Soft Drinks Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2025-2033

Soft Drinks Market Size and Share:

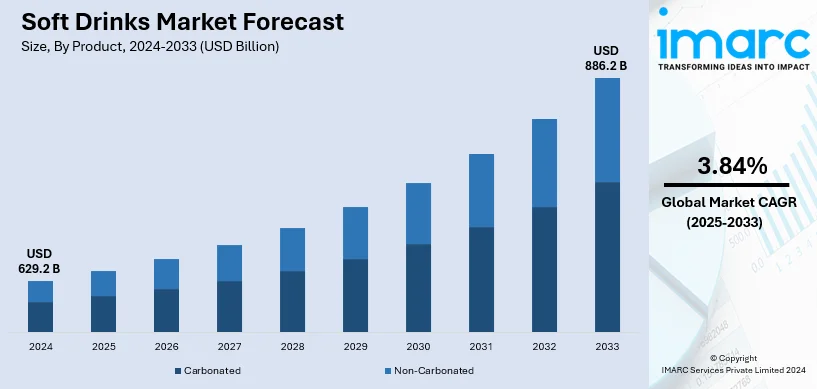

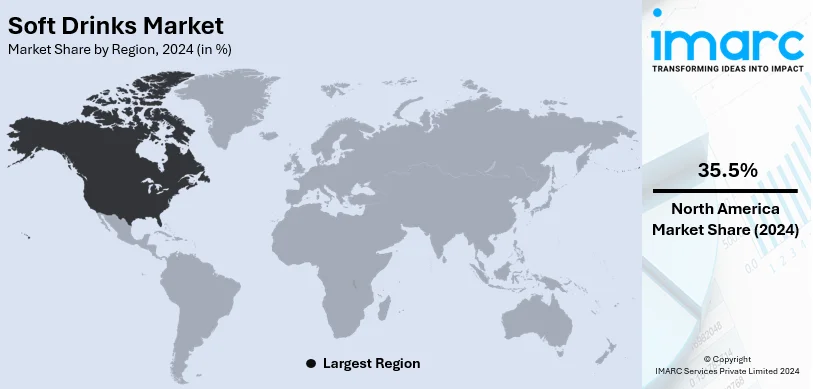

The global Soft Drinks market size was valued at USD 629.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 886.2 Billion by 2033, exhibiting a CAGR of 3.84% during 2025-2033. North America currently dominates the market, holding a significant market share of over 35.5% in 2024. It is primarily through the rising demand for healthier, low-sugar variants and innovative flavors, and packaging of the product that this market is growing significantly. The growth is also driven by the premiumization of high-quality beverages, effective branding, and the expansion of distribution channels, especially e-commerce.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 629.2 Billion |

| Market Forecast in 2033 | USD 886.2 Billion |

| Market Growth Rate (2025-2033) | 3.84% |

Advancement in consumer preferences towards more healthy and low sugar forms of soft drinks propels innovations in product formulation in this market. Branding with effective marketing campaigns also gives assurance to brand loyalty besides increasing market penetration. Enhanced distribution channels, such as ecommerce and convenience stores, increase access to products. This, coupled with improved technology in packaging will create sustainability and appeal for the product, which drives the market toward growth significantly. For instance, in June 2024, Coca-Cola India came up with its Affordable Small Sparkling Package (ASSP) using 100% Recycled PET (rPET) bottles starting in Orissa. The project aims to cut carbon emissions by 66% as compared to traditional packaging, thus reinforcing the company's commitment to sustainability and its World Without Waste goal of incorporating 50% recycled content by 2030. In addition to such critical endeavors, rising disposable incomes in emerging markets boost the product consumption, thereby contributing to the market growth.

To get more information on this market, Request Sample

The United States soft drinks market is growing rapidly, driven primarily by the demand for healthier options, such as low-sugar, natural, and functional product variants, that reflect the trends of health and wellness. Premiumization serves as the other key driving factor with consumers seeking high-quality, craft, and specialty drinks. For example, as per industry reports, in 2024, low sugar was still the leading influencer of the purchase decision for soft drinks in the United States. There is a growing demand for caffeine-free options as well. Innovation in flavors and packaging also drives market growth. With increased importance of sustainability, this trend is driving brands to make eco-friendly packaging and practice responsible practices, which significantly contributes to the growth in the market.

Soft Drinks Market Trends:

Functional Beverage Revolution

The global soft drinks market demand is witnessing a transformative shift toward functional beverages that deliver health benefits beyond basic refreshment. Prebiotic sodas, energy-enhancing drinks, and immunity-boosting beverages have emerged as the fastest-growing segment, driven by consumer prioritization of gut health and wellness. Major manufacturers are investing heavily in research and development to incorporate functional ingredients such as probiotics, vitamins, minerals, and botanical extracts into their formulations. The digestive health soft drinks category has expanded from USD 197 million in 2020 to approximately USD 440 million in 2024, representing exponential growth that reflects changing consumer priorities. This trend is particularly pronounced among millennials and Generation Z consumers who seek beverages that align with their health-conscious lifestyles while maintaining the enjoyable taste profiles of traditional soft drinks, significantly enhancing global soft drinks market growth.

Premiumization and Artisanal Products

The premium soft drinks segment is experiencing remarkable expansion as consumers increasingly gravitate toward high-quality, craft, and artisanal beverages that offer unique flavor experiences and superior ingredients. This premiumization trend is characterized by consumers' willingness to pay higher prices for products that feature natural ingredients, exotic flavors, and sustainable production methods. Small-batch producers and craft beverage makers are capturing significant global soft drinks market share by offering distinctive taste profiles that differentiate them from mass-market offerings. Major corporations are responding by launching premium sub-brands and acquiring artisanal beverage companies to compete in this lucrative segment. The emphasis on quality over quantity, coupled with sophisticated branding and storytelling, has transformed premium soft drinks from niche products into mainstream offerings that command retail shelf space in upscale supermarkets and specialty stores, positively impacting the global soft drinks market analysis.

Sustainability and Eco-Friendly Packaging Innovation

Environmental consciousness has become a defining characteristic of the modern soft drinks industry, with sustainability initiatives driving major innovations in packaging technology and production processes. Manufacturers are transitioning from traditional plastic bottles to recyclable aluminum cans, biodegradable materials, and lightweighted packaging solutions that minimize environmental impact. The adoption of recycled PET (rPET) bottles, refillable container systems, and concentrated syrups for at-home carbonation represents significant progress toward achieving zero-waste production goals. Consumer surveys indicate that approximately 73% of global consumers prefer brands committed to sustainability, creating competitive pressure for companies to demonstrate environmental responsibility. This sustainability focus extends beyond packaging to encompass water conservation, carbon emission reduction, and renewable energy utilization throughout the supply chain. The integration of sustainability principles into core business strategies has become essential for maintaining global soft drinks market demand and ensuring long-term viability in an increasingly eco-conscious marketplace.

Growth Factors of Global Soft Drinks Market:

Digital Marketing and Social Media Engagement

The proliferation of digital marketing channels and social media platforms has revolutionized how soft drink companies engage with consumers and build brand loyalty. Manufacturers are leveraging Instagram, TikTok, and other social platforms to create viral marketing campaigns, influencer partnerships, and user-generated content that resonates with younger demographics. Interactive experiences such as personalized packaging campaigns, augmented reality applications, and gamification strategies have transformed passive consumers into active brand ambassadors who share their experiences across digital networks. The ability to collect real-time consumer data through digital channels enables companies to rapidly adapt their marketing strategies and product offerings to meet evolving preferences. Social media-driven trends, such as the "dirty soda" phenomenon and viral flavor combinations, demonstrate the powerful influence of digital platforms on consumer purchasing decisions. This digital transformation has reduced traditional advertising costs while increasing marketing effectiveness, contributing significantly to global soft drinks market growth through enhanced consumer engagement and brand visibility.

Soft Drinks Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global soft drinks market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, distribution channel, and region.

Analysis by Product:

- Carbonated

- Non-Carbonated

Carbonated stand as the largest component in 2024, holding around 71.4% of the market. The carbonated category, which consists of beverages such as cola, lemon-lime soda, root beer, and other fizzy drinks, is the leading segment as per the soft drinks market research. Carbonation is done by dissolving carbon dioxide gas under pressure which creates the characteristic effervescence that consumers enjoy. One of the key attractions of carbonated soft drinks is their refreshing and thirst-quenching qualities making them a popular choice especially in warm weather. Brand houses, in this segment, established strong brand recognition and loyal over several decades. Consider Coca-Cola and PepsiCo. They are the brand goliaths for their age-old iconic cola brands and have adapted to the evolution of consumer preference through options such as low sugar for Coca-Cola and eco-friendly sustainable packaging solutions by Pepsi.

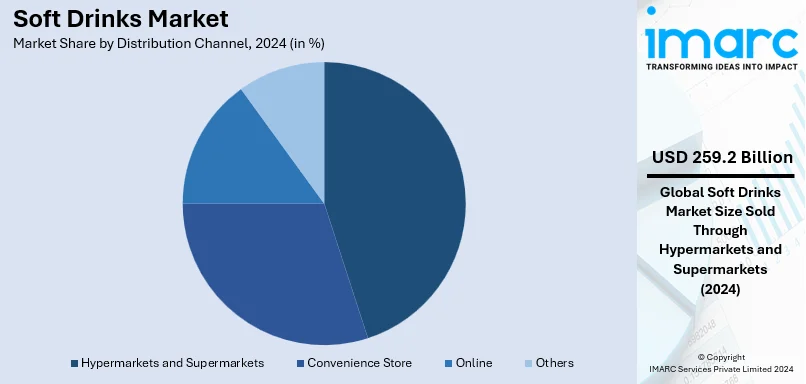

Analysis by Distribution Channel:

- Hypermarkets and Supermarkets

- Convenience Store

- Online

- Others

Hypermarkets and supermarkets lead the market with around 41.2% of market share in 2024. Hypermarkets and supermarkets account for a considerable soft drinks market share. The large retail stores offer a variety of beverages such as carbonated soft drinks, fruit juices, bottled water, and other non-alcoholic beverages to the consumers. The major benefit of purchasing soft drinks from hypermarkets and supermarkets is that it offers a wide variety of products. Shoppers can access different varieties, flavors and pack-size options under one roof-a very convenient beverage shopping solution. Hypermarkets and supermarkets frequently carry out promotions wherein consumers are encouraged to buy their products in greater quantity. Both hypermarkets and supermarkets facilitate brand outreach and marketing by providing these retailers with adequate shelf placement, attractive product displays as well as the promotional work carried out inside the same stores that considerably influence their customers' decision-making patterns. In order to achieve prime shelf space, leading soft drink manufacturers invest heavily in marketing strategies in pursuit of attracting consumer attention.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.5%. North America happens to be one of the largest and most mature markets in soft drinks. The region has a diverse soft drink offering for the market, including CSDs, bottled water, fruit juices, and energy drinks, among others. Though CSD consumption has been relatively stable of late, there is a fast-growing trend toward healthier options, such as flavored water, functional beverages, and reduced sugar. Health and wellness concerns are the key drivers in North America for a decline in sugary soft drinks and an increase in demand for products such as sparkling water and natural fruit juices. Moreover, the region has experienced an increase in craft and premium soft drink brands to meet the demands of the more discerning consumer seeking unique flavors and higher-quality ingredients. This shift towards premium and health-conscious offerings reflects broader soft drinks industry trends in North America, where consumer preferences are leaning towards beverages that offer both unique taste experiences and nutritional benefits.

Key Regional Takeaways:

United States Soft Drinks Market Analysis

The United States accounts for 93.7% of the market share in North America. Increasing consumer demand for enhanced, functional soft drinks featuring additional health benefits, in terms of vitamins, minerals and probiotics, is pushing the manufacturers to design newer offerings. This subsequently promotes market growth. This, in turn, has been the result of rising demand for sugar-free and low-calorie alternatives forcing companies to reformulate traditional sodas as well as introducing diet or zero-sugar versions of their offerings that appeals to health-conscious consumers and acts as an impetus to market growth. Additionally, firms are constantly investing in research and development to develop new unique products in a highly competitive market, which is increasingly focusing on new flavors, innovative designs in packaging, and functional beverages that provide additional health benefits like improved hydration, energy, or probiotic support. Launches are increasingly emphasizing the use of premium ingredients and unique production techniques that create consumer demand for unique, high-quality drinks.

Asia Pacific Soft Drinks Market Analysis

Manufacturers are actively launching healthier and more functional beverage options, like low-calorie, sugar-free, and fortified drinks, to meet the rising preference for wellness-oriented products. Expanding middle classes in countries, such as China, India, and Indonesia, are increasingly seeking premium and international beverage brands. Youth-centric marketing campaigns with celebrity endorsements and innovative product launches are also propelling growth. Also, the growth of e-commerce platforms and new retail networks allows soft drinks to be more widely available in cities and villages. Brands also continue to diversify their portfolios with premium and exotic flavors as a growing set of consumers seek unique indulgent experiences in their beverages.

Europe Soft Drinks Market Analysis

European markets are witnessing a rise in demand for artisanal and premium soft drinks as consumers gravitate towards unique flavours, higher quality and exclusivity in their beverage choices. This trend reflects a broader shift in European consumer culture toward premiumization and the appreciation of craft production methods. This, in turn, is impelling the market growth across diverse European nations, from the Nordic countries to Mediterranean regions.

The European soft drinks landscape is heavily influenced by stringent regulatory frameworks, particularly concerning sugar content, artificial additives, and environmental sustainability. Several European countries have implemented sugar taxes and mandatory nutritional labeling, prompting manufacturers to reformulate products and introduce healthier alternatives. These regulations have accelerated innovation in natural sweeteners and clean-label formulations, with brands emphasizing transparency and ingredient simplicity.

Additionally, busy lifestyles are driving an increasing preference for convenient ready-to-drink soft beverages, pushing companies to innovate in portable and on-the-go packaging formats. Single-serve containers, resealable bottles, and lightweight aluminum cans have become increasingly popular among commuters and urban professionals. The rise of coffee shop culture and the "grab-and-go" mentality has influenced packaging design, with brands focusing on functionality and aesthetic appeal.

Sustainability concerns are particularly pronounced in European markets, where consumers demonstrate high environmental awareness and willingness to pay premiums for eco-friendly products. Deposit return schemes, widespread recycling infrastructure, and consumer activism have pushed beverage companies to adopt circular economy principles. Many brands are transitioning to 100% recycled PET bottles, biodegradable materials, and refillable packaging systems to meet consumer expectations and regulatory requirements.

Regional diversity within Europe presents both challenges and opportunities for soft drinks manufacturers. Northern European countries show strong preferences for functional beverages and low-sugar options, while Southern European markets maintain traditional preferences for fruit-based drinks and natural juices. Central and Eastern European countries are experiencing rapid growth as disposable incomes rise and Western consumption patterns gain traction.

Latin America Soft Drinks Market Analysis

The soft drink market in Latin America is strongly shaped by consumers' liking for traditional tastes like tamarind, guava, and various tropical fruits that are deeply embedded in the region's cultural heritage. These authentic flavors represent more than mere taste preferences; they connect consumers to their cultural identity and childhood memories, creating powerful emotional bonds with local beverage brands.

The increasing trend for artisanal and natural drinks corresponds with the area's desire for health-conscious and locally inspired choices, as consumers seek to balance modern wellness trends with traditional flavor profiles. Small-scale producers and craft beverage makers have emerged throughout the region, creating products that celebrate Latin American ingredients and traditional preparation methods while incorporating contemporary health attributes.

Economic recovery in nations such as Brazil, Mexico, and Argentina has enhanced consumer purchasing power, leading to increased soft drink consumption across various price segments. The expanding middle class demonstrates growing sophistication in beverage choices, seeking both value and quality. However, economic volatility in certain countries continues to influence consumption patterns, with consumers showing price sensitivity while maintaining aspirations for premium products.

The supremacy of global brands such as Coca-Cola and PepsiCo is backed by intense marketing strategies and tactical collaborations with local bottlers, sports teams, and cultural events. These multinational corporations have invested heavily in understanding regional preferences and adapting their product portfolios accordingly. Local production facilities, extensive distribution networks, and strong relationships with retailers ensure their products remain accessible even in remote areas.

Middle East and Africa Soft Drinks Market Analysis

Consumer preferences in the Middle East and Africa continue to evolve towards functional and convenient beverage options, significantly impacting the soft drinks market share and positioning brands that can cater to these needs for stronger growth in the region. In line with this, functional beverages that offer hydration and added benefits, like vitamins or energy-boosting properties, are becoming more popular among health-conscious individuals. This is providing an impetus to the market growth across this diverse and rapidly developing region.

The Middle East and Africa region presents a unique market landscape characterized by significant diversity in consumer preferences, purchasing power, and distribution infrastructure. In Gulf Cooperation Council (GCC) countries, high disposable incomes and cosmopolitan populations drive demand for premium international brands and innovative beverages. Conversely, in Sub-Saharan African markets, affordability and accessibility remain critical factors, with single-serve formats and smaller package sizes enabling broader market penetration.

Religious and cultural considerations play important roles in shaping the soft drinks market, particularly in predominantly Muslim countries where alcohol consumption is restricted or prohibited. This creates substantial opportunities for non-alcoholic beverages, including soft drinks, juices, and mocktails, which serve as primary beverage choices for social occasions and celebrations. During Ramadan, consumption patterns shift dramatically, with increased demand for dates-based drinks, fruit juices, and refreshing beverages for iftar meals.

The hot climate across much of the region drives year-round demand for cold beverages, with hydration being a primary consumer need. Sports drinks, enhanced waters, and electrolyte-fortified beverages have gained popularity among active consumers and outdoor workers. The growing fitness culture, particularly in urban centers and affluent communities, supports continued growth in functional beverage categories.

Urbanization and the development of modern retail infrastructure are transforming distribution dynamics in many African countries. Shopping malls, supermarkets, and international retail chains are expanding into major cities, creating new channels for premium and imported beverages. However, traditional trade channels, including small independent retailers and informal markets, remain dominant in many areas, requiring brands to maintain flexible distribution strategies.

Competitive Landscape:

The market is very competitive. However, market leadership is being spearheaded by a few major players like Coca-Cola and PepsiCo, who employ vast brand recognition, wide-reaching distribution systems, and continuous innovation of products to ensure their sustainability. These brands also compete by producing low-sugar and functional beverages that would answer the current changes in consumers' preferences. Novelty in taste and an environment-friendly pack also attract the entrance of new and niche players in the industry. Additionally, aggressive marketing campaigns and strategic partnerships increase the rivalry, and pricing wars and domestic players also determine the competitive landscape, which sustains continuous innovation and differentiation. In August 2024, Doodles and AriZona Beverages announced their partnership to launch a limited-edition Iced Tea with Lemon featuring collectible art on 20oz Tallboy cans.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Arizona Beverage Company

- Asahi Group Holdings Ltd.

- Keurig Dr Pepper Inc.

- National Beverage Corp.

- Nestlé S.A.

- Pepsico Inc.

- Purity Soft Drinks Ltd.

- Red Bull GmbH

- Refresco Group BV

- The Coca-Cola Company

Latest News and Developments:

- February 2025: Coca-Cola launched Simply Pop, a prebiotic soda featuring six grams of fiber, no added sugar, and 25-30% real fruit juice, marking the beverage giant's entry into the fast-growing functional soda market to compete directly with brands like Olipop and Poppi.

- July 2025: PepsiCo introduced Pepsi Prebiotic Cola in traditional Cola and Cherry Vanilla flavors, containing three grams of prebiotic fiber, five grams of cane sugar, and thirty calories, positioning the 132-year-old brand in the better-for-you soda segment.

- September 2025: Red Bull broke ground on a $1.7 billion manufacturing and distribution facility in Concord, North Carolina, following a four-year delay. The 2.36 million-square-foot facility will produce three billion cans annually and create 700 jobs when operational in 2028.

- December 2024: Saudi Arabia introduced Milaf Cola, the worlds first soft drink made from dates, during the Riyadh Date Festival. Created by Thurath Al-Madina, the beverage emphasizes health advantages, sustainability, and economic variety through the use of locally sourced dates. The company intends to broaden its date-oriented drink range by including energy drinks and infused beverages.

Soft Drinks Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Carbonated, Non-Carbonated |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Store, Online, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arizona Beverage Company, Asahi Group Holdings Ltd., Keurig Dr Pepper Inc., National Beverage Corp., Nestlé S.A., Pepsico Inc., Purity Soft Drinks Ltd., Red Bull GmbH, Refresco Group BV, The Coca-Cola Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the soft drinks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global soft drinks market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the soft drinks industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The soft drink is a wide range of non-alcoholic beverages, including carbonated soft drinks, bottled water, fruit juices, energy drinks, and ready-to-drink teas and coffees. The product demand is primarily driven by evolving consumer preferences, innovation in product formulations, effective branding, and expanding distribution channels globally.

The soft drinks market was valued at USD 629.2 Billion in 2024.

IMARC estimates the global soft drinks market to exhibit a CAGR of 3.84% during 2025-2033.

Evolving consumer preferences for healthier, low-sugar options, innovation in flavors and packaging, premiumization, effective branding and marketing, expanding distribution channels including e-commerce, and a focus on sustainability are key drivers of the global Soft Drinks market.

In 2024, Carbonated Soft Drinks represented the largest segment by product, driven by their refreshing and thirst-quenching qualities.

Hypermarkets and Supermarkets lead the market by distribution channel share, owing to their extensive product selection and promotional activities.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Arizona Beverage Company, Asahi Group Holdings Ltd., Keurig Dr Pepper Inc., National Beverage Corp., Nestlé S.A., Pepsico Inc., Purity Soft Drinks Ltd., Red Bull GmbH, Refresco Group BV, The Coca-Cola Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)