South Korea E-Invoicing Market Size, Share, Trends and Forecast by Channel, Deployment Type, Application, and Region, 2026-2034

South Korea E-Invoicing Market Size Overview:

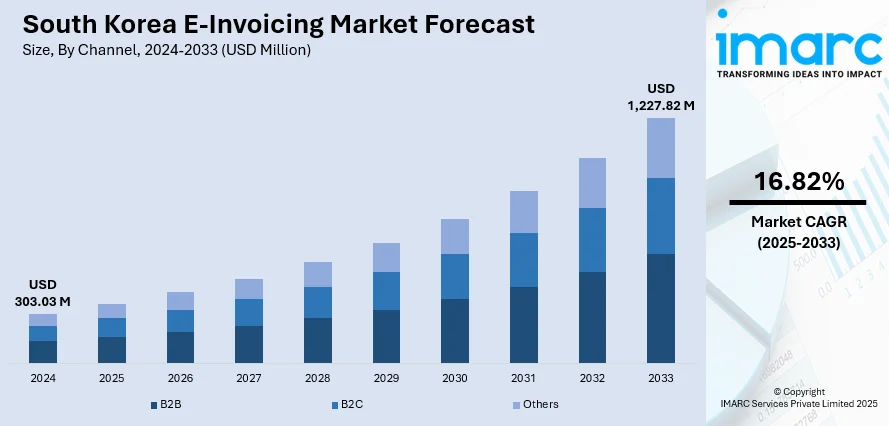

The South Korea e-invoicing market size reached USD 303.03 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,227.82 Million by 2034, exhibiting a growth rate (CAGR) of 16.82% during 2026-2034. Mandatory adoption by tax authorities, digital transformation in finance, strong internet infrastructure, and demand for real-time tax reporting are some of the factors contributing to South Korea e-invoicing market share. Widespread enterprise software use and government incentives further encourage compliance and automation across businesses.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 303.03 Million |

| Market Forecast in 2034 | USD 1,227.82 Million |

| Market Growth Rate 2026-2034 | 16.82% |

South Korea E-Invoicing Market Trends:

Adoption Driven by Corporate Compliance and Digital Tax Enforcement

South Korea’s push for digital tax administration is behind a sharp increase in e-invoicing adoption. Large businesses were the early adopters due to government mandates, but smaller enterprises are now catching up as regulators expand enforcement. The National Tax Service (NTS) has been investing in advanced audit tools, and real-time invoice reporting is becoming a norm. This has put pressure on businesses to upgrade their internal systems. ERPs and accounting platforms now integrate e-invoicing features as standard offerings, often customized for Korean tax law. Accountants and tax consultants are also shifting focus, from filing and reconciliation tasks to advisory work, as automation handles more of the routine. There’s a noticeable uptick in demand for local-language cloud-based platforms that comply with Korea’s specific legal formats and data retention rules. Local providers dominate for now, but international SaaS players are entering the space with Korea-specific modules. Regulatory clarity, penalties for non-compliance, and a tech-savvy population are making South Korea one of the faster-maturing markets in digital invoicing across Asia. These factors are intensifying the South Korea e-invoicing market growth.

To get more information on this market, Request Sample

E-Invoicing Systems as a Gateway to B2B Payments and Fintech Growth

In South Korea, e-invoicing is evolving into more than just a compliance tool. Companies are now using these systems to speed up payments, manage cash flow, and connect with new fintech services. E-invoice data is feeding directly into payment gateways, allowing suppliers to get paid faster through embedded finance options. Lenders are also using invoice data to offer short-term credit to small suppliers with limited borrowing history. These services often sit within the e-invoicing interface itself, cutting the need to switch between multiple apps. Some Korean fintech startups have started bundling e-invoicing with AR/AP automation, credit scoring, and invoice factoring, targeting mid-market firms that want more visibility into their working capital. Banks are entering this space too, partnering with software firms to capture invoice data early in the transaction cycle. What started as a regulatory requirement is now becoming an entry point for broader digital finance. As integration improves, the line between e-invoicing platforms and digital banking tools is starting to blur. This shift is creating new competitive dynamics between banks, tech companies, and ERP vendors.

South Korea E-Invoicing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on channel, deployment type, and application.

Channel Insights:

- B2B

- B2C

- Others

The report has provided a detailed breakup and analysis of the market based on the channel. This includes B2B, B2C, and others.

Deployment Type Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes cloud-based and on-premises.

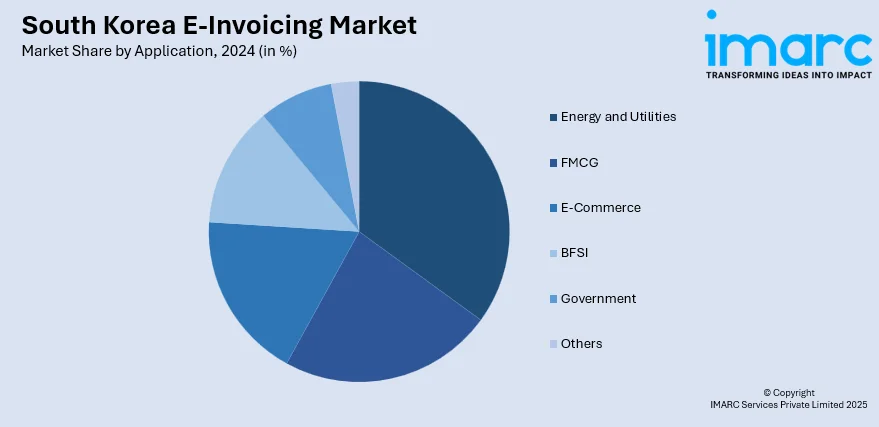

Application Insights:

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes energy and utilities, FMCG, e-commerce, BFSI, government, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea E-Invoicing Market News:

- In April 2025, South Korea continued expanding its e-Tax Invoice system, first launched in 2011. The latest update in July 2023 mandated businesses earning over KRW 100 Million to issue electronic VAT invoices via the National Tax Service. Initially targeting large firms, the system's scope has steadily widened through phased thresholds in 2012, 2014, 2019, and 2022, aiming to streamline reporting and reduce tax fraud.

South Korea E-Invoicing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | B2B, B2C, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| Applications Covered | Energy and Utilities, FMCG, E-Commerce, BFSI, Government, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea e-invoicing market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea e-invoicing market on the basis of channel?

- What is the breakup of the South Korea e-invoicing market on the basis of deployment type?

- What is the breakup of the South Korea e-invoicing market on the basis of application?

- What is the breakup of the South Korea e-invoicing market on the basis of region?

- What are the various stages in the value chain of the South Korea e-invoicing market?

- What are the key driving factors and challenges in the South Korea e-invoicing market?

- What is the structure of the South Korea e-invoicing market and who are the key players?

- What is the degree of competition in the South Korea e-invoicing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea e-invoicing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea e-invoicing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea e-invoicing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)