South Africa Gaming Market Size, Share, Trends and Forecast by Device Type, Platform, Revenue Type, Type, Age Group, and Region, 2025-2033

South Africa Gaming Market Overview:

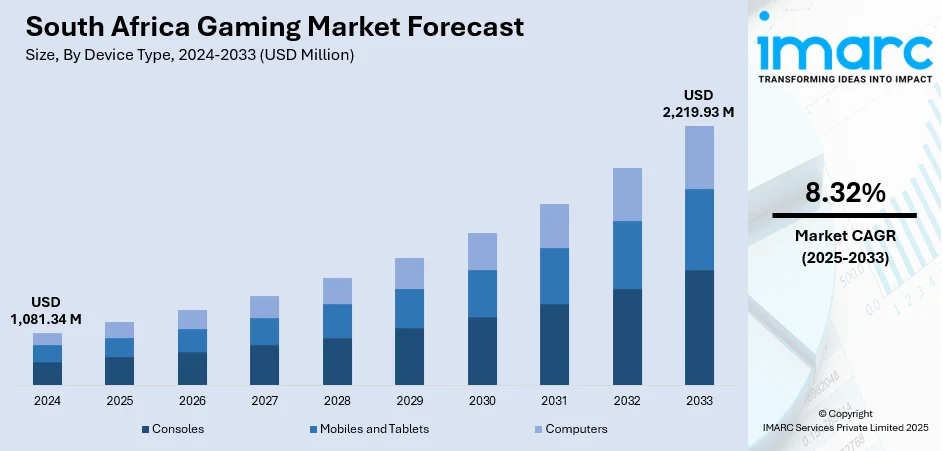

The South Africa gaming market size reached USD 1,081.34 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,219.93 Million by 2033, exhibiting a growth rate (CAGR) of 8.32% during 2025-2033. The speedy increase in internet connectivity throughout South Africa is strongly contributing to the market growth. Additionally, esports is gaining popularity in South Africa, with increased participation and viewers indulging in competitive gaming competitions. Furthermore, the move towards digital game distribution is expanding the South Africa gaming market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,081.34 Million |

| Market Forecast in 2033 | USD 2,219.93 Million |

| Market Growth Rate 2025-2033 | 8.32% |

South Africa Gaming Market Trends:

Rising Internet Penetration and Mobile Use

The speedy increase in internet connectivity throughout South Africa is strongly contributing to the market growth. Increasing numbers of individuals are connected with fast-speed internet connections, which are facilitating smooth online gaming experiences. The use of mobile phones is growing as well, and more South Africans are playing video games with smartphones. As the cost of mobile devices comes down and internet connectivity reaches remote locations, mobile platforms are becoming highly convenient. Furthermore, mobile gaming is gaining popularity, as it provides ease and flexibility in that one can play games anywhere and at any time. With mobile gaming platforms remaining on the rise, game developers are trying to keep pace with the demand for mobile-content-friendly offerings, including localized gaming products customized for South African audiences. As per Meltwater, in 2024, 45.34 million people were recorded to use the internet, and 118.6 million mobile connections were active in the country.

To get more information on this market, Request Sample

Rise of Esports and Competitive Gaming

Esports are fast gaining popularity in South Africa, with increased participation and viewers indulging in competitive gaming competitions. The rising popularity of esports is due to the improved accessibility of high-speed internet, which enables uninterrupted online gameplay. South African players are taking part in international esports competitions, promoting a local esports community. Leading gaming brands, sponsors, and media organizations are investing in esports tournaments, further propelling the market growth. With more individuals participating in competitive gaming as players and as followers, the esports culture in South Africa is growing. Esports complexes are being built, and professional teams are becoming organized, further raising the level of competition. Additionally, South African esports teams and players are getting recognition on international platforms, thereby supporting the South Africa gaming market growth. In 2025, VeliTech, a comprehensive iGaming technology provider, officially debuted in South Africa and is poised to transform the industry with its advanced solutions and integrated platform. VeliTech’s automated machine learning (ML) solutions tackle every local operator issue, enabling them to take advantage of a rapidly growing betting market. The advanced ecosystem aims to provide operators with smooth market access through flexible, adaptable, and scalable growth strategies.

Move Towards Digital Game Distribution

The gaming industry in South Africa is transitioning from the sale of physical games to digital distribution platforms. Customers are now downloading games from digital stores and foregoing the typical brick-and-mortar retail outlet. This shift to digital is due to the convenience of gaining immediate access to games and the offerings of digital storefronts that have a plethora of titles to choose from. The trend is also driven by the expansion of digital payment systems, which are making it convenient for South African gamers to make purchases. Developers are catering by emphasizing digital-first releases since they offer a convenient means to reach more people without the logistical limitations of physical distribution. This transformation is contributing to a more accessible and cost-effective gaming experience, further accelerating the popularity of gaming in South Africa. For instance, in 2025, SmartSoft expanded its global reach by introducing its game portfolio on Supabets, one of South Africa’s top iGaming operators. SmartSoft’s collection features high-performing games like JetX, Balloon, FootballX, CricketX, Plinko, and Mine Island, along with various other cutting-edge crash and slot titles.

South Africa Gaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on device type, platform, revenue type, type, and age group.

Device Type Insights:

- Consoles

- Mobiles and Tablets

- Computers

The report has provided a detailed breakup and analysis of the market based on the device type. This includes consoles, mobiles and tablets, and computers.

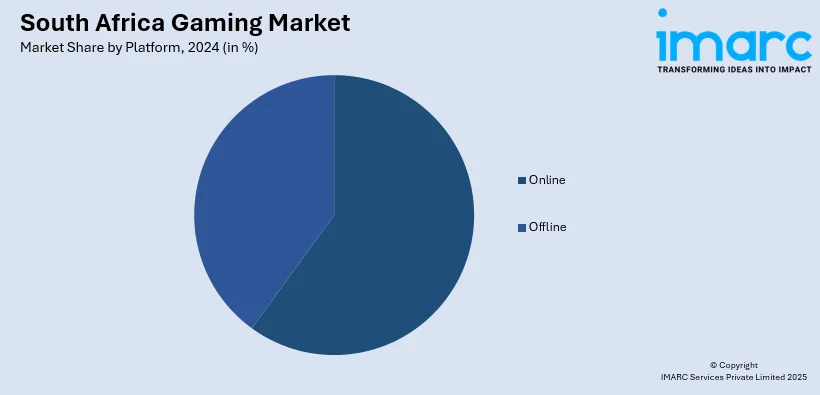

Platform Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the platform. This includes online and offline.

Revenue Type Insights:

- In-Game Purchase

- Game Purchase

- Advertising

The report has provided a detailed breakup and analysis of the market based on the revenue type. This includes in-game purchase, game purchase, and advertising.

Type Insights:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Stimulation

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes adventure/role playing games, puzzles, social games, strategy, stimulation, and others.

Age Group Insights:

- Adults

- Children

The report has provided a detailed breakup and analysis of the market based on the age group. This includes adults and children.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Gaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computers |

| Platforms Covered | Online, Offline |

| Revenue Types Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Simulation, Others |

| Age Group Covered | Adult, Children |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa gaming market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa gaming market on the basis of device type?

- What is the breakup of the South Africa gaming market on the basis of platform?

- What is the breakup of the South Africa gaming market on the basis of revenue type?

- What is the breakup of the South Africa gaming market on the basis of type?

- What is the breakup of the South Africa gaming market on the basis of age group?

- What is the breakup of the South Africa gaming market on the basis of region?

- What are the various stages in the value chain of the South Africa gaming market?

- What are the key driving factors and challenges in the South Africa gaming market?

- What is the structure of the South Africa gaming market and who are the key players?

- What is the degree of competition in the South Africa gaming market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa gaming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa gaming market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)