Snack Bar Market Size, Share, Trends and Forecast by Product Type, Ingredient, Distribution Channel, and Region, 2026-2034

Snack Bar Market Size and Share:

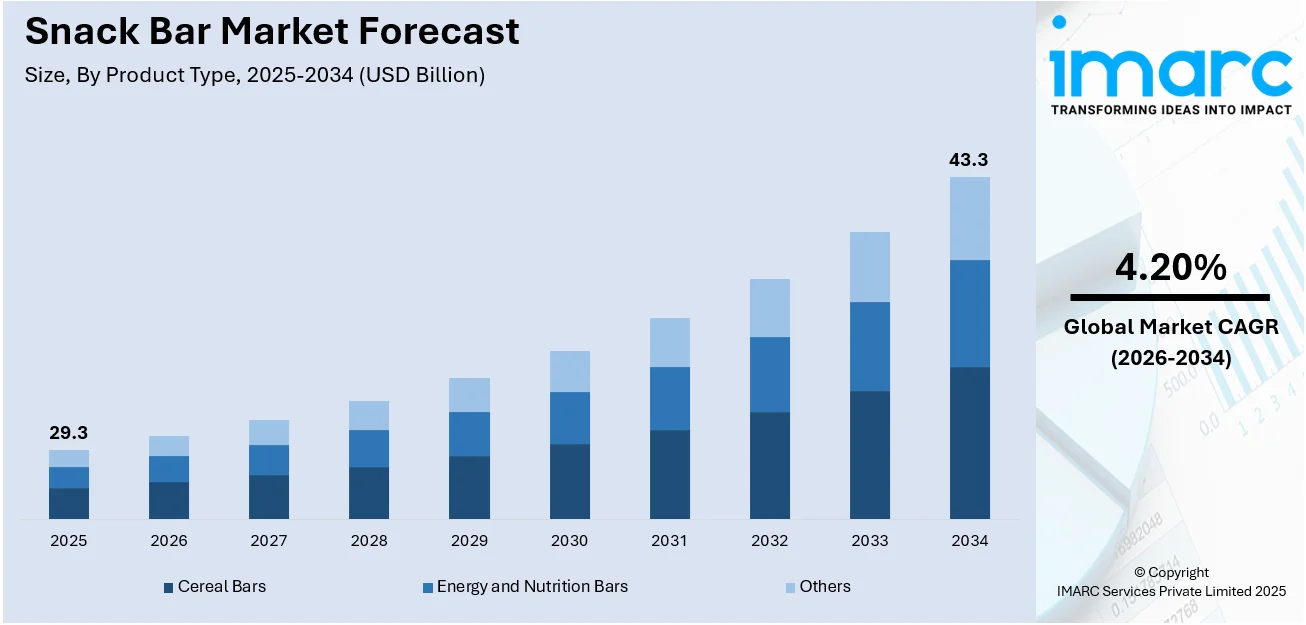

The global snack bar market size was valued at USD 29.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 43.3 Billion by 2034, exhibiting a CAGR of 4.20% during 2026-2034. North America currently dominates the market, holding a significant market share of 38.7% in 2025. The rising health consciousness, escalating demand for convenient on-the-go nutrition, increasing preference for high-protein and low-sugar options, growing fitness trends, and the popularity of clean-label, organic, and functional ingredients among consumers seeking healthier snacking alternatives are some of the major factors fueling the snack bar market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 29.3 Billion |

|

Market Forecast in 2034

|

USD 43.3 Billion |

| Market Growth Rate 2026-2034 | 4.20% |

The market for snack bars is witnessing strong growth due to a combination of health, lifestyle, and convenience factors. Rising health awareness among consumers has boosted demand for nutritious, low-sugar, and high-protein snack options that support weight management and active lifestyles. The growing popularity of fitness and wellness trends has further encouraged the consumption of energy and protein bars. The trend towards urbanization and hectic lifestyles is necessitating the demand for portable, on-the-go snacks, which need no preparation. Moreover, consumers want clean-label products containing natural, organic, and functional ingredients, e.g., superfoods, probiotics, and plant-based proteins. New flavors, textures, and packaging, as well as the growing reach in both retail and online distribution, are helping the market grow.

To get more information on this market Request Sample

In the United States, the snack bar market growth is driven by increasing demand for convenient, on-the-go nutrition options amid busy lifestyles. Health-conscious consumers are seeking products that offer functional benefits such as high protein, fiber, and low sugar content. For instance, in January 2025, Genius Gourmet, a rapidly expanding brand known for its intelligently crafted protein snacks, unveiled four new indulgent offerings designed to elevate snacking more healthily. The lineup includes Mint and Milk Chocolate Protein Cookie Bites, a sweet-meets-savory Protein Nut Roll Bar featuring zero grams of added sugar, and Salted Caramel Protein Cookie Bites. The rising popularity of fitness and wellness trends has also spurred interest in energy and protein bars. Also, the trend of clean-label, organic, and plant-based ingredients is driving purchase decisions. This has broadened its consumer appeal through innovation in flavours, formats, and packaging and extended access through heavy retail distribution and availability in online outlets.

Snack Bar Market Trends:

Rising Health and Wellness Awareness

The increasing awareness about health and wellness is significantly boosting the market for snack bars. Consumers are nowadays looking for convenient food options that align with their fitness goals, dietary preferences, and overall well-being. Snack bars enriched with protein, fiber, vitamins, and natural ingredients are gaining popularity among health-conscious individuals. The demand for low-sugar, gluten-free, keto, vegan, and clean-label bars has risen as people become more aware of lifestyle diseases and preventive nutrition. According to the snack bar market forecast, this shift is especially prominent among millennials and Gen Z, who prioritize transparency and nutritional value in their snacks. Brands are responding by innovating with functional ingredients such as superfoods, probiotics, and plant-based proteins, making health-focused snack bars a preferred choice for everyday consumption. For instance, in June 2025, RXBar introduced RXBar High Protein, a new snack bar developed for consumers looking for a protein-rich option. Containing 18 grams of protein and crafted with just six ingredients, the bar is both gluten-free and plant-based. It is naturally sweetened with organic agave nectar and comes in two flavor varieties: strawberry peanut butter and vanilla peanut butter. Designed to deliver both nutrition and taste, the bar features a soft, cookie-dough-like consistency complemented by a roasted nut finish.

Growing Demand for Convenient, On-the-Go Nutrition

Fast-paced lifestyles, urbanization, and the rise of dual-income households have intensified the demand for portable, ready-to-eat snacks. Snack bars offer an ideal solution for busy consumers seeking a quick energy boost between meals or during commutes, workouts, or office hours. Their compact size, shelf stability, and minimal preparation make them a convenient alternative to traditional snacks. This snack bar market trend is particularly strong in developed markets like the U.S., where time-strapped individuals are looking for nutritious options that fit into their daily routines. Additionally, the increasing number of health-conscious travelers and mobile professionals is driving the growth of this segment. As convenience remains a top consumer priority, the appeal of snack bars as a versatile and satisfying option continues to expand. For instance, in June 2025, Creative Nature, the acclaimed brand known for its free-from products, marked a significant achievement with the debut of its first-ever snack bar range designed specifically for children. The newly introduced Berry & Beetroot Oatie Snack Bars are set to hit the shelves in 510 Tesco Free From sections throughout the UK, offering families across the country a vibrant, wholesome, and allergy-friendly snacking choice.

Product Innovation and Variety in Flavors and Ingredients

Innovation in flavors, ingredients, and formats is a crucial growth factor in the snack bar market. Manufacturers are constantly experimenting with new taste combinations, textures, and functional benefits to differentiate their offerings and meet evolving consumer preferences. This includes the use of plant-based proteins, ancient grains, adaptogens, collagen, and other trending health ingredients. Unique flavor profiles, such as matcha, turmeric, sea salt dark chocolate, and mint chip, are attracting adventurous consumers seeking novelty, which is creating a positive snack bar market outlook. In addition, companies are focusing on allergen-free and specialty diet-friendly bars to cater to niche markets. Enhanced packaging designs and smaller portion sizes for calorie control are also contributing to broader market appeal. This innovation cycle sustains consumer interest and encourages repeat purchases. For instance, in November 2024, Beeyond Snacks stepped into the snack bar segment with the launch of its Pasteli Honey and Sesame Bars, made using authentic Greek honey and sesame seeds. The product, created by entrepreneurial sisters Andrea and Angelina Papanikolaou, draws inspiration from pasteli, a time-honored Greek delicacy traditionally prepared with gently roasted sesame seeds and honey.

Snack Bar Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global snack bar market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, ingredient, and distribution channel.

Analysis by Product Type:

- Cereal Bars

- Granola/Muesli Bars

- Others

- Energy and Nutrition Bars

- Others

Cereal bars hold the largest share in the market due to their broad consumer appeal, versatility, and perceived health benefits. These bars are often made with whole grains, oats, nuts, and dried fruits, making them a convenient and nutritious snack for both children and adults. Their positioning as a healthier alternative to traditional snacks, along with their suitability for breakfast on the go or quick energy boosts, drives high demand. Cereal bars are also widely available across retail formats and offered in various flavors, dietary options (e.g., low sugar, gluten-free), and price points, enhancing their accessibility. Additionally, strong marketing by leading brands and constant innovation in ingredients and packaging help sustain their dominance in the growing snack bar category.

Analysis by Ingredient:

- Nuts

- Whole Grains

- Dried Fruits

- Others

Whole grains hold the largest share in the snack bar market due to their strong association with health, nutrition, and satiety. Consumers increasingly seek functional ingredients that offer digestive benefits, sustained energy, and essential nutrients, and whole grains meet these demands. Ingredients like oats, quinoa, brown rice, and millet are rich in fiber, vitamins, and antioxidants, making them highly attractive to health-conscious buyers. Their versatility allows brands to incorporate them into various snack bar formats, from breakfast and cereal bars to protein and energy bars. Moreover, the growing popularity of clean-label and natural products has boosted demand for whole grain-based options. Continuous innovation and endorsements from health authorities further reinforce consumer trust and preference, solidifying whole grains’ leading market position.

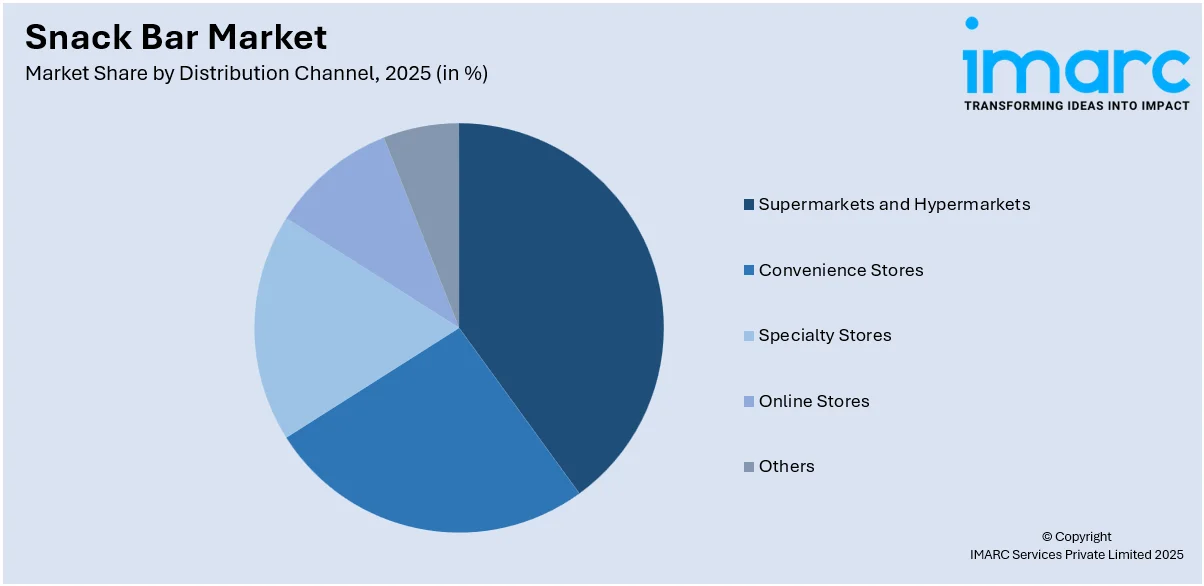

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets lead the market with 45.2% of market share in 2025 due to their wide product assortment, high foot traffic, and convenience. These retail formats offer consumers easy access to multiple snack bar brands and varieties, including health-focused, functional, and on-the-go options. Their strategic product placements, promotional offers, and in-store visibility further drive impulse purchases. Supermarkets also provide products for different dietary preferences, including high-protein or gluten-free snacks, to meet the needs of a diverse customer base. Additionally, trusted private-label offerings and established distribution networks enhance consumer loyalty and repeat purchases, solidifying their dominance in the overall snack bar retail landscape.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of 38.7%. The rising health consciousness, busy lifestyles, and the growing demand for convenient, on-the-go nutrition are driving the snack bar market demand in North America. Consumers are increasingly opting for high-protein, low-sugar, and functional snack bars that support fitness and wellness goals. The popularity of clean-label, plant-based, and allergen-free products also boosts market growth. Innovative flavors, inclusion of superfoods, and transparent ingredient sourcing attract health-focused buyers. Additionally, strong retail distribution through supermarkets, online platforms, and specialty stores enhances accessibility. Marketing strategies emphasizing natural energy, weight management, and meal replacement benefits further fuel consumer interest across diverse demographic segments in the region.

Key Regional Takeaways:

United States Snack Bar Market Analysis

In 2025, the United States accounted for 92.10% of the snack bar market in North America. The United States snack bar market is majorly fueled by the rising popularity of functional foods that offer targeted health benefits such as immune support and gut health. In line with this, growing consumer demand for personalized nutrition is encouraging the development of bars tailored to individual dietary needs and fitness goals. The increasing adoption of plant-based diets, augmenting demand for vegan and dairy-free options, and aligning with changing dietary trends is impelling the market. In 2024, 59% of households in the US bought plant-based foods, keeping a level like the year before. Plant-based items represented 1.1% of the overall retail food and beverage dollar sales that year. Additionally, the ongoing shift towards sustainable sourcing and ethical manufacturing practices is influencing brand loyalty and purchase decisions. The changing dynamics of work environments, especially hybrid and remote models, are increasing the demand for convenient, shelf-stable nutrition solutions, fostering market expansion. Furthermore, heightened millennial and Gen Z preferences for transparency and clean-label ingredients are shaping product development. Moreover, the multifunctionality of snack bars as meal alternatives or performance enhancers is continuously expanding their market appeal.

Europe Snack Bar Market Analysis

The market in Europe is experiencing growth due to increasing demand for on-the-go nutrition driven by fast-paced urban lifestyles and developing work patterns. In accordance with this, a heightened awareness of wellness and fitness is promoting snack bars formulated with high-protein, high-fiber, and low-sugar profiles. As per an industry report, between 2022 and 2023, fitness club membership in Europe grew by 7.5% to 67.6 Million. The proportion of Europeans practicing fitness at least once a week increased from 54% in 2022 to 60% in 2023, reaching 61% in 2024. Similarly, the rise in food sensitivities is impelling the market for gluten-free and allergen-friendly alternatives across diverse consumer groups. The growing adoption of front-of-pack labeling systems, such as Nutri-Score, is enabling informed choices and stimulating market appeal. Furthermore, the increasing popularity of flexitarian and plant-based diets increasing the presence of vegan snack bars made from legumes, seeds, and natural sweeteners, is bolstering market development. The growing inclusion of regional superfoods like Nordic berries and ancient grains is strengthening the market demand. Besides this, the rise in eco-conscious consumers supporting brands with recyclable packaging and carbon-reduction commitments is creating lucrative market opportunities.

Asia Pacific Snack Bar Market Analysis

The growing middle class and rising disposable incomes in the Asia Pacific area are the main drivers of the industry, which are elevating consumer demand for convenient and nutritious on-the-go products. In parallel, the widespread adoption of Western dietary patterns, especially among younger demographics, is influencing the popularity of protein- and fiber-rich snack bars. Additionally, the rapid urbanization across countries such as India, China, and Indonesia are encouraging busy lifestyles, thereby increasing reliance on functional snacking. Furthermore, e-commerce proliferation significantly improving consumer access to niche and global snack bar brands, is impelling the market. IBEF reported that India’s e-commerce platforms recorded a Gross Merchandise Value (GMV) of USD 60 Billion in FY23, representing a 22% growth over the prior year. Online retail penetration is anticipated to increase from 8% in 2024 to 14% by 2028. Moreover, the rise in government-backed nutrition programs promoting fortified foods is providing an impetus to the market.

Latin America Snack Bar Market Analysis

In Latin America, the market is advancing due to rising urban health awareness and growing demand for functional, nutrient-rich snacks. A report on the industry disclosed that in key metropolitan areas of Latin America, 61% of individuals participate in physical activity several times a week, and 78% exercise at least a few times monthly, highlighting a significant regional emphasis on fitness and well-being. Similarly, expanding participation in fitness activities is promoting the popularity of protein-enhanced snack bars tailored for active lifestyles. Furthermore, modern retail growth across major economies is improving product accessibility and shelf visibility. Apart from this, the rapid incorporation of native superfoods such as quinoa, acai, and amaranth into snack bars is fostering regional innovation and global appeal.

Middle East and Africa Snack Bar Market Analysis

The market in the Middle East and Africa is progressing due to increasing consumer interest in functional snacks that align with changing health and wellness priorities. In addition to this, rising urbanization and shifting lifestyles are driving demand for nutritious, portable food formats such as high-fiber and protein-rich snack bars. Similarly, growing investments in modern retail infrastructure across the GCC and North African countries are enhancing accessibility to premium and health-oriented snack options. An industry report stated that by 2028, the GCC is projected to add 3.9 Million Square Meters of new organized retail space, increasing the total gross leasable area (GLA) to around 24.3 Million square meters, reflecting significant growth in the region’s retail infrastructure. Moreover, the rising popularity of halal-certified, clean-label formulations aligned with cultural and ethical values is fostering innovation in natural and regionally inspired snack bar offerings.

Competitive Landscape:

The snack bar market is highly competitive, dominated by major players like General Mills, Kellogg’s, Mars, and Nestlé, who leverage strong brand portfolios, global distribution, and acquisitions to maintain market share. Brands such as Nature Valley, Clif Bar, and Kind focus on clean-label and health-driven innovations to attract fitness and wellness consumers. Emerging startups and niche brands compete by offering plant-based, protein-rich, or allergen-free options with unique flavors and natural ingredients. Private label offerings from major retailers are also growing, providing affordable alternatives. Innovation, health positioning, and ingredient transparency are key competitive tools. The landscape remains dynamic, with established brands expanding and startups carving out space through differentiation and targeted marketing. For instance, in November 2024, KIND Snacks Canada renewed its collaboration with Tennis Canada, once again serving as the Official Snack Bar Partner for the National Bank Open presented by Rogers (NBO) in both Montreal and Toronto. Throughout the tournament, KIND’s snack bars will be offered at various points, delivering bold flavour and clean ingredients to attendees, players, and event volunteers alike.

The report provides a comprehensive analysis of the competitive landscape in the snack bar market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Associated British Foods plc

- Clif Bar & Company

- General Mills Inc.

- Halo Foods Ltd.

- Mars Incorporated

- Nestlé S.A.

- Ocado Retail Limited

- PepsiCo Inc.

- The Hain Celestial Group Inc.

- The Kellogg Company

- The Simply Good Foods Company

Latest News and Developments:

- May 2025: CLIF BUILDERS launched three new high-protein bars, including an OREO-flavored bar with 20g of plant protein and Reduced Sugar Crispy bars with 16g protein and 5g sugar. All bars are gluten-free, contain no artificial sweeteners, and are available nationwide for USD 1.99–USD 2.19 each.

- April 2025: UK-based Trek launched its first natural high-protein, low-sugar bar range, featuring 12–15g plant-based protein and up to 47% less sugar. Using stevia and chicory fibre, the bars aim to cut 8.3 Million teaspoons of sugar annually. Retail launch begins May 25 at Sainsbury’s.

- February 2025: Perfect Snacks partnered with Grammy-winner Jason Mraz to launch Chocolate Mrazberry, a limited-edition protein bar featuring peanut and cashew butter, cocoa, and superfoods. With 8g of protein, sales support the Jason Mraz Foundation. An exclusive campaign and merchandise accompany the USD 29 eight-pack release.

- January 2025: TruFood and Bar Bakers rebranded as Tandem Foods following their Spring 2024 merger. The new identity emphasizes collaboration, innovation, and customer partnership in the better-for-you snack market. Tandem Foods now operates eight U.S. facilities, offering expanded capabilities and a unified focus on delivering trusted, high-quality snack solutions.

- January 2025: Ferrero Group announced its acquisition of protein snack brand Power Crunch from Bio-Nutritional Research Group. The move expands Ferrero’s U.S. presence and better-for-you snack offerings. Power Crunch’s Irvine, California, office and 50 employees will join Ferrero, building on its recent acquisitions of FULFIL and Eat Natural.

- August 2024: Pakka and Brawny Bear launched India’s first Date Energy Bars in compostable flexible packaging. Made with premium dates and no added sugars, the bars offer a healthy snack while addressing packaging waste. This marks their second collaboration, promoting sustainability and nutrition in the Indian snack market.

- July 2024: Once Upon a Farm launched organic Soft-Baked Bars for Kids in four flavors, made with whole grain oats, fruits, veggies, and no added sugar. Perfect for back-to-school, the bars are non-GMO, mess-free, and available nationwide, alongside limited-edition snack packs supporting Save the Children.

Snack Bar Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Ingredients Covered | Nuts, Whole Grains, Dried Fruits, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Associated British Foods plc, Clif Bar & Company, General Mills Inc., Halo Foods Ltd., Mars Incorporated, Nestlé S.A., Ocado Retail Limited, PepsiCo Inc., The Hain Celestial Group Inc., The Kellogg Company and The Simply Good Foods Company. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the snack bar market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global snack bar market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the snack bar industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The snack bar market was valued at USD 29.3 Billion in 2025.

The snack bar market is projected to exhibit a CAGR of 4.20% during 2026-2034, reaching a value of USD 43.3 Billion by 2034.

The snack bar market is driven by rising health awareness, demand for convenient on-the-go nutrition, and busy lifestyles. Consumers seek high-protein, low-sugar, and clean-label options. Innovation in flavors, functional ingredients, and plant-based offerings further fuels growth, alongside strong retail presence and increasing preference for healthier snacking alternatives.

North America currently dominates the snack bar market due to rising health awareness, demand for convenient on-the-go nutrition, preference for high-protein and clean-label products, and innovation in flavors and functional ingredients.

Some of the major players in the snack bar market include Abbott Laboratories, Associated British Foods plc, Clif Bar & Company, General Mills Inc., Halo Foods Ltd., Mars Incorporated, Nestlé S.A., Ocado Retail Limited, PepsiCo Inc., The Hain Celestial Group Inc., The Kellogg Company, and The Simply Good Foods Company.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)