South Africa Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2025-2033

South Africa Logistics Market Overview:

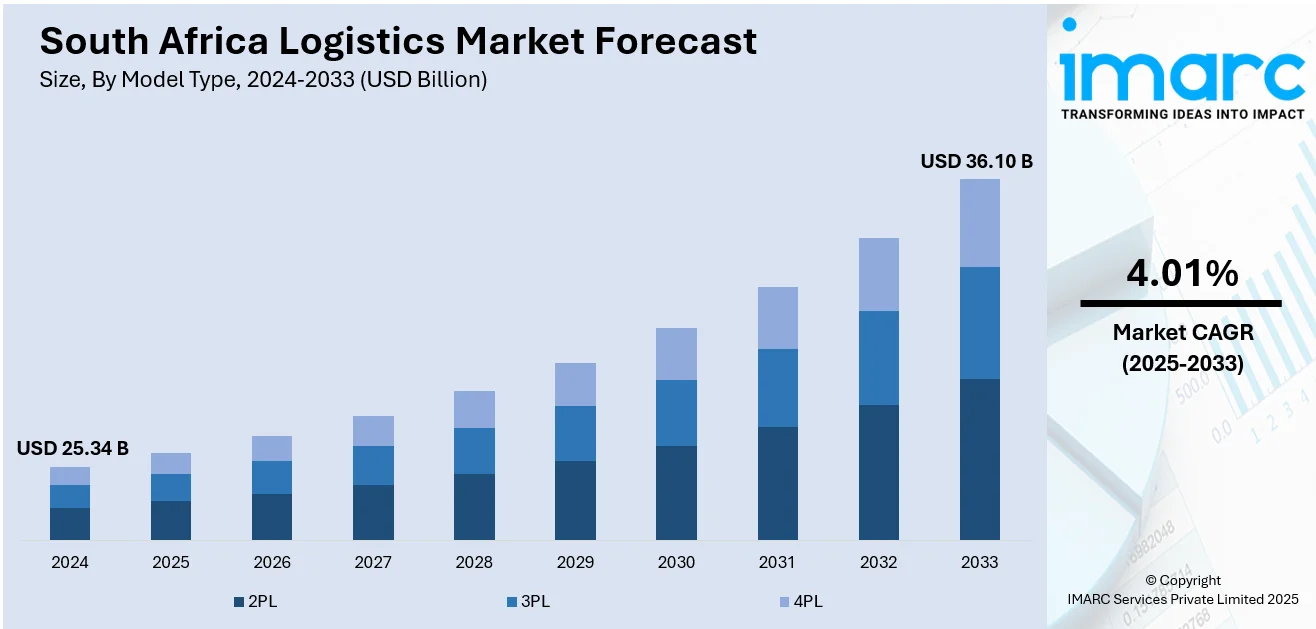

The South Africa logistics market size reached USD 25.34 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 36.10 Billion by 2033, exhibiting a growth rate (CAGR) of 4.01% during 2025-2033. The market is experiencing robust growth, fueled by significant investments in infrastructure and technological advancements. Key drivers, including improvements in port facilities, transportation networks, and the rise of digital logistics solutions that enhance efficiency, are also catalyzing market growth. The wholesale and retail sectors continue to lead the market, contributing a substantial share. As the demand for more efficient supply chains grows, the market is set to expand, further strengthening the South Africa logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 25.34 Billion |

| Market Forecast in 2033 | USD 36.10 Billion |

| Market Growth Rate 2025-2033 | 4.01% |

South Africa Logistics Market Trends:

Infrastructure Modernization

South Africa is experiencing considerable investment in the enhancement of its logistics infrastructure focusing on the upgrade of crucial transport networks including ports, railways, and roads. For instance, in May 2025, South Africa's Finance Minister announced a R1 Trillion infrastructure investment emphasizing transport and logistics. Key allocations include R93.1 Billion for national road maintenance and R66.3 Billion for PRASA aimed at enhancing rail services. These enhancements are designed to tackle bottlenecks and inefficiencies within the supply chain allowing for more efficient and rapid movement of goods both within the country and across borders. The development and modernization of major ports like Durban and Cape Town are vital for improving the nation's competitiveness in global markets. Furthermore, advancements in rail and road infrastructure are essential for better linking inland regions with important ports resulting in faster delivery times and lower transportation expenses. This continuous investment in infrastructure is pivotal in enhancing the overall efficiency and capability of logistics throughout the country. As a result, the South Africa logistics market growth is expected to accelerate driven by these strategic infrastructure enhancements that support the growing demand for logistics services.

To get more information on this market, Request Sample

Cold Chain Expansion

South Africa's growing need for temperature-sensitive products has resulted in major investments being made in cold chain infrastructure. This is particularly significant for industries dealing with pharmaceuticals, fresh foodstuffs, and other products that need tight temperature control during storage and transportation. In response to this demand, a lot of new modern cold storage facilities with sophisticated refrigeration technologies have been built. For instance, in May 2025, Maersk announced plans for its Belcon Logistics Park cold storage facility in Cape Town set to open in late 2025. The facility aims to enhance logistics for perishable exports minimizing losses for South African exporters. Maersk will also launch a cold store in Cato Ridge focusing on sustainability. Furthermore, improvements are being made to refrigerated transportation options to ensure that products retain their quality from warehouses to consumers. The growth of cold chain infrastructure is essential for fulfilling the requirements of industries like food retail, pharmaceuticals, and healthcare where maintaining specific temperature ranges is crucial. As this sector continues to expand, it is anticipated to play a significant role in the growth of the logistics market in South Africa enhancing the efficiency and reliability of delivering perishable and temperature-sensitive goods throughout the country.

South Africa Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on model type, transportation mode, and end use.

Model Type Insights:

- 2PL

- 3PL

- 4PL

The report has provided a detailed breakup and analysis of the market based on the model type. This includes 2PL, 3PL, and 4PL.

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

A detailed breakup and analysis of the market based on the transportation mode have also been provided in the report. This includes roadways, seaways, railways, and airways.

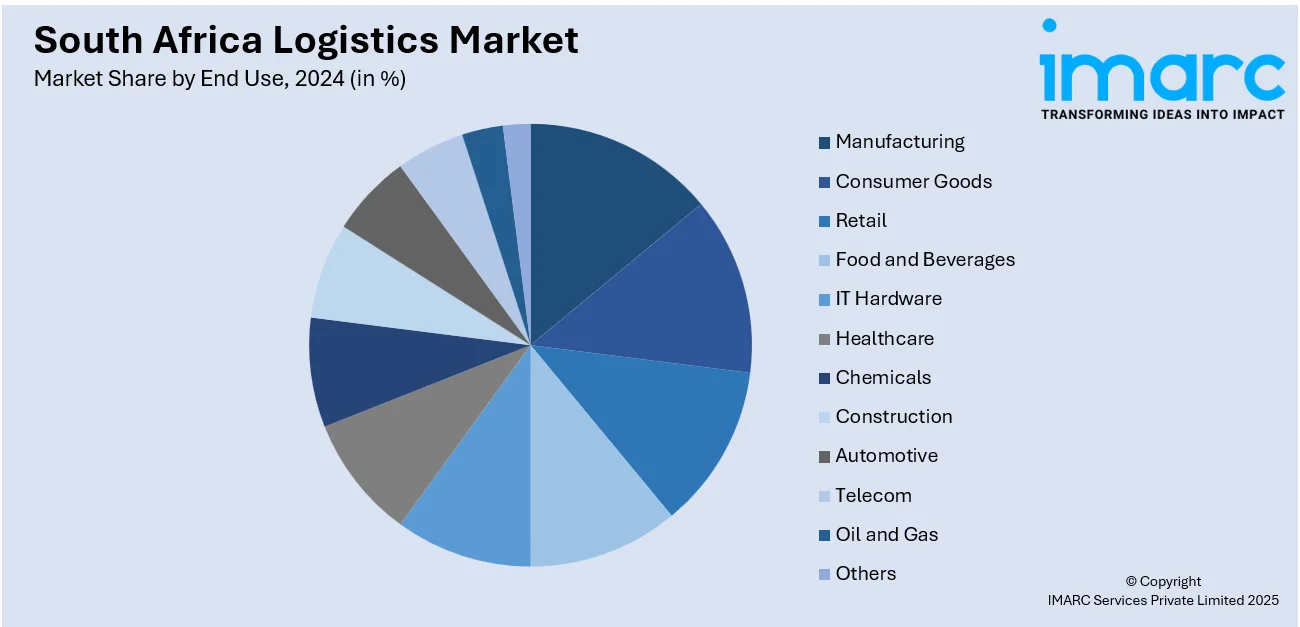

End Use Insights:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Logistics Market News:

- In May 2025, DP World introduced a turnkey logistics solution to support automotive OEMs in South Africa, overcoming market entry challenges. Successfully tested with Foton Motor, this integrated model facilitates rapid distribution, regulatory compliance, and digital dealer support, positioning manufacturers for growth in one of the fastest-growing automotive markets in the world.

- In April 2025, Huawei launched a smart warehouse in Johannesburg, South Africa, covering 14,000 square meters. Utilizing advanced automation and sustainable technology, the facility enhances logistics efficiency and security. With features like AI monitoring and solar power, it aims to transform African supply chains and support the region’s economic growth in logistics.

South Africa Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2PL, 3PL, 4PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa logistics market on the basis of model type?

- What is the breakup of the South Africa logistics market on the basis of transportation mode?

- What is the breakup of the South Africa logistics market on the basis of end use?

- What is the breakup of the South Africa logistics market on the basis of region?

- What are the various stages in the value chain of the South Africa logistics market?

- What are the key driving factors and challenges in the South Africa logistics market?

- What is the structure of the South Africa logistics market and who are the key players?

- What is the degree of competition in the South Africa logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)