South Africa Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End-User, and Province, 2025-2033

South Africa Air Freight Market Overview:

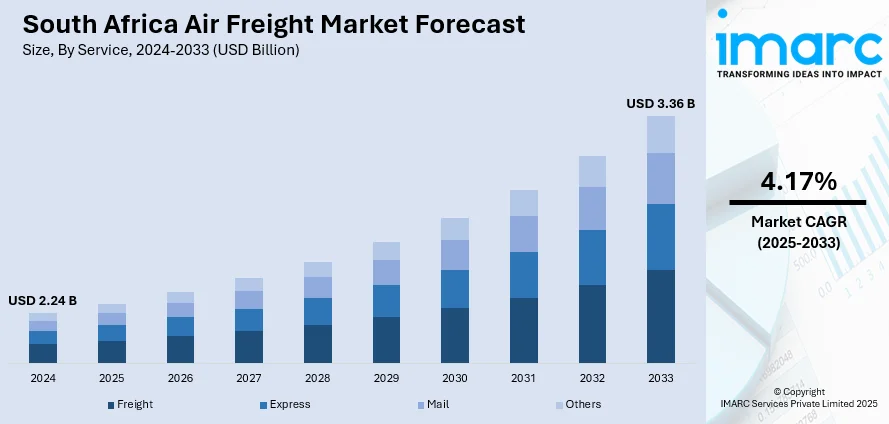

The South Africa air freight market size reached USD 2.24 Billion in 2024. The market is projected to reach USD 3.36 Billion by 2033, exhibiting a growth rate (CAGR) of 4.17% during 2025-2033. The market is expanding as businesses seek quicker delivery options and better access to regional trade routes. Growing investment in cargo infrastructure and reduced transit costs are helping to boost South Africa air freight market share across sectors like agriculture, consumer goods, and industrial exports.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.24 Billion |

| Market Forecast in 2033 | USD 3.36 Billion |

| Market Growth Rate 2025-2033 | 4.17% |

South Africa Air Freight Market Trends:

Expanding Air Trade Linkages

Cross-border logistics in Africa are evolving, with greater emphasis on speed, access, and regional partnerships. South Africa’s air freight sector is benefiting from this shift as neighboring countries invest in stronger air cargo frameworks. Businesses today require efficient delivery routes that minimize delays and reduce reliance on traditional shipping methods. In this context, the start of Suid Cargo Airlines in March 2023 added valuable capacity to the region. The airline began operating from Johannesburg using leased aircraft and strategic partnerships to reach over 20 African cities. A standout feature of this model was its connection to coastal hubs, such as Durban and Cape Town, which enabled the integration of ocean freight with air services. This hybrid structure helped accelerate inland delivery to landlocked markets. As a result, South Africa emerged as a more attractive connection point for cargo entering and moving within the African continent. Such targeted infrastructure growth is influencing how freight is managed, supporting quicker turnaround times and more dependable service. Overall, the trend signals a shift toward connected, flexible logistics platforms that support both national exports and the movement of regional goods more effectively, further impelling South Africa air freight market growth.

To get more information on this market, Request Sample

Lower-Cost Logistics for Regional Growth

Efforts to reduce shipping expenses and enhance market reach are shaping air freight strategies across Africa. For South Africa, which plays a pivotal role in regional logistics, such moves are opening up new trade possibilities. Small and mid-sized exporters often face cost-related barriers when attempting to reach distant African destinations. To address this, some countries are forming joint logistics programs that ease cargo movement and cut overheads. A key example came in May 2025 when Uganda Air introduced a discounted air cargo route linking Nigeria to South Africa and other regional hubs. Offering freight rates significantly below regular prices, the initiative provided Nigerian exporters especially smaller firms, an affordable means of accessing broader African markets. This not only improved delivery speed but also elevated South Africa’s position in intra-African logistics. As more corridors like this emerge, countries are moving away from isolated systems and toward shared solutions that benefit multiple economies. For South Africa’s air freight operators, this means a growing demand for services tied to consolidated, cost-effective trade networks. The larger impact is a more balanced and inclusive market where air cargo is no longer reserved for high-value goods but becomes viable for a wider range of industries.

South Africa Air Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on service, destination, and end-user.

Service Insights:

- Freight

- Express

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes freight, express, mail, and others.

Destination Insights:

- Domestic

- International

The report has provided a detailed breakup and analysis of the market based on the destination. This includes domestic and international.

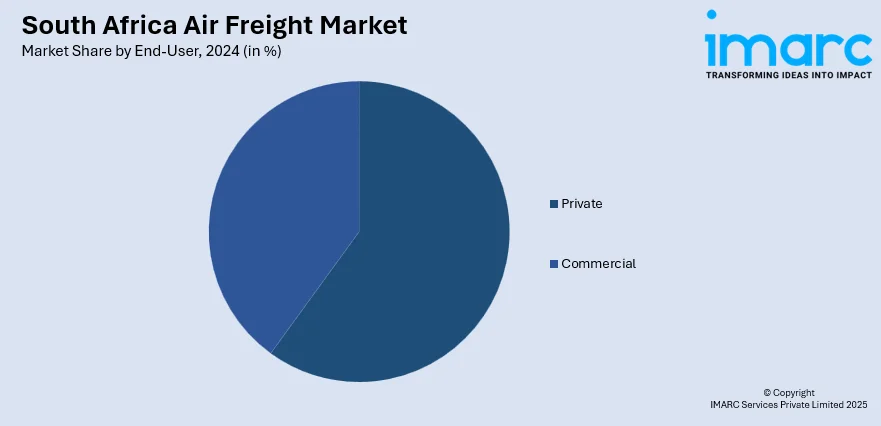

End-User Insights:

- Private

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes private and commercial.

Province Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major provincial markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Air Freight Market News:

- May 2025: Uganda Air launched the Nigeria–East/Southern Africa air cargo corridor, cutting freight costs by 50% for Nigerian exporters. Operating from Lagos and Abuja, the initiative boosted intra-African trade efficiency, reduced delivery times, and supported MSMEs entering the AfCFTA market with better logistics access.

- May 2025: Nigeria’s Ministry of Trade, in partnership with UNDP and Uganda Airlines, launched a discounted air cargo corridor linking Nigeria to Uganda, Kenya, and South Africa. Offering up to 75% reduced freight rates, it improved intra-African logistics, boosted MSME exports, and expanded market access.

South Africa Air Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End-Users Covered | Private, Commercial |

| Provinces Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa air freight market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa air freight market on the basis of service?

- What is the breakup of the South Africa air freight market on the basis of destination?

- What is the breakup of the South Africa air freight market on the basis of end user?

- What is the breakup of the South Africa air freight market on the basis of province?

- What are the various stages in the value chain of the South Africa air freight market?

- What are the key driving factors and challenges in the South Africa air freight market?

- What is the structure of the South Africa air freight market and who are the key players?

- What is the degree of competition in the South Africa air freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa air freight market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa air freight market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa air freight industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)