South Korea Precious Metals Market Report by Metal Type (Gold, Platinum, Silver, Palladium, and Others), Application (Jewelry, Investment, Electricals, Automotive, Chemicals, and Others), and Region 2025-2033

Market Overview:

The south korea precious metals market size reached USD 4.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.8 Billion by 2033, exhibiting a growth rate (CAGR) of 5.13% during 2025-2033. The inflating popularity of holding physical assets outside of the financial system, along with the growing adoption of these elements as a popular form of investment, is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.8 Billion |

| Market Growth Rate (2025-2033) | 5.13% |

Precious metals denote rare metallic chemical elements with significant economic value. They generally exhibit lower reactivity compared to most elements, possess high luster and ductility, and serve as efficient conductors of both electricity and heat. Their malleability allows for shaping without breakage, either through hammering or pressing. Prominent examples of precious metals include gold, silver, platinum, palladium, and rhodium. Gold stands out as the most popular, extensively employed in jewelry design, investments, electronics, dentistry, and coinage. Silver finds application in jewelry and coins, extending to medical, electrical, and industrial uses. Platinum serves as a catalyst in chemical reactions, alongside applications in jewelry and electronics. Palladium sees use in electronics, jewelry, and catalytic processes, while rhodium is employed in catalysts and electronic components. Precious metals, valued for their scarcity and diverse applications, often serve as a secure asset during periods of economic uncertainty.

South Korea Precious Metals Market Trends:

South Korea's precious metals market is driven by a combination of economic dynamics and domestic trends. The increasing demand for gold and silver arises from their traditional role as safe-haven assets during times of economic uncertainty, which is primarily driving the market growth. Additionally, in South Korea, this is influenced by the country's robust economy and the awareness of precious metals as a secure investment. Besides this, the technological sector is a significant driver, with South Korea being a major player in electronics. Moreover, the use of precious metals like platinum, palladium, and rhodium in electronic components and catalytic processes contributes to the market growth. Moreover, the cultural significance of precious metals, especially gold, in jewelry and traditional ceremonies, sustains steady demand. South Korea's commitment to sustainability aligns with the emerging trend of eco-friendly practices, fostering interest in recycled precious metals. This, in turn, is projected to fuel the regional market over the forecasted period.

South Korea Precious Metals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on metal type and application.

Metal Type Insights:

- Gold

- Jewelry

- Investment

- Technology

- Others

- Platinum

- Auto-catalyst

- Jewelry

- Chemical

- Petroleum

- Medical

- Others

- Silver

- Industrial Application

- Jewelry

- Coins and Bars

- Silverware

- Others

- Palladium

- Auto-catalyst

- Electrical

- Dental

- Chemical

- Jewelry

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the metal type. This includes gold (jewelry, investment, technology, and others), platinum (auto-catalyst, jewelry, chemical, petroleum, medical, and others), silver (industrial application, jewelry, coins and bars, silverware, and others), palladium (auto-catalyst, electrical, dental, chemical, jewelry, and others), and others.

Application Insights:

- Jewelry

- Investment

- Electricals

- Automotive

- Chemicals

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes jewelry, investment, electricals, automotive, chemicals, and others.

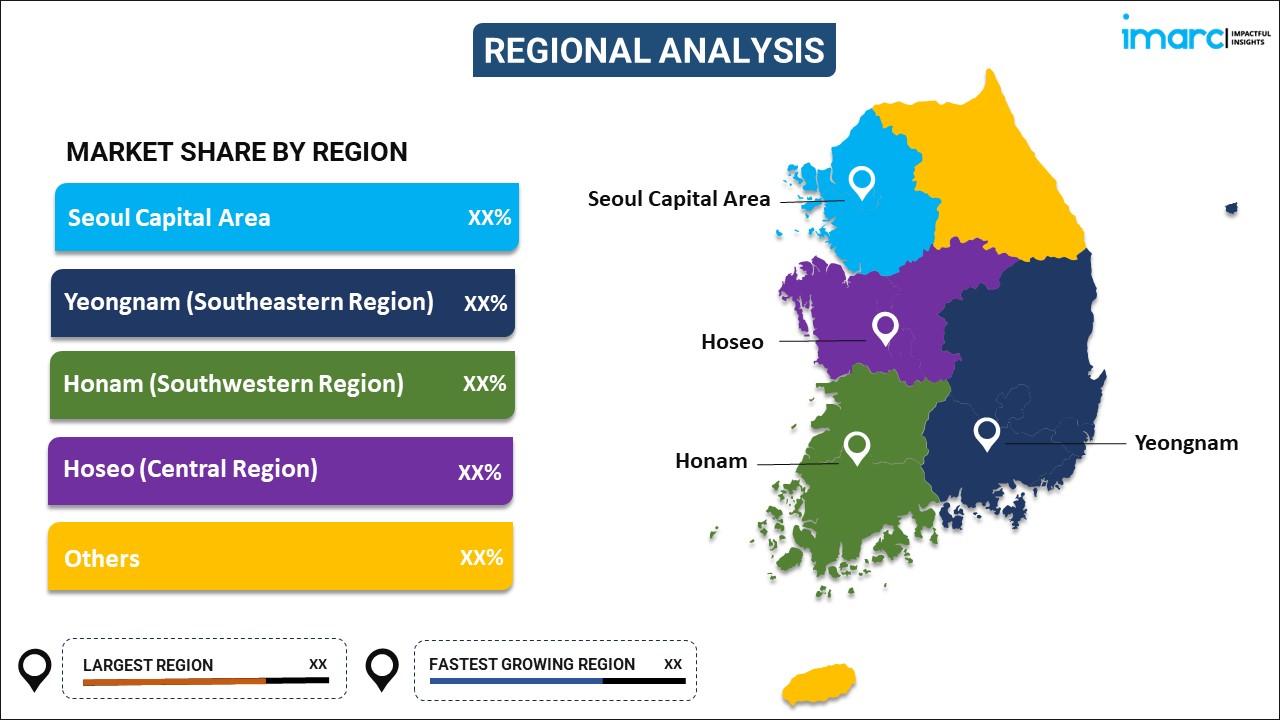

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Precious Metals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Metal Types Covered |

|

| Applications Covered | Jewelry, Investment, Electricals, Automotive, Chemicals, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea precious metals market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea precious metals market on the basis of metal type?

- What is the breakup of the South Korea precious metals market on the basis of application?

- What are the various stages in the value chain of the South Korea precious metals market?

- What are the key driving factors and challenges in the South Korea precious metals?

- What is the structure of the South Korea precious metals market and who are the key players?

- What is the degree of competition in the South Korea precious metals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea precious metals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea precious metals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea precious metals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)