South Korea Hard Seltzer Market Size, Share, Trends and Forecast by ABV Content, Packaging Material, Distribution Channel, Flavor, and Region, 2025-2033

South Korea Hard Seltzer Market Overview:

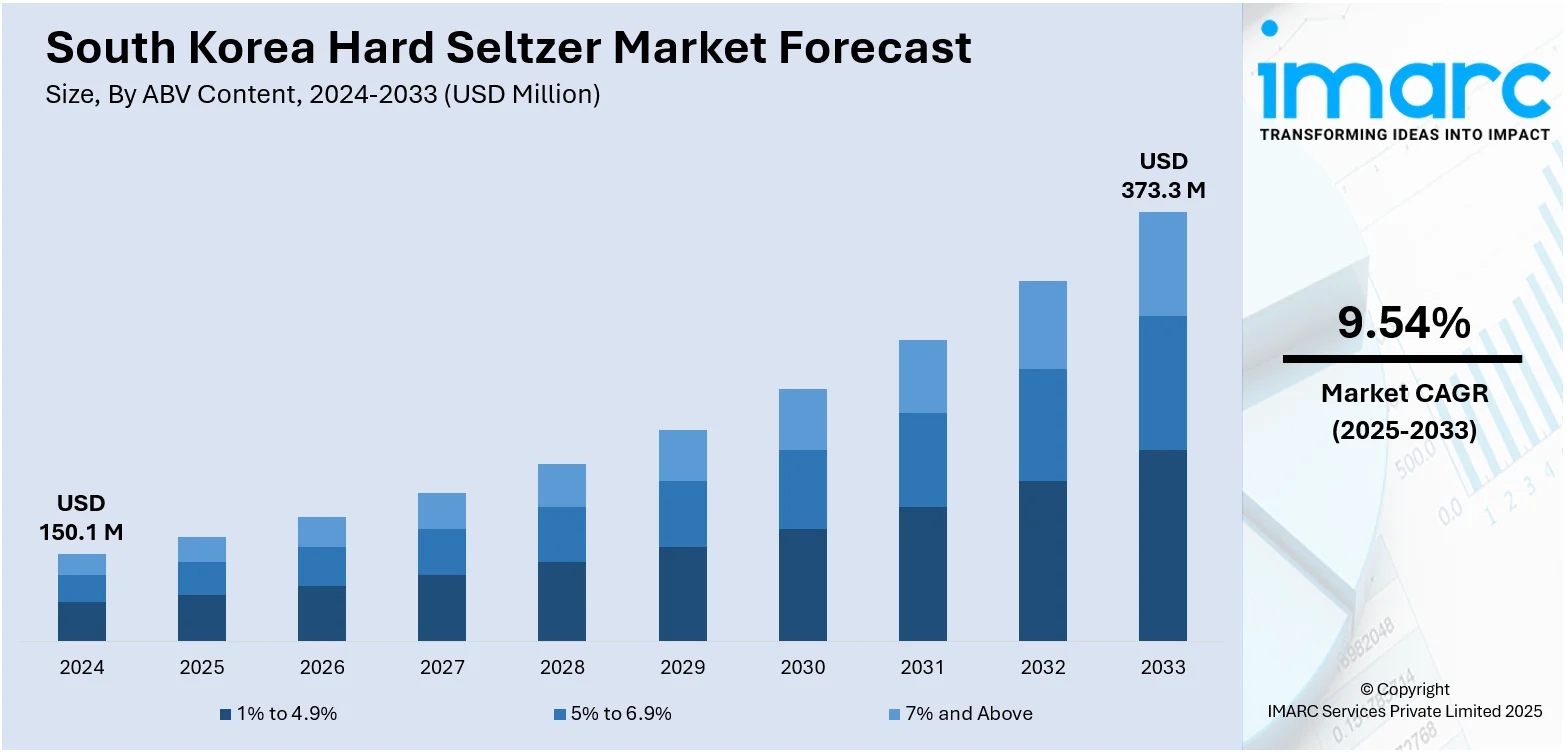

The South Korea hard seltzer market size reached USD 150.1 Million in 2024. The market is projected to reach USD 373.3 Million by 2033, exhibiting a growth rate (CAGR) of 9.54% during 2025-2033. The market is fueled by rising customer demand for low-sugar, low-calorie alcoholic drinks that meet healthy lifestyle standards. Besides this, the increasing number of local and foreign brands entering the market with new flavors and pack sizes is fueling the growth of hard seltzers across the nation. Furthermore, the increasing popularity of Western alcoholic drinking culture, especially among young generations, has also contributed to expanding the South Korea hard seltzer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 150.1 Million |

| Market Forecast in 2033 | USD 373.3 Million |

| Market Growth Rate 2025-2033 | 9.54% |

South Korea Hard Seltzer Market Trends:

Growing Health Consciousness and Low-Calorie Alcohol Preferences

Health consciousness is steadily reshaping consumer behavior in South Korea, particularly among millennials and Gen Z, who are driving a significant shift in alcohol consumption patterns. As a result of these changing preferences, the country has experienced a 12% decline in alcohol consumption since its peak in 2015, representing the second-fastest reduction rate among OECD member nations. This declining trend mirrors a larger shift away from the classic high-alcohol drinks like soju and beer, as health-conscious consumers increasingly desire lower-calorie, lighter alternatives. In this regard, hard seltzers have made swift gains in the market. Their popularity lies in their formulation, which is often lower in sugar, calories, and carbs, and resonates with the consumer's priorities of being fit, weight-conscious, and well. Apart from that, the nation's thriving fitness and wellness culture further supports this trend, as it urges alcohol sales to produce alcoholic beverages that are conducive to healthier lifestyles without sacrificing taste or socializing. Moreover, government campaigns to encourage sensible drinking and reduce excessive alcohol consumption have also contributed to a shift in preferences toward lighter options. Consequently, hard seltzers are becoming a good alternative to traditional beverages.

To get more information on this market, Request Sample

Expansion Through E-Commerce and Digital Engagement Strategies

Digital transformation is a significant factor providing a boost to South Korea hard seltzer market growth. The integration of digital media has significantly influenced how hard seltzer brands market and distribute their products in South Korea. As per industry reports, the country had approximately 50.4 Million internet users as of January 2025, accounting for 97.4% of the country's total population. With high internet penetration and a digitally savvy population, e-commerce has become a primary channel for alcohol sales, especially among younger demographics. Additionally, online channels give the convenience of browsing, comparing, and buying a variety of hard seltzer brands, usually with special promotions and subscription offers. Furthermore, the COVID-19 pandemic further hastened this shift, and most consumers continued to prefer shopping for alcohol online even after the pandemic. Also, digital marketing is aggressively expanded by brands to develop engagement and brand affinity. Social media sites such as Instagram, TikTok, and YouTube are used to execute influencer programs, user-generated content contests, and virtual tastings. These programs appeal to digitally native consumers who demand personal, interactive experiences. In addition, QR code campaigns, AR filters, and gamified loyalty programs are also being utilized in order to connect digital touchpoints to physical products. This convergence of lifestyle marketing and digital commerce is not only generating sales, but also promoting community-led brand ecosystems, which are essential for long-term market presence.

South Korea Hard Seltzer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on ABV content, packaging material, distribution channel, and flavor.

ABV Content Insights:

- 1% to 4.9%

- 5% to 6.9%

- 7% and Above

The report has provided a detailed breakup and analysis of the market based on the ABV content. This includes 1% to 4.9%, 5% to 6.9%, and 7% and above.

Packaging Material Insights:

- Cans

- Glass

- Others

A detailed breakup and analysis of the market based on the packaging material have also been provided in the report. This includes cans, glass, and others.

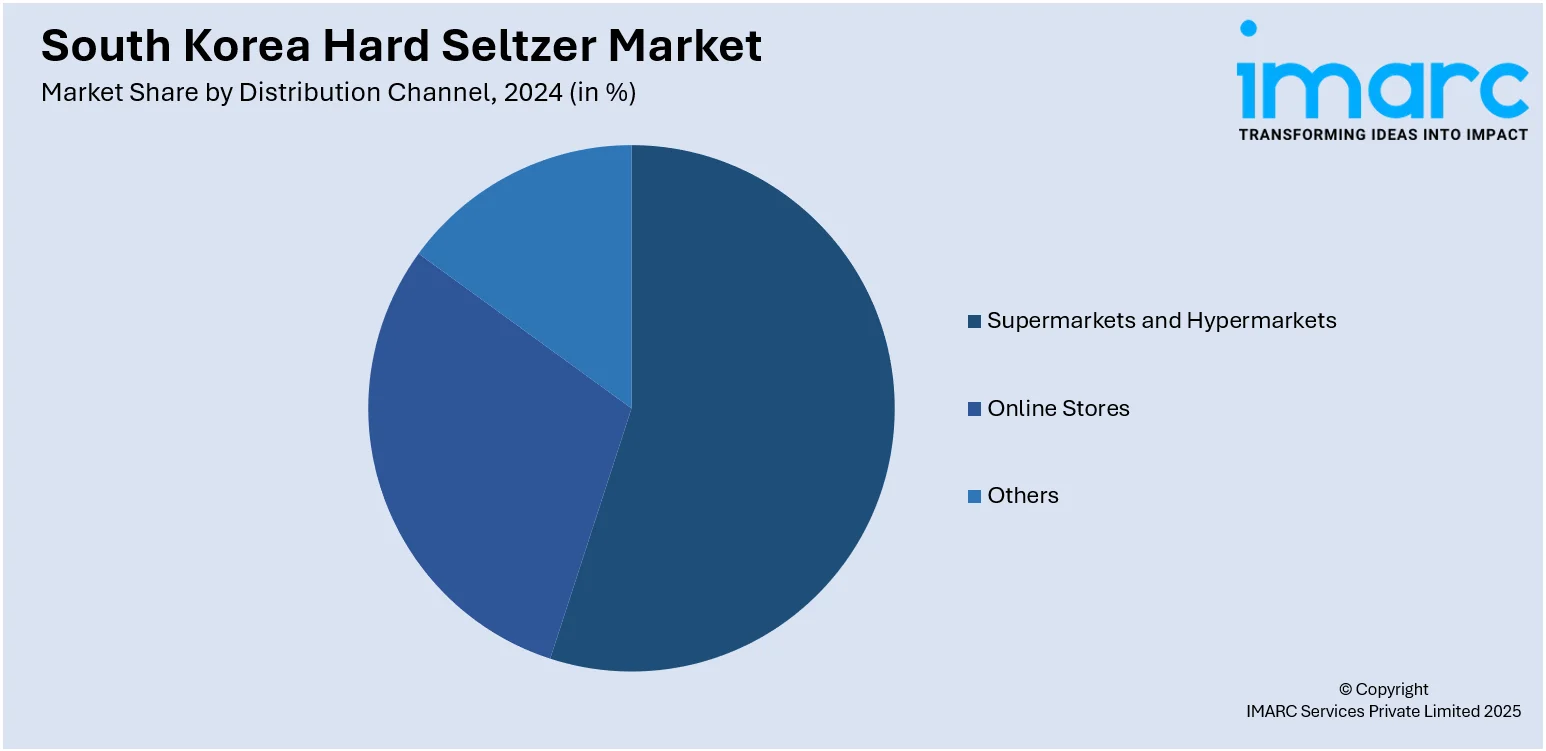

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, online stores, and others.

Flavor Insights:

- Cherry

- Grapefruit

- Mango

- Lime

- Others

A detailed breakup and analysis of the market based on the flavor have also been provided in the report. This includes cherry, grapefruit, mango, lime, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Hard Seltzer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| ABV Contents Covered | 1% to 4.9%, 5% to 6.9%, 7% and Above |

| Packaging Materials Covered | Cans, Glass, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Online Stores, Others |

| Flavors Covered | Cherry, Grapefruit, Mango, Lime, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea hard seltzer market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea hard seltzer market on the basis of ABV content?

- What is the breakup of the South Korea hard seltzer market on the basis of packaging material?

- What is the breakup of the South Korea hard seltzer market on the basis of distribution channel?

- What is the breakup of the South Korea hard seltzer market on the basis of flavor?

- What is the breakup of the South Korea hard seltzer market on the basis of region?

- What are the various stages in the value chain of the South Korea hard seltzer market?

- What are the key driving factors and challenges in the South Korea hard seltzer market?

- What is the structure of the South Korea hard seltzer market and who are the key players?

- What is the degree of competition in the South Korea hard seltzer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea hard seltzer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea hard seltzer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea hard seltzer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)