South Korea Board Games Market Size, Share, Trends and Forecast by Product Type, Game Type, Age Group, Distribution Channel, and Region, 2025-2033

South Korea Board Games Market Overview:

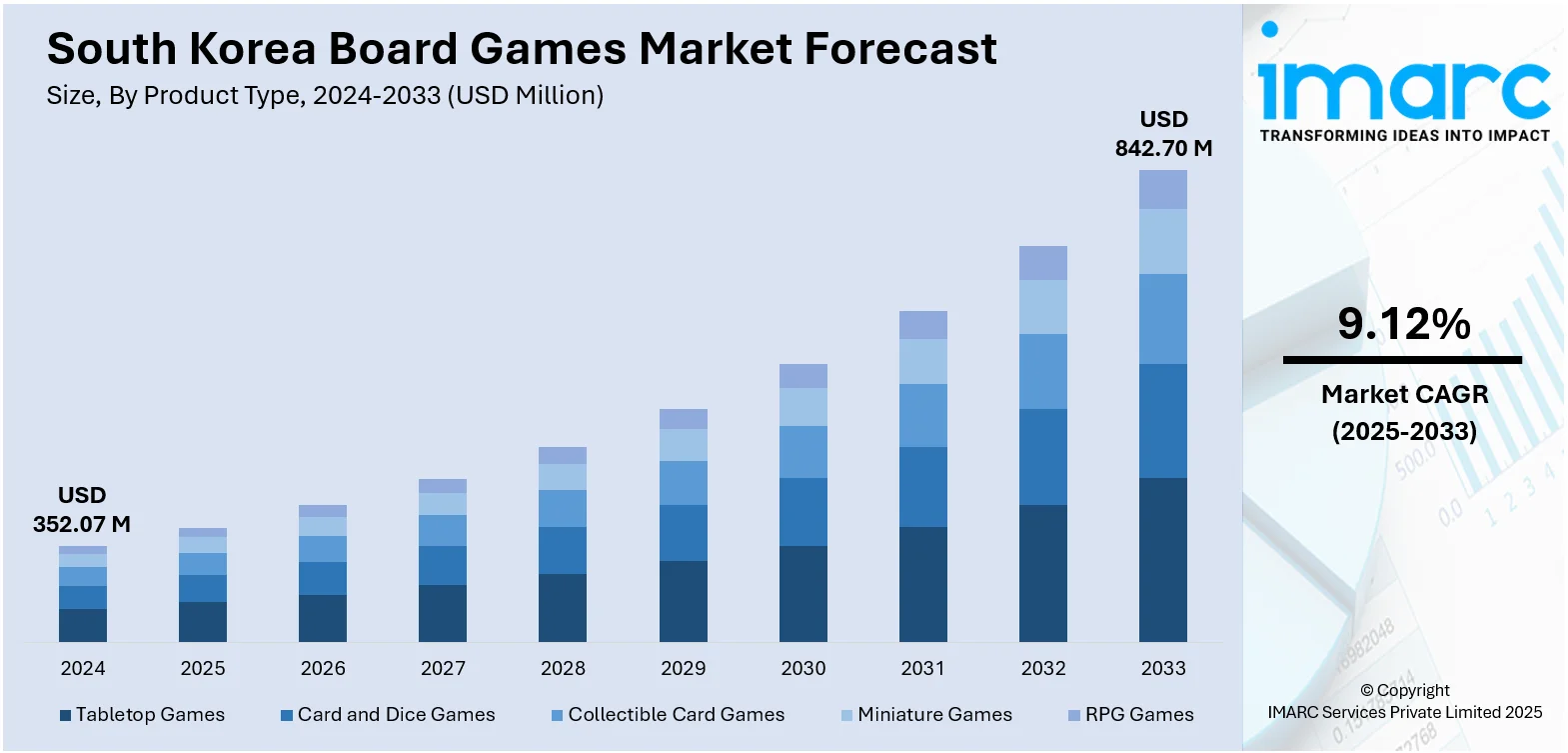

The South Korea board games market size reached USD 352.07 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 842.70 Million by 2033, exhibiting a growth rate (CAGR) of 9.12% during 2025-2033. At present, the demand for social and family-oriented entertainment experiences is impelling the market growth. Moreover, local developers and publishers are placing more emphasis on creative and culturally appropriate content. Apart from this, the heightened rise of cafés and planned community events is expanding the South Korea board games market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 352.07 Million |

| Market Forecast in 2033 | USD 842.70 Million |

| Market Growth Rate 2025-2033 | 9.12% |

South Korea Board Games Market Trends:

Growing interest in family and social entertainment:

The South Korea board games sector is also experiencing growth as people increasingly demand social and family-oriented entertainment experiences. With increasing hectic digital life, there is greater demand among families and friends to stay away from screens and indulge in offline activities that bring people together. Board games are offering a valuable way for people to enhance social bonds, improve cognitive function, and share quality leisure time. Specialized board gaming cafés are becoming trendy meeting places, drawing both regular gamers and serious enthusiasts alike. The cultural trend toward emphasizing work-life balance is also contributing to the phenomenon as consumers increasingly allocate time and disposable income to leisure activities that promote group involvement. This social trend is also driving demand for games across a wide variety of categories, ranging from strategy and party games to educational format, thereby making the market wider in terms of reach across different demographics and age groups. In 2025, Grand Korea Leisure Co Ltd (GKL), a South Korean operator of three foreigner-only casinos launched its self-developed card game BROG. BROG is characterized by its creators as a user-friendly game where the victor is decided by evaluating the card patterns of the betting side against the non-betting side.

To get more information on this market, Request Sample

Enlarging Local Game Development and Innovation

South Korea's board game market is steadily expanding as local developers and publishers place more emphasis on creative and culturally appropriate content. Local game designers are producing titles that are based on Korean culture, mythology, and social stories, which appeal very strongly to locals and set these items apart from international products. This also driven by government programs and industry organizations encouraging local creative industries, providing grants and support for up-and-coming developers. In addition, partnerships between independent creators and established publishers are yielding innovative products combining classic gameplay with contemporary elements. The industry is also seeing the rise in game events, expos, and workshops, which are fostering a thriving community of creators and enthusiasts. By focusing on originality and localized narration, South Korean board game manufacturers are not only getting local interest but also staking out a competitive position within the wider Asian and global markets.

Increased Popularity of Board Game Cafés and Community Events:

The rise of cafés and planned community events are impelling the growth of the South Korea board games market growth. The cafés are providing convenient venues in which customers can sample a large range of games without having to buy them outright, promoting repeat business and expanding the hobby to new fans. Café culture is embracing board gaming as a hip, social pursuit, especially among young adults and college students looking for budget-friendly and interactive forms of entertainment. Structured tournament play, themed nights, and teaching sessions are also building community, increasing loyalty, and generating word-of-mouth marketing. Moreover, collaborations between game publishers and cafes are making direct marketing possible, where new games gain entry into the player base in a timely and efficient manner. By acting as focal points for discovery, socialization, and learning, these locations are helping to normalize board gaming as a mass activity and fuel long-term marketplace expansion. The IMARC Group predicts that the South Korea food service market size is expected to show a growth rate (CAGR) of 17.8% during 2025-2033.

South Korea Board Games Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, game type, age group, and distribution channel.

Product Type Insights:

- Tabletop Games

- Card and Dice Games

- Collectible Card Games

- Miniature Games

- RPG Games

The report has provided a detailed breakup and analysis of the market based on the product type. This includes tabletop games, card and dice games, collectible card games, miniature games, and RPG games.

Game Type Insights:

- Strategy and War Games

- Educational Games

- Fantasy Games

- Sport Games

- Others

The report has provided a detailed breakup and analysis of the market based on the game type. This includes strategy and war games, educational games, fantasy games, sport games, and others.

Age Group Insights:

- 0-2 Years

- 2-5 Years

- 5-12 Years

- Above 12 Years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 0-2 years, 2-5 years, 5-12 years, and above 12 years.

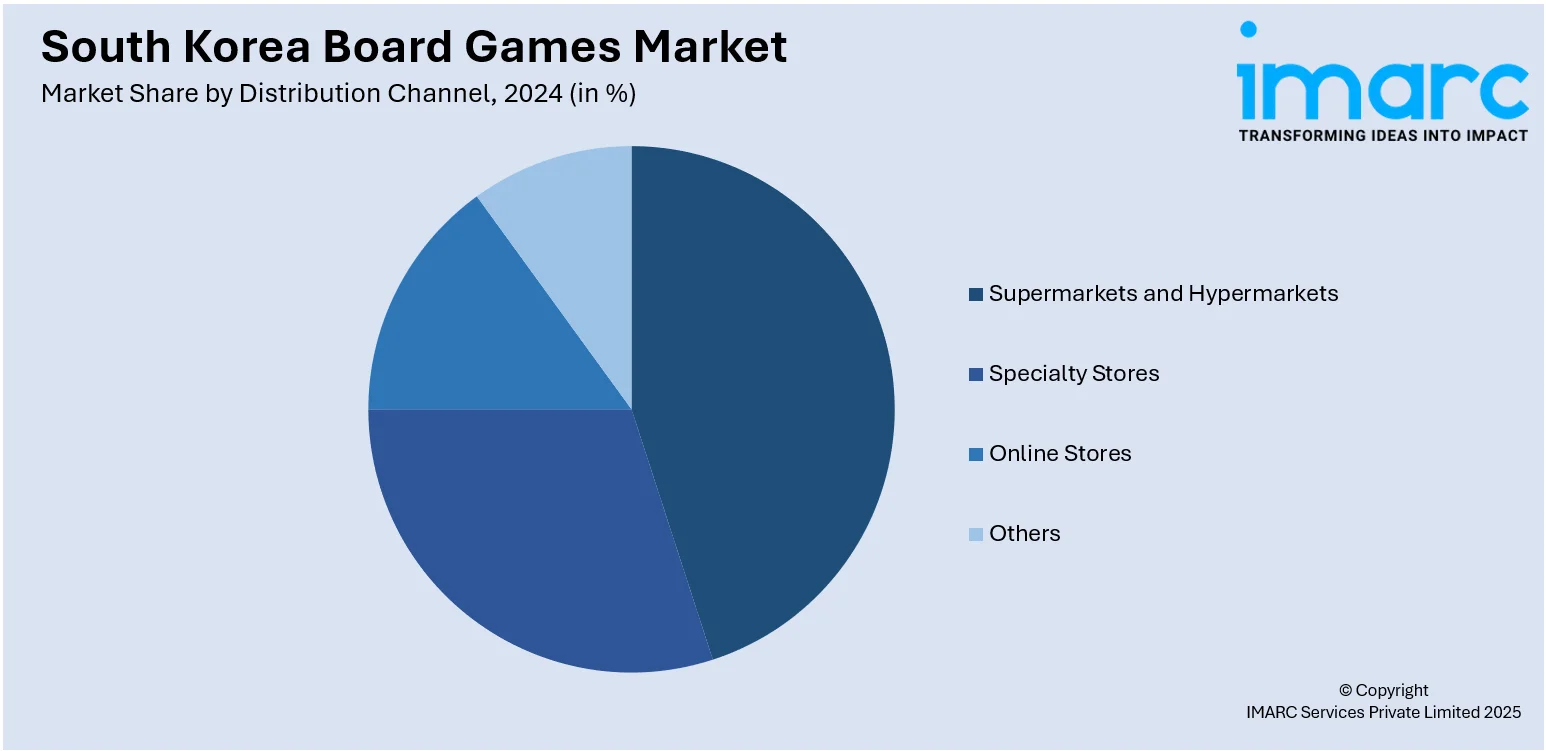

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialty stores, online stores, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Board Games Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tabletop Games, Card and Dice Games, Collectible Card Games, Miniature Games, RPG Games |

| Game Types Covered | Strategy and War Games, Educational Games, Fantasy Games, Sport Games, Others |

| Age Groups Covered | 0-2 Years, 2-5 Years, 5-12 Years, Above 12 Years |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea board games market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea board games market on the basis of product type?

- What is the breakup of the South Korea board games market on the basis of game type?

- What is the breakup of the South Korea board games market on the basis of age group?

- What is the breakup of the South Korea board games market on the basis of distribution channel?

- What is the breakup of the South Korea board games market on the basis of region?

- What are the various stages in the value chain of the South Korea board games market?

- What are the key driving factors and challenges in the South Korea board games market?

- What is the structure of the South Korea board games market and who are the key players?

- What is the degree of competition in the South Korea board games market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea board games market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea board games market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea board games industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)