South Korea Automotive Lighting Market Size, Share, Trends and Forecast by Technology, Vehicle Type, Sales Channel, Application, and Region, 2026-2034

South Korea Automotive Lighting Market Overview:

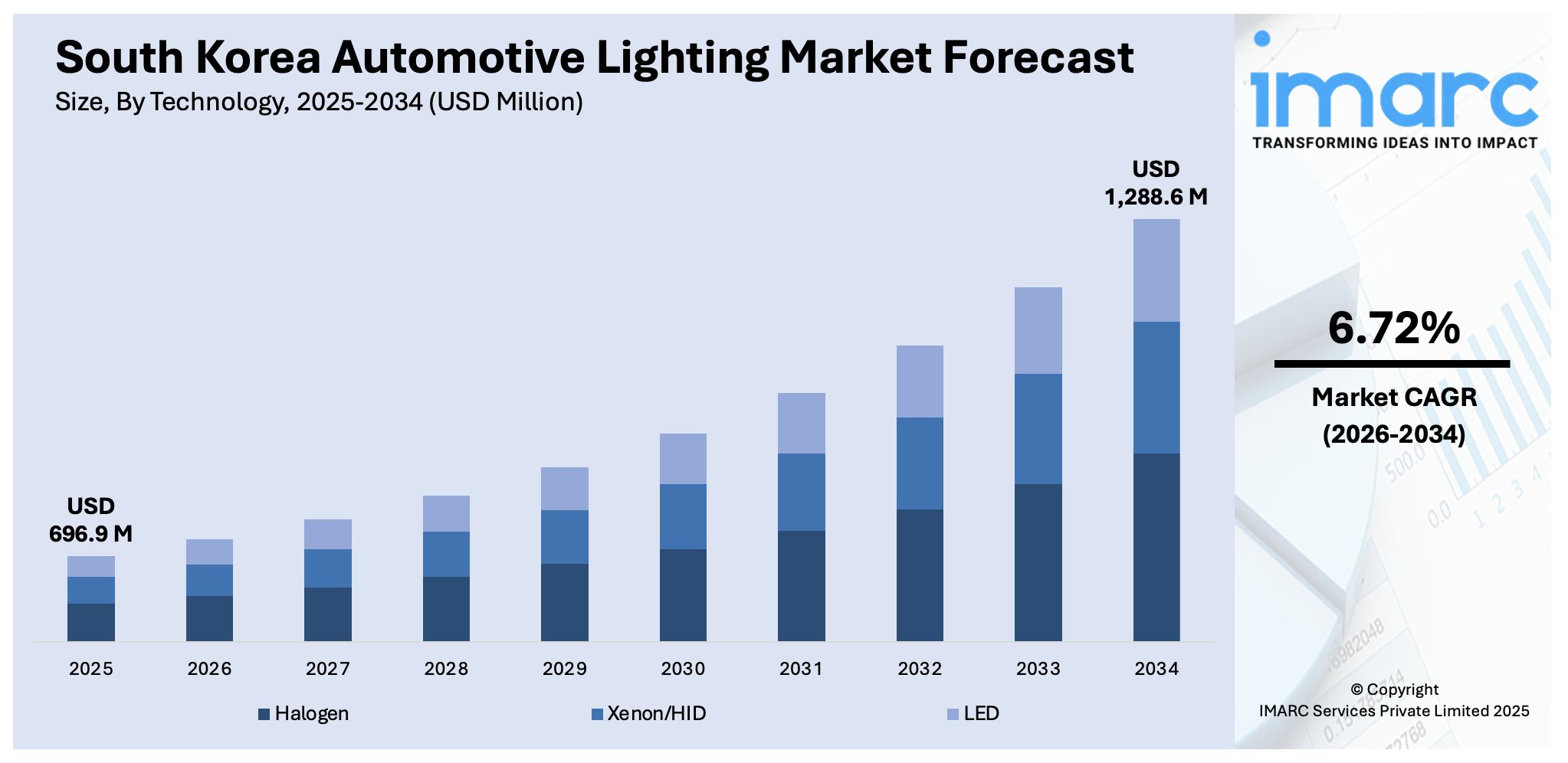

The South Korea automotive lighting market size reached USD 696.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,288.6 Million by 2034, exhibiting a growth rate (CAGR) of 6.72% during 2026-2034. The automotive lighting market in South Korea is being shaped by advanced driver assistance systems (ADAS) integration and the rise of electric vehicles (EVs). Lighting systems support sensor-driven safety features and energy-efficient, design-focused solutions for EVs. These advancements are reshaping design priorities, boosting innovation, and contributing to the South Korea automotive lighting market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 696.9 Million |

| Market Forecast in 2034 | USD 1,288.6 Million |

| Market Growth Rate 2026-2034 | 6.72% |

South Korea Automotive Lighting Market Trends:

Integration with ADAS

The integration of lighting systems with ADAS is becoming a fundamental component of vehicle development in South Korea. Modern automotive lighting is no longer limited to illumination but incorporates sensors and embedded software that communicate with the digital architecture of the vehicle to improve safety and driving performance. Adaptive headlights, for instance, are designed to automatically modify beam angles and intensity based on speed, steering input, road curvature, and the presence of other vehicles, thereby enhancing driver visibility and minimizing glare. This type of responsive lighting is increasingly expected across all vehicle segments, not just in premium models. As domestic manufacturers accelerate their transition toward semi-autonomous and fully autonomous platforms, lighting modules are being engineered to interact in real time with light detection and ranging (LiDAR), radar, cameras, and onboard artificial intelligence (AI) systems. These modules must support low-latency data exchange and operate under diverse conditions, aligning closely with evolving ADAS standards. In this context, the opening of Valeo’s new ADAS components manufacturing facility in Daegu in 2024 marks a significant development. Following a $56 million investment agreement signed in 2022, the facility began producing parking assistant sensors and expanded to include mass production of radar, ultrasound, camera, and LiDAR sensors. This expansion reflects the increasing demand for integrated sensor-based technologies and is expected to accelerate innovation and production capabilities, further supporting South Korea automotive lighting market growth.

To get more information on this market Request Sample

Rapid Electrification of the Vehicle Fleet

The robust EV market in South Korea, which reached a valuation of USD 3,394.3 million in 2024, is catalyzing the demand for specialized automotive lighting solutions. EV models differ significantly from traditional internal combustion vehicles in both structure and function, necessitating a unique approach to lighting design. In the absence of engine noise, visual signals become increasingly important for safety, especially in urban and low-speed environments. Distinctive front and rear lighting signatures also serve to differentiate EVs in a competitive market, reinforcing brand identity and enhancing visual recognition. Furthermore, energy efficiency is a critical concern in EVs, placing added pressure on lighting systems to minimize power usage. This is encouraging widespread adoption of ultra-low-power light-emitting diode (LED) modules and advanced lighting control software capable of dynamically adjusting output. South Korean OEMs developing dedicated EV platforms are now demanding lighting systems that offer not only aesthetic appeal but also thermal efficiency, minimal energy draw, and seamless integration with electric drivetrains and battery configurations. Suppliers are responding by adapting their product portfolios that align with these evolving technical and design specifications. Interior lighting is also evolving, with ambient systems gaining prominence in EV cabins that emphasize comfort and digital interactivity. As EV adoption continues to rise, lighting technology is becoming an essential element of product development strategy, influencing vehicle architecture, user appeal, and energy management across South Korea’s automotive sector.

South Korea Automotive Lighting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on technology, vehicle type, sales channel, and application.

Technology Insights:

- Halogen

- Xenon/HID

- LED

The report has provided a detailed breakup and analysis of the market based on the technology. This includes halogen, xenon/HID, and LED.

Vehicle Type Insights:

- Passenger Vehicle

- Commercial Vehicle

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger vehicle and commercial vehicle.

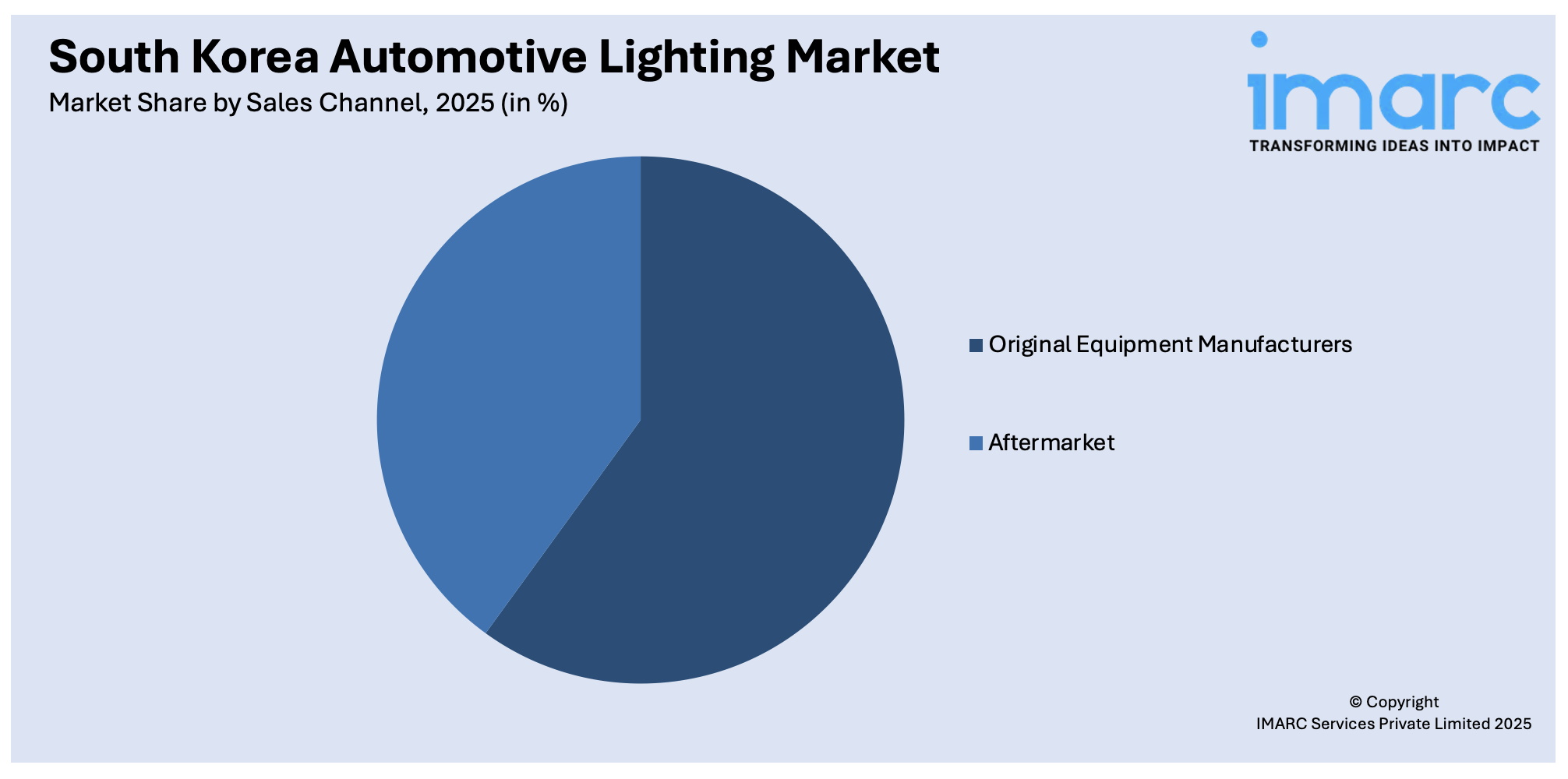

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Original Equipment Manufacturers

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes original equipment manufacturers and aftermarket.

Application Insights:

- Front Lighting/Headlamps

- Rear Lighting

- Side Lighting

- Interior Lighting

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes front lighting/headlamps, rear lighting, side lighting, and interior lighting.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Automotive Lighting Market News:

- In May 2025, South Korean company ROOTS CO., LTD. announced the launch of its ultra-compact 450㎛ Phosphor in Glass (PiG) technology for smart multi-beam automotive headlights. The innovation enhances efficiency, brightness, and precision, supporting miniaturization in next-gen vehicle lighting systems. ROOTS developed the PiG entirely in-house using semiconductor processing techniques.

- In April 2025, Hyundai Mobis unveiled its human-centered mobility vision at the 2025 Seoul Mobility Show, showcasing next-gen technologies, including the Holographic Windshield Display, Human-Centric Interior Lighting, and the MOBION vehicle with an advanced e-Corner System for sideways and diagonal driving. These innovations aim to enhance safety, comfort, and interactive mobility experiences.

South Korea Automotive Lighting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Halogen, Xenon/HID, LED |

| Vehicle Types Covered | Passenger Vehicle, Commercial Vehicle |

| Sales Channels Covered | Original Equipment Manufacturers, Aftermarket |

| Applications Covered | Front Lighting/Headlamps, Rear Lighting, Side Lighting, Interior Lighting |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea automotive lighting market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea automotive lighting market on the basis of technology?

- What is the breakup of the South Korea automotive lighting market on the basis of vehicle type?

- What is the breakup of the South Korea automotive lighting market on the basis of sales channel?

- What is the breakup of the South Korea automotive lighting market on the basis of application?

- What is the breakup of the South Korea automotive lighting market on the basis of region?

- What are the various stages in the value chain of the South Korea automotive lighting market?

- What are the key driving factors and challenges in the South Korea automotive lighting market?

- What is the structure of the South Korea automotive lighting market and who are the key players?

- What is the degree of competition in the South Korea automotive lighting market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea automotive lighting market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea automotive lighting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea automotive lighting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)