South Korea Cyber Insurance Market Size, Share, Trends and Forecast by Component, Insurance Type, Organization Size, End Use Industry, and Region, 2025-2033

South Korea Cyber Insurance Market Overview:

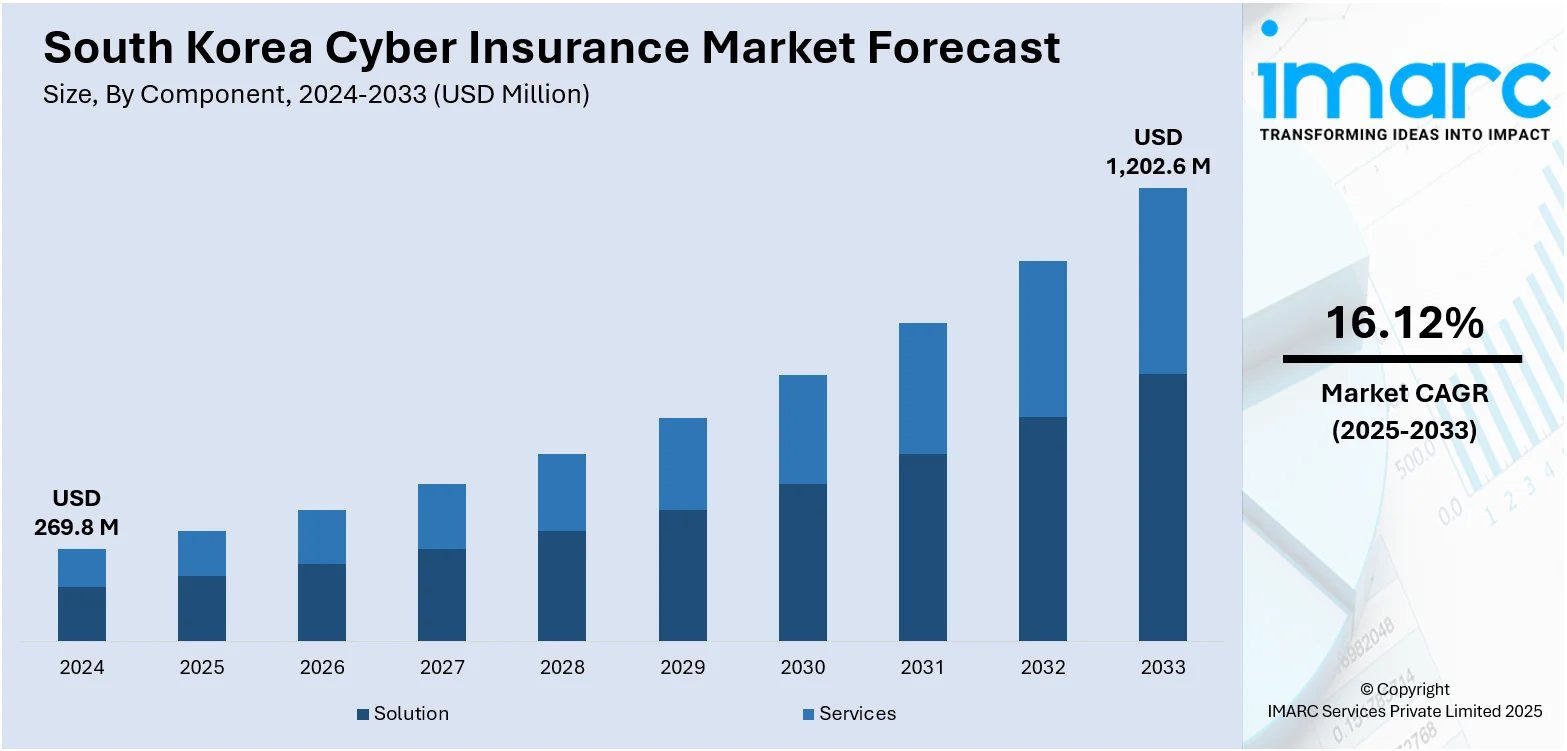

The South Korea cyber insurance market size reached USD 269.8 Million in 2024. Looking forward, the market is projected to reach USD 1,202.6 Million by 2033, exhibiting a growth rate (CAGR) of 16.12% during 2025-2033. The market is experiencing rapid growth as businesses prioritize protection against increasing cyber threats. Stricter data protection laws, rising incident frequency, and growing cyber risk awareness among SMEs and large enterprises, also drive the demand for tailored insurance solution. Technological integration, including AI-assisted underwriting and real-time monitoring, is further maturing the market, increasing South Korea cyber insurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 269.8 Million |

| Market Forecast in 2033 | USD 1,202.6 Million |

| Market Growth Rate 2025-2033 | 16.12% |

South Korea Cyber Insurance Market Trends:

Rising Regulatory Pressure

In South Korea, the increasing strictness of data protection and cybersecurity regulations is driving the adoption of cyber insurance across various sectors. As organizations confront more stringent compliance demands stemming from evolving legal frameworks, many are discovering that cyber insurance is not only advantageous but crucial for maintaining operational stability. Regulatory authorities are progressively requiring companies especially those managing sensitive consumer data or functioning within critical infrastructure sectors to show strong cyber risk management practices. Cyber insurance acts as both a mechanism for risk transfer and a tool for compliance support, providing coverage for data breaches, regulatory penalties, and legal liabilities. This regulatory momentum is urging even small and mid-sized enterprises to obtain policies that meet governance requirements. Consequently, mandatory compliance responsibilities are emerging as a significant factor behind the ongoing South Korea cyber insurance market growth, particularly in heavily regulated industries.

To get more information on this market, Request Sample

Tailored Industry-Specific Policies

In South Korea, there is a growing trend among cyber insurers to create insurance solutions that are tailored to the unique risk profiles of various industries. Different sectors such as finance, healthcare, and manufacturing encounter specific cyber threats, including data breaches, ransomware, industrial sabotage, and regulatory compliance issues. Acknowledging these distinctions, insurers are shifting away from one-size-fits-all coverage to offer protection that directly addresses the vulnerabilities inherent to each industry. For instance, financial institutions might benefit from improved fraud protection and regulatory breach coverage, while healthcare organizations are safeguarded against patient data theft and potential system downtimes. This focused approach boosts the relevance and effectiveness of insurance policies, making them more appealing to businesses operating in complex environments. As cyber threats become more advanced, the need for customized, sector-specific coverage is poised to foster ongoing market engagement and innovation.

Bundled Risk Management Services

In South Korea, cyber insurance is transitioning from mere financial compensation to a more holistic risk management solution. Insurers are now combining their policies with valuable services like real-time threat monitoring, incident response planning, forensic investigation, and post-breach recovery assistance. These offerings enable businesses not only to recover from cyber incidents but also to proactively prepare for them, thus minimizing downtime and curbing reputational harm. By serving as both insurers and advisors on cyber risk, providers are cultivating stronger client relationships and fostering long-term trust. This enhanced value proposition is particularly crucial for mid-sized companies that may lack in-house cybersecurity resources. As cyber threats continue to escalate in frequency and severity, the combination of advisory and technical support with insurance coverage is becoming a significant differentiator in the South Korean cyber insurance market.

South Korea Cyber Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, insurance type, organization size, and end use industry.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Insurance Type Insights:

- Packaged

- Stand-alone

A detailed breakup and analysis of the market based on the insurance type have also been provided in the report. This includes packaged and stand-alone.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium enterprises, and large enterprises.

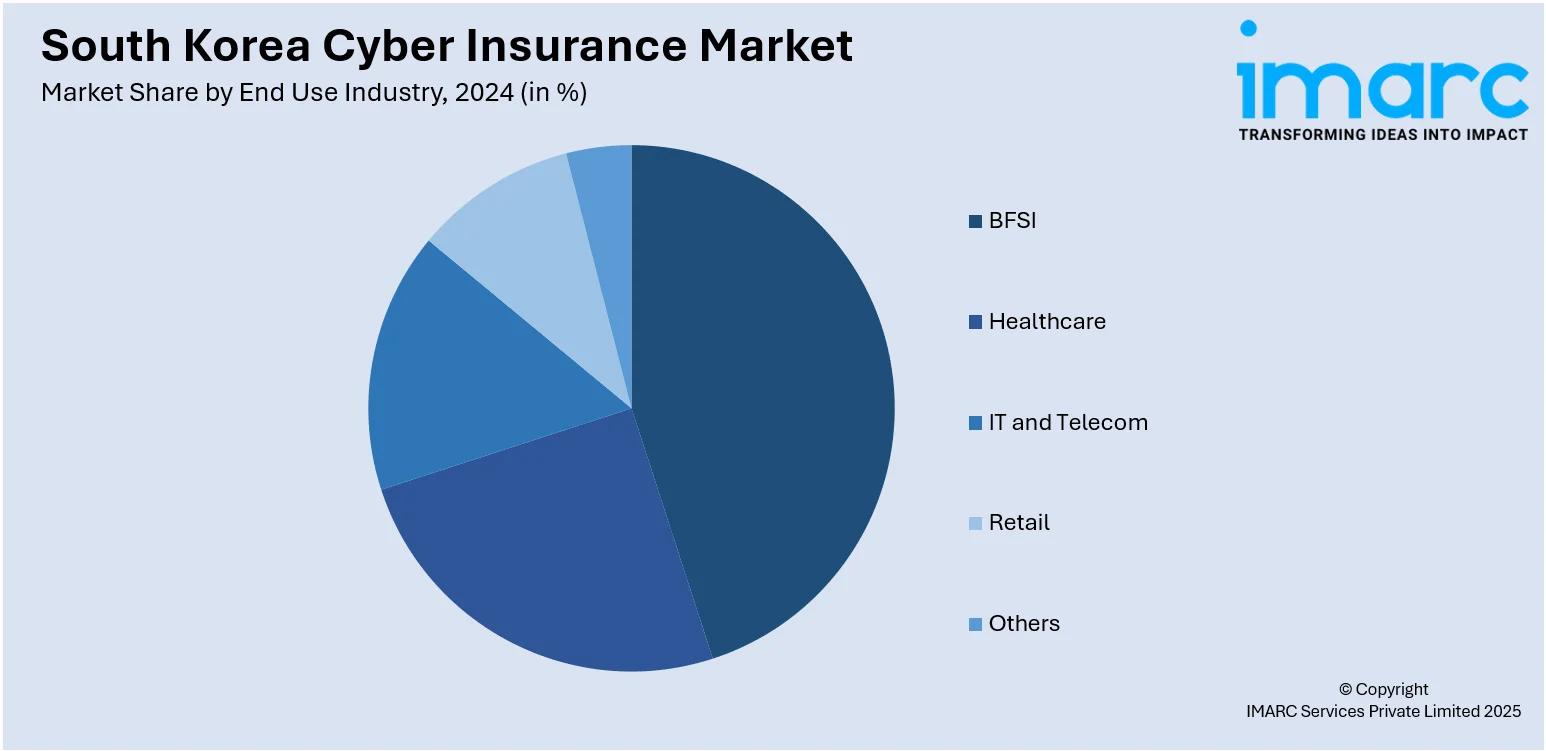

End Use Industry Insights:

- BFSI

- Healthcare

- IT and Telecom

- Retail

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes BFSI, healthcare, IT and telecom, retail, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Cyber Insurance Market News:

- In May 2025, Cyberwrite partnered with Samsung Fire & Marine Insurance to enhance its cyber insurance capabilities. The collaboration aims to improve risk assessment and management of cyber threats, with a projected global market growth of cyber insurance from USD 16 Billion in 2025 to over USD 40 Billion by 2030.

South Korea Cyber Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Insurance Types Covered | Packaged, Stand-alone |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End Use Industries Covered | BFSI, Healthcare, IT and Telecom, Retail, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea cyber insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea cyber insurance market on the basis of component?

- What is the breakup of the South Korea cyber insurance market on the basis of insurance type?

- What is the breakup of the South Korea cyber insurance market on the basis of organization size?

- What is the breakup of the South Korea cyber insurance market on the basis of end use industry?

- What is the breakup of the South Korea cyber insurance market on the basis of region?

- What are the various stages in the value chain of the South Korea cyber insurance market?

- What are the key driving factors and challenges in the South Korea cyber insurance market?

- What is the structure of the South Korea cyber insurance market and who are the key players?

- What is the degree of competition in the South Korea cyber insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea cyber insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea cyber insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea cyber insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)