South Korea Luxury Residential Real Estate Market Report by Type (Apartments and Condominiums, Villas and Landed Houses), and Region 2025-2033

Market Overview:

South Korea luxury residential real estate market size is projected to exhibit a growth rate (CAGR) of 9.89% during 2025-2033. A growing class of high-net-worth individuals due to strong economic growth, rising urbanization trends increasing land value across the country, and continuous technological advancements facilitating easier transactions represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Growth Rate (2025-2033) | 9.89% |

Luxury residential real estate refers to the segment of the housing market that focuses on properties with characteristics and amenities above and beyond those of typical homes. These properties usually feature superior design, construction quality, and a range of amenities, such as swimming pools, home gyms, and smart technology systems. The locations of these residences are generally in prime areas, offering panoramic views, excellent schools, and convenient access to business districts or leisure facilities. In terms of investment, luxury real estate is often seen as a stable and lucrative option, appreciating in value over time. The buyers for these properties typically include high-net-worth individuals, investment firms, and sometimes, even corporations looking for guest or executive residences. Technological innovations, such as virtual tours and online transactions, are facilitating a smoother buying experience, even for overseas clients. Furthermore, these properties are often associated with a certain lifestyle and prestige, making them a statement of success and aspiration. The luxury real estate market also serves as an important indicator of economic conditions. An expanding luxury segment usually implies a healthy economy, as it signifies that there is a substantial population with significant disposable income. As a result, luxury residential real estate contributes to individual portfolios and reflects broader economic trends.

South Korea Luxury Residential Real Estate Market Trends:

The South Korea luxury residential real estate market is currently witnessing robust growth fueled by multiple interconnected factors. One of the most significant drivers is the country's strong economic growth, which is generating a rising class of high-net-worth individuals (HNWIs) with the financial capacity to invest in luxury properties. In addition to domestic wealth, there is also an increasing interest from international buyers, particularly from China and the United States, who see South Korea as a stable and promising investment landscape. Moreover, the development of prime real estate areas in major cities like Seoul, where a mix of traditional culture and modern amenities is attracting prospective buyers, represents another major growth-inducing factor. These luxury residential spaces often offer high-end features, such as state-of-the-art security systems, smart home technologies, and exclusive community amenities like private gyms and pools. Their proximity to business districts, prestigious schools, and luxury shopping centers further adds to the attractiveness of these properties. Additionally, rising urbanization trends in South Korea have augmented the demand for luxury residential real estate. With more people moving to cities for employment and better living conditions, the scarcity of land in urban areas is making real estate more valuable, leading to higher prices and growing interest in luxury residences as both a lifestyle choice and a long-term investment. Furthermore, technological advancements are facilitating easier transactions and greater market transparency. Virtual tours, blockchain-based contracts, and mobile-friendly platforms are making it simpler for both domestic and international buyers to make informed decisions. This enhanced customer experience is encouraging more transactions, contributing to market growth. Besides this, favorable government policies, such as tax incentives for real estate investments and a relatively stable political climate make South Korea an attractive location for luxury residential property investments, thus propelling market growth.

South Korea Luxury Residential Real Estate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type.

Type Insights:

- Apartments and Condominiums

- Villas and Landed Houses

The report has provided a detailed breakup and analysis of the market based on the type. This includes apartments and condominiums and villas and landed houses.

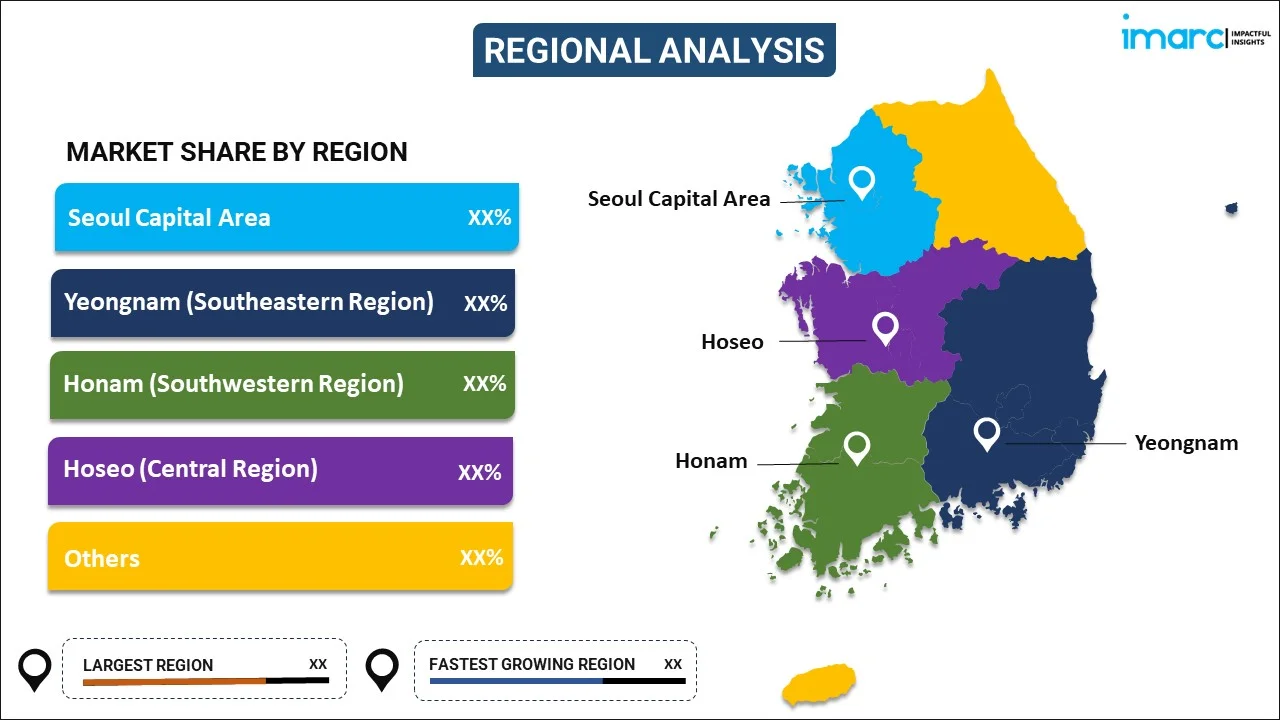

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Luxury Residential Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Apartments and Condominiums, Villas and Landed Houses |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea luxury residential real estate market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the South Korea luxury residential real estate market?

- What is the breakup of the South Korea luxury residential real estate market on the basis of type?

- What are the various stages in the value chain of the South Korea luxury residential real estate market?

- What are the key driving factors and challenges in the South Korea luxury residential real estate?

- What is the structure of the South Korea luxury residential real estate market and who are the key players?

- What is the degree of competition in the South Korea luxury residential real estate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea luxury residential real estate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea luxury residential real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea luxury residential real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)