South Africa IT Training Market Size, Share, Trends and Forecast by Application, End-User, and Province, 2025-2033

South Africa IT Training Market Overview:

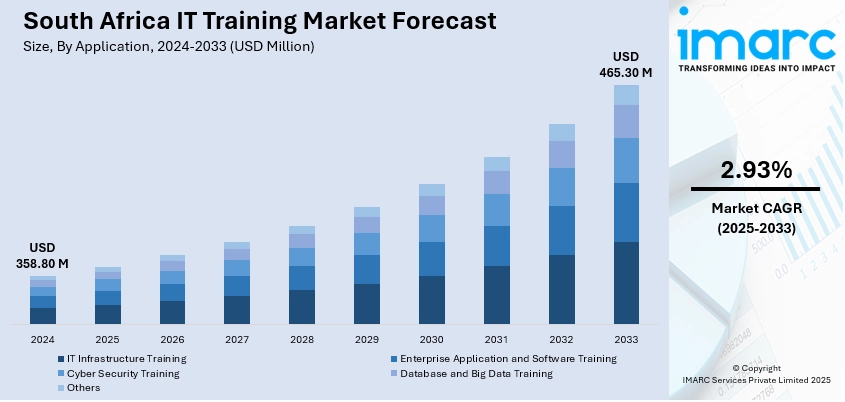

The South Africa IT training market size reached USD 358.80 Million in 2024. The market is projected to reach USD 465.30 Million by 2033, exhibiting a growth rate (CAGR) of 2.93% during 2025-2033. The market is fueled by the increasing need for skilled professionals for new technologies, including artificial intelligence (AI), cloud computing, and cybersecurity. Besides, rising digital transformation in industries further stokes the demand for IT specializations and certifications. Apart from this, the increasing amount of government support and private investments in education and technology infrastructure is augmenting the South Africa IT training market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 358.80 Million |

| Market Forecast in 2033 | USD 465.30 Million |

| Market Growth Rate 2025-2033 | 2.93% |

South Africa IT Training Market Trends:

Expansion of Cloud Computing and AI Skills Development

The market is witnessing a transition towards cloud computing and artificial intelligence (AI). As organizations are moving their operations to cloud-based platforms like AWS, Microsoft Azure, and Google Cloud, there is an increasing demand for professionals with cloud-based certifications. This is additionally supported by the implementation of AI in various industries, from the financial sector to healthcare. Cloud computing and AI are both considered to be the prime enablers of digital transformation, and companies require highly experienced personnel who can manage and implement cloud-based solutions efficiently and use AI for data analytics and automation. Therefore, universities and corporate training institutes are scaling up efforts to provide special courses in these topics at the entry-level as well as higher levels. With the growing need for cloud architects, data scientists, and AI engineers, the South African IT training market is steadily shifting to equip the workforce with the skills necessary to adapt to evolving technology needs.

To get more information on this market, Request Sample

Growth of Cybersecurity Training

As the number of cyber threats continues to rise, there is a huge increase in demand for cybersecurity skills. Large-scale data breaches, combined with rising reliance on the internet, have highlighted the absolute need for the protection of IT systems by organizations. Consequently, programs for training people in cybersecurity have emerged as the focal points, and governments and corporate entities are laying special emphasis on building skilled professionals who can ward off, detect, and counter cyber threats. Certifications such as Certified Information Systems Security Professional (CISSP) and Certified Ethical Hacker (CEH) are extremely sought after. In addition to technical education, training courses increasingly focus on risk management, regulatory compliance, and incident response. Moreover, teleworking and digitalization increase cybersecurity threats even more, leading businesses to spend heavily on the training of employees in order to equip them with robust cyberattack protection. This trend is driving a major surge in cybersecurity training enrolments across the region.

Demand for Remote and Flexible Learning Options

The increasing demand for remote and flexible learning options drives the South Africa IT training market growth. This trend has been mainly driven by the worldwide COVID-19 pandemic, which increased the embracement of online learning platforms. Organizations and individuals alike want simple, affordable, and accessible ways to reskill workers or acquire personal skills in IT. Virtual instructor-led training, self-paced learning modules, and blended programs are gaining popularity as they allow professionals to learn at their convenience, often while coping with work obligations. Most training providers currently employ advanced technologies, such as learning management systems (LMS) and artificial intelligence-based educational materials, to offer customized learning experiences. In addition, the convenience offered by online platforms has made IT training accessible to individuals, including remote or underserved populations. This has led to an increased pool of human capital, hence maintaining South Africa's labor force competitiveness in an increasingly digitalized world.

South Africa IT Training Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application and end-user.

Application Insights:

- IT Infrastructure Training

- Enterprise Application and Software Training

- Cyber Security Training

- Database and Big Data Training

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes IT infrastructure training, enterprise application and software training, cyber security training, data and big data training, and others.

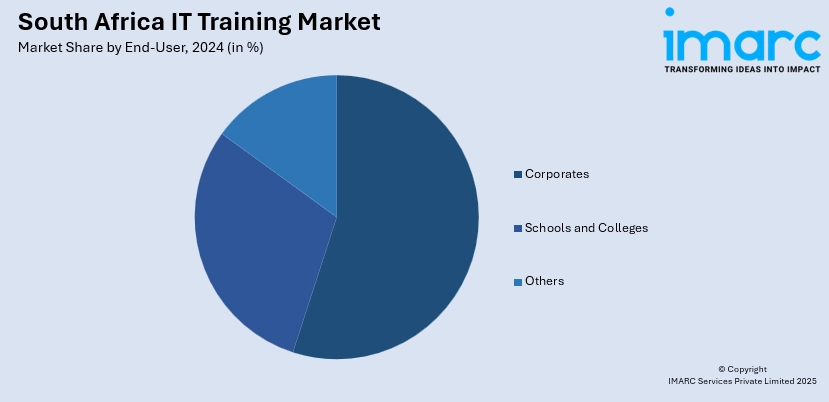

End-User Insights:

- Corporates

- Schools and Colleges

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes corporate, schools and colleges, and others.

Province Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa IT Training Market News:

- On March 6, 2025, Microsoft announced a ZAR 5.4 Billion (USD 291.6 Million) investment in order to expand its cloud and AI infrastructure in South Africa by 2027. The investment will enhance access to Azure cloud services for businesses, government entities, and startups while supporting workforce capacity-building via fully funded certifications for 50,000 young South Africans in high-requirement areas such as data science, AI, cybersecurity, and cloud architecture.

- On June 12, 2025, WeThinkCode, a South African tech academy, secured a USD 2 Million grant to significantly expand its artificial intelligence training programs across South Africa and Kenya. The initiative aims to train 12,000 participants, equally split between technical stream (AI for software engineers) and non-technical roles, leveraging free 40–80‑hour extracurricular courses delivered via an enhanced learning management system. The program prioritizes underserved groups in low-income, rural, and peri‑urban communities, with tailored support to bridge Africa’s AI skills gap and boost employability in both software development and administrative sectors.

South Africa IT Training Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | IT Infrastructure Training, Enterprise Application and Software Training, Cyber Security Training, Database and Big Data Training, Others |

| End-Users Covered | Corporate, Schools and Colleges, Others |

| Provinces Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request |

Key Questions Answered in This Report:

- How has the South Africa IT training market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa IT training market on the basis of application?

- What is the breakup of the South Africa IT training market on the basis of end-user?

- What is the breakup of the South Africa IT training market on the basis of province?

- What are the various stages in the value chain of the South Africa IT training market?

- What are the key driving factors and challenges in the South Africa IT training market?

- What is the structure of the South Africa IT training market and who are the key players?

- What is the degree of competition in the South Africa IT training market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa IT training market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa IT training market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa IT training industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)