South Africa Cement Market Size, Share, Trends and Forecast by Type, End-Use, and Region, 2025-2033

South Africa Cement Market Overview:

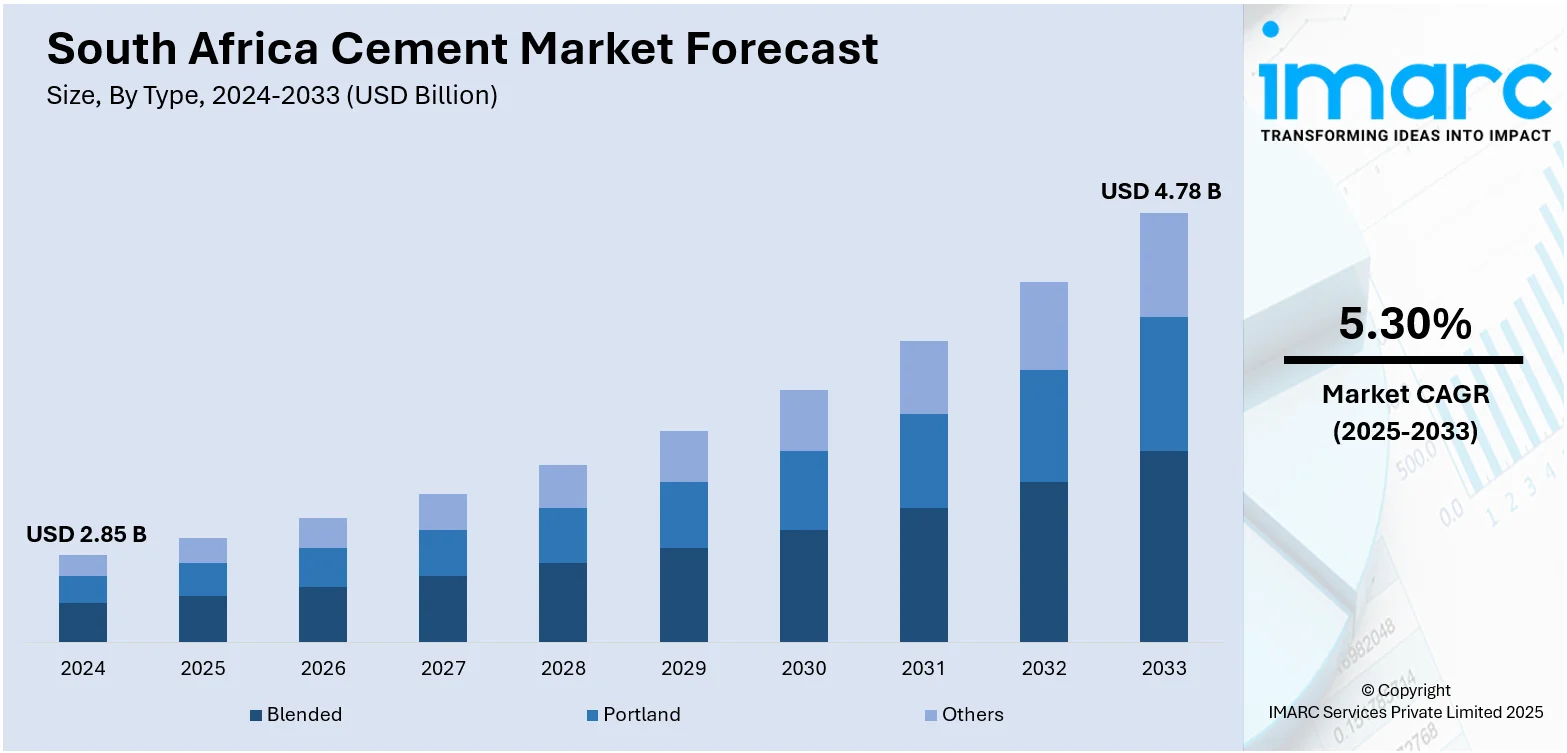

The South Africa cement market size reached USD 2.85 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.78 Billion by 2033, exhibiting a growth rate (CAGR) of 5.30% during 2025-2033. South Africa is presently increasing its infrastructure development programs, which is driving the demand for cement. Moreover, urban populations in South Africa are growing at a fast pace, especially in urban areas such as Gauteng, Cape Town, and Durban, which is currently increasing the need for housing units and business structures. This trend, along with the rising shift to renewable energy, is expanding the South Africa cement market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.85 Billion |

| Market Forecast in 2033 | USD 4.78 Billion |

| Market Growth Rate 2025-2033 | 5.30% |

South Africa Cement Market Trends:

Accelerating Infrastructure Development Initiatives

South Africa is presently increasing its infrastructure development programs, which is driving the demand for cement. The government is investing with vigor in national plans like the Strategic Integrated Projects (SIPs) as part of the National Infrastructure Plan 2050. These projects focus on upgrading energy supply, transport links, water, and social infrastructure such as schools and hospitals. The continuous development of roads, highways, bridges, and affordable housing is working to drive the constant consumption of cement in both public and private development. In 2025, Dean Macpherson, the Minister of Public Works and Infrastructure, expressed his approval of the R1 trillion infrastructure investment pledge highlighted by Finance Minister Enoch Godongwana in the 2025 Budget Speech. The Minister highlighted that this investment in infrastructure will produce outcomes only if Infrastructure South Africa (ISA) is formalized, as it needs to be pivotal in project preparation and pipeline management. This encompasses ISA's establishment via laws to efficiently guide the national infrastructure strategy. In addition, public-private partnerships are being utilized to drive investment in mega-projects, thereby driving the consumption of cement products even further. As these projects take shape, the consumption of various forms of cement, including Portland and blended cement, is continually on the rise to address varying structural requirements. This is also generating opportunities for domestic producers and importers to deal with procurement invites and tender-based building.

To get more information on this market, Request Sample

Increasing Urbanization and Housing Demand

Urban populations in South Africa are growing at a fast pace, especially in urban areas such as Gauteng, Cape Town, and Durban, which is currently increasing the need for housing units and business structures. This growth is leading to the development of affordable units, high-rise apartments, and mixed-use units, which is catalyzing the demand for cement-based products. The government's initiative for inclusive urban development by way of initiatives like the Integrated Urban Development Framework (IUDF) is actively promoting the implementation of housing schemes and infrastructure development. Concurrently, increasing levels of income and evolving lifestyle needs are prompting real estate developers to build up-to-date houses and commercial buildings that depend on robust and cost-effective cement products. Cement demand is also growing in the upgrading of informal settlements as municipalities attempt to replace temporary housing with permanent structures. This continuing urban shift is catalyzing cement demand, especially in urban peripheries where new construction is taking place. Moreover, at the State of the Nation Address (SONA) 2025, President Cyril Ramaphosa declared that the government is focusing on building more houses for South Africans in the upcoming years. The president also stated that the nation is redesigning the housing subsidies and sanctioning more funds towards programs that help people buy or rent a house in an area of their choice.

Fore Fronting Industrial and Renewable Energy Projects

The rising shift to renewable energy is bolstering the South Africa cement market growth. Industrial parks, logistic centers, and export terminals are being developed under economic diversification initiatives. They need high-quality cement for structural strength, warehouse flooring, and foundational structures. On top of that, South Africa's pledge to upgrade renewable energy, particularly wind and solar, is fueling the development of energy facilities, storage centers, and transmission lines, all of which rely greatly on cement-hungry materials. The Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) projects are being initiated in several provinces, calling for orders in cement for turbine bases, substation buildings, and grid supports. This transition towards sustainable power generation and industrial independence is generating a consistent pipeline of cement-consumption projects while innovating in low-carbon, high-performance cement products that are aligned with environmental objectives.

South Africa Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end-use.

Type Insights:

- Blended

- Portland

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blended, Portland, and others.

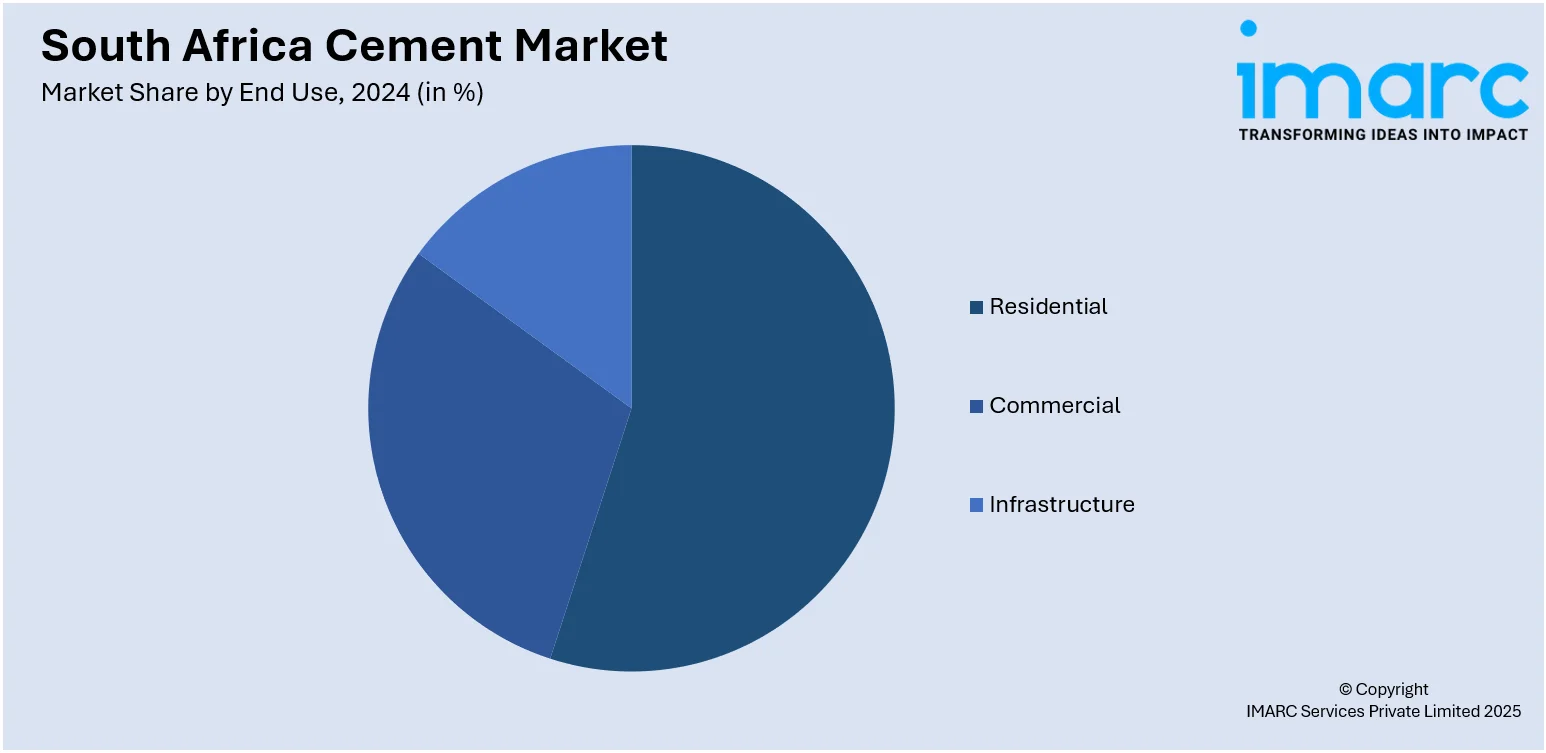

End-Use Insights:

- Residential

- Commercial

- Infrastructure

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes residential, commercial, and infrastructure.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End-Uses Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa cement market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa cement market on the basis of type?

- What is the breakup of the South Africa cement market on the basis of end-use?

- What is the breakup of the South Africa cement market on the basis of region?

- What are the various stages in the value chain of the South Africa cement market?

- What are the key driving factors and challenges in the South Africa cement market?

- What is the structure of the South Africa cement market and who are the key players?

- What is the degree of competition in the South Africa cement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)