South Korea Wine Market Size, Share, Trends and Forecast by Product Type, Color, Distribution Channel, and Region, 2026-2034

South Korea Wine Market Size and Share:

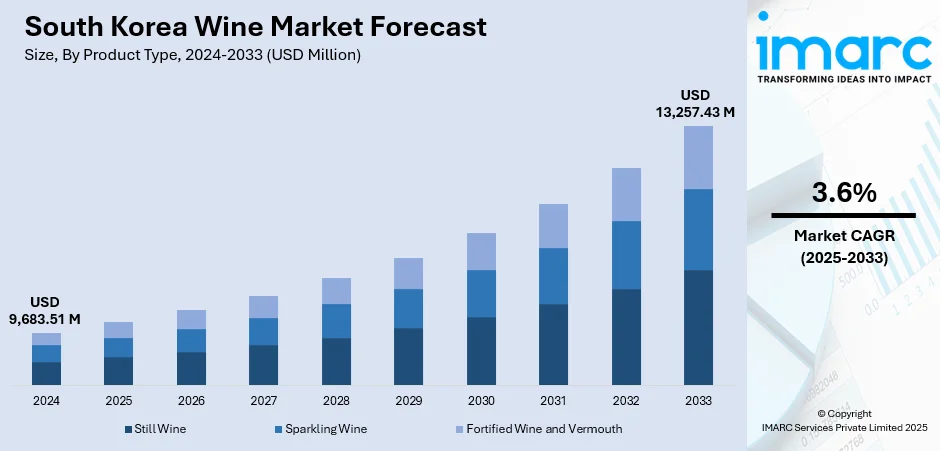

The South Korea wine market size was valued at USD 9,683.51 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 13,257.43 Million by 2034, exhibiting a CAGR of 3.6% from 2026-2034. Seoul Capital area currently dominates the market driven by the changing consumer lifestyles, with younger generations viewing wine as a trendy, healthier alternative to traditional spirits. Increased exposure to global cultures and cuisines has boosted wine’s popularity, especially in urban areas. The rise of e-commerce and relaxed alcohol regulations have made wine more accessible through online and convenience channels. Growing interest in wine education and tastings has also deepened consumer engagement, encouraging exploration of diverse wine types and origins further surging South Korea wine market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 9,683.51 Million |

| Market Forecast in 2034 | USD 13,257.43 Million |

| Market Growth Rate (2026-2034) | 3.6% |

South Korea's wine market is growing fast as a result of changing consumer tastes, particularly among young generations and urban professionals. Wine is becoming more perceived as an upscale and healthier beverage compared to mainstream spirits such as soju. Social media, global exposure, and the impact of Western eating culture have all further made wine consumption fashionable. Wine is increasingly being linked with leisure, dining, and individual enjoyment, as opposed to formal events. Increased home drinking culture after COVID and increasing interest in wine tastings and education also drive demand to inspire more consumers to try and buy both domestic and imported types of wine.

To get more information on this market, Request Sample

The rise of e-commerce and modern retail has been a significant driver of wine consumption in South Korea. Online platforms, convenience stores, and premium supermarkets have improved wine accessibility and variety. Recent deregulations allowing online alcohol promotions and easier delivery options have bolstered online wine sales. Retailers offer curated selections, targeted promotions, and wine subscription services that attract tech-savvy consumers. Additionally, partnerships between wine brands and lifestyle influencers or Korean celebrities help drive visibility. This expansion in distribution channels makes wine more approachable, convenient to purchase, and integrated into consumers’ everyday lives.

South Korea Wine Market Trends:

Evolving Consumer Demographics and Lifestyle Changes

Wine drinking in South Korea is undergoing a cultural transformation, largely driven by Millennials and Gen Z. These younger generations, influenced by international travel, global media, and a growing interest in wellness, increasingly view wine as a trendy, aspirational, and healthier alternative to traditional Korean spirits like soju and makgeolli. Wine is now associated with personal indulgence, refined dining, and social sophistication rather than formal or ceremonial occasions. The COVID-19 pandemic further normalized wine consumption at home, expanding its role in everyday life. A key demographic fueling this shift is women, who currently account for approximately 48% of the wine market—a figure expected to reach 60% within the next decade. Women are drawn to wine for its perceived elegance, moderate alcohol content, and variety. This generational and gender-driven shift is creating sustained demand for a wide range of domestic and imported wines across price points.

Growth of E-commerce and Omni-channel Retail

The overwhelming growth of online and omni-channel retail websites is a key South Korea wine market trend. The old limits on the advertising and sale of alcohol have slowly relaxed, opening the door for online sites to display wine offerings, make recommendations, and ship directly to consumers' doorsteps. Large e-commerce players like Coupang and Market Kurly now carry wide selections of wine with fast delivery options, which are appealing to busy urban residents. Subscription wine services and tasting box curation also involve consumers more by streamlining the discovery process. Off-trade channels such as convenience stores and higher-end supermarkets have also expanded their wine assortment, making wine more readily available in the country. This multi-channel retailing increases consumer convenience, variety, and engagement, generating higher trial and repeat rates. The combination of digital marketing, influencer promotions, and customized algorithms is transforming the way wine is discovered and bought in South Korea.

Rising Popularity of Wine Culture and Education

A growing public interest in wine culture and education is driving long-term market expansion in South Korea. Wine tasting sessions, certification courses (such as WSET), wine bars, and lifestyle experiences are gaining traction among consumers interested in increasing their knowledge and appreciation of wine. Social media influencers and sommeliers such as those on YouTube and Instagram demystify wine for novices and render it more accessible and less high-end. This cultural adoption is also evident in Korean television and K-dramas, which frequently showcase wine in urbane, lifestyle-driven situations. On the local front, there are wine festivals and government-supported campaigns that raise the profile of Korean wines domestically. As knowledge and appreciation intensify, consumers are shifting beyond entry-level wines to explore greater diversity of varietals, geographies, and prices. This increase in wine literacy is creating a more sophisticated and loyal base of customers, sustaining sustainable growth at all levels of the market.

South Korea Wine Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the South Korea wine market, along with forecast at the regional, and country levels from 2026-2034. The market has been categorized based on product type, color, and distribution channel.

Analysis by Product Type:

- Still Wine

- Sparkling Wine

- Fortified Wine and Vermouth

Based on the South Korea wine market forecast, still wine account for the majority share of 85.2% due to its broad appeal, accessibility, and alignment with local consumption habits. Consumers often perceive still wine—especially red and white—as versatile and suitable for various occasions, from casual meals to social gatherings. Its pairing compatibility with Korean cuisine, lower carbonation, and wide range of flavor profiles make it approachable for both new and experienced wine drinkers. Still wine is also more widely available across retail channels, including supermarkets, convenience stores, and online platforms. In addition, educational efforts, tastings, and social media content often spotlight still wines, further reinforcing consumer familiarity and comfort. These factors together contribute to still wine’s dominant position in the market and sustained consumer demand.

Analysis by Color:

- Red Wine

- Rose Wine

- White Wine

Red wine dominates South Korea’s wine market with a 67.8% share, largely due to its established perception as a sophisticated, health-beneficial beverage. Many South Korean consumers associate red wine with antioxidants and heart health, aligning with the country’s growing wellness trends. Red wine also pairs well with Korean cuisine, especially grilled meats and spicy dishes, making it a preferred choice for both dining and gifting occasions. Its richer flavor profiles appeal to traditional palates, while global exposure through media and travel has increased its appeal among younger demographics. Additionally, red wine’s visibility in K-dramas, social media, and lifestyle branding reinforces its image as classy and aspirational. These cultural, culinary, and health-related factors continue to sustain South Korea wine market growth.

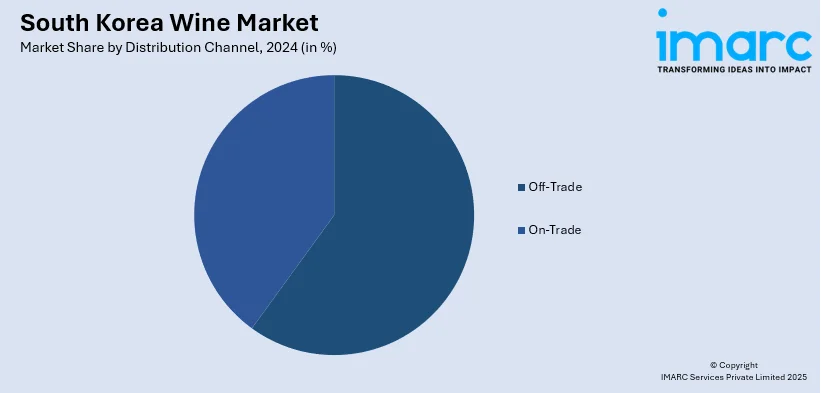

Analysis by Distribution Channel:

- Off-Trade

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

- On-Trade

Off-trade channels represent 71.1% of South Korea’s wine market share, reflecting the dominant role of retail purchases through supermarkets, convenience stores, liquor shops, and e-commerce platforms. This majority share is driven by rising consumer demand for at-home wine consumption, particularly after the COVID-19 pandemic, which normalized drinking wine in casual, private settings. The convenience, variety, and affordability of off-trade options appeal to busy urban consumers, especially Millennials and Gen Z. E-commerce growth, smart-order systems, and wine availability in everyday outlets like convenience stores have made wine more accessible than ever. Additionally, curated promotions, wine subscription services, and influencer marketing further enhance consumer engagement. These factors collectively make off-trade the preferred channel for wine purchases, supporting consistent market expansion and repeat buying behavior.

Regional Analysis:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

According to the South Korea wine market analysis, the Seoul Capital Area is the leading region in South Korea’s wine market due to its high population density, economic affluence, and cultural openness to global trends. Home to a large portion of the nation’s urban, middle- and upper-class consumers, the region drives demand for premium and imported wines. Its vibrant dining and nightlife scenes, along with a strong café and wine bar culture, make wine a popular choice for social and casual drinking. Additionally, advanced retail infrastructure, including high-end supermarkets and specialty wine shops, ensures wide product availability. E-commerce platforms are also highly developed in the area, offering convenient access to diverse wine selections. These factors collectively position the Seoul Capital Area as the dominant hub for wine consumption and market growth.

Competitive Landscape:

The market structure for wine in South Korea's wine market is competitive and growing more fragmented, fueled by increasing demand and varied consumer tastes. Foreign wine leads the market, with offerings from different nations competing at multiple price points and flavor profiles. Domestic producers are slowly winning favor, especially with consumers looking for distinctive or locally produced wines. The market observes intense rivalry between distributors, retailers, and online store platforms vying to provide handpicked assortments and improved consumer experiences. Branding, narrative, and packaging become key drivers of consumer decisions. Competition is increasingly moving from price competition to value competition, with an emphasis on quality, place, and lifestyle appeal as wine culture evolves. Marketing innovation, online engagement, and bespoke offerings further fuel the battle for market share.

The report provides a comprehensive analysis of the competitive landscape in the South Korea Wine market with detailed profiles of all major companies, including:

- Accolade Wines

- Bacardi Limited

- Pernod Ricard SA

Latest News and Developments:

- May 2025: Choi Ja, a hip-hop artist in South Korea, announced the launch of Molecular, a fruit wine developed from bokbunja. This creative fruit wine attempts to fill the gap between contemporary drinks and Korean cuisine.

- January 2025: South Korean alcoholic beverages manufacturer Hite Jinro announced its expansion in the United States wine market with the launch of two premium Oregon wines, the Bethel Heights Vineyard and the Shea Wine Cellar. This strategic action was taken just one month after the business was selected as the sole distributor of two exceptional wines, Founding Brothers and Hora, from another American winery.

- July 2024: Rathfinny Estate, a manufacturer of Sussex sparkling wines, established a partnership with Cave de Vin, a prominent importer of wines, to launch its premium wines in South Korea. The extensive launch program represents a significant turning point in Rathfinny's worldwide expansion aspirations for the APAC region and highlights Nimbility's strategic commitment to increasing awareness about premium English sparkling wines in the rapidly evolving South Korean market.

- June 2024: Gen.G, in collaboration with South Korean wine company Allvintage Wine, launched its custom wine brand, GenRang Wine, in South Korea. With this partnership, Gen.G and Allvintage Wine have become the first esports organization to release a wine product. At present, there are two novel wine options for sale: a Chilean red wine and a Chilean white.

South Korea Wine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Still Wine, Sparkling Wine, Fortified Wine and Vermouth |

| Colors Covered | Red Wine, Rose Wine, White Wine |

| Distribution Channels Covered |

|

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Companies Covered | Accolade Wines, Bacardi Limited, Pernod Ricard SA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea wine market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea wine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea wine industry and its attractiveness.

- A competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The South Korea wine market was valued at USD 9,683.51 Million in 2024.

The South Korea wine market is projected to exhibit a CAGR of 3.6% during 2025-2033, reaching a value of USD 13,257.43 Million by 2033.

Key factors driving South Korea's wine market include shifting consumer preferences toward healthier, sophisticated beverages, rising influence of Western dining culture, and increased wine accessibility through e-commerce and retail channels. Additionally, growing interest in wine education and lifestyle appeal encourages exploration and regular consumption among younger, urban demographics.

Seoul Capital Area currently dominates the South Korea wine market driven by its high population density, affluent consumers, and exposure to global trends. The region’s vibrant dining scene, premium retail outlets, and strong e-commerce infrastructure support wine accessibility and consumption, particularly among younger, trend-conscious, and health-aware urban professionals.

Some of the major players in the South Korea wine market include Accolade Wines, Bacardi Limited, Pernod Ricard SA, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)