South Africa Steel Market Size, Share, Trends and Forecast by Type, Product, Application, and Province, 2025-2033

South Africa Steel Market Overview:

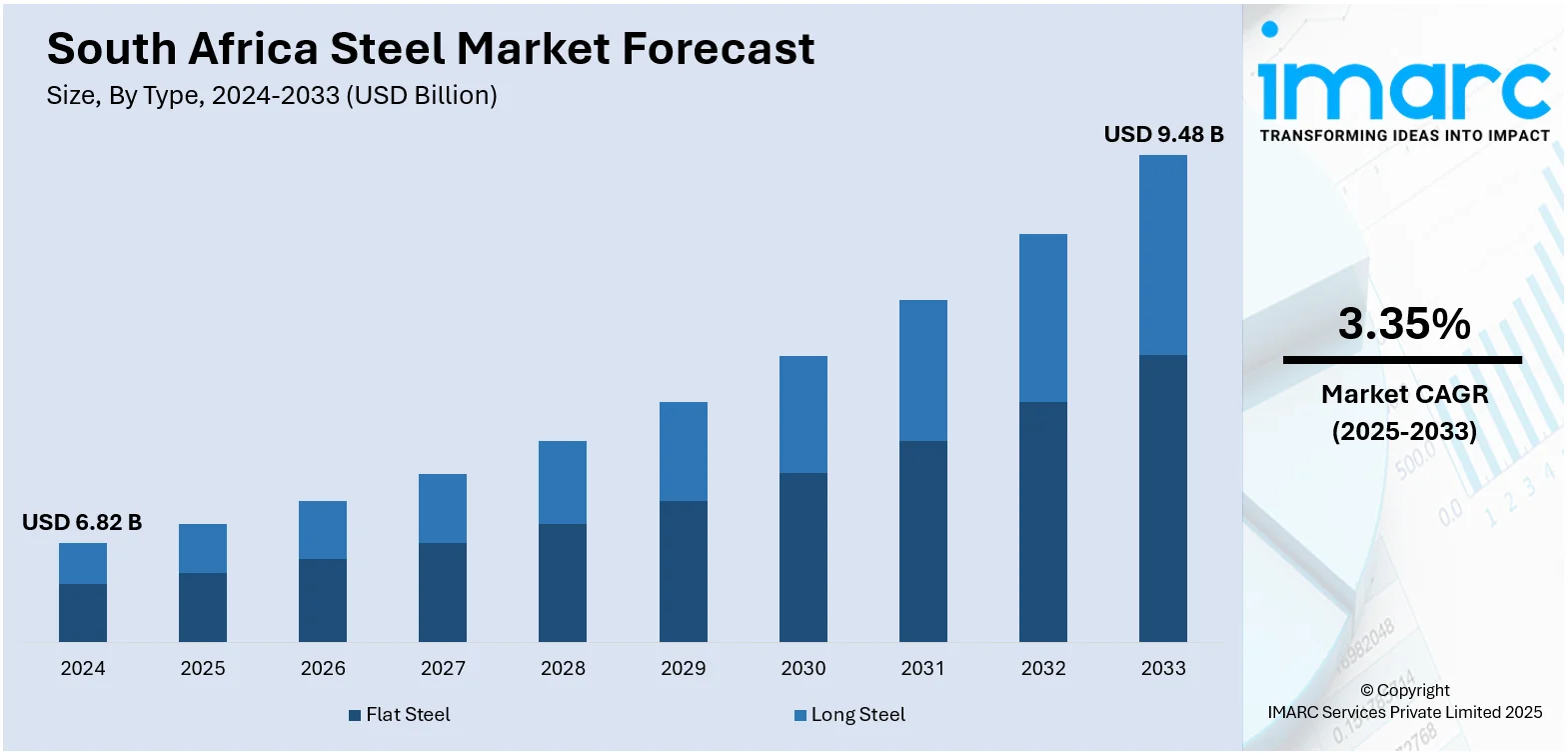

The South Africa steel market size reached USD 6.82 Billion in 2024. Looking forward, the market is expected to reach USD 9.48 Billion by 2033, exhibiting a growth rate (CAGR) of 3.35% during 2025-2033. Infrastructure growth, industrialization, and rising demand from important industries like construction and automotive are some of the drivers propelling the market. Government regulations, international investments, and the transition to sustainable steel production also boost the market's expansion and increase South Africa market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.82 Billion |

| Market Forecast in 2033 | USD 9.48 Billion |

| Market Growth Rate 2025-2033 | 3.35% |

South Africa Steel Market Trends:

Growth in Infrastructure Development

The government of South Africa is focusing on large-scale development projects, such as power plants, transport networks, and urbanization. These ventures heavily depend on steel as a major building material, hence creating demand in the steel market. The National Development Plan (NDP) of the country sets very ambitious targets for infrastructure development, encompassing road construction, bridges, ports, and railways. This drive for infrastructure construction is being speeded up in accordance with initiatives for the enhancement of the economic environment and the generation of employment, especially in economically backward areas. The government's continued investment in the generation of energy, including projects involving renewable energy, is also one that demands tremendous amounts of steel, particularly the building of turbines, steel pylons, and transmission lines. For instance, in 2025, Anthem, an independent renewable energy platform, is officially launched on September 22, 2025, merging African Clean Energy Developments (ACED) and EIMS Africa. The firm functions under the IDEAS fund, overseen by AIIM, with joint investments from the Mahlako Energy Fund and Norfund. The new organization seeks to become a cohesive participant in South Africa’s energy transition. These infrastructure projects are projected to continue expanding, leading to steady demand for steel products. Additionally, local steel producers are increasing production capacity to supply the needs of such huge infrastructure projects.

To get more information on this market, Request Sample

Manufacturing Sector Growth

The manufacturing sector of South Africa is witnessing a gradual but visible upturn, increasing the demand for steel. Manufacturing industries like motor vehicle, machinery, and electronics, which are largely dependent on steel for manufacture, are witnessing growth. The automobile sector, in general, is a major contributor, with South Africa remaining a principal player in automobile manufacturing, both for the local market and international markets. Flat and long steel products used in automobile production are increasingly in demand in local steel mills. The increasing trend of industrialization and urbanization in South Africa is also responsible for higher consumption of steel. As urbanization takes place, demand for steel in construction, infrastructure, and manufacturing of machinery is increasing, leading to sustained growth in the steel market. Additionally, there is pressure to upgrade and modernize plants, necessitating increased use of steel tools. Companies are also presenting various steel tools in exhibitions, thereby supporting the market growth. Machine Tools Africa 2024, the largest and sole exhibition for machine tools in Africa, highlighting innovative advancements in the machine tools and related sectors, was revealed in November 2022. The Machine Tools Merchants’ Association of South Africa (MTMA) will host Machine Tools Africa at the Expo Centre in Nasrec, Johannesburg, from May 21 to May 24, 2024.

Increasing Demand for Steel Exports

The steel industry of South Africa is growing more export-oriented as a strategy for growth, leveraging its strategic location and well-developed port facilities. Steel shipments to African nations, as well as global markets like Europe, Asia, and North America, are increasing consistently. The African Continental Free Trade Area (AfCFTA) agreement has provided new prospects for intra-continental trade, making South Africa the prime supplier of steel in the region. The robust trade relationships with nations like India, China, and the Middle East are also boosting export volumes. Data from the South African Revenue Service (SARS) reveals that in July of this year, South Africa's export value of base metals and related articles reached ZAR 14.94 billion ($850.37 million), an increase of 21.2 percent compared to June. During the January to July timeframe, South Africa's export value of base metals and related products decreased by 18.2 percent compared to the previous year, totaling ZAR 103.99 billion ($5.92 billion). Steel products, especially in the form of flat and long steel, are highly demanded worldwide due to construction, manufacturing, and automobile industries in these countries. Growing numbers of infrastructure projects worldwide and industrialization, particularly in developing economies, are boosting the demand for steel. As international steel markets recover and expand, South Africa's steel producers are taking advantage of export opportunities by expanding production and making their products suitable for international markets.

South Africa Steel Market Growth Drivers:

Technological Advancements in Steel Production

Technological innovation in steel manufacturing is heavily transforming the South African steel industry by enhancing efficiency, lowering costs, and raising sustainability. South African steel manufacturers are funding new technologies like electric arc furnaces (EAF) and continuous casting, which boost manufacturing capacity while reducing energy usage. These technologies are helping to drive costs down and the environment up with reduced carbon emissions, which becomes more vital as world environmental regulations become more stringent. Automation and artificial intelligence (AI) are also being incorporated into the manufacturing process, providing detailed control over steel quality and overall improving productivity. Through sophisticated data analytics, mills are maximizing operational efficiency, reducing waste, and optimizing resource management. Additionally, studies on alternative processes and materials, such as green steel production, are in development to make steel production more sustainable and competitive in an industry where the environment is increasingly a determining issue for production. As the South African steel industry embraces these advanced technologies, it is not only enhancing its operating output but also conforming to international industry developments that emphasize sustainability, cost-effectiveness, and high-quality outputs.

Increasing Raw Material Prices

Increasing raw material prices of materials like iron ore, coking coal, and scrap metal are placing heavy pressure on the South African steel industry. With growing world demand for steel, the prices of major raw materials are also on the rise, impacting production costs for domestic steel mills. South Africa is a net importer of the majority of these key materials, and global market fluctuations are being directly translated into the local prices. The uncertainty in the international supply chain, which is being exacerbated by geopolitical conflicts, transportation disruptions, and natural calamities, is further increasing raw material prices. Consequently, steelmakers in South Africa are being saddled with increased input prices, which in turn are being passed on to consumers. Steel producers are reacting by embracing cheaper technologies and considering alternative sourcing options, including using domestic raw materials or processing scrap metal to lower dependence on costly imports. This increase in raw material costs is also challenging domestic manufacturers to find more sustainable and affordable methods to compete with their foreign and local competitors in both domestic and global markets.

Government Policies and Support for Local Industries

The government of South Africa is not only actively pursuing policies that will assist the local steel industry but also increase its competitiveness. One of the major strategies is the imposition of tariffs on steel products that are imported, aimed at shielding local manufacturers from unfair competition and low-cost imports. The policy enables local steel manufacturers to sustain a market share and keeps them financially stable in the event of competition from around the world. Besides that, the government is also offering subsidies, tax relief, and other incentives to promote investments in steel production plants, technology enhancements, and research and development of the industry. Improving localization and minimizing reliance on overseas imports are key components of these policies. Moreover, government policies target improving infrastructure as well as employment generation, which indirectly enhances demand for building material, thus, favoring the steel sector.

South Africa Steel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and provincial levels for 2025-2033. Our report has categorized the market based on type, product, and application.

Type Insights:

- Flat Steel

- Long Steel

The report has provided a detailed breakup and analysis of the market based on the type. This includes flat steel and long steel.

Product Insights:

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes structural steel, prestressing steel, bright steel, welding wire and rod, iron steel wire, ropes, and braids.

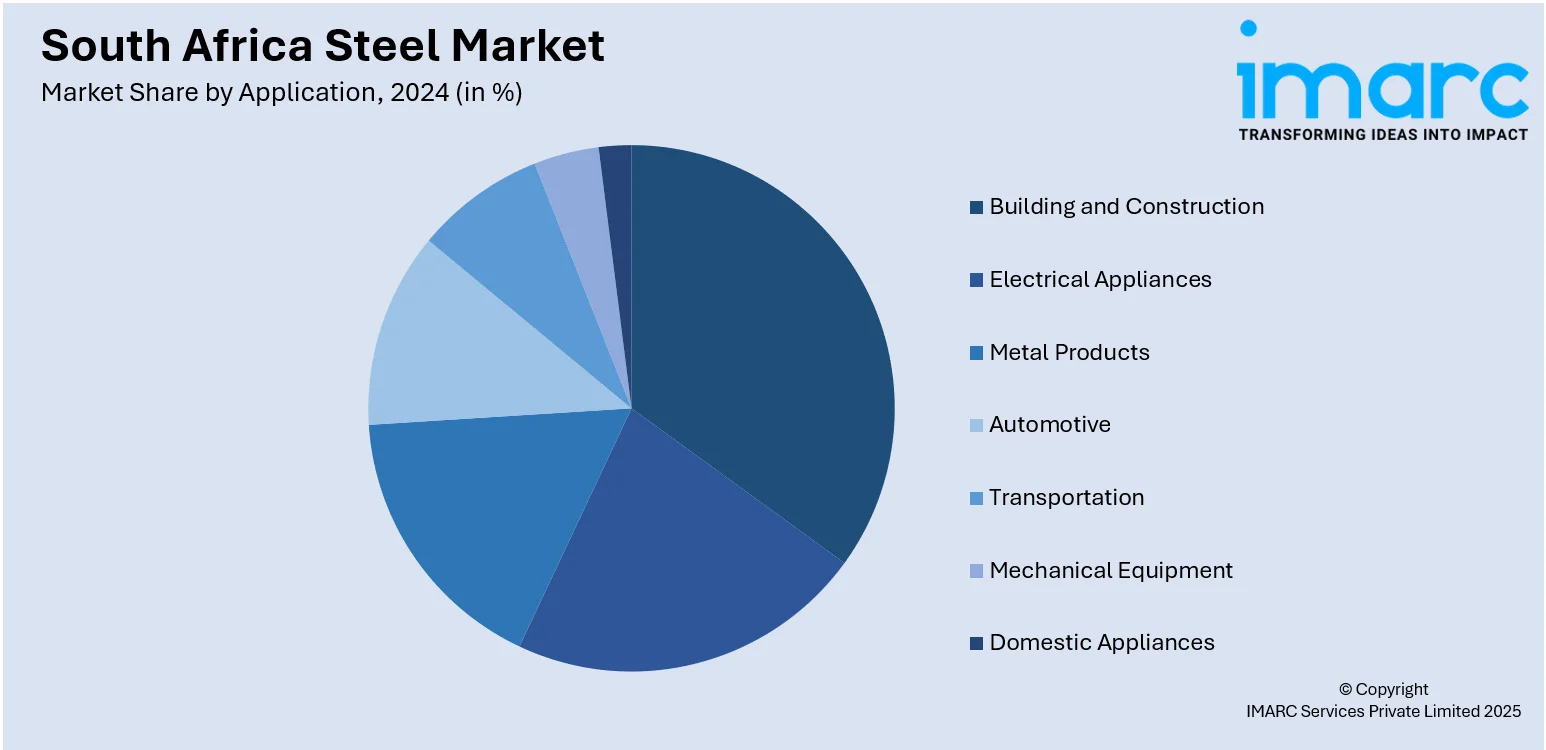

Application Insights:

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

The report has provided a detailed breakup and analysis of the market based on the application. This includes building and construction, electrical appliances, metal products, automotive, transportation, mechanical equipment, and domestic appliances.

Provincial Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Steel Market News:

- In September 2025, The Steel Tube Export Association of South Africa (STEASA) is one of 15 firms taking part in the Outward Selling Mission (OSM) to Nigeria and Ghana from 25–30 August 2025. The Department of Trade, Industry and Competition (the dtic) supports the mission to enhance trade and investment connections between South Africa and significant West African economies.

- In August 2025, In a major move towards sustainability and energy efficiency, Maxion Wheels, the worldwide leader in wheel manufacturing for passenger and commercial vehicles, has collaborated with Terra Firma, South Africa's top solar and storage solutions provider. They have jointly executed a 2.9 MWp solar initiative at Maxion's manufacturing facility in Johannesburg. Maxion Wheels, the top producer of steel and aluminum wheels globally, manufactures approximately 50 million wheels each year across 31 sites worldwide. The Johannesburg facility manufactures high-precision aluminum wheels for premium automotive OEMs in South Africa.

- In May 2025, South Africa’s CSIR begun pilot-scale production of high-quality 316L stainless steel powder for 3D printing, previously reliant on imports. Using a new ultrasonic atomiser, the CSIR aims to localise and boost the additive manufacturing (AM) industry. This development supports job creation, industrial growth, and technological advancement.

- In March 2025, ArcelorMittal South Africa postponed the closure of two steel mills after securing a 1.683 Billion-Rand ($91 Million) loan from the Industrial Development Corporation (IDC). The loan will help delay the closure of the Newcastle and Vereeniging mills, safeguarding 3,500 jobs. The government also promised to address issues like cheap imports, high energy costs, and regulatory challenges.

- In December 2024, NAACAM extends its congratulations to manufacturing member Trident Steel for the recent inauguration of their new structural blanking press at their Eastern Cape location. This growth represents an important achievement for both the firm and the sector. It significantly enhances Trident’s status as an automotive and specialty steel service center in South Africa's automotive supply chain and promotes increased localisation in the industry. NAACAM CEO, Renai Moothilal, praised the launch of Trident Steel, asserting that this substantial investment not only highlights Trident Steel’s prominence as a vital automotive and specialty steel service centre but also shows a solid dedication to improving localisation in South Africa’s automotive value chain.

South Africa Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flat Steel, Long Steel |

| Products Covered | Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids |

| Applications Covered | Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances |

| Provinces Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa steel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa steel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The steel market in South Africa was valued at USD 6.82 Billion in 2024.

The South Africa steel market is projected to exhibit a CAGR of 3.35% during 2025-2033, reaching a value of USD 9.48 Billion by 2033.

The key factors driving the South African steel market include increasing infrastructure development, growth in manufacturing sectors, rising demand for steel exports, technological advancements in production, rising raw material costs, and government support through policies and tariffs that promote local production and reduce reliance on imports.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)