South Korea Online Travel Market Size, Share, Trends and Forecast by Service Type, Platform, Mode of Booking, Age Group, and Region, 2025-2033

South Korea Online Travel Market Overview:

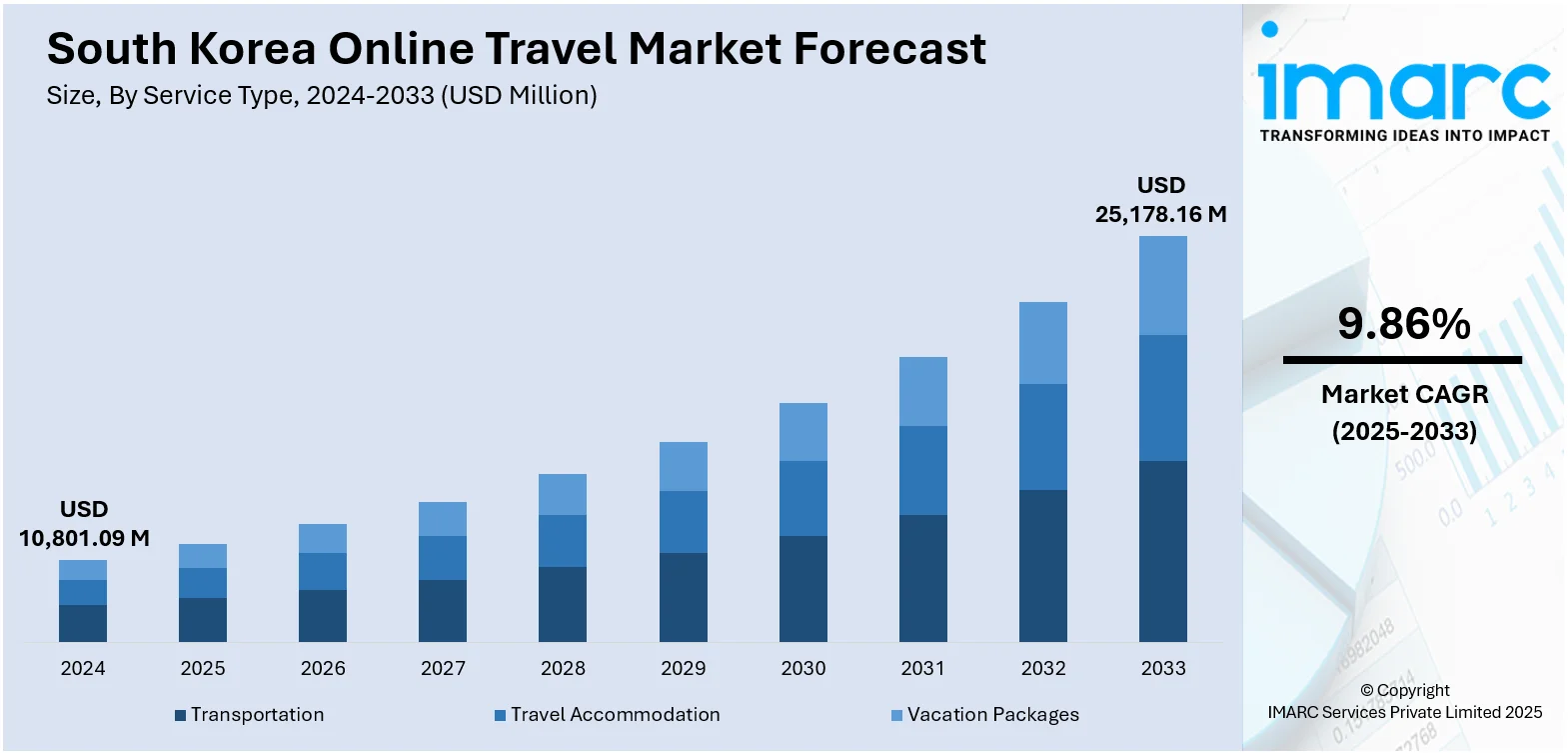

The South Korea online travel market size reached USD 10,801.09 Million in 2024. The market is projected to reach USD 25,178.16 Million by 2033, exhibiting a growth rate (CAGR) of 9.86% during 2025-2033. The market is rapidly evolving, driven by a tech-savvy population and mobile-first behavior. Platforms offer integrated services flights, hotels, transport, tours, and cultural experiences like K-pop and culinary immersions, via immersive digital solutions. Emphasis on multi-language support and seamless mobile interfaces caters to both domestic and international travelers. As online travel gains dominance across age groups and regions, the industry is poised for sustained expansion in the Soth Korea online travel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10,801.09 Million |

| Market Forecast in 2033 | USD 25,178.16 Million |

| Market Growth Rate 2025-2033 | 9.86% |

South Korea Online Travel Market Trends:

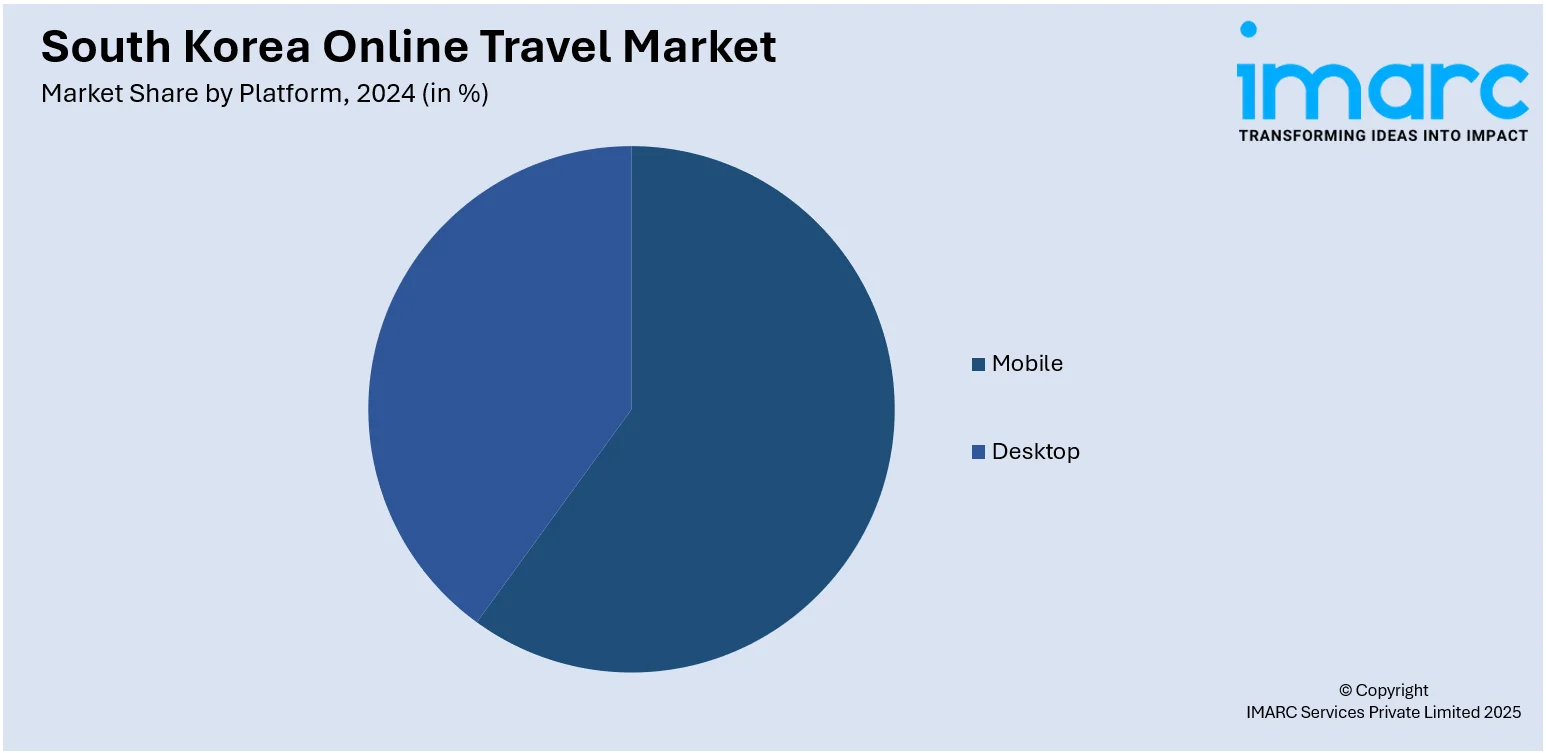

Rapid Rise in Mobile-Centric Booking Platforms

South Korea’s travel booking landscape is increasingly defined by mobile-first innovation. In April 2025, a Phocuswright analysis noted that South Korean travelers lead Northeast Asia in mobile travel adoption, with many online bookings originating from smartphones a trend that began during the pandemic and continues to grow. Leading platforms have responded with AI assistants, one-tap payments, and voice-search features tailored to the local market, while app interfaces are optimized for dense content and rapid navigation. This mobile dominance is supported by expanding 5G infrastructure and near-universal smartphone ownership among urban and suburban populations. Providers increasingly enable seamless booking of flights, rail, accommodation, and tour packages within a single app ecosystem. As travel demand surges in peak seasons like summer 2025, platforms offering quick confirmation, and a frictionless user journey are gaining market share. Mobile convenience has shifted from optional to essential, becoming the industry benchmark. This mobile-driven evolution signals a paradigm shift in South Korea online travel trends.

To get more information on this market, Request Sample

Personalization Empowered by Smart Technology

South Korea’s online travel platforms are deploying advanced personalization technologies to enhance user engagement. Emerging AI and machine learning (ML) models analyze route history, cultural preferences, and viewing behavior to recommend tailored travel itineraries soon after initial search queries. From suggesting guided hanok-stays with traditional experiences to curated K‑pop fan tours, platforms offer bespoke packages that resonate strongly with both domestic and inbound tourists. In early 2025, South Korean authorities reinforced this trend by integrating personalized e-visa and itinerary tools aimed at international travelers. Data-driven recommendations are integrated across messaging apps and in-app ecosystems, reducing time spent on booking and increasing the relevance of offers. Additionally, interest-based filters, whether on cuisine, wellness, or cultural access are gaining traction. This intelligent customization not only heightens user satisfaction but also supports upselling and repeat engagement. As demand for tailored experiences grows, personalization is becoming a defining feature in South Korea online travel growth.

Elevation of Eco-Aware and Cultural Immersion Offerings

South Korea is seeing strong growth in sustainable and culturally immersive travel packages. In March 2025, sources report highlighted that South Korean travelers exhibit high environmental awareness and actively seek authentic local experiences. Against this backdrop, travel platforms now feature eco-certified stays, hanok-based rural tourism, and community-led cultural workshops. These offerings allow travelers to connect with nature and heritage, while promoting responsible tourism practices that support regional economies. National initiatives such as “Traveling Spring,” launched by the Korea Tourism Organization from March to May 2025, have promoted lesser-known destinations through themed programs featuring discounted accommodations, guided temple stays, and eco-friendly transportation across coastal and mountainous regions. In response, digital travel platforms have started embedding filters for green accommodations, low-emission transit, and cultural depth. Interactive content such as virtual previews and user reviews now further enables travelers to make informed, sustainable decisions. These developments align with Seoul’s broader urban conservation policies and reflect a shift in traveler mindset. As eco-conscious and heritage-driven experiences grow in demand, they are becoming integral to South Korea’s evolving online travel ecosystem.

South Korea Online Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type, platform, mode of booking, and age group.

Service Type Insights:

- Transportation

- Travel Accommodation

- Vacation Packages

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, travel accommodation, and vacation packages.

Platform Insights:

- Mobile

- Desktop

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes mobile and desktop.

Mode of Booking Insights:

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

The report has provided a detailed breakup and analysis of the market based on the mode of booking. This includes online travel agencies (OTAs) and direct travel suppliers.

Age Group Insights:

- 22-31 Years

- 32-43 Years

- 44-56 Years

- Above 56 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 22-31 years, 32-43 years, 44-56 years, and above 56 years.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Online Travel Market News:

- April 2025: Trip.com, the global online travel platform, has significantly expanded its presence in South Korea through aggressive pricing and localized services. The company tailored its app and offerings to Korean preferences, enabling enhanced customer experiences. This includes support for domestic payment systems, regional customer service, and specialized promotions. By reinforcing its localization strategy, Trip.com is steadily advancing its market position and competing closely with established South Korean travel agencies.

- February 2025: EaseMyTrip, India’s leading online travel platform, has partnered with the Korea Tourism Organization (KTO) through a new MoU to promote South Korea as a prime destination for Indian travelers. The agreement includes a dedicated Korea microsite featuring curated itineraries, travel guides, and attractions, alongside co-branded content such as blogs, videos, and social media campaigns. EaseMyTrip will expand outreach to Tier 2 and Tier 3 cities in India, while providing KTO with insights into Indian traveler preferences. This collaboration aims to deliver seamless booking experiences and elevate Korea’s appeal.

South Korea Online Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Transportation, Travel Accommodation, Vacation Packages |

| Platforms Covered | Mobile, Desktop |

| Mode of Bookings Covered | Online Travel Agencies (OTAs), Direct Travel Suppliers |

| Age Groups Covered | 22-31 Years, 32-43 Years, 44-56 Years, Above 56 Years |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea online travel market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea online travel market on the basis of service type?

- What is the breakup of the South Korea online travel market on the basis of platform?

- What is the breakup of the South Korea online travel market on the basis of mode of booking?

- What is the breakup of the South Korea online travel market on the basis of age group?

- What is the breakup of the South Korea online travel market on the basis of region?

- What are the various stages in the value chain of the South Korea online travel market?

- What are the key driving factors and challenges in the South Korea online travel market?

- What is the structure of the South Korea online travel market and who are the key players?

- What is the degree of competition in the South Korea online travel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea online travel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea online travel market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea online travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)