Sodium Chloride Market Size, Share, Trends and Forecast by Source, End-Use, and Region, 2025-2033

Sodium Chloride Market Size and Share:

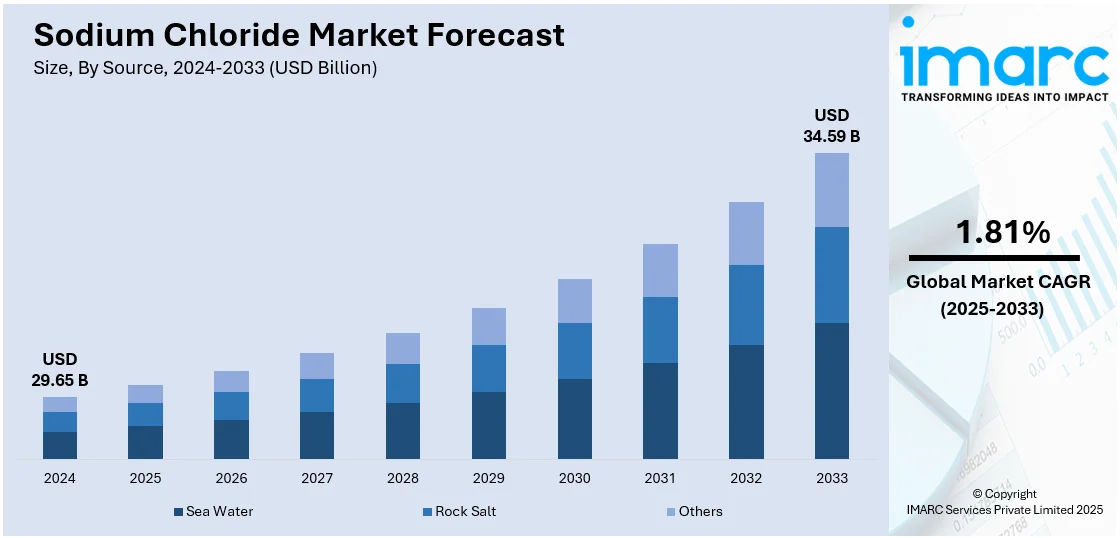

The global sodium chloride market size was valued at USD 29.65 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 34.59 Billion by 2033, exhibiting a CAGR of 1.81% during 2025-2033. Asia currently dominates the market, holding a significant market share of over 36% in 2024. The market is driven by its widespread use in food processing, chemical manufacturing, water treatment, and de-icing applications. Increasing industrial activities and urbanization are boosting demand, particularly in Asia-Pacific. Technological advancements in extraction and purification further support market growth. Key players are focusing on sustainability and capacity expansion to strengthen their presence. These dynamics collectively shape the competitive landscape of the global sodium chloride market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 29.65 Billion |

|

Market Forecast in 2033

|

USD 34.59 Billion |

| Market Growth Rate 2025-2033 | 1.81% |

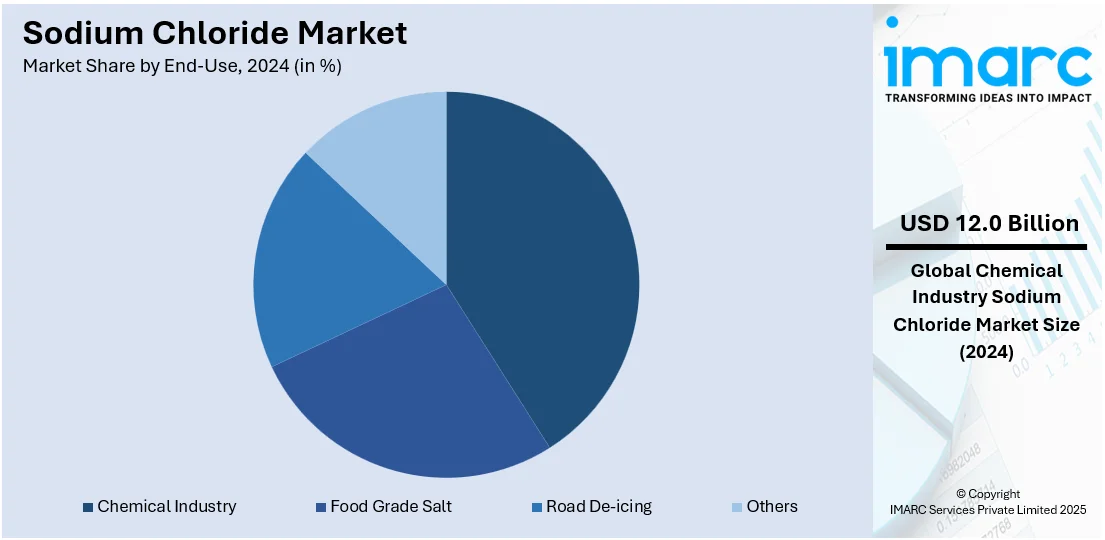

The global market of sodium chloride is experiencing consistent growth based on its extensive use in many industries. The rising demand in food processing and preservation, surging use in water treatment, continuous use in de-icing and snow control operations, and use in oil and gas drilling where sodium chloride is utilized in drilling fluids are some of the factors propelling the market growth. Increased use of drugs like intravenous (IV) fluids is another factor for the market. The chemical industry depends on it for most of the synthesis processes. It is widely used in dyeing of fabrics, tanning in the leather sector, and as flux in metal refining. Animal feed supplementation, production of detergents and soap, and industrial cleaning are favoring the Chemical industry leads the market with around 40.6% of market share in 2024. It is particularly driven by the essential role of sodium chloride as a feedstock in the chlor-alkali process, which produces chlorine, caustic soda, and hydrogen growth. Urban infrastructure and road construction has boosted the demand for highway de-icing salts. In addition to this, burgeoning product use by farmers for weed growth suppression and land preparation are fostering the sodium chloride market growth.

The U.S. sodium chloride market holds a share of 88.7% and is witnessing steady demand across industrial, commercial, and household uses. Road de-icing remains the largest segment, with heavy seasonal demand in northern states. Water softening and purification continue to grow with expanding urban infrastructure. In 2023, total consumption reached 22 million tons, with state and local governments accounting for 80% of market demand. Water softening and purification continue to grow with expanding urban infrastructure. The chemical industry relies on salt in the chlor-alkali process for the production of chlorine and caustic soda. Oil and gas exploration use it in drilling and well completion fluids. The pharmaceutical industry employs it in IV fluids and tablets. It facilitates dyeing in textiles and tanning in leather. Metallurgy uses it in aluminum and steel treatment. It's a key input in animal nutrition and feed mixes. It is used in soaps, detergents, and household cleaners. It is also used in agriculture for weed control and soil conditioning. Long-term growth drivers are increased investment in salt storage, mine improvement, industrial cleaning, and regional exports.

Sodium Chloride Market Trends:

Expanding Use in Food Preservation and Seasoning

Sodium chloride continues to hold strong relevance in the global food industry, both as a preservative and a seasoning agent. Its core function in food preservation stems from its ability to draw moisture out of food, reducing bacterial growth and spoilage. This role becomes especially important in regions where cold storage or refrigeration is limited. In developing economies, rising disposable incomes and lifestyle shifts are pushing demand for packaged and ready-to-eat (RTE) foods, which often rely on salt as a key ingredient. For instance, the global ready to eat (RTE) food market was valued at around USD 189.1 billion in 2024, with a steady growth rate of 4.01% per year from 2025 to 2033. Moreover, the global expansion of fast food and processed meat consumption has further supported sodium chloride usage. Even in health-conscious markets, where low-sodium alternatives are gaining popularity, regular salt remains the dominant choice due to its affordability and versatility. The consistent global need for basic food-grade salt makes this one of the most stable demand drivers across both mature and developing markets.

Growth in Water Treatment Applications

Sodium chloride plays a critical role in water treatment processes, especially in residential and industrial water softening systems. It is primarily used to regenerate ion exchange resins in water softeners, which helps remove hardness-causing minerals like calcium and magnesium. As urbanization accelerates, and access to clean, soft water becomes more critical, the demand for water treatment systems continues to increase. The growth is also visible in commercial establishments such as hotels, hospitals, and manufacturing units where treated water is essential for daily operations. Additionally, in some regions facing groundwater quality issues, public infrastructure investments in water purification are driving up bulk salt procurement, which is further supporting the market growth. For instance, in India, the Namami Gange Mission-II was allocated around USD 2.7 billion (₹22,500 crore) to clean the Ganges River by building sewage treatment plants, laying down new sewer lines, fixing up riverbanks, and using better ways to manage waste and keep the water cleaner. Apart from this, the market is driven by the population growth and stricter environmental regulations that push for more effective water treatment practices, making it a long-term and resilient area of demand for sodium chloride.

Seasonal Demand in De-Icing and Road Maintenance

In colder regions, sodium chloride serves as the primary de-icing material for roads, sidewalks, and highways. During winter, municipalities and highway authorities use rock salt extensively to prevent ice buildup and maintain road safety. The effectiveness of salt in lowering the freezing point of water makes it a reliable and cost-efficient choice compared to alternatives like calcium magnesium acetate or potassium chloride. The demand spikes sharply during winter months, especially in North America, Europe, and parts of East Asia. Moreover, governments are stockpilinf salt ahead of winter, leading to large-volume contracts that drive short-term surges in production and distribution. With increasing focus on road safety and preparedness against extreme weather, the de-icing segment remains a dependable source of recurring demand for the global sodium chloride market.

Sodium Chloride Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global sodium chloride market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on source and end-use.

Analysis by Source:

- Sea Water

- Rock Salt

- Others

Rock salt stands as the largest component in 2024, driven by the growing need for effective and economical de-icing solutions, particularly in regions prone to harsh winter conditions. In North America and parts of Europe, road safety during snow and ice events remains a top priority for local governments and highway authorities, prompting bulk procurement of rock salt each winter season. This trend significantly shapes the sodium chloride market outlook, highlighting sustained demand from the transportation and public safety sectors. Its ability to lower the freezing point of water makes it a practical choice for maintaining road conditions, minimizing accidents, and reducing traffic disruptions. Additionally, the relatively low cost and widespread availability of rock salt give it a strong edge over alternative materials. The segment also benefits from well-established supply chains and long-term contracts with public sector agencies, ensuring steady demand. Infrastructure development in cold-climate regions and heightened preparedness for extreme weather events are further encouraging stockpiling and proactive usage, keeping the rock salt segment a vital contributor to the overall sodium chloride market.

Analysis by End-Use:

- Chemical Industry

- Food Grade Salt

- Road De-icing

- Others

The chemical industry leads the market with around 40.6% share in 2024, driven by the essential role of sodium chloride as a feedstock in the chlor-alkali process, which produces chlorine, caustic soda, and hydrogen. This dominance is a key factor shaping the sodium chloride market forecast, as consistent demand from chemical manufacturing continues to underpin long-term market growth. This process accounts for a significant portion of industrial salt consumption globally. Chlorine is vital in manufacturing PVC, solvents, and disinfectants, while caustic soda is used extensively in paper, textiles, detergents, and aluminum production. The rising global demand for construction materials, consumer goods, and hygiene products indirectly fuels sodium chloride use in chemical manufacturing. Additionally, emerging economies are expanding their chemical production capacities, further strengthening regional demand for industrial-grade salt. Stable pricing, abundant availability, and ease of transport make sodium chloride a dependable raw material.

Regional Analysis:

- Asia

- Europe

- North America

- South and Central America

- Others

In 2024, Asia accounted for the largest market share of over 36%. The growing demand from food processing, chemical manufacturing, and water treatment sectors across rapidly developing economies, is favoring the market demand. Expanding urban populations and rising incomes are fueling consumption of packaged foods, where salt is used extensively as a preservative and flavor enhancer. In parallel, large-scale industrialization in countries like China and India is increasing demand for sodium chloride in the chlor-alkali process, essential for producing chlorine and caustic soda. Municipal and industrial water treatment projects are also supporting bulk procurement of salt, particularly for softening and purification systems. Additionally, Asia’s textile and dyeing industries rely on sodium chloride in various fabric treatment stages, further strengthening market use. With abundant raw salt reserves, supportive policies, and growing domestic consumption, Asia is positioned as both a key producer and consumer in the global sodium chloride market.

Key Regional Takeaways:

North America Sodium Chloride Market Analysis

The North America sodium chloride market maintains a strong position, driven by consistent demand across industrial, municipal, and consumer sectors. One of the key contributors is the extensive use of rock salt in road de-icing, especially across the United States and Canada. Each winter, highway authorities and local municipalities rely on sodium chloride to ensure road safety during snow and ice events. This creates seasonal spikes in procurement and usage. The region also witnesses strong demand from the chlor-alkali industry, where sodium chloride serves as a fundamental raw material in producing chlorine and caustic soda, which are used in chemicals, paper, and plastics manufacturing. In the food sector, North America shows stable consumption patterns driven by high per capita intake of processed and packaged food. Additionally, demand from the water treatment industry is rising due to expanding residential and commercial water softening systems. While environmental concerns about excessive salt use in de-icing have prompted exploration of alternatives, sodium chloride remains the dominant choice due to its cost-effectiveness and availability.

United States Sodium Chloride Market Analysis

United States is witnessing increasing sodium chloride adoption due to growing investment in pharmaceuticals, where it plays a crucial role in drug formulation, saline solutions, and medical treatments. According to reports, in the US pharmaceutical industry, there were 25 private equity deals announced in Q3 2024, worth a total value of USD 2.3 Billion. The expanding pharmaceutical sector is driving demand for high-purity sodium chloride used in intravenous therapies, haemodialysis, and oral rehydration solutions. Rising healthcare spending and research initiatives are fostering innovation in medical applications, strengthening its role in pharmaceutical-grade formulations. Enhanced regulatory standards further push demand for refined sodium chloride in sterile conditions. Expanding drug production facilities and the rising prevalence of chronic diseases necessitate a stable supply of pharmaceutical-grade sodium chloride. Additionally, technological advancements in manufacturing processes ensure consistent quality, supporting its increased use in medical formulations. With sustained investment in pharmaceutical research and manufacturing, sodium chloride remains an essential component, reinforcing its significance in the industry’s growth trajectory.

Asia Pacific Sodium Chloride Market Analysis

Asia-Pacific is experiencing rising sodium chloride adoption due to growing investment in water and waste treatment, where it is essential in desalination, softening, and purification processes. According to Ministry of Commerce and Industry India, 565 investment projects in water treatment plants subsector in India worth USD 60.43 Billion. Increasing urbanization and industrial expansion are elevating the demand for sodium chloride in municipal and industrial water treatment systems. The rising necessity for sustainable solutions is driving advanced treatment technologies incorporating sodium chloride to optimize ion exchange and reverse osmosis processes. Regulatory initiatives promoting clean water standards further enhance its usage in purification facilities. Expanding industrial sectors require efficient wastewater management, contributing to increased utilization of sodium chloride in treating effluents. Growing concerns about water scarcity and environmental sustainability encourage infrastructure development, fostering investment in advanced treatment facilities. The integration of sodium chloride in large-scale water treatment projects ensures its continued adoption, supporting regional efforts toward sustainable water resource management.

Europe Sodium Chloride Market Analysis

Europe is seeing expanding sodium chloride adoption due to growing demand for preserved foods resulting from the growing food processing sector. According to reports, in 2020, there were 291,000 enterprises in the EU processing food and beverages. Processed meats, dairy, and ready-to-eat meals require sodium chloride as a preservative to enhance flavour and extend shelf life. Increasing consumer preference for convenience food is driving manufacturers to incorporate sodium chloride for its preservation properties. Expanding production facilities and stringent food safety regulations are further pushing its demand in food processing. The shift toward pre-packaged and frozen meals necessitates sodium chloride’s role in maintaining product integrity and taste. Growth in international food trade and rising export activities amplify its utilization in processed food formulations. Continuous investment in technological advancements ensures efficient sodium chloride application in preservation techniques. The evolving consumer lifestyle and busy work schedules reinforce its significance in the expanding food processing sector.

Latin America Sodium Chloride Market Analysis

Latin America is witnessing rising sodium chloride adoption to keep ready-to-eat meats and cheeses safe to eat. The increasing purchasing power enables higher consumption of packaged and processed foods, where sodium chloride is essential for maintaining freshness and preventing spoilage. For instance, Brazil households disposable Income data was reported at approximately USD 127,664 Million in Dec 2024. Expanding urban populations are driving demand for convenient food options, enhancing its necessity in meat curing and cheese aging processes. Growing cold storage and distribution networks support the sustained use of sodium chloride in extending product shelf life. Stringent food safety regulations ensure its continued application in preserving perishable food items. Rising food retail infrastructure development further accelerates sodium chloride utilization in processed food industries.

Middle East and Africa Sodium Chloride Market Analysis

Middle East and Africa is seeing increasing sodium chloride adoption due to growing investment in the textiles sector, where it plays a critical role in fabric dyeing, printing, and processing. According to reports, in 2022, the UAE textile market was valued at more than USD10 Billion and is now expected to expand by more than 5% a year over the medium term. The expanding textile industry requires sodium chloride for colour fixation and improving dye absorption efficiency in fabric treatment. Industrial growth and rising exports of textiles are fuelling its use in manufacturing processes. Technological advancements in textile processing techniques are enhancing sodium chloride’s effectiveness in achieving uniform dyeing results. Increasing government support for industrial diversification further strengthens investment in textile production, boosting its demand.

Competitive Landscape:

The sodium chloride market is dominated by competitiveness, led by its critical use across various applications like chemical production, water treatment, food preservation, and de-icing. Competition is mainly product purity, price, supply chain manageability, and regional raw material access. Manufacturers close to salt mines or sea water sources enjoy lower logistics costs and a stable supply, providing them with a strategic advantage. Peak seasonal demand, particularly de-icing in colder climates, additionally heightens competition. Industry players concentrate on maximizing production techniques, such as solar evaporation and brine extraction, to increase efficiency and accommodate differing industry standards. It also has environmental regulations influencing operations, encouraging businesses to adopt sustainable extraction and processing methods. As demand increases in industrial and commercial markets, firms seek to balance cost leadership with quality control, so they can serve bulk industrial customers as well as more regulated food-grade or pharmaceutical markets.

The report provides a comprehensive analysis of the competitive landscape in the sodium chloride market with detailed profiles of all major companies, including:

- K+S Group

- China National Salt Industry Group (CNSIG)

- Compass Minerals International, Inc

- Cargill Corporation

- Dampier Salt Limited (DSL)

Latest News and Developments:

- April 2025: B. Braun Medical Inc. announced FDA approval for Piperacillin and Tazobactam with Sodium Chloride Injection in its DUPLEX® Drug Delivery System, which reduced medication errors and contamination risks. The system, requiring no thawing, offered labor savings compared to Baxter’s Mini-Bag Plus and traditional compounding, streamlining administration with sodium chloride as the diluent.

- December 2024: Brenntag Specialties Pharma was selected as the global strategic distributor for K+S’s high-purity Sodium Chloride and Potassium Chloride for pharmaceutical applications. This partnership expanded Brenntag’s pharmaceutical portfolio, covering medical nutrition, biopharma, and dietary supplements. K+S produced these pharmaceutical salts at multiple European sites, ensuring compliance with strict pharmacopoeia standards.

- November 2024: NINER Pharmaceutical launched a strategic initiative to address IV fluid shortages in the U.S. and Latin America. The effort focused on ensuring the availability of critical medical supplies, including sodium chloride solutions. This expansion reinforced NINER’s commitment to strengthening healthcare systems. The initiative aimed to mitigate supply chain disruptions affecting essential treatments.

- May 2024: B. Braun Medical Inc. launched its Levetiracetam in Sodium Chloride Injection portfolio, expanding its anticonvulsant offerings. The product, manufactured in Irvine, CA, was made available in PAB® IV Containers with three concentration options. Designed for supply reliability, the injection featured biodegradable packaging and color-coded dosages.

- May 2024: ITC Aashirvaad launched 'Himalayan Pink Salt' on May 16, 2024, emphasizing its purity and natural color. The product contained no added colors and was sourced from high-quality salt mines. Rich in essential minerals like calcium and magnesium, it was also known as Sendha Namak in India. The launch was driven by consumer preference for sodium chloride with perceived health benefits.

- January 2024: Dampier Salt announced the sale of its Lake MacLeod site to Leichhardt Industrials Group for USD 251 million. The Australian company, 68% owned by Rio Tinto, operated three production sites. The transaction aimed to streamline its sodium chloride operations. The deal marked a strategic shift in Australia's salt industry.

Sodium Chloride Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons, Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Sea Water, Rock Salt, Others |

| End-Uses Covered | Chemical Industry, Food Grade Salt, Road De-icing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | K+S Group, China National Salt Industry Group (CNSIG), Compass Minerals International, Inc, Cargill Corporation, Dampier Salt Limited (DSL) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the sodium chloride market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global sodium chloride market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sodium chloride industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global Sodium Chloride market was valued at USD 29.65 Billion in 2024.

The sodium chloride market is projected to exhibit a CAGR of 1.81% during 2025-2033, reaching a value of USD 34.59 Billion by 2033.

Widespread use in food preservation and processing, growing demand in water treatment, and high seasonal consumption for road de-icing are factors fueling the market growth. Other key drivers include use in oil and gas drilling, pharmaceuticals, textile dyeing, and leather tanning.

Asia leads the sodium chloride market due to strong demand from food, chemical, and water treatment sectors, supported by industrial growth, urbanization, abundant reserves, and expanding applications in textiles.

Some of the major players in the global Sodium Chloride market include K+S Group, China National Salt Industry Group (CNSIG), Compass Minerals International, Inc, Cargill Corporation and Dampier Salt Limited (DSL).

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)