South Africa Vegetable Oil Market Size, Share, Trends and Forecast by Oil Type, Application, and Region, 2025-2033

South Africa Vegetable Oil Market Overview:

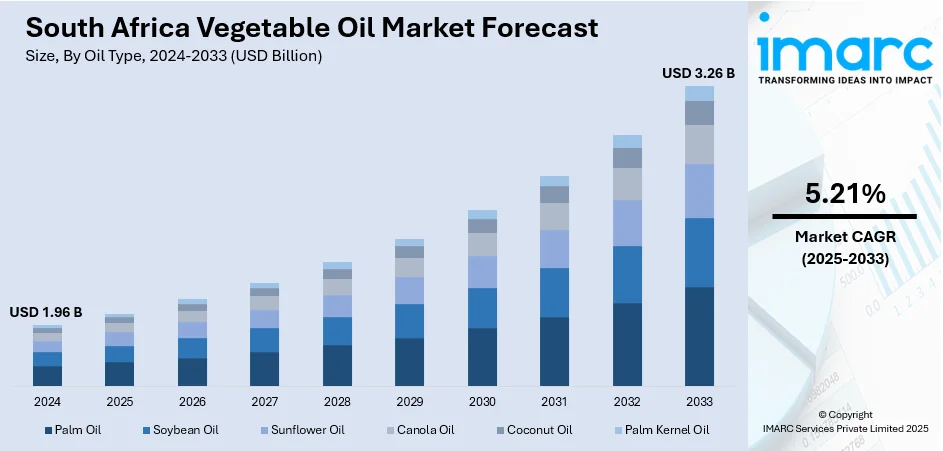

The South Africa vegetable oil market size reached USD 1.96 Billion in 2024. Looking forward, the market is projected to reach USD 3.26 Billion by 2033, exhibiting a growth rate (CAGR) of 5.21% during 2025-2033. The demand is fueled by regular household dependence on edible oil for domestic cooking and street food vending. Domestic processing of oilseeds, supported by targeted imports, provides a balanced and responsive supply structure. Increasing utilization in industrial food processing and hotels is also increasing the South Africa vegetable oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.96 Billion |

| Market Forecast in 2033 | USD 3.26 Billion |

| Market Growth Rate 2025-2033 | 5.21% |

South Africa Vegetable Oil Market Trends:

Staple Status and Household Dependence

Vegetable oil is a staple in the South African diet, particularly in low- and middle-income households. Daily usage in cooking, frying, and baking, vegetables like sunflower and canola are part of both rural and urban diets. High reliance on edible oils as a source of calories in the nation, especially in informal food vendors and township economies, provides constant base-level demand. Government programs of food assistance also use oil as a key input in meal delivery. As affordability remains a major concern, consumers gravitate toward bulk purchases and private-label brands, especially during periods of economic strain or inflation. Domestic oil processors focus on offering affordable products in various sizes, including sachets, to cater to daily wage earners and low-income communities. This price-sensitive segment anchors the overall market and buffers it from sharp volume declines. In addition to direct retail consumption, cooking oil is central to local street food culture, where informal vendors rely on affordable oil for large-scale frying. Together, these patterns of daily use and cultural integration reinforce a consistent and essential demand. South Africa vegetable oil market growth is sustained by this embedded, non-discretionary role of edible oil in household nutrition and informal food economies.

To get more information on this market, Request Sample

Local Oilseed Processing and Import Balancing

South Africa maintains a moderately integrated vegetable oil supply chain, with domestic oilseed cultivation, particularly sunflower and soy, serving as a major input for the edible oil industry. Processing hubs in provinces like Mpumalanga, Free State, and Gauteng support local farmers and provide crushing capacity for refining. While domestic production contributes substantially, South Africa still imports crude and refined oils to meet its national needs, particularly during poor harvest seasons or pricing fluctuations. To balance this dependency, the country continues to invest in refining capacity and agricultural modernization. Government initiatives encourage crop diversification and offer support to smallholder farmers through training, subsidies, and mechanization programs. Major processors often engage in vertical integration to mitigate import cost pressures and currency volatility. Additionally, South Africa benefits from regional trade within the Southern African Development Community (SADC), serving both as an importer and a supplier to neighboring countries. This combination of local production and adaptive import sourcing ensures stable supply in volatile global markets. The industry’s ability to adjust between domestic sourcing and imports contributes to its resilience and pricing competitiveness, making the market structurally flexible and sustainable.

Industrial Applications and Food Manufacturing Demand

Beyond household use, vegetable oil is a critical input for South Africa’s fast-growing food processing and manufacturing sectors. Refined oils are widely used in the production of margarine, baked goods, snacks, ready-to-eat meals, and sauces. As demand for processed and packaged foods grows, driven by urbanization, dual-income households, and changing dietary preferences, oil consumption in industrial settings has expanded. Major food manufacturers maintain supply contracts with oil refiners, ensuring consistency in volume and price for continuous operations. Similarly, quick-service restaurants, commercial kitchens, and institutional caterers consume large quantities of frying oil, particularly in hospitality hubs such as Cape Town, Johannesburg, and Durban. The rising popularity of Western-style and fusion cuisines in South Africa also increases demand for a variety of oils, including corn, soybean, and blended formats. Used cooking oil (UCO) collection is also gaining traction as biodiesel production scales up, aligning with sustainability goals. Collectively, these industrial uses contribute significantly to total oil demand, often exceeding retail consumption in value terms. Industrial and commercial demand thus forms a crucial pillar of the national oil economy, ensuring that edible oils remain indispensable to South Africa’s food production ecosystem.

South Africa Vegetable Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on oil type and application.

Oil Type Insights:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Canola Oil

- Coconut Oil

- Palm Kernel Oil

The report has provided a detailed breakup and analysis of the market based on the oil type. This includes palm oil, soybean oil, sunflower oil, canola oil, coconut oil, and palm kernel oil.

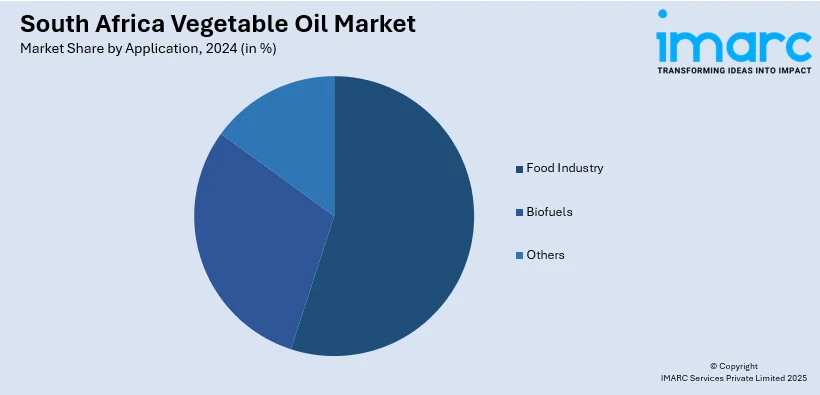

Application Insights:

- Food Industry

- Biofuels

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food industry, biofuels, and others.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Vegetable Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Oil Types Covered | Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Coconut Oil, Palm Kernel Oil |

| Applications Covered | Food Industry, Biofuels, Others |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa vegetable oil market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa vegetable oil market on the basis of oil type?

- What is the breakup of the South Africa vegetable oil market on the basis of application?

- What is the breakup of the South Africa vegetable oil market on the basis of region?

- What are the various stages in the value chain of the South Africa vegetable oil market?

- What are the key driving factors and challenges in the South Africa vegetable oil market?

- What is the structure of the South Africa vegetable oil market and who are the key players?

- What is the degree of competition in the South Africa vegetable oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa vegetable oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa vegetable oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa vegetable oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)