South Korea Automotive Lubricants Market Size, Share, Trends and Forecast by Vehicle Type, Product Type, and Region, 2026-2034

South Korea Automotive Lubricants Market Size and Share:

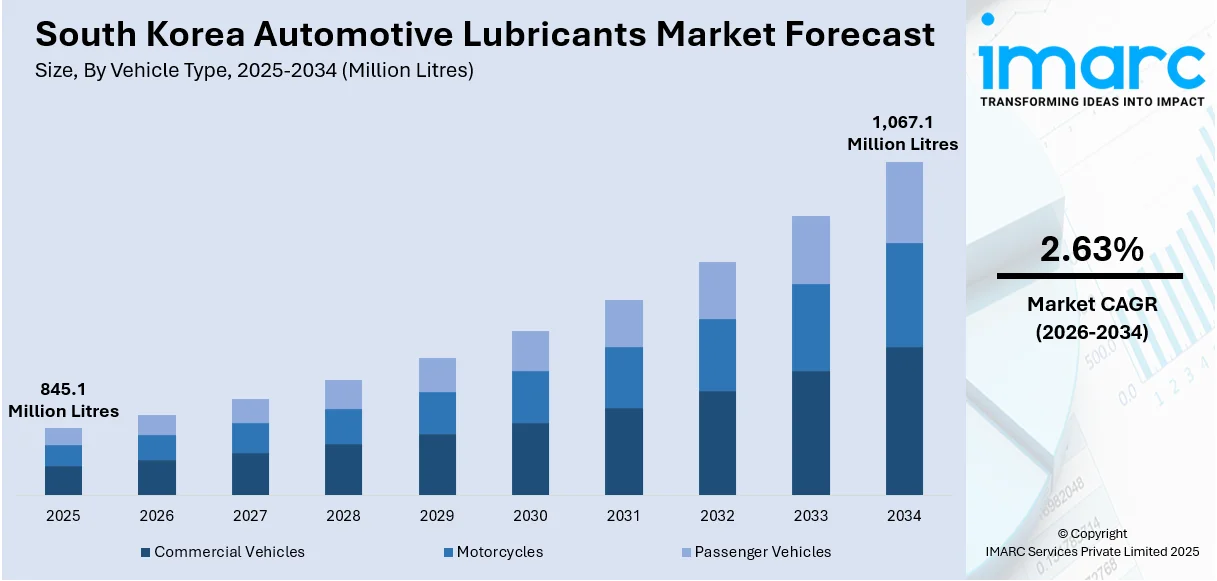

The South Korea automotive lubricants market size reached 845.1 Million Litres in 2025. Looking forward, IMARC Group estimates the market to reach 1,067.1 Million Litres by 2034, exhibiting a CAGR of 2.63% during 2026-2034. Seoul Capital Area currently dominates the market in 2025. The rising vehicle ownership and increasing adoption of electric and hybrid vehicles are leading to higher demand for high-performance, eco-friendly lubricants that meet stricter emission regulations. In addition to this, rapid urbanization, continual technological advancements in engine designs, and government initiatives promoting environmental sustainability are some of the major factors strengthening market growth across passenger and commercial vehicle segments and augmenting the South Korea automotive lubricants market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 845.1 Million Litres |

| Market Forecast in 2034 | 1,067.1 Million Litres |

| Market Growth Rate 2026-2034 | 2.63% |

The market is propelled by a combination of evolving automotive technologies and growing vehicle ownership rates. Additionally, the increasing penetration of electric and hybrid vehicles is creating demand for specialized lubricants that enhance energy efficiency and thermal management. According to industry reports, approximately 82.4% of South Korea's population resides in urban areas. The rapid pace of urbanization is significantly contributing to the rise in passenger vehicle sales, creating greater demand for automotive lubricants. Furthermore, increased customer knowledge of the value of routine auto maintenance is encouraging more frequent lubricant changes, which is increasing market volumes.

To get more information on this market Request Sample

In addition to this, stringent environmental regulations are pushing manufacturers to develop high-performance, eco-friendly lubricants, fostering innovation and product diversification. According to industry reports, the South Korea logistics market is expected to reach USD 138.62 Billion by 2032, exhibiting a growth rate (CAGR) of 3.06% during 2024-2032. The expanding logistics and e-commerce sectors are driving the commercial vehicle segment, consequently increasing the need for heavy-duty lubricants. The trend toward longer oil drain intervals, enabled by the development of synthetic and semi-synthetic lubricants, is also shaping product preferences. Apart from this, the growth of organized automotive aftermarket services is enhancing the accessibility and availability of premium lubricants across the country. Furthermore, the government's investments in smart mobility and autonomous vehicle projects are expected to generate new technical requirements for lubricants.

South Korea Automotive Lubricants Market Trends:

Rising Vehicle Ownership Driving Lubricant Demand

The increasing vehicle ownership rate in South Korea is significantly impacting the automotive lubricants market. According to industry reports, in 2024, there were over 26 million registered cars in South Korea, and for the first time, more than 10% of them were environmentally friendly vehicles. As personal vehicle ownership rises alongside urban expansion and lifestyle changes, the need for regular engine maintenance is growing proportionally. Moreover, higher numbers of passenger vehicles, particularly in metropolitan areas such as Seoul, Incheon, and Busan, are resulting in increased consumption of engine oils, transmission fluids, and other automotive lubricants, which is supporting the South Korea automotive lubricants market growth. Apart from this, commercial fleets, including logistics and delivery services, are also expanding, further reinforcing demand across the light commercial vehicle and heavy-duty truck segments. Frequent stop-and-go traffic patterns common in urban centers are placing additional strain on engines, necessitating more frequent lubricant changes to maintain vehicle performance. This broader base of vehicle ownership continues to provide a stable and expanding consumer pool for lubricant manufacturers and service providers in South Korea.

Eco-Friendly Vehicles Increasing the Use of High-Quality Lubricants

South Korea's push for lower emissions and stricter environmental standards is accelerating the adoption of high-quality automotive lubricants. Besides this, the implementation of several government initiatives to reduce pollution, improve air quality, and promote the use of eco-friendly vehicles are resulting in increased adoption, which is accelerating the demand for better lubricants. As per OECD, South Korea has committed to becoming carbon neutral by 2050 and cutting greenhouse gas emissions by 40% by 2030. As a result, there is heightened demand for synthetic and semi-synthetic lubricants, which offer better oxidative stability, lower volatility, and improved fuel economy compared to conventional mineral oils. Also, one of the emerging South Korea automotive lubricants market trends is the introduction of modern internal combustion engines designed to meet stringent domestic emission standards, which require lubricants that perform effectively under high thermal stress and reduce friction losses. Consumers are increasingly aware of environmental impacts, leading to a preference for premium lubricants with lower ash content and better biodegradability. Additionally, regulatory incentives for environmentally friendly vehicle maintenance practices are encouraging service centers and workshops to recommend high-end lubricant products, further supporting the market's shift toward higher-quality formulations aligned with sustainability goals.

Specialized Lubricants for Electric and Hybrid Vehicles

The increasing penetration of electric vehicles (EVs) and hybrid electric vehicles (HEVs) in South Korea is reshaping lubricant requirements. According to industry reports, under South Korea's "2030 National Determined Contribution (NDC) Upgrade Plan," the nation aims to have 4.5 million battery electric and fuel cell electric vehicles (16.7%) by 2030, out of an anticipated 27 million registered automobiles. EV components such as electric motors, battery packs, and power electronics demand lubricants that offer excellent dielectric properties, thermal conductivity, and material compatibility to ensure system efficiency and longevity, which is positively impacting South Korea automotive lubricants market outlook. Apart from this, hybrid vehicles, which combine internal combustion engines with electric motors, require lubricants that can perform across a broader temperature range and under intermittent operating conditions. Additionally, leading automakers in South Korea including are collaborating with lubricant manufacturers to co-develop EV-specific fluids that improve drivetrain efficiency and battery cooling. The rapid expansion of EV charging infrastructure and government subsidies for eco-friendly vehicles are expected to drive sustained demand for these specialized lubricants across both the OEM and aftermarket segments.

South Korea Automotive Lubricants Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the South Korea automotive lubricants market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on vehicle type and product type.

Analysis by Vehicle Type:

- Commercial Vehicles

- Motorcycles

- Passenger Vehicles

Passenger vehicles lead the market with around 58.96% of market share in 2025. The segment is driven by the nation's high rates of vehicle ownership and strong consumer demand for private travel. Rapid urbanization, increased disposable incomes, and a growing cultural focus on vehicle upkeep further propel the consistent demand for quality lubricants from passenger car owners. This segment benefits from regular oil change intervals, rising concerns for engine performance, and the popularity of synthetic and semi-synthetic lubricants that provide longer service life and enhanced protection. Also, continuous technology developments in passenger cars, such as the introduction of hybrid and electric vehicles, are driving lubricant formulation requirements. In addition to this, the comprehensive aftersales service network, the presence of sophisticated service centers, and the growing e-commerce channels for the purchase of lubricants support the commanding market position of passenger vehicles in the market across South Korea.

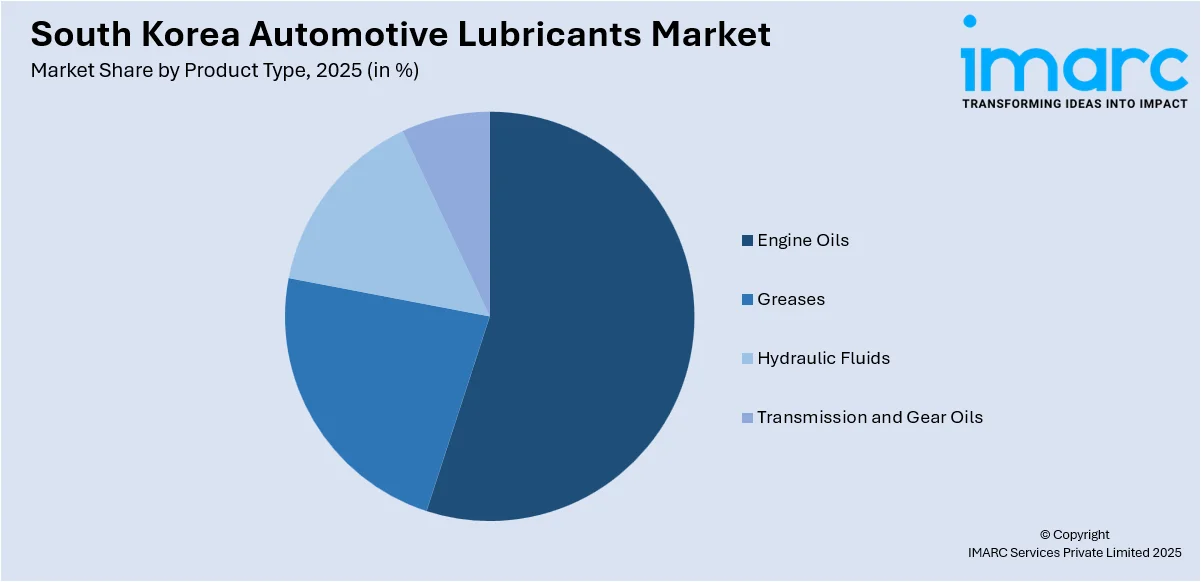

Analysis by Product Type:

Access the comprehensive market breakdown Request Sample

- Engine Oils

- Greases

- Hydraulic Fluids

- Transmission and Gear Oils

Engine oils lead the market with around 55.4% of market share in 2025. The prominence is directly related to the nation's strict maintenance requirements for vehicles and the engineering requirements of contemporary engines, requiring sophisticated lubrication products to perform and last optimally. Regular change in oils, particularly in urban locales with heavy traffic levels, generates a steady demand for engine oils for both passenger and commercial vehicles. The increasing use of synthetic and semi-synthetic engine oils mirrors consumer demand for more fuel-efficient products that have lower emissions and longer drain intervals. Further, new vehicle technologies such as turbocharged engines and hybrid technologies are driving the demand for premium, high-performance engine oils. The presence of high-quality engine oil brands in service centers, dealerships, and online is a strong statement that solidifies their leading position in the South Korean lubricant market.

Regional Analysis:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

In 2025, Seoul Capital Area is the dominant region in the South Korea automotive lubricants market due to the high vehicle density and urban population. As the country's economic and administrative center, the region commands a significant portion of private and commercial vehicle ownership, resulting in consistent and large volumes of demand for automotive lubricants. The availability of sophisticated service infrastructure, extensive networks of authorized dealerships, and a high culture of frequent vehicle maintenance also enhances lubricant usage. Furthermore, consumers in the Seoul Capital Area have a strong affinity for premium, high-performance lubricants, especially synthetic and semi-synthetic types that meet contemporary vehicle requirements and more stringent emission regulations. In addition, the increased use of hybrid and electric vehicles in this region is impacting the demand for niche lubricants.

Competitive Landscape:

The competitive landscape of the market is characterized by high competition, with companies concentrating on innovations, quality enhancements, and growth in premium product offerings. The market is dominated by a high demand for synthetic and semi-synthetic lubricants due to the high standards of vehicle maintenance in the country and fuel efficiency requirements. Additionally, firms are heavily investing in research and development (R&D) activities to develop sophisticated formulations that satisfy more stringent emission standards and performance levels. Branding, post-sales support, and localized marketing strategies also contribute significantly to achieving consumer loyalty. Furthermore, distribution channels are well developed, ranging from authorized dealerships, service centers, independent garages, and online platforms. Pricing strategies are well-calibrated to provide valuable products without sacrificing quality, particularly in the synthetic segment. According to the South Korea automotive lubricants market forecast, sustainability trends are expected to significantly influence product innovation, with manufacturers projected to expand their portfolios of environmentally friendly lubricants to align with rising eco-consciousness among consumers.

The report provides a comprehensive analysis of the competitive landscape in the South Korea automotive lubricants market with detailed profiles of all major companies.

Latest News and Developments:

- February 2025: S-OIL TotalEnergies Lubricants Co., Ltd. (STLC) unveiled a new line of engine oils meeting API SQ and ILSAC GF-7 standards to enhance fuel efficiency and engine protection. The products offered improved timing chain wear protection, reduced LSPI, enhanced cleanliness, and supported lower emissions for modern petrol engines.

- January 2025: FUCHS SE and Dumarey Group introduced a market-ready lubricant tailored for hydrogen internal combustion engines. In South Korea, FUCHS LUBRICANTS (KOREA) LTD. Already offers a comprehensive range of automotive lubricants, including products with proprietary XTL® technology.

- November 2024: Hi-Tech Lubricants Limited (HTL) began blending and packaging high-quality synthetic lubricants under the ZIC brand at its subsidiary’s plant, following an MoU with SK Enmove. The partnership aimed to reduce import costs, improve margins, and enhance competitiveness through local production using SKEN-supplied materials.

- April 2024: Schaeffler Automotive Aftermarket Korea launched the ‘Schaeffler TruPower’ commercial vehicle coolant in Korea, optimized for high-load, extreme conditions. Available in 4L packs via Junwoo APS, the coolant featured corrosion-preventing additives and a ready-to-use 50-50 ethylene glycol mix, aiming to enhance engine thermal management and durability across various vehicle types.

South Korea Automotive Lubricants Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Litres |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Commercial Vehicles, Motorcycles, Passenger Vehicles |

| Product Types Covered | Engine Oils, Greases, Hydraulic Fluids, Transmission and Gear Oils |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea automotive lubricants market from 2020-2034.

- The South Korea automotive lubricants market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea automotive lubricants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive lubricants market in South Korea size reached 845.1 Million Litres in 2025.

The growth of the South Korea automotive lubricants market is driven by by rising vehicle ownership rates, increasing disposable income, strong demand for premium and synthetic lubricants, technological advancements in engine design, regular maintenance practices, and government regulations promoting fuel efficiency and emission control, which collectively boost lubricant consumption across the country.

The automotive lubricants market in South Korea is projected to exhibit a CAGR of 2.63% during 2026-2034, reaching a volume of 1,067.1 Million Litres by 2034.

Passenger vehicles hold the largest share in the market due to their high ownership levels, frequent usage for daily commuting, rising consumer preference for private transport, and the growing popularity of premium and synthetic lubricant products that enhance vehicle performance and engine durability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)