South Africa Higher Education Market Size, Share, Trends and Forecast by Component, Deployment Mode, Course Type, Learning Type, End User, and Region, 2025-2033

South Africa Higher Education Market Overview:

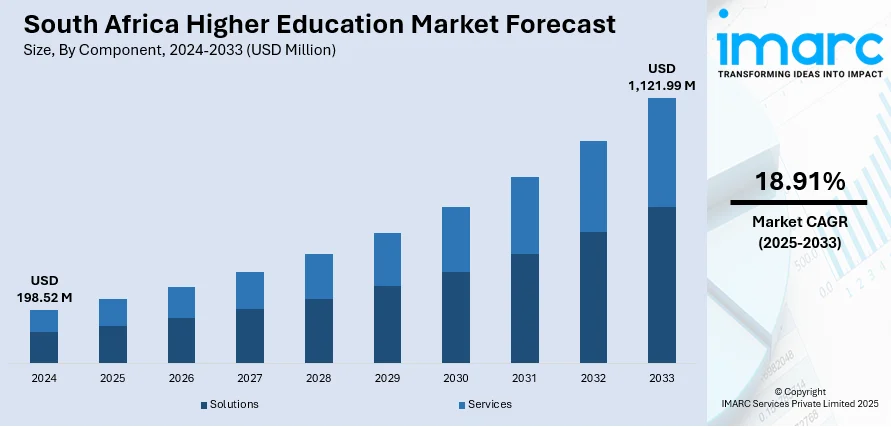

The South Africa higher education market size reached USD 198.52 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,121.99 Million by 2033, exhibiting a growth rate (CAGR) of 18.91% during 2025-2033. The market is driven by government-led reforms expanding access to tertiary education through financial aid and infrastructure investments. Growth in private institutions and online learning is diversifying educational pathways, catering to both domestic and international demand. Additionally, strengthened partnerships between universities and industry are aligning graduate skills with labor market needs, further augmenting the South Africa higher education market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 198.52 Million |

| Market Forecast in 2033 | USD 1,121.99 Million |

| Market Growth Rate 2025-2033 | 18.91% |

South Africa Higher Education Market Trends:

Government Initiatives and Policy Reforms Supporting Accessibility

South Africa’s higher education sector has been undergoing critical reforms aimed at expanding access and improving the quality of tertiary education. Government initiatives such as the National Development Plan (NDP) 2030 emphasize increasing university enrollment, especially for historically disadvantaged groups. The National Student Financial Aid Scheme (NSFAS) has played a critical role by providing financial assistance to students from lower-income households, improving participation across the country’s 26 public universities. In 2025, South Africa’s NSFAS supported 542,653 university students, well above its initial target of 417,938. Total higher education enrollment reached 1.7 million, comprising 1,152,418 university students, 587,671 TVET college students, and 97,951 at CET colleges. In addition to financial aid expansion, South Africa is focusing on improving university infrastructure, digital learning environments, and the quality of research output. Public investment is also targeting historically disadvantaged institutions to ensure equitable academic development. The introduction of new technical universities and greater emphasis on vocational education reflect efforts to balance theoretical and practical learning for national development. Moreover, collaborations with international educational agencies are strengthening academic exchange, curriculum modernization, and research collaboration. Collectively, these reforms are not only enhancing inclusivity but also helping position the country’s universities more competitively on a global scale. These structural improvements are contributing significantly to South Africa higher education market growth, strengthening its role in building a skilled, diversified workforce.

To get more information on this market, Request Sample

Expanding Role of Private Institutions and Online Learning

The role of private higher education institutions is expanding in South Africa, offering additional capacity to meet rising demand for quality tertiary education. These institutions are increasingly popular for their specialized programs, flexible study modes, and industry-focused curricula. Many private colleges collaborate with foreign universities to offer internationally recognized qualifications, appealing to both domestic and international students. Additionally, the proliferation of online and distance learning platforms has revolutionized access to education, particularly for working adults and students in remote regions. As of 2025, South Africa’s online learning platforms market is projected to generate USD 132.37 million in revenue, with an expected CAGR of 22.4% pushing the market to USD 297.09 million by 2029. The number of users is forecasted to reach 11.1 million by 2029, with user penetration rising from 13.9% in 2025 to 17.3% in 2029. Additionally, the average revenue per user (ARPU) is estimated at USD 15.49 for 2025. South African universities are now integrating online modules into traditional degree programs, promoting blended learning environments. The COVID-19 pandemic accelerated digital adoption, forcing both private and public institutions to invest in virtual classrooms, learning management systems, and digital content. Furthermore, the private sector’s ability to respond quickly to emerging skills needs has positioned it as a valuable complement to public universities. These developments are diversifying the higher education landscape, creating multiple pathways for students to attain qualifications aligned with evolving job market demands. The growth of private provision and online education is essential for broadening access and addressing capacity challenges within South Africa’s education system.

South Africa Higher Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment mode, course type, learning type, and end user.

Component Insights:

- Solutions

- Student Information Management System

- Content Collaboration

- Data Security and Compliance

- Campus Management

- Others

- Services

- Managed Services

- Professional Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions (student information management system, content collaboration, data security and compliance, campus management, and others) and services (managed services and professional services).

Deployment Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Course Type Insights:

- Arts

- Economics

- Engineering

- Law

- Science

- Others

The report has provided a detailed breakup and analysis of the market based on the course type. This includes arts, economics, engineering, law, science, and others.

Learning Type Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the learning type. This includes online and offline.

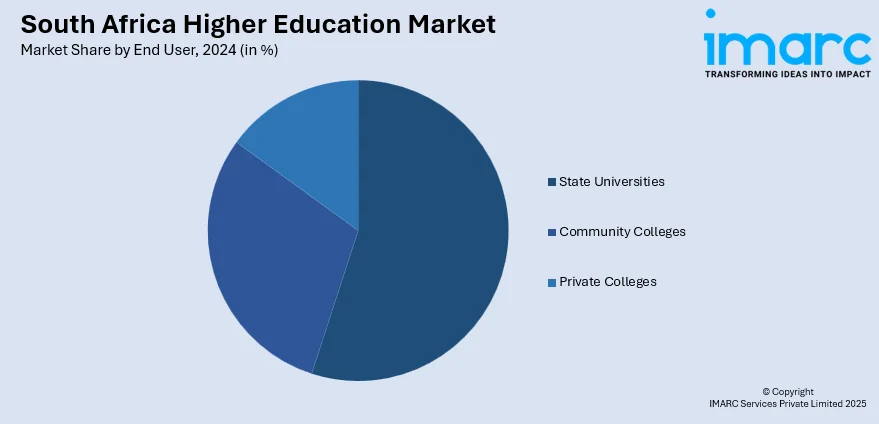

End User Insights:

- State Universities

- Community Colleges

- Private Colleges

The report has provided a detailed breakup and analysis of the market based on the end user. This includes state universities, community colleges, and private colleges.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Higher Education Market News:

- On June 18, 2025, the University of Johannesburg (UJ) secured the number one position in South Africa and Africa in the 2025 Times Higher Education (THE) Impact Rankings, rising 13 places globally to rank 23rd out of 2,318 institutions. UJ achieved top global positions in key Sustainable Development Goals, including #2 for No Poverty, #4 for Decent Work and Economic Growth, and #4 for Partnerships for the Goals. This performance underscores South Africa’s growing emphasis on higher education excellence and global competitiveness.

South Africa Higher Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Course Types Covered | Arts, Economics, Engineering, Law, Science, Others |

| Learning Types Covered | Online, Offline |

| End Users Covered | State Universities, Community Colleges, Private Colleges |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa higher education market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa higher education market on the basis of component?

- What is the breakup of the South Africa higher education market on the basis of deployment mode?

- What is the breakup of the South Africa higher education market on the basis of course type?

- What is the breakup of the South Africa higher education market on the basis of learning type?

- What is the breakup of the South Africa higher education market on the basis of end user?

- What is the breakup of the South Africa higher education market on the basis of region?

- What are the various stages in the value chain of the South Africa higher education market?

- What are the key driving factors and challenges in the South Africa higher education market?

- What is the structure of the South Africa higher education market and who are the key players?

- What is the degree of competition in the South Africa higher education market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa higher education market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa higher education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa higher education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)