South East Asia Fertilizer Market Size, Share, Trends and Forecast by Product Type, Product, Product Form, Crop Type, and Country, 2025-2033

Market Overview:

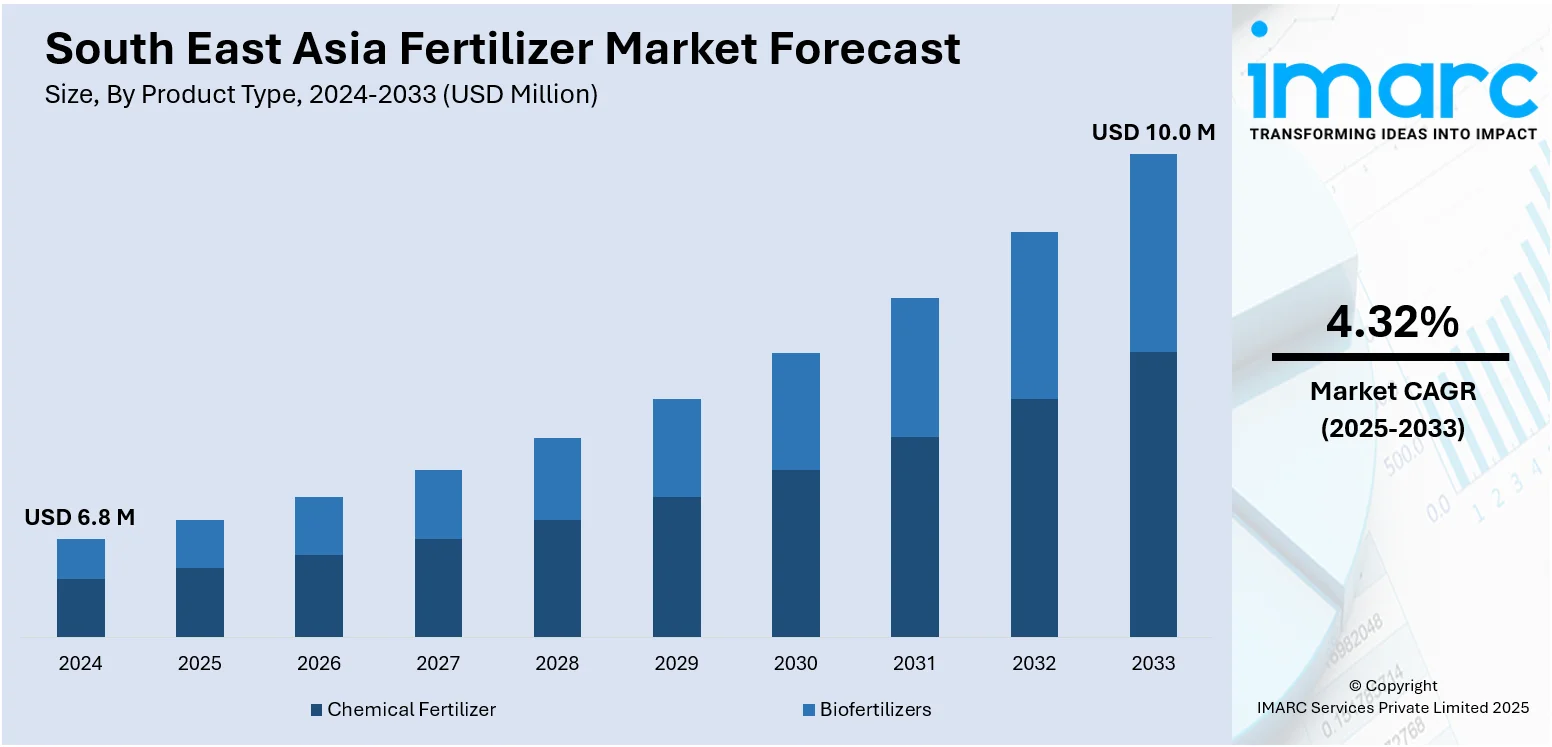

The South East Asia fertilizer market size reached USD 6.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 10.0 Million by 2033, exhibiting a growth rate (CAGR) of 4.32% during 2025-2033. The favorable government initiatives to encourage farmers to invest in fertilizers, changing dietary patterns, growing environmental concerns, crop diversification, rapid technological advancements, and adoption of modern farming technologies like controlled-release fertilizers represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.8 Million |

|

Market Forecast in 2033

|

USD 10.0 Million |

| Market Growth Rate 2025-2033 | 4.32% |

Fertilizer is a crucial substance in agriculture and horticulture that provides essential nutrients to plants, enhancing their growth and productivity. It is typically applied to soil or plants to supplement the natural nutrient levels in the soil, ensuring that crops receive the necessary elements for optimal development. Fertilizers primarily contain three key macronutrients, nitrogen (N), phosphorus (P), and potassium (K), often referred to as NPK. These macronutrients play distinct roles in plant growth; nitrogen supports leafy growth and vibrant green foliage, phosphorus aids in root development and flower/fruit formation, while potassium contributes to overall plant health and disease resistance.

To get more information on this market, Request Sample

South East Asia Fertilizer Market Trends:

The steady increase in the population of Southeast Asia is a significant factor driving the market. A growing population necessitates increased food production, which in turn, drives the demand for fertilizers to enhance crop yields. Additionally, Southeast Asian countries are witnessing a shift toward more intensive agricultural practices. This includes the cultivation of high-yield crop varieties and multiple crop cycles in a year. Fertilizers are crucial in supporting these practices by providing essential nutrients that promote crop growth. Other than this, as incomes rise in the region, there is a shift in dietary preferences toward higher consumption of protein-rich foods, such as meat and dairy products. This resulted in increased demand for animal feed, thus accelerating the sales of fertilizers for feed crop production. Besides this, there is a growing awareness about the environmental impacts of agriculture, including fertilizer use. This has led to a push for more sustainable and environment-friendly fertilizer formulations and application practices. In line with this, Southeast Asian countries are diversifying their crop portfolios to reduce dependency on a few staple crops. Different crops have varying nutrient requirements, making fertilizers essential for optimizing yields across a wide range of crops. Furthermore, numerous governments in Southeast Asia actively support their agricultural sectors through subsidies and incentives for fertilizer usage. These initiatives encourage farmers to invest in fertilizers, further boosting the market. Moreover, the adoption of modern farming technologies, such as precision agriculture and controlled-release fertilizers, is on the rise in Southeast Asia. These technologies enhance the efficiency of fertilizer utilization and are providing a positive thrust to market growth.

South East Asia Fertilizer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on product type, product, product form, and crop type.

Product Type Insights:

- Chemical Fertilizer

- Biofertilizers

The report has provided a detailed breakup and analysis of the market based on the product type. This includes chemical fertilizer and biofertilizers.

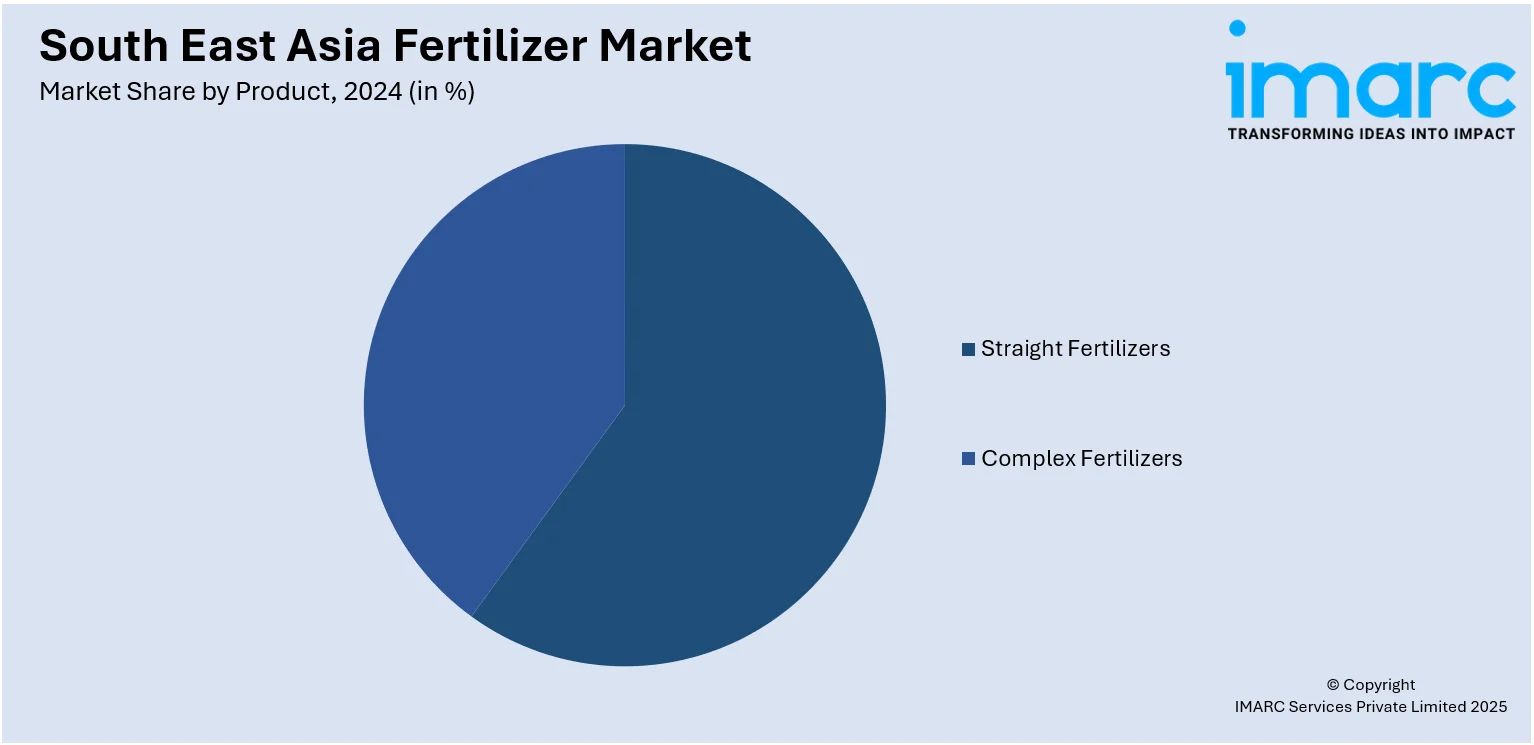

Product Insights:

- Straight Fertilizers

- Nitrogenous Fertilizers

- Urea

- Calcium Ammonium Nitrate

- Ammonium Nitrate

- Ammonium Sulfate

- Anhydrous Ammonia

- Others

- Phosphatic Fertilizers

- Mono-Ammonium Phosphate (MAP)

- Di-Ammonium Phosphate (DAP)

- Single Super Phosphate (SSP)

- Triple Super Phosphate (TSP)

- Others

- Potash Fertilizers

- Muriate of Potash (MoP)

- Sulfate of Potash (SoP)

- Secondary Macronutrient Fertilizer

- Calcium Fertilizers

- Magnesium Fertilizers

- Sulfur Fertilizers

- Micronutrient Fertilizers

- Zinc

- Manganese

- Copper

- Iron

- Boron

- Molybdenum

- Others

- Nitrogenous Fertilizers

- Complex Fertilizers

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes straight fertilizers [nitrogenous fertilizers (urea, calcium ammonium nitrate, ammonium nitrate, ammonium sulfate, anhydrous ammonia, and others), phosphatic fertilizers (mono-ammonium phosphate (MAP), di-ammonium phosphate (DAP), single super phosphate (SSP), triple super phosphate (TSP), and others), potash fertilizers (muriate of potash (MoP) and sulfate of potash (SoP)), secondary macronutrient fertilizers (calcium fertilizers, magnesium fertilizers, and sulfur fertilizers), and micronutrient fertilizers (zinc, manganese, copper, iron, boron, molybdenum, and others)] and complex fertilizers.

Product Form Insights:

- Dry

- Liquid

The report has provided a detailed breakup and analysis of the market based on the product form. This includes dry and liquid.

Crop Type Insights:

- Grains and Cereals

- Pulses and Oilseeds

- Fruits and Vegetables

- Flowers and Ornamentals

- Others

A detailed breakup and analysis of the market based on the crop type have also been provided in the report. This includes grains and cereals, pulses and oilseeds, fruits and vegetables, flowers and ornamentals, and others.

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Farmcochem Sdn Bhd

- Nufarm Malaysia Sdn Bhd

- PK Fertilizers Sdn Bhd

- Saksiam Group

- Terragro Fertilizer Co. Ltd

- Thai Central Chemical Public Company Limited

- Yara International ASA

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

South East Asia Fertilizer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Chemical Fertilizer, Biofertilizers |

| Products Covered |

|

| Product Forms Covered | Dry, Liquid |

| Crop Types Covered | Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, Flowers and Ornamentals, Others |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Companies Covered | Farmcochem Sdn Bhd, Nufarm Malaysia Sdn Bhd, PK Fertilizers Sdn Bhd, Saksiam Group, Terragro Fertilizer Co. Ltd, Thai Central Chemical Public Company Limited, Yara International ASA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South East Asia fertilizer market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the South East Asia fertilizer market?

- What is the breakup of the South East Asia fertilizer market on the basis of product type?

- What is the breakup of the South East Asia fertilizer market on the basis of product?

- What is the breakup of the South East Asia fertilizer market on the basis of product form?

- What is the breakup of the South East Asia fertilizer market on the basis of crop type?

- What are the various stages in the value chain of the South East Asia fertilizer market?

- What are the key driving factors and challenges in the South East Asia fertilizer?

- What is the structure of the South East Asia fertilizer market and who are the key players?

- What is the degree of competition in the South East Asia fertilizer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia fertilizer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South East Asia fertilizer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia fertilizer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)