South Korea Duty-Free and Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

South Korea Duty-Free and Travel Retail Market Overview:

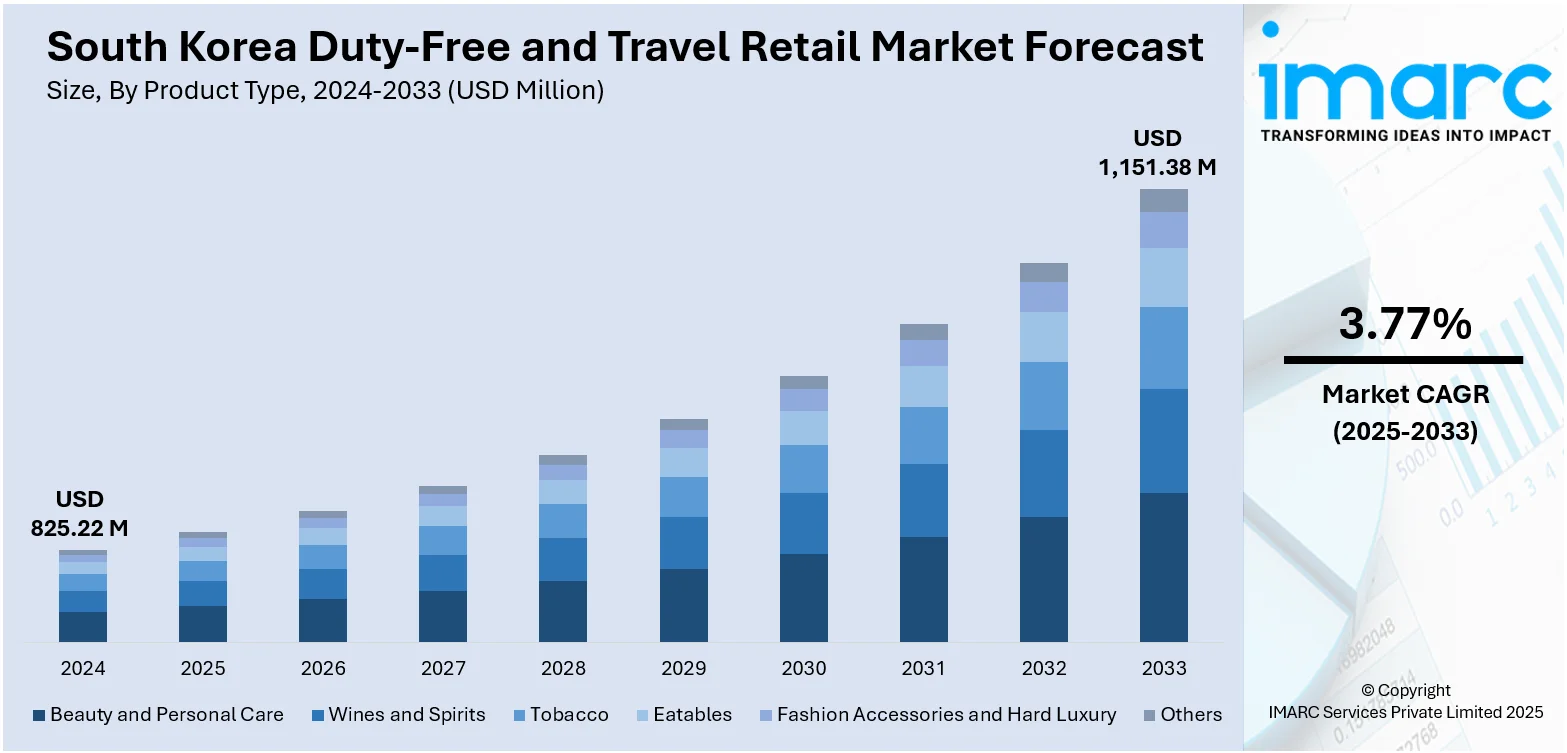

The South Korea duty-free and travel retail market size reached USD 825.22 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,151.38 Million by 2033, exhibiting a growth rate (CAGR) of 3.77% during 2025-2033. Rising Chinese tourist arrivals, strong K-beauty exports, expanding duty-free concessions at airports and downtown, aggressive promotions by Lotte and Shilla, tax refunds, Hallyu wave popularity, premium luxury brand growth, tech-savvy shopping experiences, resilient domestic demand, and supportive government policies are some of the factors contributing to the South Korea duty-free and travel retail market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 825.22 Million |

| Market Forecast in 2033 | USD 1,151.38 Million |

| Market Growth Rate 2025-2033 | 3.77% |

South Korea Duty-Free and Travel Retail Market Trends:

Renewed Momentum for Travel Retail

Cutting airport patent fees in half and easing restrictions on duty-free liquor are expected to revive South Korea’s sluggish travel retail scene. By halving fees, operators get much-needed breathing room to manage costs and reinvest in marketing and store upgrades. Removing the two-bottle limit on inbound duty-free liquor, while keeping the volume and dollar cap, lets travelers spend more freely within a familiar framework. This opens chances for higher average purchases per visitor and creates room for creative product bundles and promotions. Retailers eyeing Korean travelers can tap into this relaxed environment with tailored offers and exclusive items. Local players expect better margins and more stable operations after years of squeezed profits. These steps point to a more competitive atmosphere as operators and brands roll out fresh campaigns to capture rebounding demand. Many see this as a turning point for Korea’s position as a top shopping stop for global travelers. These factors are intensifying the South Korea duty-free and travel retail market growth. For example, South Korea cut airport patent fees in half starting April 2025 and lifted the two-bottle limit on inbound duty-free liquor purchases (keeping the two-liter and USD 400 cap). Shinsegae called the patent fee cut a major relief for operators, expecting it to help revive the country’s duty-free and travel retail business and support overseas retailers targeting Korean travelers.

To get more information on this market, Request Sample

Luxury Beauty Making a Fresh Entrance

A premium beauty label recently stepped into South Korea’s duty-free scene through a dedicated pop-up, bringing skincare, makeup, and fragrance lines to travelers for the first time. Visitors could discover new color collections, advanced skincare technology, and signature scents, all designed to turn a quick stop into a memorable shopping moment. This short-term space blended hands-on exploration with the appeal of exclusive launches, drawing in curious shoppers on the move. Such launches show how high-end brands see travel retail as a smart way to test products and build buzz with shoppers looking for unique finds before they board. The strong response hints at more collaborations and limited-time experiences ahead, giving the local market fresh energy. Luxury labels continue to bet on Korean travelers and international visitors as reliable customers for premium beauty, fueling steady interest in special pop-ups and first-to-market collections. For instance, in July 2024, Shinsegae Duty Free and L'Oréal Travel Retail Asia Pacific opened Korea’s first Prada Beauty pop-up at Incheon International Airport Terminal 2. The pop-up ran from July 4 to August 25, bringing Prada Beauty’s skincare, makeup, and fragrances to Korean travel retail for the first time. Visitors explored Prada Colors, Augmented Skincare with Adapto.gn tech, and iconic scents like Prada Paradoxe and Les Infusion.

South Korea Duty-Free and Travel Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury, and others.

Distribution Channel Insights:

- Airports

- Airlines

- Ferries

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes airports, airlines, ferries, and others.

Region Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Duty-Free and Travel Retail Market News:

- In May 2025, Kylie Cosmetics launched its first pop-up in South Korea at Incheon International Airport with The Shilla Duty Free. The exclusive pop-up in Terminal 2 gave travelers a chance to try products like the Matte Lip Kit, Cosmic Kylie Jenner Eau de Parfum, Kylash Mascara, and Lip Oils. Beauty specialists were on-site for consultations to help travelers find their Kylie look.

South Korea Duty-Free and Travel Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, Others |

| Distribution Channels Covered | Airports, Airlines, Ferries, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea duty-free and travel retail market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea duty-free and travel retail market on the basis of product type?

- What is the breakup of the South Korea duty-free and travel retail market on the basis of distribution channel?

- What is the breakup of the South Korea duty-free and travel retail market on the basis of region?

- What are the various stages in the value chain of the South Korea duty-free and travel retail market?

- What are the key driving factors and challenges in the South Korea duty-free and travel retail market?

- What is the structure of the South Korea duty-free and travel retail market and who are the key players?

- What is the degree of competition in the South Korea duty-free and travel retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea duty-free and travel retail market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea duty-free and travel retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea duty-free and travel retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)