South Africa Diaper Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Province, 2025-2033

South Africa Diaper Market Overview:

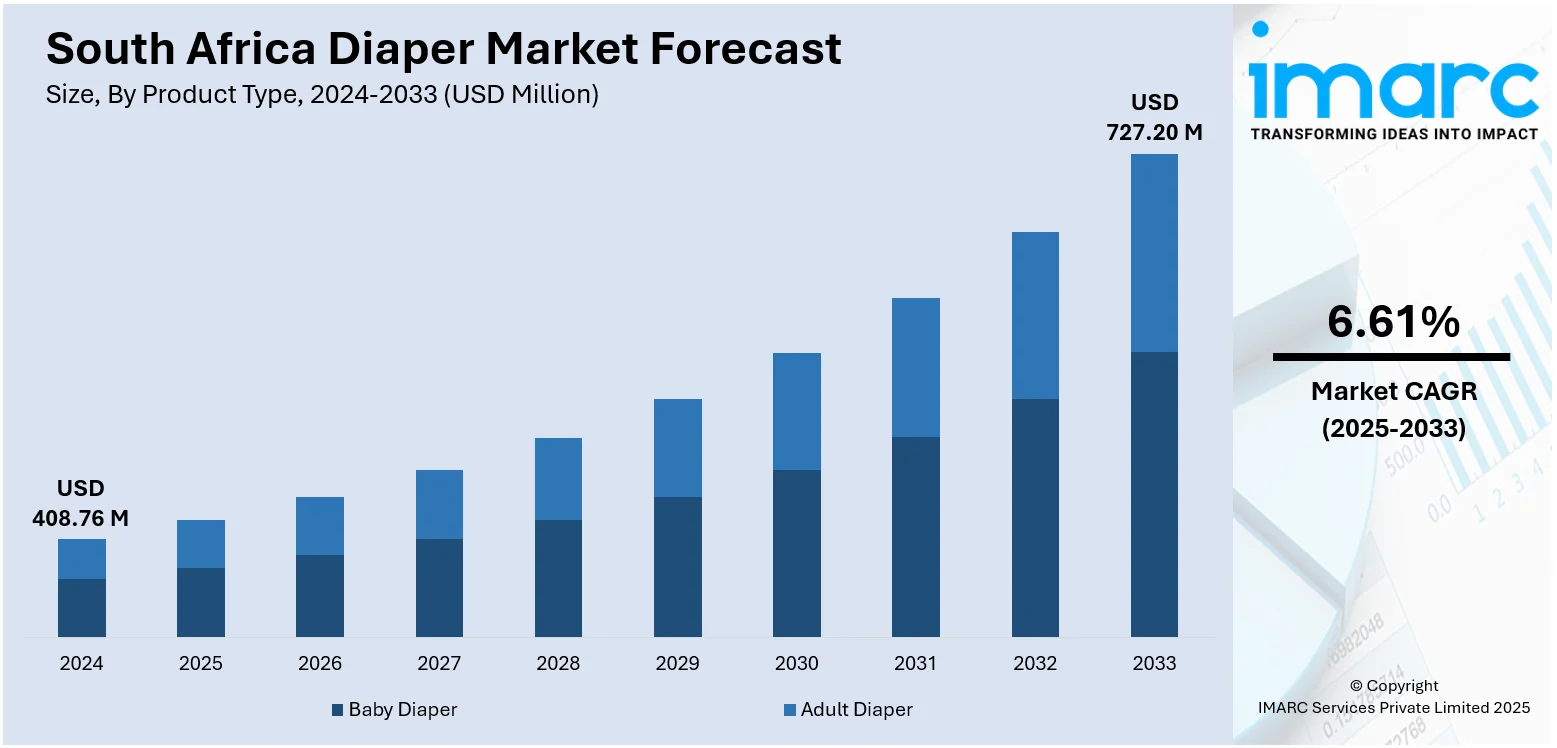

The South Africa diaper market size reached USD 408.76 Million in 2024. The market is projected to reach USD 727.20 Million by 2033, exhibiting a growth rate (CAGR) of 6.61% during 2025-2033. The market is driven by rising birth rates, increasing disposable income, urbanization, and heightened awareness of hygiene. Expanding retail distribution and the adoption of eco-friendly products also fuel demand. Private label offerings further increase accessibility. These factors are positively impacting South Africa diaper market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 408.76 Million |

| Market Forecast in 2033 | USD 727.20 Million |

| Market Growth Rate 2025-2033 | 6.61% |

South Africa Diaper Market Trends:

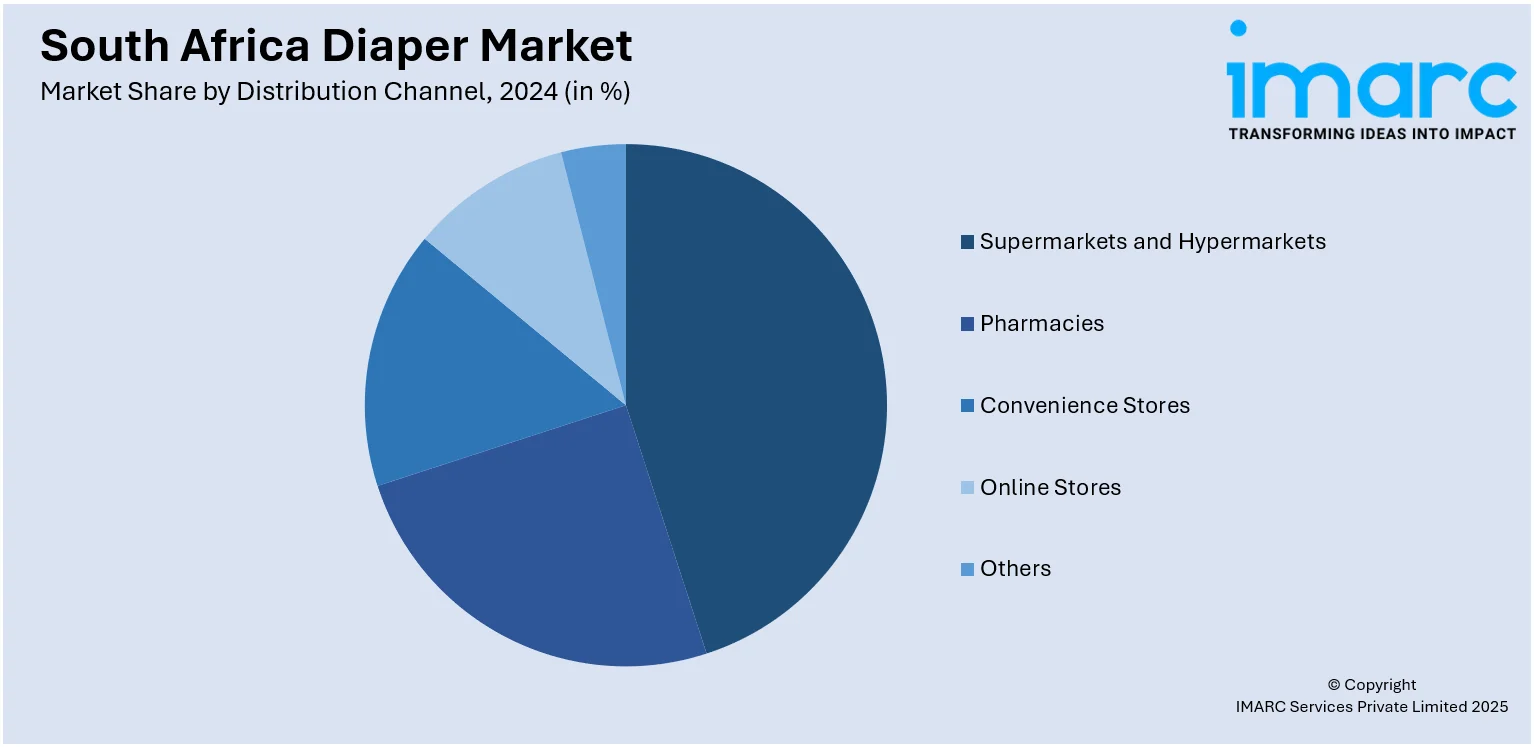

Growth of Private Label Diaper Brands

One significant trend in the South Africa diaper market is the rapid expansion of private label diaper brands. Major retail chains and supermarkets are increasingly offering in-house diaper products that are competitively priced while maintaining acceptable quality. For instance, as per industry reports, traditional convenience stores, supermarkets, hypermarkets, and discount stores hold over 90% of the market share by volume. These retail outlets remain the preferred choice for most African consumers due to their convenient neighborhood locations, broad product selection, availability of smaller package sizes, and the option to buy single units rather than entire packages. Besides this, retailers leverage extensive distribution networks and localized marketing strategies to reach a wider consumer base. The growth of private label offerings not only fosters competition but also increases product accessibility, contributing to consumer retention and brand loyalty. This trend is a key factor influencing South Africa diaper market growth by expanding market coverage and price diversity.

To get more information on this market, Request Sample

Focus on Product Customization and Skin Health

Manufacturers in the South Africa diaper market are increasingly investing in product customization to meet the diverse needs of infants and adults. For instance, Procter & Gamble’s R900 Million expansion in Kempton Park launched the Pampers Premium Care line, producing high-quality, skin-friendly diapers locally. This investment boosts local manufacturing, job creation, and exports under AfCFTA. Designed for South African needs, the line emphasizes comfort and skin health, aligning with the trend toward product customization. This also includes offering diapers tailored for different skin sensitivities, sizes, and absorption levels. There is a rising preference for hypoallergenic, dermatologically tested, and fragrance-free diapers, especially among parents seeking to prevent diaper rash and irritation. Adult incontinence products are also being refined to offer improved comfort and discretion. These innovations reflect a deeper understanding of consumer concerns and drive brand differentiation. Product development that prioritizes skin health and usability appeals to health-conscious and informed consumers, boosting customer satisfaction. As a result, this focus on customization and skin care supports South Africa diaper market growth by fostering consumer trust and repeat purchases.

South Africa Diaper Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Baby Diaper

- Disposable Diaper

- Training Diaper

- Cloth Diaper

- Swim Pants

- Biodegradable Diaper

- Adult Diaper

- Pad Type

- Flat Type

- Pant Type

The report has provided a detailed breakup and analysis of the market based on the product type. This includes baby diaper (disposable diapers, training diapers, cloth diapers, swim pants, and biodegradable diapers) and adult diaper (pad type, flat type, and pant type).

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, pharmacies, convenience stores, online stores, and others.

Province Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Diaper Market News:

- In July 2024, Harvest Group become the first company in South Africa to launch a non-woven fabric machine capable of producing five-layer material for baby diaper manufacturing. Installed at the Babelegi Industrial Site in Hammanskraal, the machine enables local production of high-quality diaper materials, reducing reliance on imports.

South Africa Diaper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online Stores, Others |

| Provinces Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa diaper market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa diaper market on the basis of product type?

- What is the breakup of the South Africa diaper market on the basis of distribution channel?

- What is the breakup of the South Africa diaper market on the basis of province?

- What are the various stages in the value chain of the South Africa diaper market?

- What are the key driving factors and challenges in the South Africa diaper market?

- What is the structure of the South Africa diaper market and who are the key players?

- What is the degree of competition in the South Africa diaper market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa diaper market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa diaper market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa diaper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)