toward natural, clean-label flavoring agents are further propelling market growth.

Asia Pacific currently dominates the smoke ingredients market due to rising consumption of processed foods, rapid urbanization, and evolving dietary habits across emerging economies. Increased demand for convenient, flavorful meals and the growth of the regional food processing industry further drive market expansion, supported by a strong preference for smoky taste profiles.

Some of the major players in the smoke ingredients market include Azelis Holding S.A, B&G Foods Inc., Besmoke Ltd, Essentia Protein Solutions, International Flavors & Fragrances Inc., Kerry Group plc, Lallemand Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)