South Africa Board Games Market Size, Share, Trends and Forecast by Product Type, Game Type, Age Group, Distribution Channel, and Province, 2025-2033

South Africa Board Games Market Overview:

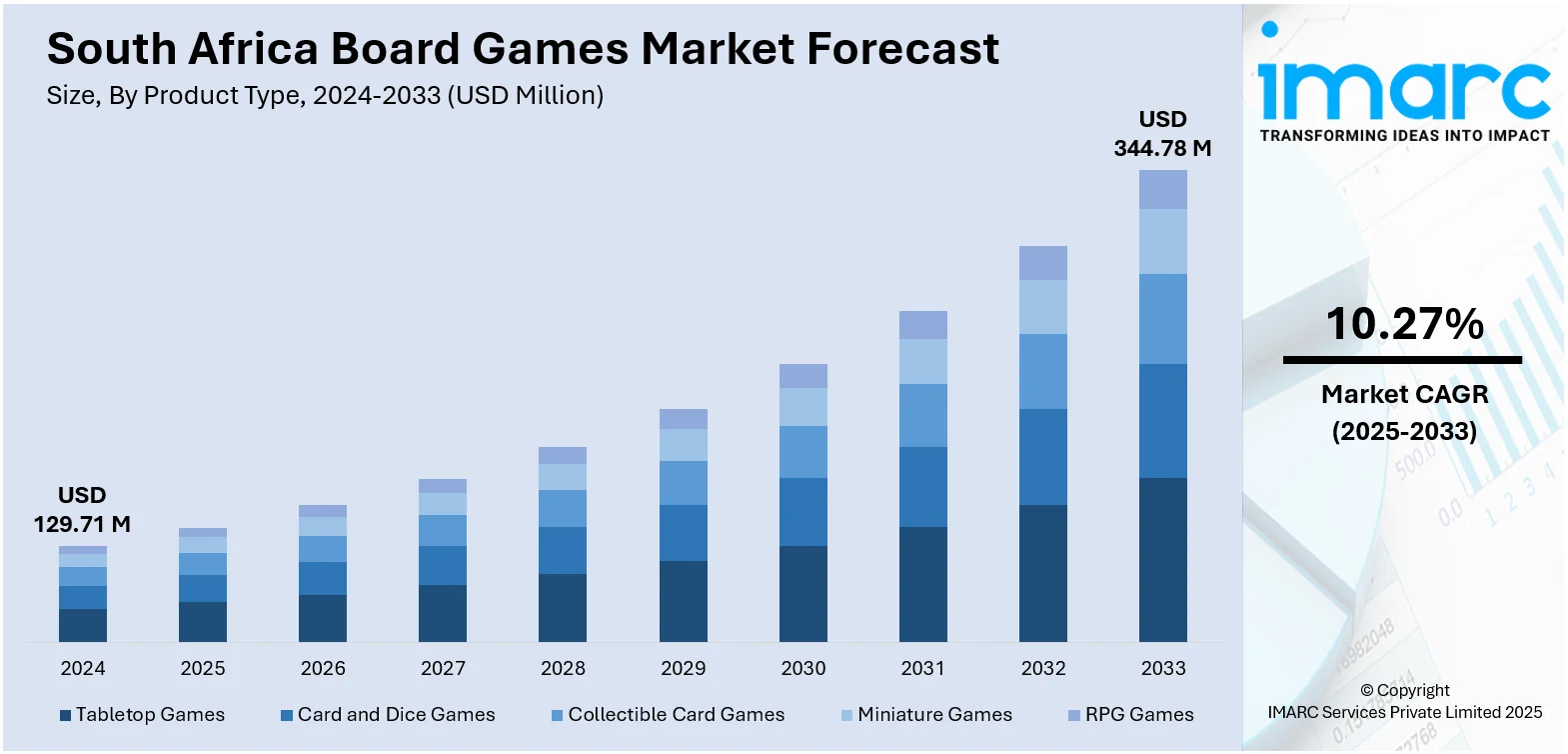

The South Africa board games market size reached USD 129.71 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 344.78 Million by 2033, exhibiting a growth rate (CAGR) of 10.27% during 2025-2033. A large, socially active youth population and secure, convenient online payment options are boosting the board games market in South Africa. Strong offline communities, diverse retail channels, and digital access together sustain steady demand and expand the user base, thereby contributing to the expansion of the South Africa board games market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 129.71 Million |

| Market Forecast in 2033 | USD 344.78 Million |

| Market Growth Rate 2025-2033 | 10.27% |

South Africa Board Games Market Trends:

Youthful Demographic and Expanding Social Play

South Africa’s sizable youth demographic, including students, early-career workers, and families with school-age kids, is influencing the market. A lot of people in this group look for affordable, captivating entertainment that promotes face-to-face interaction and provides a respite from digital screens. Board games match this need, offering approachable social experiences that flourish in university lounges, hobby cafés, and community centers where meetings are frequent and involvement is casual but spirited. Young buyers seldom choose just one game, demonstrating a significant desire for diversity, encouraging retailers to frequently refresh their selections and launch new titles to keep engagement high. Community clubs, student organizations, and hobby groups harness this passion into frequent events, informal tournaments, and themed evenings that assist in transforming new players into committed enthusiasts. The continuous arrival of young players, who often exchange experiences and suggestions via social media and messaging apps, strengthens a culture of word-of-mouth marketing that aids local publishers and retailers. Based on the 2024 Mid-year Population Estimates, around 21 million young individuals make up approximately 33.1% of South Africa’s overall population, underscoring the substantial pool of potential individuals who drive repeat purchases and attract new participants to the pastime. This extensive involvement of young people ensures the market's lasting vitality and promotes robust community bonds focused on gaming.

To get more information on this market, Request Sample

Improved Payment Options and E-Commerce Confidence

The continuous advancement of South Africa’s e-commerce sector is notably enhancing the availability and attractiveness of board games to a broader audience. Improved online payment security and more reliable delivery tracking are encouraging people to purchase games online with increased confidence, knowing that their transactions and packages are secure. This change allows smaller retailers to connect with clients in rural or remote areas that may lack easy access to physical hobby shops. The introduction of sophisticated payment solutions, exemplified by Peach Payments’ Digit Pro launch in 2025, a contemporary enterprise POS terminal for medium and large companies, offering various payment methods, including buy now pay later (BNPL), is enhancing convenience for both buyers and sellers by consolidating transactions into one manageable platform. Numerous hobby shops currently operate both physical and online stores simultaneously, offering flexible options such as click-and-collect services and reduced delivery fees, which appeal to individuals seeking convenient ways to expand their collections. Focused social media ads and digital promotions present new titles to households that might otherwise miss them in physical stores, expanding the user base beyond geographic constraints. This seamless online purchasing process strengthens South Africa board games market growth, supporting consistent sales for publishers and retailers by allowing families and casual gamers to buy new games without the added cost and inconvenience of traveling to city shopping centers, even during periods of reduced foot traffic.

South Africa Board Games Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, game type, age group, and distribution channel.

Product Type Insights:

- Tabletop Games

- Card and Dice Games

- Collectible Card Games

- Miniature Games

- RPG Games

The report has provided a detailed breakup and analysis of the market based on the product type. This includes tabletop games, card and dice games, collectible card games, miniature games, and RPG games.

Game Type Insights:

- Strategy and War Games

- Educational Games

- Fantasy Games

- Sport Games

- Others

A detailed breakup and analysis of the market based on the game type have also been provided in the report. This includes strategy and war games, educational games, fantasy games, sport games, and others.

Age Group Insights:

- 0-2 Years

- 2-5 Years

- 5-12 Years

- Above 12 Years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 0-2 years, 2-5 years, 5-12 years, and above 12 years.

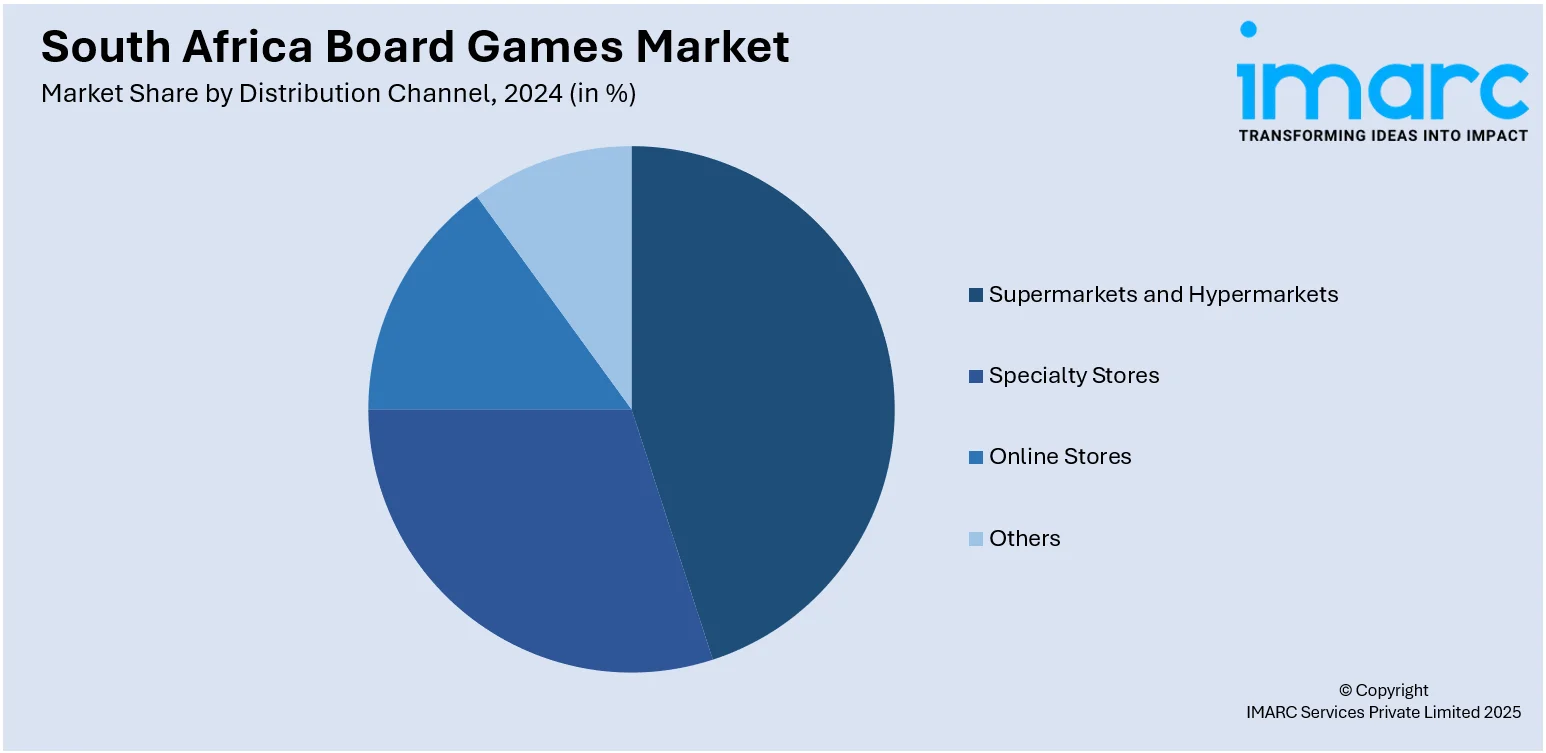

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, online stores, and others.

Province Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Board Games Market News:

- In March 2024, Mike Nkongolo introduced CyberMoraba, a cybersecurity awareness game based on the traditional South African board game Morabaraba. The game lets players act as attackers or defenders, improving cybersecurity understanding through strategic gameplay. It was accepted for presentation at the 19th International Conference on Cyber Warfare and Security, held March 26–27, 2024, in Johannesburg, South Africa.

South Africa Board Games Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tabletop Games, Card and Dice Games, Collectible Card Games, Miniature Games, RPG Games |

| Game Types Covered | Strategy and War Games, Educational Games, Fantasy Games, Sport Games, Others |

| Age Groups Covered | 0-2 Years, 2-5 Years, 5-12 Years, Above 12 Years |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Provinces Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa board games market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa board games market on the basis of product type?

- What is the breakup of the South Africa board games market on the basis of game type?

- What is the breakup of the South Africa board games market on the basis of age group?

- What is the breakup of the South Africa board games market on the basis of distribution channel?

- What is the breakup of the South Africa board games market on the basis of region?

- What are the various stages in the value chain of the South Africa board games market?

- What are the key driving factors and challenges in the South Africa board games market?

- What is the structure of the South Africa board games market and who are the key players?

- What is the degree of competition in the South Africa board games market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa board games market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa board games market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa board games industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)