South Africa Duty-Free and Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Province, 2025-2033

South Africa Duty-Free and Travel Retail Market Overview:

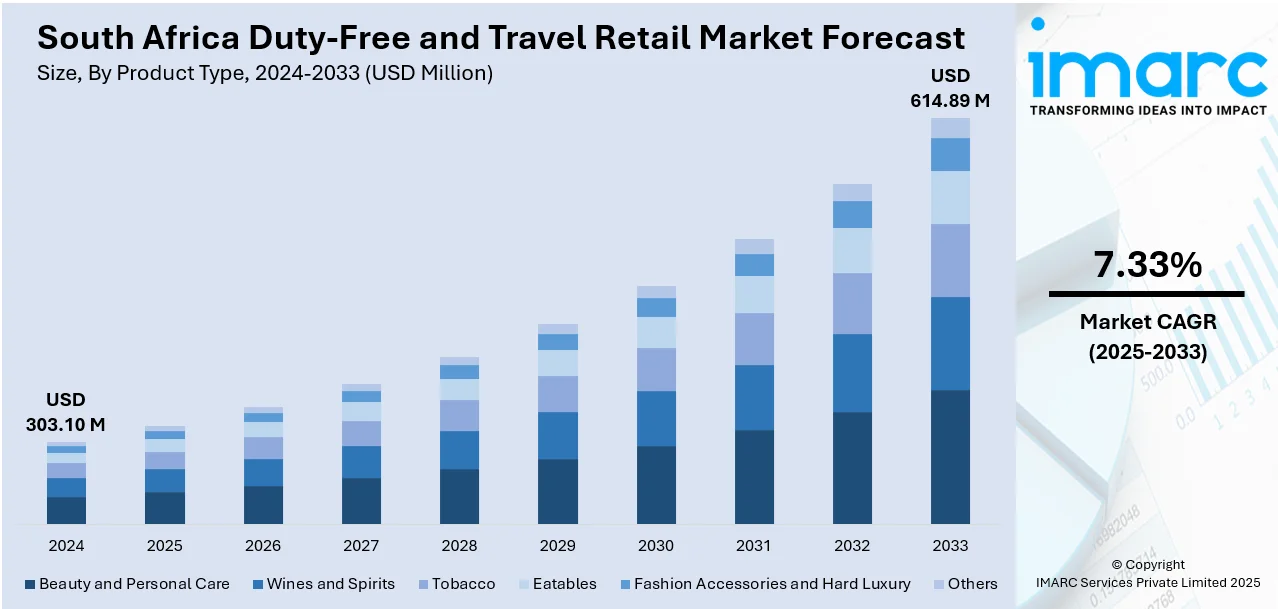

The South Africa duty-free and travel retail market size reached USD 303.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 614.89 Million by 2033, exhibiting a growth rate (CAGR) of 7.33% during 2025-2033. Strong recovery in international tourism and rising passenger volumes, growing demand for perfumes, cosmetics, electronics, and luxury goods, airport terminal expansion and privatization, digital pre‑order/click‑and‑collect services, premiumization of offerings, and strategic partnerships among global travel‑retail operators are some of the factors contributing to the South Africa duty-free and travel retail market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 303.10 Million |

| Market Forecast in 2033 | USD 614.89 Million |

| Market Growth Rate 2025-2033 | 7.33% |

South Africa Duty-Free and Travel Retail Market Trends:

Growing Local Ownership in Duty-Free Retail

In South Africa’s duty-free and travel retail sector, there is increasing emphasis on fostering locally owned retail operations to capture more spending within the country. Expanding luxury duty-free outlets at airports and border points, alongside the introduction of innovative retail services such as in-flight shopping, reflects a strategic move to enhance the traveler experience and encourage domestic economic retention. This shift aligns with broader economic diversification goals by promoting tourism, aviation, and retail industries. By focusing on homegrown retail operations, South Africa aims to strengthen its position in the competitive travel retail market, boost consumer spending locally, and create a more sustainable and integrated duty-free ecosystem that benefits the national economy. These factors are intensifying the South Africa duty-free and travel retail market growth. For example, in March 2025, the Public Investment Fund (PIF) launched Al Waha, Saudi Arabia’s first nationally owned duty-free operator, aiming to retain more travel retail spending locally. Al Waha would establish luxury duty-free outlets at airports, border crossings, and ports, and introduce in-flight retail services. This initiative supports Saudi Vision 2030’s goals to diversify the economy by boosting tourism, aviation, and retail, enhancing traveler experiences, and strengthening the Kingdom’s position in duty-free retail.

To get more information on this market, Request Sample

Experiential Marketing Elevating Duty-Free Retail

In South Africa, the duty-free and travel retail sector is seeing a rise in immersive, festive activations designed to engage travelers and boost brand visibility. Large-scale, visually striking displays combined with interactive tasting experiences are becoming popular methods to attract shoppers at key airport locations. These activations showcase premium products, encouraging trial and deeper consumer connection. By blending local market familiarity with exclusive offerings, such initiatives create memorable shopping moments that drive sales and enhance brand loyalty. Collaborations between international brands and local retail partners further amplify reach, making duty-free shopping a more dynamic and appealing experience for travelers passing through South African airports. This approach highlights the increasing importance of experiential retail in attracting and retaining consumers in competitive travel retail environments. For instance, in December 2024, Pernod Ricard Global Travel Retail and Jameson launched a festive activation at Johannesburg Airport in partnership with Big Five Duty Free. The activation featured a nine-foot whiskey bottle tree with 160 Jameson Original bottles and offered tastings of Jameson Original, Jameson Black Barrel, and the exclusive Jameson Triple Triple Málaga Edition. This campaign enhanced brand visibility in South Africa’s duty-free travel retail market.

South Africa Duty-Free and Travel Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and provincial levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury, and others.

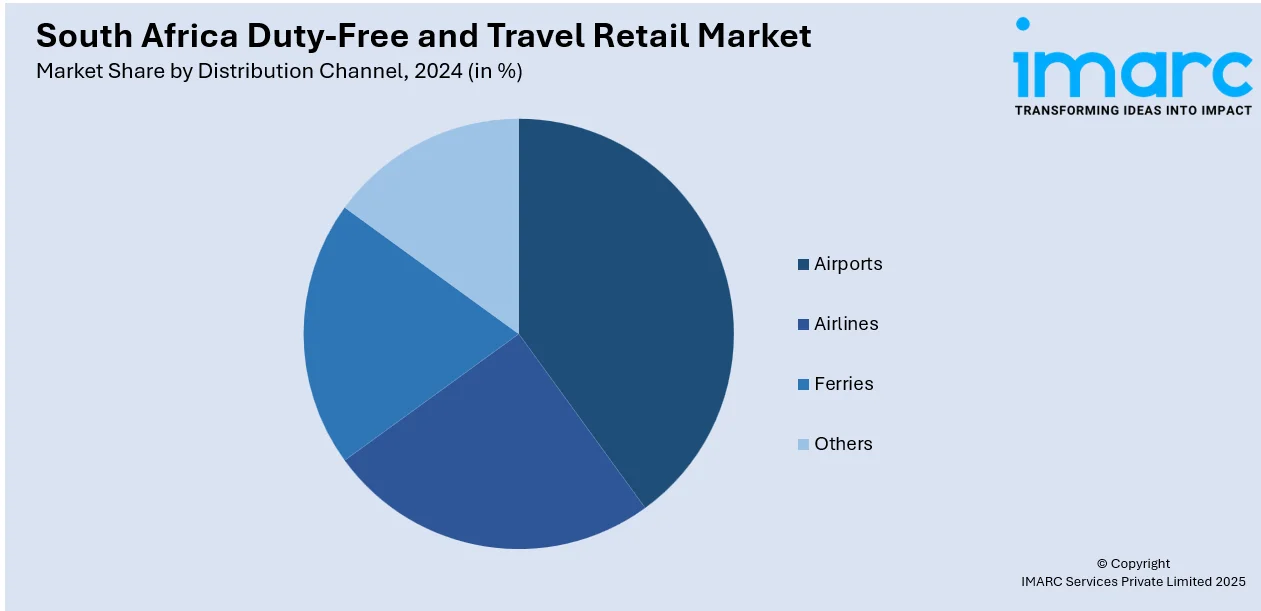

Distribution Channel Insights:

- Airports

- Airlines

- Ferries

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes airports, airlines, ferries, and others.

Province Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major provincial markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Duty-Free and Travel Retail Market News:

- In May 2025, Lagardère Travel Retail (LTR) partnered with South African tourism firm Tourvest to expand travel retail across Africa, starting with South Africa. The Paris-based duty-free operator, with USD 6.1 Billion in sales last year, aims to grow its presence beyond its existing markets in West Africa and Tanzania. The strategic MoU includes collaboration on retail, hospitality, and tourism projects, with South Africa’s deputy president attending the signing.

South Africa Duty-Free and Travel Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, Others |

| Distribution Channels Covered | Airports, Airlines, Ferries, Others |

| Provinces Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa duty-free and travel retail market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa duty-free and travel retail market on the basis of product type?

- What is the breakup of the South Africa duty-free and travel retail market on the basis of distribution channel?

- What is the breakup of the South Africa duty-free and travel retail market on the basis of province?

- What are the various stages in the value chain of the South Africa duty-free and travel retail market?

- What are the key driving factors and challenges in the South Africa duty-free and travel retail market?

- What is the structure of the South Africa duty-free and travel retail market and who are the key players?

- What is the degree of competition in the South Africa duty-free and travel retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa duty-free and travel retail market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa duty-free and travel retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa duty-free and travel retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)