South Korea Urea Market Size, Share, Trends and Forecast by Grade, Application, End Use Industry, and Region, 2025-2033

South Korea Urea Market Overview:

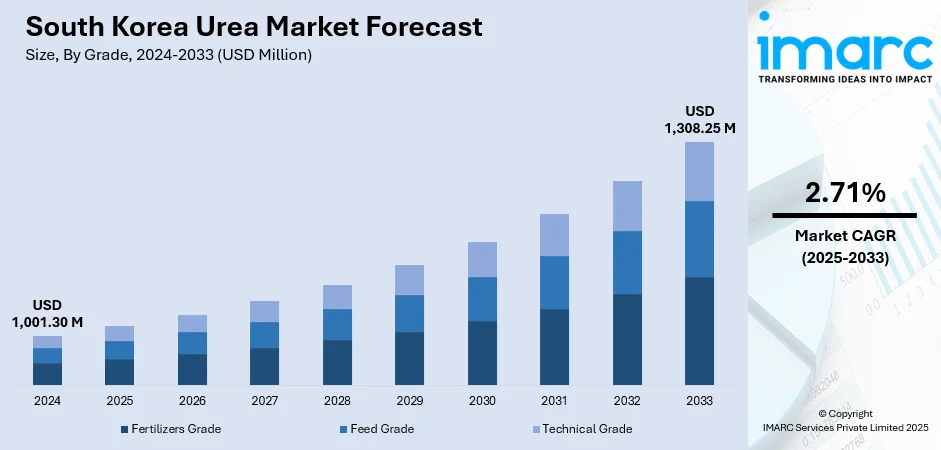

The South Korea urea market size reached USD 1,001.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,308.25 Million by 2033, exhibiting a growth rate (CAGR) of 2.71% during 2025-2033. Urea demand in South Korea continues to grow, driven by its vital role in both agriculture and textile manufacturing. In agriculture, it provides essential nitrogen for crop growth, helping maximize yields on limited farmland and supporting national food security. Additionally, the growing use of urea in textile industry to enhance dye absorption is contributing to the expansion of the South Korea urea market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,001.30 Million |

| Market Forecast in 2033 | USD 1,308.25 Million |

| Market Growth Rate 2025-2033 | 2.71% |

South Korea Urea Market Trends:

Growing Demand for Fertilizers

South Korea's farming industry continues to be a significant contributor to urea demand because of its reliance on high-nitrogen fertilizers to maintain production on scarce cultivable land. Crops, such as rice and various horticultural products, depend on regular nitrogen application, and urea remains the most used source because of its affordability and suitability for local soil and climate factors. Moreover, South Korea’s fertilizer market attained USD 3.5 billion in 2024, and forecasts by IMARC Group indicate it will increase to USD 5.2 billion by 2033, expanding at a CAGR of 4.2% from 2025 to 2033. Urea, being the most widely utilized nitrogen fertilizer, represents a significant share of this market and is anticipated to continue playing a key role in agricultural strategies, supply agreements, and policy debates regarding farm efficiency. Furthermore, farming methods in South Korea are closely regulated, featuring controlled planting and harvesting periods that lead to stable fertilizer usage year-round. Big cooperatives and agribusinesses handle a significant portion of the buying, aiding in stabilizing demand and reducing seasonal fluctuations. Distributors frequently accumulate inventory during times of advantageous global prices or due to import worries, thereby enhancing market activity. The link between fertilizer access and food production is robust, positioning urea as a critical input for ensuring national food security.

To get more information on this market, Request Sample

Rising Employment in Textile and Dyeing Industry

The increasing use of urea in the textile and dyeing industry for enhancing color quality and ensuring precision in fabric treatment is bolstering the South Korea urea market growth. Its ability to retain moisture during printing and finishing helps create sharp, vibrant colors with consistent penetration across materials like cotton. This results in high-quality, uniform output that meets the standards of both domestic and export markets. Urea’s contribution to maintaining optimal humidity during the heat-setting stage is particularly valued in large-scale production environments. Moreover, the growing focus of the governing body in enhancing the textile industry is positively influencing the market. For instance, in 2024, South Korea revealed a 2030 plan to rejuvenate its textile and fashion sector, committing KRW 2.9 trillion in funding and setting objectives such as AI integration, enhanced manufacturing, and skill development. The strategy involves educating 1,000 specialists by 2028 to upgrade textile manufacturing and incorporate advanced technologies. This drive for innovation is anticipated to boost the need for specialty chemicals, such as urea, particularly in precise dyeing and fabric processing techniques that remain reliant on dependable chemical supplies. As textile companies increase production and aim to enhance product quality for local and international markets, urea continues to be an essential component for maintaining uniform finish and color effectiveness.

South Korea Urea Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on grade, application, and end use industry.

Grade Insights:

- Fertilizers Grade

- Feed Grade

- Technical Grade

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes fertilizers grade, feed grade, and technical grade.

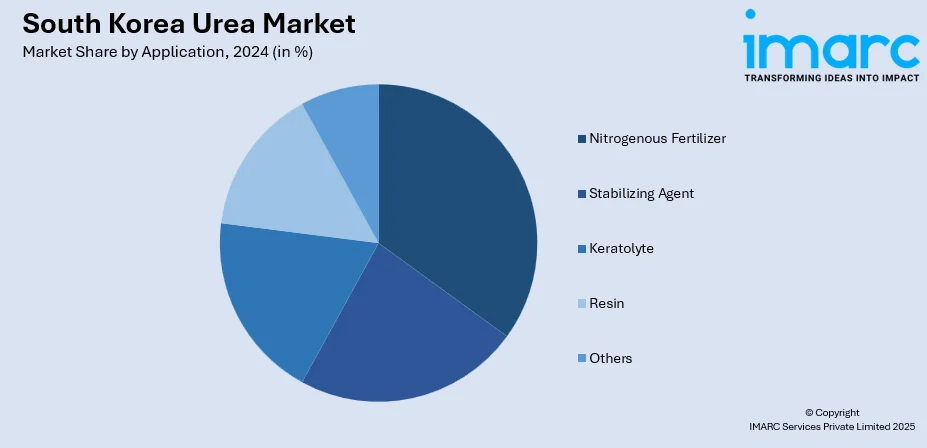

Application Insights:

- Nitrogenous Fertilizer

- Stabilizing Agent

- Keratolyte

- Resin

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes nitrogenous fertilizer, stabilizing agent, keratolyte, resin, and others.

End Use Industry Insights:

- Agriculture

- Chemical

- Automotive

- Medical

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes agriculture, chemical, automotive, medical, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Urea Market News:

- In January 2024, PVFCCo signed an MoU with South Korea's Iksan city and Aton Industry Company to supply 1,500 tons of urea monthly. This partnership aimed to ensure a stable urea supply.

South Korea Urea Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | Fertilizers Grade, Feed Grade, Technical Grade |

| Applications Covered | Nitrogenous Fertilizer, Stabilizing Agent, Keratolyte, Resin, Others |

| End Use Industries Covered | Agriculture, Chemical, Automotive, Medical, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea urea market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea urea market on the basis of grade?

- What is the breakup of the South Korea urea market on the basis of application?

- What is the breakup of the South Korea urea market on the basis of end use industry?

- What is the breakup of the South Korea urea market on the basis of region?

- What are the various stages in the value chain of the South Korea urea market?

- What are the key driving factors and challenges in the South Korea urea market?

- What is the structure of the South Korea urea market and who are the key players?

- What is the degree of competition in the South Korea urea market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea urea market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea urea market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea urea industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)