South Africa Kitchen Appliances Market Size, Share, Trends and Forecast by Product Type, Structure, Fuel Type, Application, Distribution Channel, and Region, 2026-2034

South Africa Kitchen Appliances Market Summary:

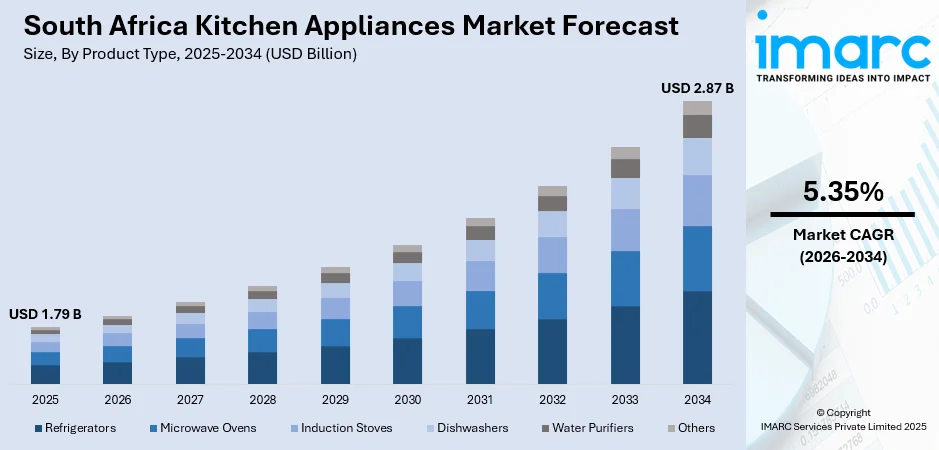

The South Africa kitchen appliances market size was valued at USD 1.79 Billion in 2025 and is projected to reach USD 2.87 Billion by 2034, growing at a compound annual growth rate of 5.35% from 2026-2034.

The South Africa kitchen appliances market is seeing substantial expansion driven by rising urbanization, increased middle-class families, and increasing demand for new, energy-efficient goods. Product accessibility across a range of socioeconomic segments is being improved by the nation's changing retail landscape, which is marked by growing organized retail networks and increasing e-commerce penetration. Manufacturers are using creative solutions, such solar-powered appliances and smart technology that maximize energy consumption, to address regional issues, such as limitations in energy supply. The market share of kitchen appliances in South Africa is growing as a result of these advancements as well as changing consumer preferences toward sustainability and convenience.

Key Takeaways and Insights:

- By Product Type: Refrigerators hold the largest market share at 35% in 2025, driven by essential food preservation needs, innovative energy-efficient designs, and the introduction of solar-powered models addressing energy challenges.

- By Structure: Free stand appliances dominate the market with 78% share in 2025, offering consumers flexibility, ease of installation, and affordability suited to diverse housing configurations across the country.

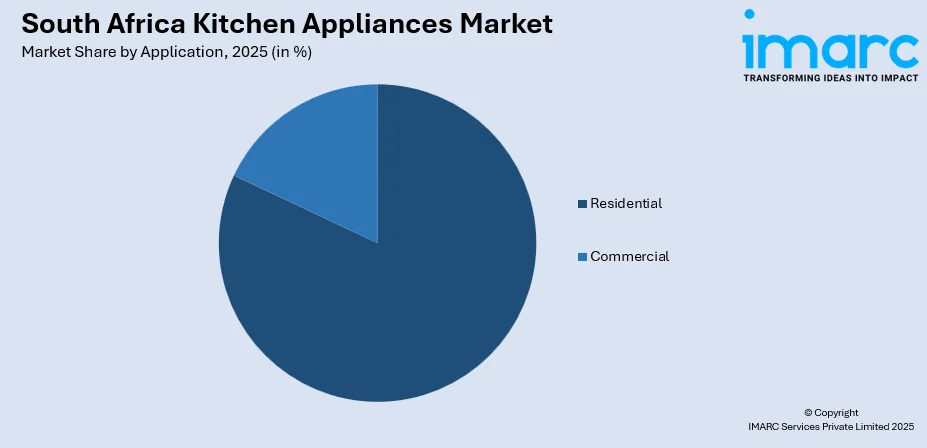

- By Application: Residential applications account for 82% of the market in 2025, reflecting strong household demand driven by urbanization, rising disposable incomes, and the growing desire for modern kitchen solutions.

- By Distribution Channel: Supermarkets and hypermarkets lead with 34% share in 2025, providing consumers with convenient access to diverse product ranges, competitive pricing, and established after-sales service networks.

- Key Players: The South Africa kitchen appliances market features intense competition among global and domestic manufacturers who are expanding product portfolios, investing in smart technologies, and strengthening distribution partnerships to enhance market presence.

To get more information on this market Request Sample

The South Africa kitchen appliances market is advancing as manufacturers integrate cutting-edge technologies and sustainable solutions to address evolving consumer needs. The market benefits from strong infrastructure investment, with retailers expanding physical and digital footprints to reach broader consumer segments. Leading appliance brands are introducing smart refrigerators, dishwashers, and connected home appliances equipped with AI-powered energy optimization and home automation connectivity. This technological advancement reflects the broader industry shift toward intelligent, energy-efficient solutions that simplify daily life while reducing operational costs. The rapid growth of e-commerce platforms and the entry of major global online retailers have further intensified competition and enhanced consumer access to diverse product offerings. The convergence of digital retail expansion, product innovation, and changing household dynamics positions South Africa as a dynamic market for kitchen appliance manufacturers seeking growth opportunities on the African continent.

South Africa Kitchen Appliances Market Trends:

Integration of AI-Powered and Smart Kitchen Technologies

South African consumers are increasingly embracing smart kitchen appliances featuring artificial intelligence, IoT connectivity, and energy optimization capabilities. This trend is reshaping buying behavior as households seek appliances that offer convenience, personalization, and energy savings. In August 2024, Samsung South Africa introduced its Bespoke AI appliance range at the Design Quarter in Johannesburg, featuring smart refrigerators with AI-powered cameras, connected dishwashers, and SmartThings integration for comprehensive home automation. The launch demonstrates the growing appetite for intelligent kitchen solutions that simplify daily life while reducing energy consumption, accelerating South Africa kitchen appliances market growth.

Solar-Powered and Off-Grid Appliance Innovation

The historical challenges of load-shedding have catalyzed significant innovation in energy-independent kitchen appliances. Manufacturers are developing solar-powered and off-grid solutions that ensure uninterrupted operation regardless of grid availability. In March 2024, Defy Appliances launched its Solar Off-Grid refrigerator and freezer range in South Africa, representing the first locally manufactured appliances capable of operating completely independent of the national power grid. The products feature integrated lithium-ion battery systems and solar panel compatibility, enabling up to three days of continuous cooling without electricity, addressing critical food preservation needs for households and small businesses.

Expansion of Digital Commerce and Omnichannel Retail

The rapid growth of e-commerce platforms and digital retail channels is transforming how South Africans purchase kitchen appliances, creating new opportunities for market expansion. Online retail in South Africa surged to R71 Billion in 2023, representing a 29% increase from the previous year, with e-commerce now exceeding 6% of total retail sales. The arrival of Amazon in South Africa in May 2024 has further intensified competition and enhanced consumer access to diverse product offerings. Retailers are investing in omnichannel capabilities, offering same-day delivery, flexible payment options, and integrated online-offline shopping experiences that make kitchen appliances more accessible to consumers across income levels and geographic regions.

Market Outlook 2026-2034:

The South Africa kitchen appliances market is positioned for sustained expansion, supported by favorable demographic trends and technological advancement. The market generated a revenue of USD 1.79 Billion in 2025 and is projected to reach a revenue of USD 2.87 Billion by 2034, growing at a compound annual growth rate of 5.35% from 2026-2034. This can be accredited to urbanization, rising household formation rates, and increasing demand for energy-efficient solutions. Continued investment in smart home technologies, expanding retail infrastructure, and innovative product development addressing local energy challenges will propel market growth. The residential segment is expected to maintain its dominant position as middle-class households prioritize kitchen modernization and appliance upgrades.

South Africa Kitchen Appliances Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Refrigerators | 35% |

| Structure | Free Stand | 78% |

| Application | Residential | 82% |

| Distribution Channel | Supermarkets and Hypermarkets | 34% |

Product Type Insights:

- Refrigerators

- Microwave Ovens

- Induction Stoves

- Dishwashers

- Water Purifiers

- Others

Refrigerators lead the South Africa kitchen appliances market, holding 35% of product type revenue in 2025.

Refrigerators represent the cornerstone of the South Africa kitchen appliances market, driven by essential food preservation needs and growing consumer demand for energy-efficient and smart cooling solutions. The segment has witnessed significant innovation as manufacturers address the country's unique energy challenges through the development of solar-powered and off-grid refrigeration solutions. These advancements feature integrated battery systems capable of maintaining optimal cooling temperatures during power interruptions, ensuring uninterrupted food preservation for households and small businesses. Local manufacturing initiatives have further strengthened the segment, with domestic producers developing off-grid refrigeration technology tailored to South African conditions. This innovation addresses critical consumer concerns regarding food spoilage while supporting the country's sustainable development objectives and reducing dependence on the national power grid.

Structure Insights:

- Built-In

- Free Stand

Free stand appliances dominate the South Africa kitchen appliances market, commanding 78% of the overall share in 2025.

Free stand kitchen appliances maintain overwhelming dominance in the South African market due to their versatility, affordability, and ease of installation across diverse housing configurations. These products appeal to the country's varied residential landscape, from traditional homes to modern apartments and informal settlements, offering consumers flexibility to relocate appliances as needed. The segment benefits from lower upfront costs compared to built-in alternatives, making modern kitchen solutions accessible to a broader consumer base. Additionally, free stand appliances align with rental housing dynamics, where tenants prefer portable solutions they can take when moving. Retailers and manufacturers focus on this segment given its mass-market appeal, offering extensive product ranges across price points to capture diverse consumer segments.

Fuel Type Insights:

- Cooking Gas

- Electricity

- Others

The fuel type segment encompasses cooking gas, electricity, and alternative energy sources, with electricity-powered appliances commanding the largest share of the market. Electric appliances dominate urban households due to established grid infrastructure and integration with smart home technologies. The widespread availability of electrical connections in metropolitan areas and the compatibility of electric appliances with modern kitchen designs reinforce this segment's leadership position.

Cooking gas appliances maintain a significant market presence, particularly among consumers seeking reliable alternatives to electricity-dependent solutions. Gas-powered stoves and ovens offer consistent performance regardless of grid availability, making them attractive to households concerned about power interruptions. The segment also appeals to consumers who prefer the precise temperature control and instant heat response that gas cooking provides.

The others segment, comprising solar-powered and hybrid energy solutions, represents the fastest-growing fuel type category. Historical load-shedding challenges have accelerated consumer interest in energy-independent kitchen appliances that operate off-grid. Solar-powered refrigerators and freezers equipped with battery storage systems are gaining traction among households and small businesses seeking uninterrupted functionality. This segment benefits from declining solar technology costs and growing environmental consciousness among South African consumers prioritizing sustainable living solutions.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Residential

- Commercial

The residential segment holds 82% of the South Africa kitchen appliances market in 2025.

Residential applications overwhelmingly drive the South Africa kitchen appliances market as urbanization accelerates household formation and rising incomes enable kitchen modernization. The segment benefits from demographic shifts including growing middle-class populations, dual-income households seeking time-saving solutions, and young professionals establishing independent households in urban centers. South Africa's government has maintained active housing programs targeting new housing opportunities for lower-income segments, creating sustained demand from first-time appliance buyers. Urban renewal initiatives and infrastructure development projects continue to generate additional housing stock requiring comprehensive kitchen outfitting. The residential segment also captures replacement demand as urban households upgrade aging appliances to energy-efficient and smart alternatives that reduce operational costs and enhance everyday convenience.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Departmental Stores

- Others

Supermarkets and hypermarkets lead the distribution channel segment with 34% of the South Africa kitchen appliances market in 2025.

Supermarkets and hypermarkets serve as the primary distribution channel for kitchen appliances in South Africa, offering consumers convenient access to diverse product ranges under one roof. These multi-brand establishments, including major retailers like Makro and Game, provide comprehensive shopping experiences with product demonstrations, competitive pricing, and established after-sales service networks. The channel benefits from high foot traffic generated by grocery shopping, enabling impulse purchases and brand discovery. Partnerships between appliance manufacturers and retail chains enhance market reach; for instance, Hisense has partnered with Makro to launch its premium smart home appliance range across South African stores.

Province Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

Growth in Gauteng is driven by the region’s status as the country's economic hub with the highest population density and urbanization rates. The region hosts major metropolitan areas including Johannesburg and Pretoria, which feature extensive retail infrastructure, high internet penetration, and concentrated middle-class populations. KwaZulu-Natal and Western Cape follow as significant markets, benefiting from strong tourism industries, port-based commerce, and growing urban populations. The Western Cape, particularly Cape Town, demonstrates premium product preference and strong adoption of smart home technologies. Eastern Cape and Mpumalanga represent emerging markets with growth potential driven by infrastructure development and expanding retail presence.

KwaZulu-Natal represents the second-largest provincial market for kitchen appliances, driven by Durban's status as a major port city and commercial hub. The region benefits from a diverse consumer base spanning urban centers and peri-urban areas, with strong retail presence through major shopping centers. The province's manufacturing sector, including Defy Appliances' production facility in Ladysmith, supports local industry development and employment.

Western Cape demonstrates strong demand for premium and smart kitchen appliances, particularly in Cape Town's affluent suburbs. The region features high internet penetration and e-commerce adoption rates, supporting online appliance purchases. Tourism-driven hospitality sectors create additional commercial demand, while the province's stable municipal services and reliable infrastructure enhance appliance performance and longevity, attracting quality-conscious consumers seeking advanced kitchen solutions.

Mpumalanga represents an emerging market for kitchen appliances, characterized by growing urbanization in towns such as Nelspruit and Witbank. The province's expanding mining and agricultural sectors support household income growth, driving demand for basic and mid-range appliances. Retail infrastructure development, including new shopping centers, is improving product accessibility for consumers previously underserved by organized retail channels.

Eastern Cape offers significant growth potential driven by government infrastructure investment and urban development initiatives in Port Elizabeth and East London. The region serves price-sensitive consumers prioritizing functionality and durability. Rural electrification programs are expanding the addressable market, while automotive industry employment provides stable household incomes supporting appliance purchases among working-class families in industrial centers.

The remaining provinces, including Free State, Limpopo, North West, and Northern Cape, collectively represent emerging opportunities in the kitchen appliances market. These regions feature lower urbanization rates but demonstrate growing demand as retail networks expand beyond major metropolitan areas. Infrastructure development, rural electrification initiatives, and rising disposable incomes in secondary towns are gradually increasing appliance penetration and market accessibility.

Market Dynamics:

Growth Drivers:

Why is the South Africa Kitchen Appliances Market Growing?

Rising Disposable Incomes and Consumer Spending Capacity

The expansion of South Africa's middle-class population and rising household incomes are driving increased consumer spending on kitchen appliances. The country's improving economic indicators reflect growing purchasing power and discretionary income available for home improvement investments. This economic trajectory enables households to prioritize appliance upgrades, shifting demand toward premium products featuring smart technologies and enhanced energy efficiency. Dual-income households, particularly in urban centers, demonstrate strong appetite for time-saving kitchen solutions that support busy lifestyles. The availability of flexible payment options, including lay-by plans and installment financing through retailers, further expands market accessibility to aspirational consumers seeking quality kitchen appliances.

Rapid Urbanization and Household Formation

South Africa's accelerating urbanization is generating sustained demand for kitchen appliances as new households form and existing ones modernize. Africa's urban population is projected to double from 700 Million to 1.4 Billion by 2050, with South Africa maintaining urbanization rates exceeding 60% in the Southern Africa region. This demographic shift creates substantial demand for first-time appliance purchases among newly formed households establishing independent living arrangements in urban centers. Government housing initiatives amplify this trend through ongoing programs targeting new housing opportunities for lower-income households. Urban renewal projects across major provinces are creating additional housing stock that requires comprehensive kitchen outfitting, sustaining market growth across product categories.

Energy Crisis Driving Innovation and Product Differentiation

South Africa's historical energy supply challenges have catalyzed unprecedented innovation in the kitchen appliances sector, creating competitive differentiation opportunities for manufacturers. The country's experience with load-shedding has driven consumer demand for energy-efficient and backup-supported kitchen solutions that maintain functionality during power interruptions. Substantial household investment in solar energy systems demonstrates growing commitment to energy independence among South African consumers. Manufacturers are responding with innovative products including solar-powered off-grid refrigerators and AI-powered energy optimization features integrated into smart appliance ranges. These developments transform market challenges into growth opportunities as consumers actively seek solutions that ensure uninterrupted kitchen functionality while reducing dependence on the national power grid.

Market Restraints:

What Challenges the South Africa Kitchen Appliances Market is Facing?

High Import Dependence and Price Volatility

The South Africa kitchen appliances market relies heavily on imports from China, South Korea, and Malaysia, exposing it to currency fluctuations and supply chain disruptions. Limited local manufacturing capacity means price changes in source countries directly impact domestic pricing. Rand volatility against major currencies creates uncertainty for both retailers and consumers, potentially constraining demand during depreciation periods.

Economic Constraints and Affordability Barriers

High levels of income inequality limit the addressable market for premium kitchen appliances in South Africa. The country faces a housing shortage with many households unable to afford modern appliances. Unemployment rates and cost-of-living pressures constrain discretionary spending, particularly affecting adoption of higher-priced smart and energy-efficient products among lower-income segments.

Infrastructure and Service Delivery Challenges

Inconsistent municipal services and infrastructure limitations in certain regions affect kitchen appliance adoption and performance. Some areas experience irregular water supply affecting dishwasher and water purifier usage, while electrical infrastructure quality varies across municipalities. These challenges can impact appliance longevity and operational reliability, potentially deterring purchases in affected areas.

Competitive Landscape:

The South Africa kitchen appliances market features intense competition among established global manufacturers and domestic players. Key companies compete through product innovation, particularly in smart technologies and energy efficiency, while expanding distribution networks and strengthening after-sales service capabilities. Local manufacturer maintains strong market presence through domestic production facilities and innovation addressing local challenges. International brands leverage premium positioning and technological leadership while investing in localized marketing and retail partnerships to enhance market penetration.

South Africa Kitchen Appliances Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Refrigerators, Microwave Ovens, Induction Stoves, Dishwashers, Water Purifiers, Others |

| Structures Covered | Built-In, Free Stand |

| Fuel Types Covered | Cooking Gas, Electricity, Others |

| Applications Covered | Residential, Commercial |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Departmental Stores, Others |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The South Africa kitchen appliances market size was valued at USD 1.79 Billion in 2025.

The South Africa kitchen appliances market is expected to grow at a compound annual growth rate of 5.35% from 2026-2034 to reach USD 2.87 Billion by 2034.

Refrigerators hold the largest product type share at 35%, driven by essential food preservation needs, growing demand for energy-efficient models, and innovations addressing local energy challenges through solar-powered and smart cooling solutions.

Key factors driving the South Africa kitchen appliances market include rising disposable incomes, rapid urbanization and household formation, expanding retail and e-commerce channels, growing demand for energy-efficient solutions, and technological innovation in smart appliances.

Major challenges include high import dependence creating price volatility, economic constraints limiting affordability for lower-income segments, infrastructure limitations in certain regions, and inconsistent municipal service delivery affecting appliance performance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)