South Africa Footwear Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End User, and Province, 2025-2033

South Africa Footwear Market Overview:

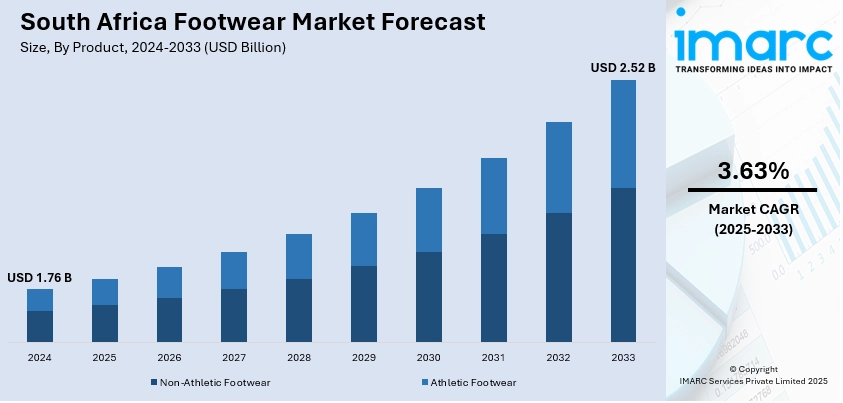

The South Africa footwear market size reached USD 1.76 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.52 Billion by 2033, exhibiting a growth rate (CAGR) of 3.63% during 2025-2033. South African infrastructure development is growing at a quick pace, with more people migrating to cities and embracing modern lifestyles. Moreover, with disposable incomes continuously rising in South Africa, buyer expenditure on shoes is increasing. Moreover, the expansion of e-commerce channels and launch of international e-commerce players is expanding the South Africa footwear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.76 Billion |

|

Market Forecast in 2033

|

USD 2.52 Billion |

| Market Growth Rate 2025-2033 | 3.63% |

South Africa Footwear Market Trends:

Evolving Lifestyles

South African infrastructure development is growing at a quick pace, with more people migrating to cities and embracing modern lifestyles. The trend is providing immense demand for footwear as city dwellers are demanding convenience, fashion, and functionality in footwear. As individuals are constantly evolving with the pace of city life, footwear demands are moving towards comfortable, multifunctional, and fashion-conscious designs. People are seeking out shoes that are capable of fulfilling the requirements of daily travels, workplaces, and social settings. Merchants are acting accordingly by launching trendy and new-generation footwear that suits these changing lifestyle requirements. Furthermore, the middle-class population is increasingly becoming fashion-oriented, choosing functional as well as fashionable footwear, which is further fueling growth in the market.

To get more information on this market, Request Sample

Increasing Disposable Incomes and Consumer Expenditure

With disposable incomes continuously rising in South Africa, consumer expenditure on non-essential items, such as footwear, is also on the rise. As per Trading Economics, Disposable Personal Income in South Africa rose to 4798643 ZAR Million in the fourth quarter of 2024, up from 4741037 ZAR Million in the third quarter of 2024. Furthermore, the middle-class segment is expanding, and this shift in purchasing power has caused more individuals to move towards branded, high-quality footwear. This upward growth in disposable income is allowing people to seek out a broader category of footwear, such as premium, style-driven, and performance-driven footwear. Retailers and footwear companies are reacting by diversifying their ranges, serving different price points, and targeting discerning consumer interests. With rising competitiveness in the industry, companies are continually enhancing their marketing strategies and providing deals to tempt the wealthier consumer segment, supporting the South Africa footwear market growth.

Growth of E-commerce and Online Shopping

The expansion of e-commerce in South Africa is revolutionizing the footwear industry by offering customers increased convenience and exposure to a vast range of choices. People are opting to use online platforms more and more to shop, compare, and buy footwear, fueled by the ease of access, wider range of products, and lower prices. Retailers are constantly refining their online presence, providing services like virtual try-ons and improved user experience, which are making individuals more actively involved. Further, with better payment infrastructure and delivery options, South Africans are adopting online shopping for shoes. This online transformation is encouraging both incumbent brands and new players to invest in e-commerce websites. Furthermore, various well-known international e-commerce brands are also launching in south Africa. For instance, in 2024, Amazon announced the launch of Amazon.co.za in South Africa to enable individuals purchase various products from local and international vendors.

South Africa Footwear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, material, distribution channel, pricing, and end user.

Product Insights:

- Non-Athletic Footwear

- Athletic Footwear

The report has provided a detailed breakup and analysis of the market based on the product. This includes non-athletic footwear and athletic footwear.

Material Insights:

- Rubber

- Leather

- Plastic

- Fabric

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes rubber, leather, plastic, fabric, and others.

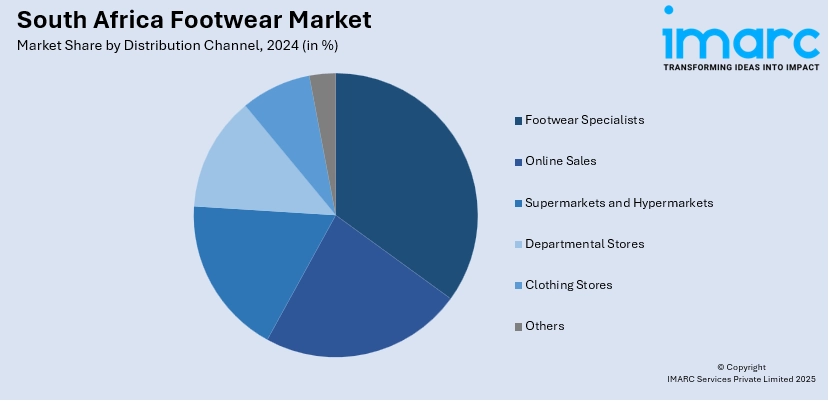

Distribution Channel Insights:

- Footwear Specialists

- Online Sales

- Supermarkets and Hypermarkets

- Departmental Stores

- Clothing Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes footwear specialists, online sales, supermarkets and hypermarkets, departmental stores, clothing stores, and others.

Pricing Insights:

- Premium

- Mass

The report has provided a detailed breakup and analysis of the market based on the pricing. This includes premium and mass.

End User Insights:

- Men

- Women

- Kids

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men, women, and kids.

Province Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Footwear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Non-Athletic Footwear, Athletic Footwear |

| Materials Covered | Rubber, Leather, Plastic, Fabric, Others |

| Distribution Channels Covered | Footwear Specialists, Online Sales, Supermarkets and Hypermarkets, Departmental Stores, Clothing Stores, Others |

| Pricings Covered | Premium, Mass |

| End Users Covered | Men, Women, Kids |

| Provinces Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa footwear market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa footwear market on the basis of product?

- What is the breakup of the South Africa footwear market on the basis of material?

- What is the breakup of the South Africa footwear market on the basis of distribution channel?

- What is the breakup of the South Africa footwear market on the basis of pricing?

- What is the breakup of the South Africa footwear market on the basis of end user?

- What is the breakup of the South Africa footwear market on the basis of province?

- What are the various stages in the value chain of the South Africa footwear market?

- What are the key driving factors and challenges in the South Africa footwear market?

- What is the structure of the South Africa footwear market and who are the key players?

- What is the degree of competition in the South Africa footwear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa footwear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa footwear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa footwear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)