South Africa EdTech Market Size, Share, Trends and Forecast by Sector, Type, Deployment Mode, End User, and Province, 2025-2033

South Africa EdTech Market Overview:

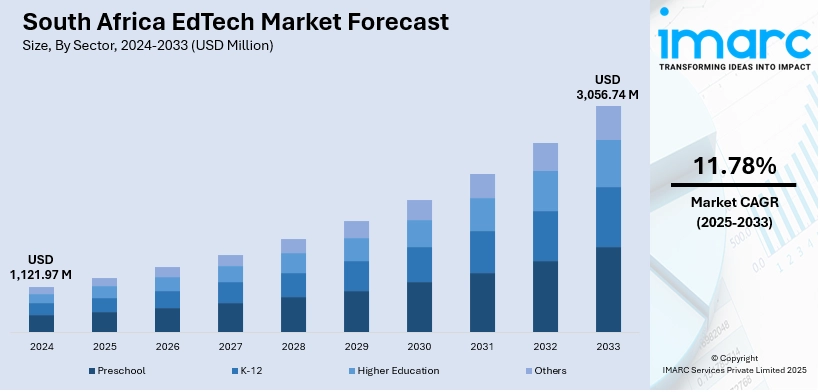

The South Africa EdTech market size reached USD 1,121.97 Million in 2024. The market is projected to reach USD 3,056.74 Million by 2033, exhibiting a growth rate (CAGR) of 11.78% during 2025-2033. The market is driven by increasing digital literacy, rising internet penetration, mobile-first learning preferences, and government investments in digital infrastructure. Additionally, a growing demand for flexible, personalized learning post-pandemic has accelerated platform adoption across schools and universities. South Africa EdTech market share continues to expand steadily.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,121.97 Million |

| Market Forecast in 2033 | USD 3,056.74 Million |

| Market Growth Rate 2025-2033 | 11.78% |

South Africa EdTech Market Trends:

Mobile-First Learning Platforms

A significant trend shaping the South Africa EdTech market growth is the prioritization of mobile-first learning platforms. Industry data indicates that by early 2024, South Africa had 118.6 million active smartphones, resulting in a penetration rate of 195.4%. Additionally, the country had 45.34 million internet users, equating to a penetration rate of 74.7%. With smartphone penetration increasing in the country, educational technology providers are optimizing their content and delivery for mobile devices. These platforms enable students in both urban and rural areas to access digital learning resources regardless of fixed broadband availability. Moreover, mobile applications with offline capabilities are helping overcome connectivity challenges, making education more accessible in low-bandwidth environments. Educational institutions and startups are increasingly collaborating to launch data-efficient, mobile-optimized solutions for K–12 and vocational learners. This trend reflects a strategic alignment with South Africa’s unique digital ecosystem, which favors mobile accessibility over traditional desktop usage, and continues to fuel South Africa EdTech market growth in underserved regions.

To get more information on this market, Request Sample

Public-Private Collaboration for Infrastructure Development

The South Africa EdTech market growth is further supported by increasing collaboration between public entities and private technology firms. Government-led initiatives to bridge the digital divide, such as broadband rollout projects and the National Digital and Future Skills Strategy, are being reinforced by private sector investment in digital classrooms, cloud services, and teacher training. Partnerships between EdTech startups and telecom providers also enable subsidized data packages and device financing for students. These collaborations are critical for scaling digital education and ensuring sustainability of tech integration in schools. In addition, pilot programs in provinces like Gauteng and the Western Cape are becoming models for national implementation. These synergistic efforts between stakeholders are accelerating infrastructure readiness and are vital to sustaining long-term South Africa EdTech market growth. For instance, in June 2025, ADvTECH, Africa’s leading private education group, launched SIRIUS, South Africa’s first integrated Centre of Teaching and Learning Excellence. This pioneering initiative provides ongoing professional development for teachers and lecturers across 119 schools and 33 tertiary campuses. SIRIUS offers in-person, online, and self-study training to enhance teaching quality and student outcomes. Equipped with modern facilities in Sandton, it aims to attract top talent and support academic innovation, reinforcing ADvTECH’s commitment to educational excellence across Africa and beyond.

South Africa EdTech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on sector, type, deployment mode, and end user.

Sector Insights:

- Preschool

- K-12

- Higher Education

- Others

The report has provided a detailed breakup and analysis of the market based on the sector. This includes preschool, K-12, higher education, and others.

Type Insights:

- Hardware

- Software

- Content

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes hardware, software, and content.

Deployment Mode Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes cloud-based and on-premises.

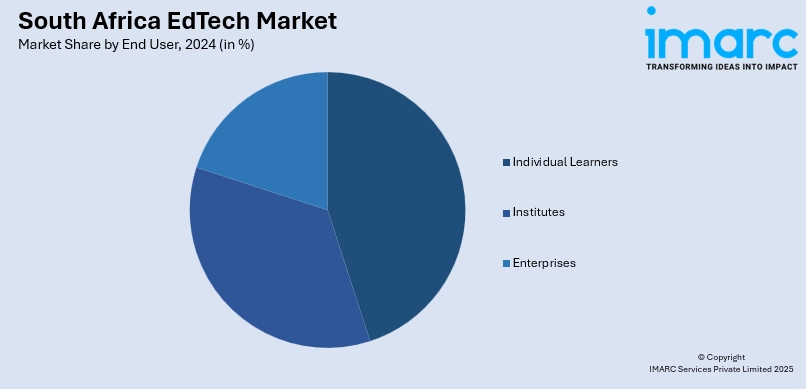

End User Insights:

- Individual Learners

- Institutes

- Enterprises

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individual learners, institutes, and enterprises.

Province Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and Others

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa EdTech Market News:

- In June 2025, TORSH has been named “Professional Development Solution of the Year” at the 2025 EdTech Breakthrough Awards. Recognized for its TORSH Talent platform, the company supports scalable, data-driven coaching and educator development. The platform integrates video feedback, progress tracking, and AI to enhance teacher effectiveness and student outcomes. TORSH’s user-friendly tools foster real-time collaboration and measurable impact.

- In February 2025, McGraw Hill expanded its Career and Technical Education (CTE) offerings with new computer science courses developed in partnership with Binary Logic. Covering topics like AI, robotics, and cybersecurity, the courses span elementary to high school levels. They feature interactive tools, virtual simulations, and soft skills training. Additional updates include business, health science, and digital technology courses. The initiative aims to prepare students for the evolving workforce by fostering early exposure to technical and professional skills across multiple disciplines.

South Africa EdTech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| Types Covered | Hardware, Software, Content |

| Deployment Modes Covered | Cloud-based, On-premises |

| End Users Covered | Individual Learners, Institutes, Enterprises |

| Provinces Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa EdTech market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa EdTech market on the basis of sector?

- What is the breakup of the South Africa EdTech market on the basis of type?

- What is the breakup of the South Africa EdTech market on the basis of deployment mode?

- What is the breakup of the South Africa EdTech market on the basis of end user?

- What is the breakup of the South Africa EdTech market on the basis of region?

- What are the various stages in the value chain of the South Africa EdTech market?

- What are the key driving factors and challenges in the South Africa EdTech market?

- What is the structure of the South Africa EdTech market and who are the key players?

- What is the degree of competition in the South Africa EdTech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa EdTech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa EdTech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa EdTech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)