South Korea Energy as a Service Market Size, Share, Trends and Forecast by Service Type, End User, and Region, 2025-2033

South Korea Energy as a Service Market Overview:

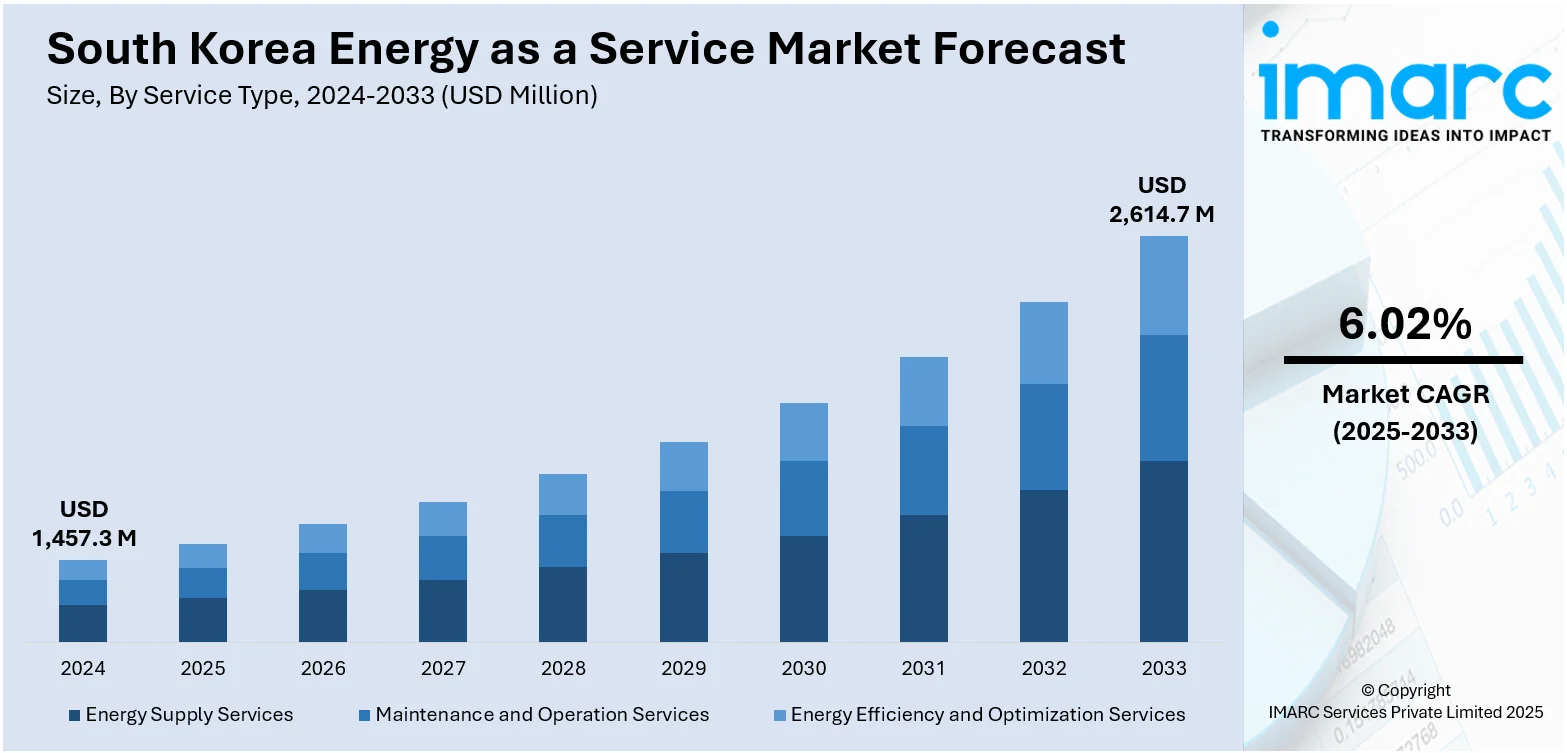

The South Korea energy as a service market size reached USD 1,457.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,614.7 Million by 2033, exhibiting a growth rate (CAGR) of 6.02% during 2025-2033. The government of South Korea is strongly encouraging carbon neutrality by 2050, thereby driving the market. Moreover, technological innovation is playing a key role in remodeling the way energy is being produced, distributed, and consumed in South Korea. Additionally, the growing energy demand in industrial, commercial, and residential segments is expanding the South Korea energy as a service market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,457.3 Million |

| Market Forecast in 2033 | USD 2,614.7 Million |

| Market Growth Rate 2025-2033 | 6.02% |

South Korea Energy as a Service Market Trends:

Governmental push for carbon neutrality and green energy transition

The government of South Korea is strongly encouraging carbon neutrality by 2050, thereby driving the market. The government is constantly implementing green policies, providing tax rebates, and implementing carbon pricing schemes to encourage companies to adopt cleaner energy patterns. Since companies are being set tighter emissions goals, they are increasingly turning to energy as a service (EaaS) providers for energy optimization, renewable integration, and emission tracking. The government is also ramping up funding for smart grid initiatives and distributed energy systems, thus paving the way for EaaS solutions. Public-private collaborations are being encouraged to construct energy-efficient infrastructure, which is driving demand for services such as energy performance contracting and remote monitoring. EaaS models are supporting South Korea's "Green New Deal" agenda perfectly by providing scalability, cost predictability, and support for compliance, thereby allowing clients to concentrate on core business activities while adapting to sustainable energy models. In 2025, South Korea’s Ministry of Trade, Industry, and Energy (MOTIE) has initiated its inaugural solar energy tender for 2025, targeting the acquisition of 1 GW of solar energy. This tender signifies an important advance in South Korea’s dedication to growing its renewable energy industry and decreasing its reliance on fossil fuels.

To get more information on this market, Request Sample

Advances in energy analytics and Internet of Things (IoT)

Technological innovation is playing a key role in remodeling the way energy is being produced, distributed, and consumed in South Korea. EaaS providers are resorting to Internet of Things (IoT) devices, artificial intelligence (AI)-driven energy analytics, and cloud-based energy management systems to provide real-time optimization and automation, thereby supporting the South Korea energy as a service market growth. Smart sensors are increasingly installed in industrial and commercial properties to capture energy consumption data, which is analyzed with machine learning (ML) algorithms to identify inefficiencies and propose implementable improvements. Energy storage systems, electric vehicle (EV) charging facilities, and microgrid systems are also being rolled out under EaaS platforms to deliver robust, adaptive energy services. Rapid deployment of these technologies is being enabled by South Korea's highly advanced digital infrastructure. Companies are counting on data-driven insights for predictive maintenance and performance forecasting, while service providers are employing digital twins to simulate and coordinate energy flows. This technology foundation is enhancing EaaS solutions to become more intelligent, scalable, and attractive across industries.

Increasing energy demand and shift towards decentralization

Growing energy demand in industrial, commercial, and residential segments is driving the need for efficient and flexible energy solutions in South Korea. The nation is experiencing higher electrification of transportation and industrial processes, putting extra pressure on conventional energy supply mechanisms. Subsequently, energy decentralization through solar panels, wind farms, and local storage is gaining traction. EaaS is proving to be the perfect solution to oversee such decentralized assets with hassle-free integration, load balancing, and demand response. Companies are embracing EaaS so that they do not have to make capital investments in infrastructure and pay for energy results through performance contracts. The transition from centralized utility models to decentralized, prosumer-centric systems is providing opportunities for third-party energy service providers. EaaS models are constantly aiding customers in coping with changing energy requirements, hedging against uncertain prices, and becoming more energy independent. In 2025, Utility, the off-gas-to-value company commercializing its proprietary H2Gen® hydrogen production system, announced a joint project development agreement with Kunhwa E&C, a leading Korean engineering firm. The agreement establishes a strategic partnership to provide engineering services for the development and deployment of multiple hydrogen production plants that convert biogas into clean, affordable, carbon-negative hydrogen using the Utility’s breakthrough H2Gen® technology.

South Korea Energy as a Service Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type and end user.

Service Type Insights:

- Energy Supply Services

- Maintenance and Operation Services

- Energy Efficiency and Optimization Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes energy supply services, maintenance and operation services, and energy efficiency and optimization services.

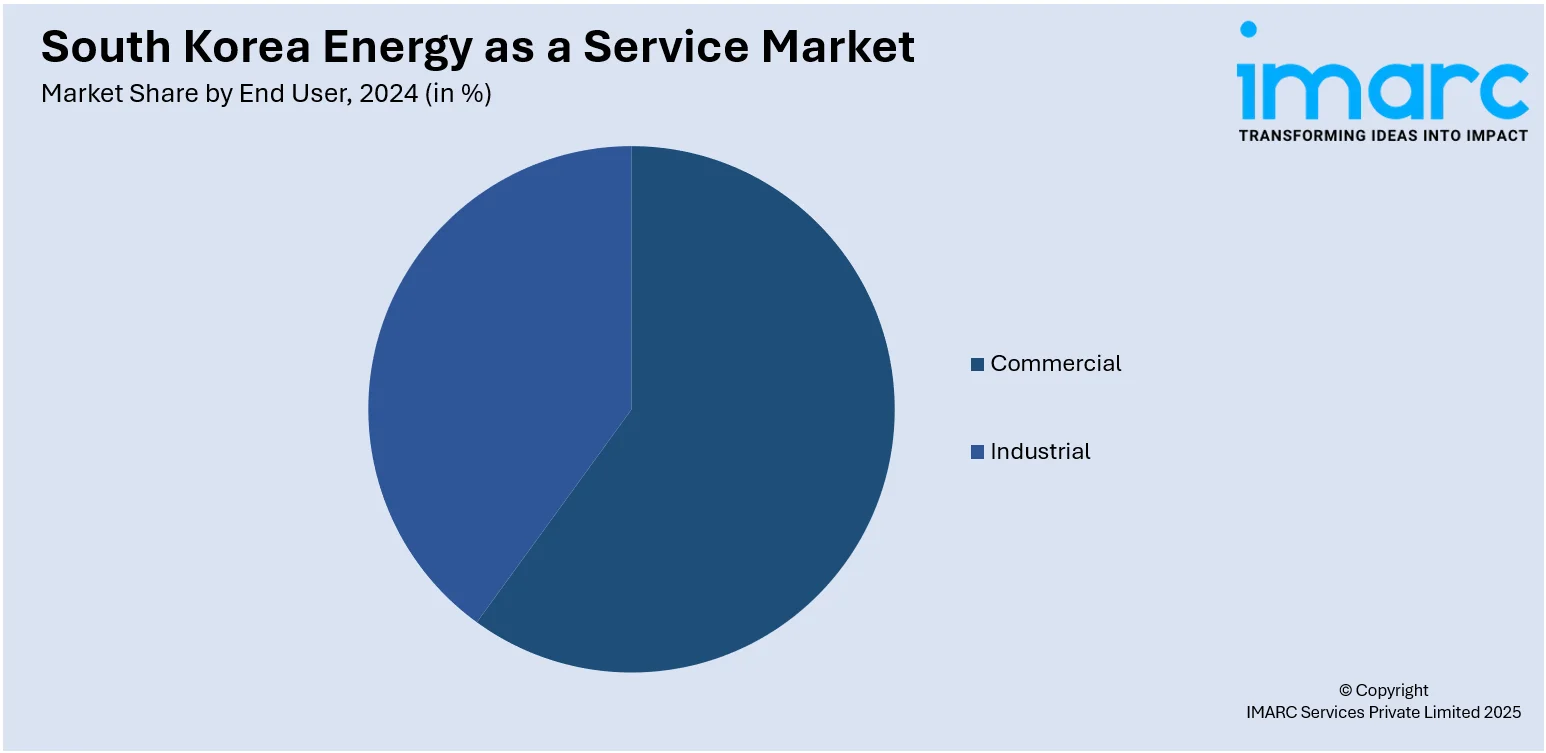

End User Insights:

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes commercial and industrial.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Energy as a Service Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Energy Supply Services, Maintenance and Operation Services, Energy Efficiency and Optimization Services |

| End Users Covered | Commercial, Industrial |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea energy as a service market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea energy as a service market on the basis of service type?

- What is the breakup of the South Korea energy as a service market on the basis of end user?

- What is the breakup of the South Korea energy as a service market on the basis of region?

- What are the various stages in the value chain of the South Korea energy as a service market?

- What are the key driving factors and challenges in the South Korea energy as a service market?

- What is the structure of the South Korea energy as a service market and who are the key players?

- What is the degree of competition in the South Korea energy as a service market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea energy as a service market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea energy as a service market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea energy as a service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)