South Africa Subscription Box Market Size, Share, Trends and Forecast by Type, Gender, Application, and Province, 2025-2033

South Africa Subscription Box Market Overview:

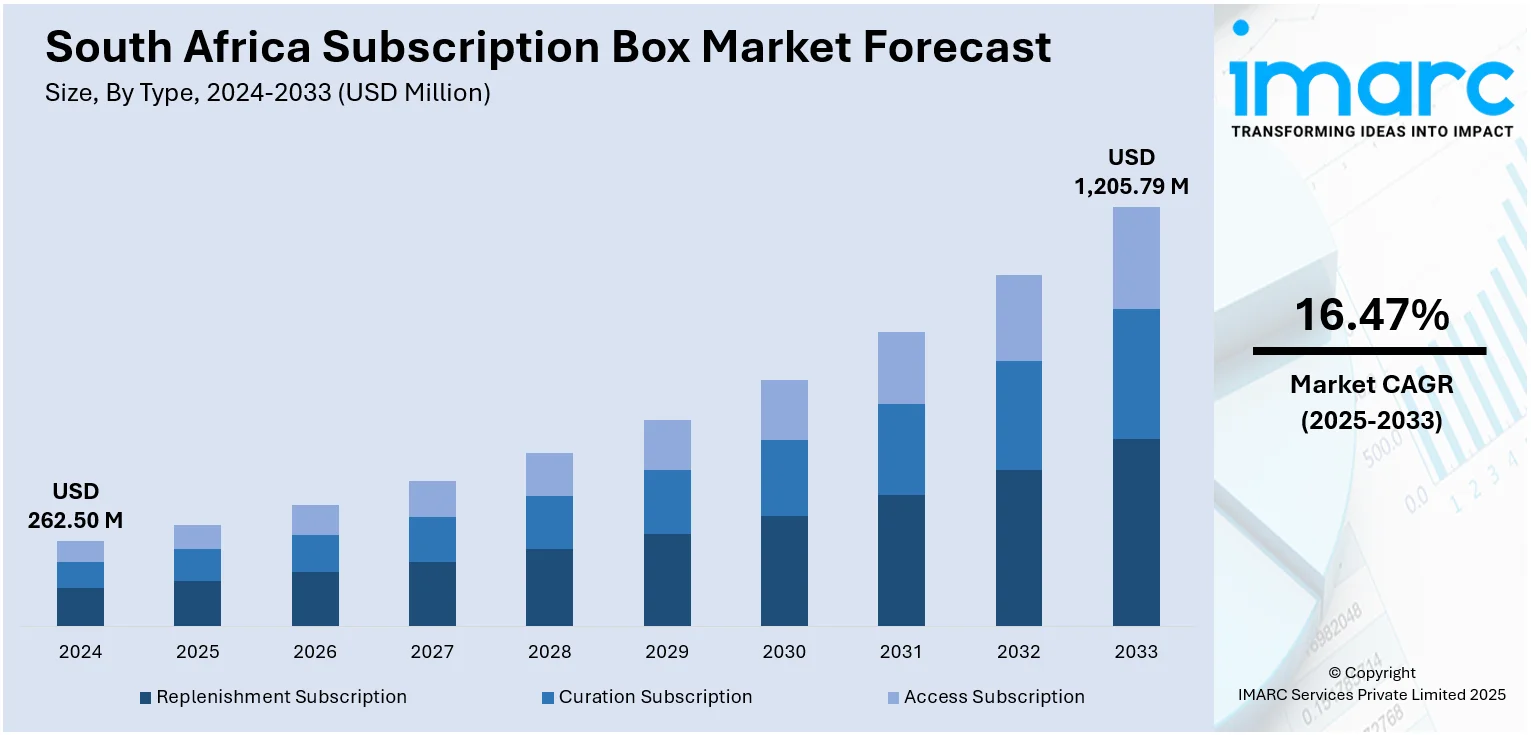

The South Africa subscription box market size reached USD 262.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,205.79 Million by 2033, exhibiting a growth rate (CAGR) of 16.47% during 2025-2033. Growing internet and smartphone usage, better logistics and delivery systems, and a rising middle class with higher disposable income are driving the subscription box market. These factors improve accessibility, client experience, and demand for convenient, personalized lifestyle products across diverse regions, contributing to the expansion of the South Africa subscription box market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 262.50 Million |

| Market Forecast in 2033 | USD 1,205.79 Million |

| Market Growth Rate 2025-2033 | 16.47% |

South Africa Subscription Box Market Trends:

Increasing Internet and Mobile Penetration

The rising internet access and smartphone usage in South Africa is a major factor fueling the growth of the market. As per the International Trade Administration (ITA) in 2024, more than 75% of households in South Africa had internet access, and 97% possessed at least one mobile phone, emphasizing the broad digital connectivity. This enhanced accessibility, particularly in urban and semi-urban regions, enables browsing, subscribing, and overseeing deliveries online more smoothly than before. Subscription services are evolving by enhancing their platforms for mobile-centric experiences, allowing users to effortlessly find and interact with selected products. Moreover, advancements in secure online payment systems are enhancing user trust in digital transactions. This improved digital framework expands market access and enables companies to collect crucial data for tailored services and better client loyalty. With the ongoing advancement of connectivity, subscription models are ideally suited to cater to a broader, tech-savvy audience in South Africa.

To get more information on this market, Request Sample

Enhanced Logistics and Delivery Infrastructure

Improved logistics and delivery infrastructure in South Africa are crucial drivers of the subscription box market growth. In 2025, South Africa is prioritizing infrastructure investment to enhance its transport and logistics sectors, aiming to boost trade efficiency and economic growth. Efficient parcel delivery networks reduce friction in the client experience by ensuring timely, intact deliveries, which is essential for maintaining subscriber satisfaction. Advances in warehousing, inventory management, and last-mile delivery make it feasible for subscription companies to scale while controlling costs. Innovations like package tracking and flexible delivery options increase transparency and convenience, fostering user trust. As courier services extend their reach into suburban and rural areas, subscription businesses can expand beyond urban centers, tapping into new markets. This strengthened logistical capacity supports repeat purchases and retention, enabling subscription models to thrive across South Africa’s diverse and geographically spread population.

Expanding Middle-Class and Disposable Income Growth

The increasing middle class and rising disposable income are key factors bolstering the South Africa subscription box market growth. According to the South African Reserve Bank, disposable personal income increased to 4,798,643 million ZAR in the fourth quarter of 2024, up from 4,741,037 million ZAR in the previous quarter. As more households achieve financial stability, discretionary spending on lifestyle-enhancing products rises. Subscription boxes, often featuring curated and premium items, appeal to individuals seeking affordable luxury and convenient indulgences. This demographic, including dual-income families and young professionals, values experiences and novelty, motivating them to adopt recurring purchase models that simplify shopping. As economic conditions stabilize, this growing segment is catalyzing the demand across multiple categories. The combination of increased income and shifting user preferences creates a positive environment for subscription services to flourish throughout South Africa.

South Africa Subscription Box Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, gender, and application.

Type Insights:

- Replenishment Subscription

- Curation Subscription

- Access Subscription

The report has provided a detailed breakup and analysis of the market based on the type. This includes replenishment subscription, curation subscription, and access subscription.

Gender Insights:

- Male

- Female

A detailed breakup and analysis of the market based on the gender have also been provided in the report. This includes male and female.

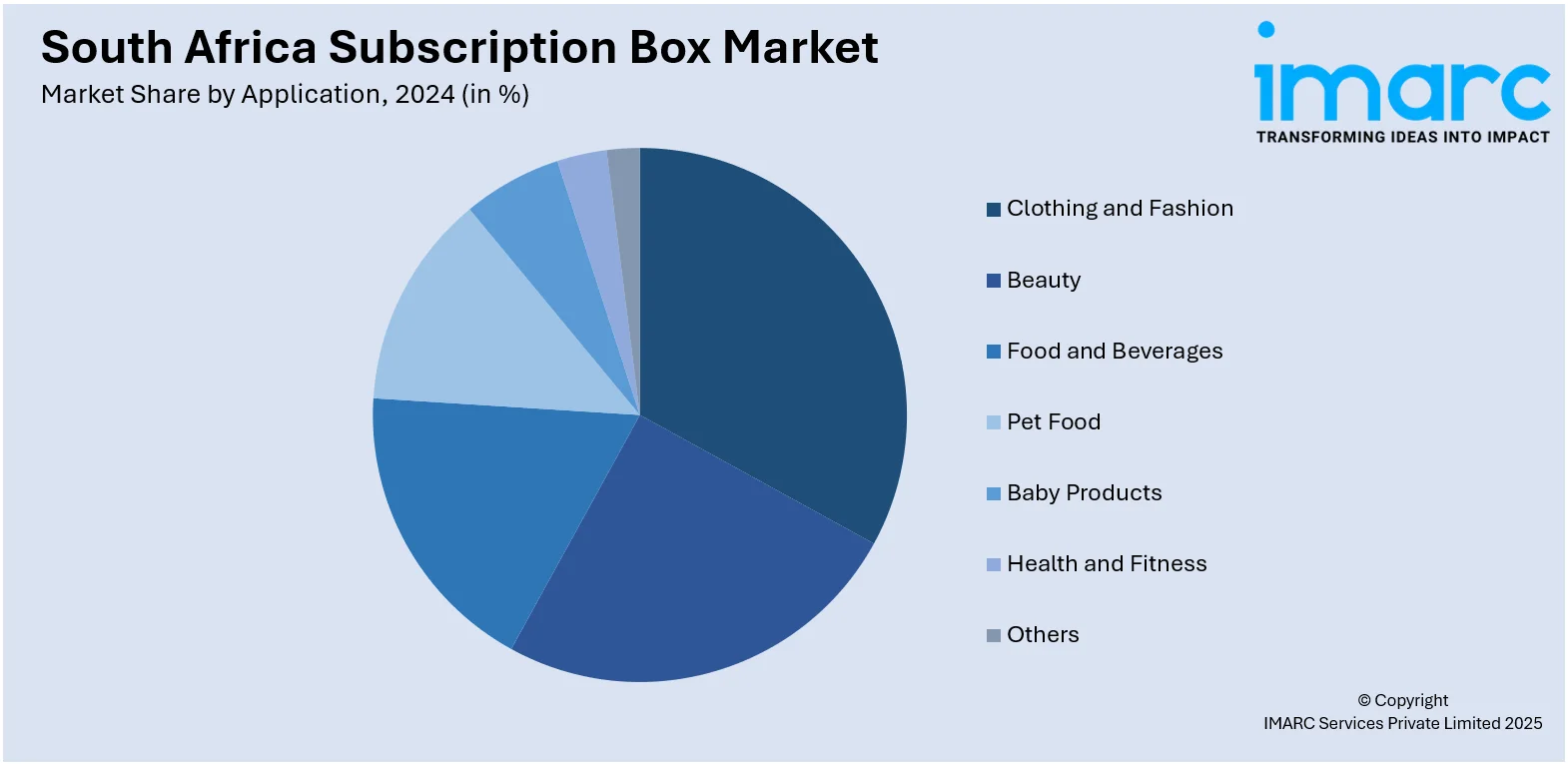

Application Insights:

- Clothing and Fashion

- Beauty

- Food and Beverages

- Pet Food

- Baby Products

- Health and Fitness

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes clothing and fashion, beauty, food and beverages, pet food, baby products, health and fitness, and others.

Province Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Subscription Box Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Replenishment Subscription, Curation Subscription, Access Subscription |

| Genders Covered | Male, Female |

| Applications Covered | Clothing and Fashion, Beauty, Food and Beverages, Pet Food, Baby Products, Health and Fitness, Others |

| Provinces Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa subscription box market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa subscription box market on the basis of type?

- What is the breakup of the South Africa subscription box market on the basis of gender?

- What is the breakup of the South Africa subscription box market on the basis of application?

- What is the breakup of the South Africa subscription box market on the basis of region?

- What are the various stages in the value chain of the South Africa subscription box market?

- What are the key driving factors and challenges in the South Africa subscription box market?

- What is the structure of the South Africa subscription box market and who are the key players?

- What is the degree of competition in the South Africa subscription box market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa subscription box market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa subscription box market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa subscription box industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)