South Korea Vegetable Oil Market Size, Share, Trends and Forecast by Oil Type, Application, and Region, 2025-2033

South Korea Vegetable Oil Market Overview:

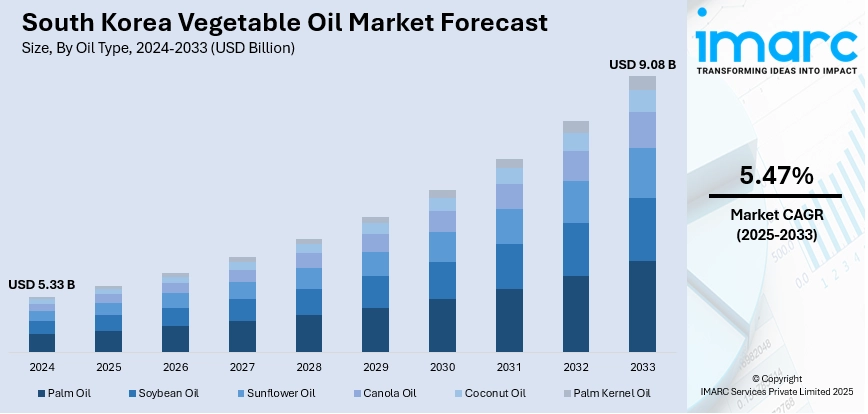

The South Korea vegetable oil market size reached USD 5.33 Billion in 2024. Looking forward, the market is projected to reach USD 9.08 Billion by 2033, exhibiting a growth rate (CAGR) of 5.47% during 2025-2033. The market is driven by high product usage in convenience foods, restaurant chains, and at-home cooking, reflecting modern culinary and lifestyle trends. Robust import infrastructure and trade-led procurement ensure stable supply across consumer and industrial channels. Functional and premium oil innovations in food and cosmetics are further augmenting the South Korea vegetable oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.33 Billion |

| Market Forecast in 2033 | USD 9.08 Billion |

| Market Growth Rate 2025-2033 | 5.47% |

South Korea Vegetable Oil Market Trends:

Evolving Culinary Patterns and Processed Food Demand

South Korea’s highly urbanized society has seen a marked rise in processed food consumption, convenience meals, and home-cooking kits, each of which relies heavily on vegetable oil. Sunflower, soybean, and canola oils are key components in fried snacks, instant noodles, and sauces used in dishes such as tteokbokki, ramen, and japchae. South Korea’s annual vegetable oil consumption totals 1.5–1.6 Million Metric Tons, with palm, soybean, and rapeseed oils making up 86%. In MY 2022/23, palm oil accounted for 41% of supply, soybean oil 36%, and rapeseed oil 9%, while other oils varied with global prices. Growing household preference for health-conscious products is leading to the adoption of non-GMO, low-saturated-fat, and trans-fat-free oils. In parallel, the restaurant and foodservice sector, which includes fried chicken chains and global fast-food franchises, sustains industrial-scale demand for deep-frying oil. Convenience stores and delivery platforms continue to proliferate across South Korea’s major cities, intensifying consumption of oil-dependent ready-to-eat meals. Online grocery platforms and health-oriented retail brands have also begun offering premium oils such as avocado, olive, and cold-pressed canola. These products appeal to affluent urban consumers seeking quality, flavor, and nutritional benefit. The dual-track growth of everyday bulk oil and premium alternatives ensures resilient, multi-tiered market demand. As Korea’s food culture embraces convenience alongside clean eating, the consistent use of oil in mass-market food production and emerging health formats drives South Korea vegetable oil market growth across traditional and modern consumption channels.

To get more information on this market, Request Sample

High Import Dependency and Strategic Sourcing Channels

South Korea is heavily reliant on vegetable oil imports, with minimal domestic oilseed cultivation due to limited arable land and climate constraints. The country primarily imports soybean, palm, and canola oils from nations including the US, Canada, Indonesia, and Malaysia. In 2023, South Korea's palm oil imports rose by 17% (101,000 Tons) to reach 688,000 Tons, making up 51% of total oil and fats imports. Soybean oil followed with a 28% share, highlighting palm oil’s dominance in the country’s import mix. Korean food conglomerates and trading houses manage long-term import contracts, hedging against price volatility and ensuring steady supply for both consumer retail and food manufacturing. Major processors refine imported crude oils at facilities located near industrial ports like Incheon and Busan, where efficient logistics and storage infrastructure facilitate large-scale distribution. Trade agreements such as KORUS FTA and CPTPP provide tariff advantages and regulatory clarity, improving cost competitiveness. The government actively monitors edible oil supply through the Ministry of Agriculture and KOFPI (Korea Food Promotion Institution), particularly during geopolitical or shipping disruptions. Strategic reserves and bilateral trade diplomacy help reduce exposure to supply shocks, while private firms are diversifying sourcing regions to strengthen resilience. This import-based, risk-managed supply chain is critical to ensuring food security and industrial continuity. As South Korea’s consumption rises, its structured and well-governed procurement system plays a central role in sustaining long-term supply consistency.

South Korea Vegetable Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on oil type and application.

Oil Type Insights:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Canola Oil

- Coconut Oil

- Palm Kernel Oil

The report has provided a detailed breakup and analysis of the market based on the oil type. This includes palm oil, soybean oil, sunflower oil, canola oil, coconut oil, and palm kernel oil.

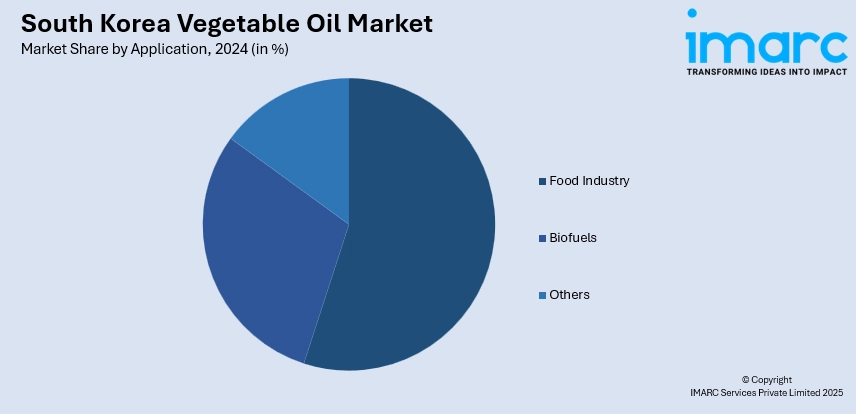

Application Insights:

- Food Industry

- Biofuels

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food industry, biofuels, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Vegetable Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Oil Types Covered | Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Coconut Oil, Palm Kernel Oil |

| Applications Covered | Food Industry, Biofuels, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea vegetable oil market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea vegetable oil market on the basis of oil type?

- What is the breakup of the South Korea vegetable oil market on the basis of application?

- What is the breakup of the South Korea vegetable oil market on the basis of region?

- What are the various stages in the value chain of the South Korea vegetable oil market?

- What are the key driving factors and challenges in the South Korea vegetable oil market?

- What is the structure of the South Korea vegetable oil market and who are the key players?

- What is the degree of competition in the South Korea vegetable oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea vegetable oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea vegetable oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea vegetable oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)