South Africa Online Travel Market Size, Share, Trends and Forecast by Service Type, Platform, Mode of Booking, Age Group, and Province, 2025-2033

South Africa Online Travel Market Overview:

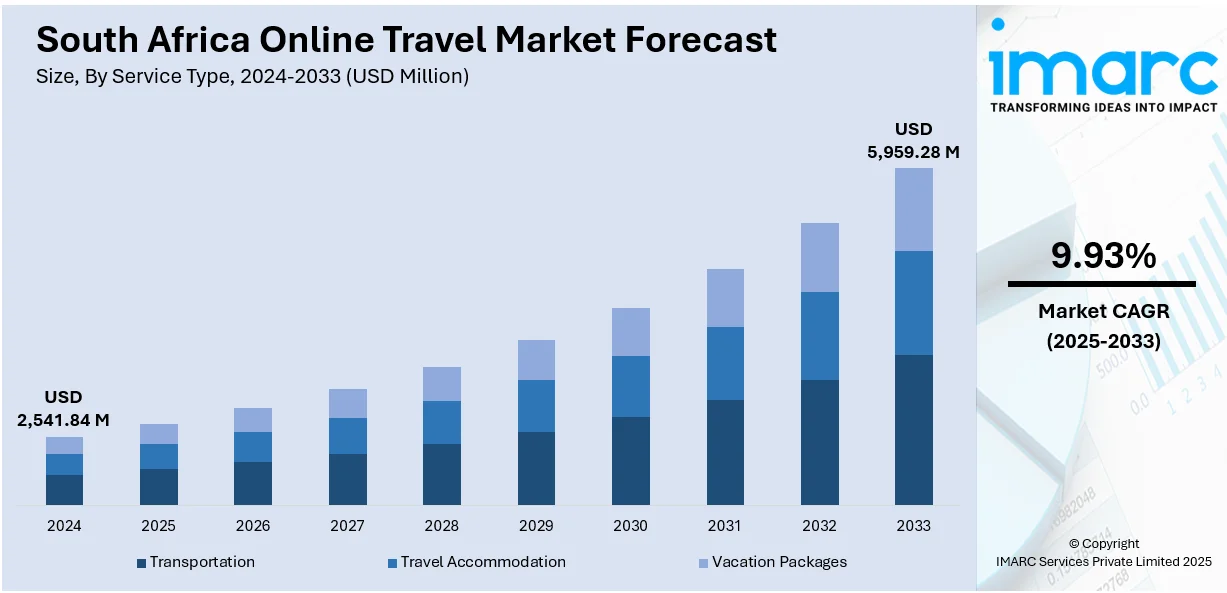

The South Africa online travel market size reached USD 2,541.84 Million in 2024. The market is projected to reach USD 5,959.28 Million by 2033, exhibiting a growth rate (CAGR) of 9.93% during 2025-2033. The market is expanding due to rising smartphone penetration, improved internet connectivity, and growing demand for personalized travel experiences. Consumers increasingly prefer digital platforms for booking flights, accommodations, and tours. Enhanced payment gateways, AI-based recommendations, and government efforts to promote tourism further fuel this growth. The surge in domestic and international travel bookings reflects the increasing South Africa online travel share in the broader tourism sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,541.84 Million |

| Market Forecast in 2033 | USD 5,959.28 Million |

| Market Growth Rate 2025-2033 | 9.93% |

South Africa Online Travel Market Trends:

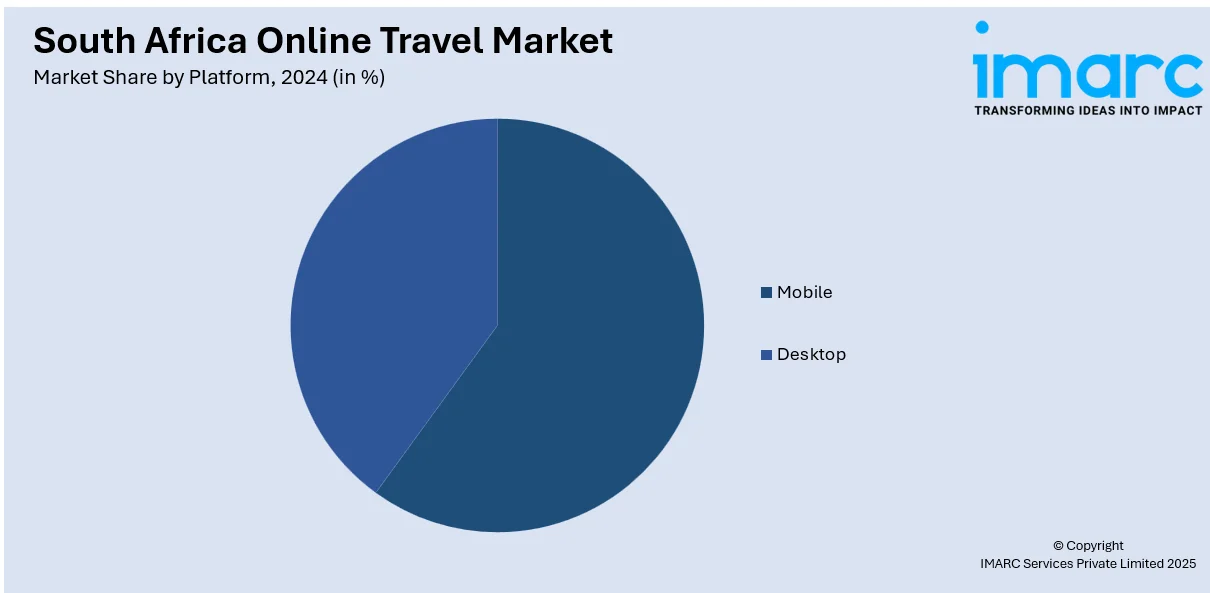

Digital Booking Expansion with Seamless Mobile UX

South Africa’s travel landscape is undergoing a significant digital transformation, with mobile-first platforms emerging as the dominant mode for planning and booking. Users now benefit from AI-enabled support tools, real-time itinerary adjustments, and one-click payment systems that offer ease and efficiency throughout the booking experience. Platforms increasingly use augmented reality to allow virtual previews of accommodations and experiences, building trust and encouraging informed decision-making. This transformation is supported by national tourism efforts that focus on enhancing mobile infrastructure and digital literacy across urban and remote areas. In February 2025, national data confirmed a surge in visitor activity, reinforcing the importance of intuitive, accessible digital platforms in responding to evolving traveller expectations. These developments mark a departure from traditional booking formats, replacing them with dynamic, responsive ecosystems that adapt to user needs in real time. As connectivity improves and AI capabilities expand, digital convenience will become the foundation of travel planning across demographics. Mobile-first innovation is not merely a feature but a defining requirement for competitiveness, firmly positioning digital convenience as a driving force in South Africa online travel market growth.

To get more information on this market, Request Sample

Sustainable and Cultural Travel Emphasis

Eco-conscious and culturally immersive travel is becoming a central theme in South Africa’s online travel offerings. Platforms now integrate sustainability filters, allowing users to easily identify heritage lodges, community-run guesthouses, and conservation activities. This trend reflects a broader shift in traveller values, where authenticity and environmental awareness play a critical role in shaping decision-making. In February 2025, official reports documented an upswing in inbound tourism, which has prompted digital providers to prioritise underexplored destinations such as the Karoo, Wild Coast, and Northern Cape. Through analytics-driven campaigns, platforms promote off-peak travel to balance demand and distribute economic benefit more equitably across regions. Augmented reality tools are increasingly employed to offer immersive previews of experiences, empowering users to make informed, sustainable choices. These efforts align with broader national objectives to protect ecological assets while supporting inclusive growth through tourism. As expectations evolve, sustainability is no longer a niche preference but a mainstream standard embedded in digital platforms. This emphasis on purpose-driven travel is actively reshaping user preferences and reinforces emerging patterns within South Africa online travel market trends.

AI-Powered Personalisation through Mobile Channels

South African travel platforms are rapidly adopting artificial intelligence to personalise user experiences, particularly within mobile environments. AI-driven recommendation systems now analyse user preferences, location data, and past behaviour to deliver custom itineraries featuring wildlife safaris, cultural tours, or wellness retreats. Chatbots provide real-time multilingual support, reducing the need for manual searches and increasing booking confidence. Dynamic pricing tools adapt to demand fluctuations, while augmented reality maps guide users through attractions, restaurants, and lodging options relevant to their current location. The integration of smart features is not limited to major providers government-backed digital transformation initiatives enabling smaller operators to participate in mobile-friendly innovation. This is especially valuable in connecting travellers with locally operated services, thereby boosting regional economies. By reducing friction and increasing relevance throughout the user journey, these AI capabilities are becoming essential features across the booking ecosystem. In the context of evolving expectations for convenience, speed, and customisation, intelligent mobile tools offer a superior experience.

South Africa Online Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type, platform, mode of booking, and age group.

Service Type Insights:

- Transportation

- Travel Accommodation

- Vacation Packages

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, travel accommodation, and vacation packages.

Platform Insights:

- Mobile

- Desktop

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes mobile and desktop.

Mode of Booking Insights:

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

The report has provided a detailed breakup and analysis of the market based on the mode of booking. This includes online travel agencies (OTAs) and direct travel suppliers.

Age Group Insights:

- 22-31 Years

- 32-43 Years

- 44-56 Years

- Above 56 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 22-31 years, 32-43 years, 44-56 years, and above 56 years.

Province Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Other

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and other.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Online Travel Market News:

- January 2024: Travelstart, a leading South African online travel agency, has officially joined the Association of Southern African Travel Agents (ASATA). This strategic move marks a significant milestone for both the company and the broader travel industry in South Africa. ASATA’s recognition reinforces Travelstart’s commitment to excellence, industry standards, and customer trust. The partnership is expected to strengthen collaboration within the local travel sector and support ongoing efforts to enhance digital travel services across South Africa’s evolving tourism landscape.

South Africa Online Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Transportation, Travel Accommodation, Vacation Packages |

| Platforms Covered | Mobile, Desktop |

| Mode of Bookings Covered | Online Travel Agencies (OTAs), Direct Travel Suppliers |

| Age Groups Covered | 22-31 Years, 32-43 Years, 44-56 Years, Above 56 Years |

| Provinces Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Other |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa online travel market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa online travel market on the basis of service type?

- What is the breakup of the South Africa online travel market on the basis of platform?

- What is the breakup of the South Africa online travel market on the basis of the mode of booking?

- What is the breakup of the South Africa online travel market on the basis of age group?

- What is the breakup of the South Africa online travel market on the basis of the province?

- What are the various stages in the value chain of the South Africa online travel market?

- What are the key driving factors and challenges in the South Africa online travel market?

- What is the structure of the South Africa online travel market and who are the key players?

- What is the degree of competition in the South Africa online travel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa online travel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa online travel market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa online travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)