Southeast Asia Cloud Computing Market Size, Share, Trends and Forecast by Service, Workload, Deployment Mode, Organization Size, Vertical, and Country, 2025-2033

Market Overview:

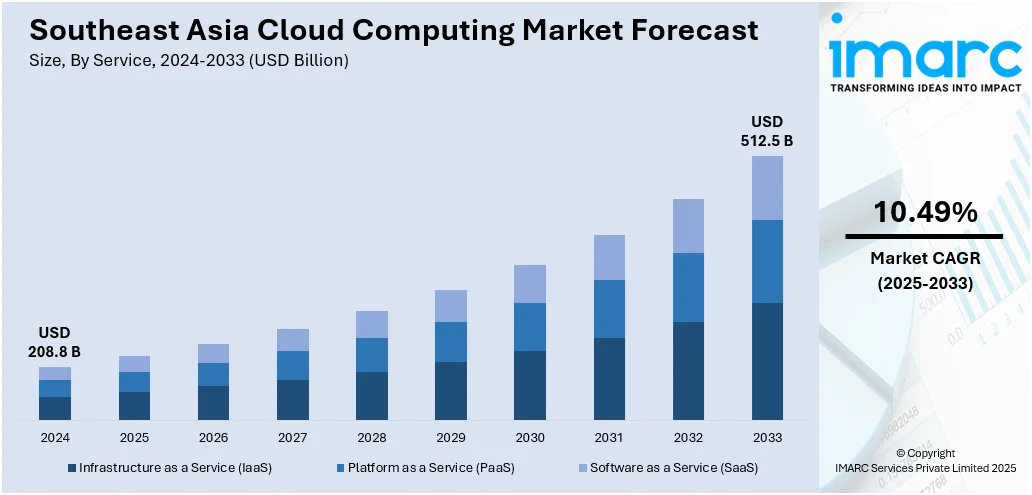

The Southeast Asia cloud computing market size reached USD 208.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 512.5 Billion by 2033, exhibiting a growth rate (CAGR) of 10.49% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 208.8 Billion |

|

Market Forecast in 2033

|

USD 512.5 Billion |

| Market Growth Rate (2025-2033) | 10.49% |

Cloud computing refers to the technology that delivers on-demand computing services over the internet. It uses a network of remote servers instead of a local server to manage, store, and process the data, making it accessible at any time from any location. Cloud computing primarily comprises of three types of services, including Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS). It is widely adopted by businesses for application development and testing, data storage and backup, resource management, orchestration services, etc. As a result, cloud computing finds numerous applications across diverse sectors, including IT and telecom, healthcare, BFSI, manufacturing, retail, media and entertainment, etc.

To get more information on this market, Request Sample

Southeast Asia Cloud Computing Market Trends:

The growing popularity of cloud services among organizations owing to numerous associated benefits, such as low initial infrastructure costs and availability of computing services on demand, is primarily driving the South Asia cloud computing market. In addition to this, the emerging trend of remote and hybrid working modules during the COVID-19 pandemic has resulted in an increased requirement for SaaS services that allow collaborative teams to access formerly centralized data and analytics. This is further augmenting the demand for cloud computing solutions in the region. Moreover, the rising utilization of cloud-based infrastructures across various industries, such as government and public sector, BFSI, healthcare, etc., due to the escalating need for enhanced security and better customer experience is acting as another signficant growth-inducing factor. Besides this, numerous initiatives by the Southeast Asian government bodies to encourage cloud adoption within the private and public sectors are also augmenting the regional market. For instance, the 'Cloud First' initiative by the Thailand government, which aims to shift 80% of public data to hybrid cloud systems, would enable the public sector to develop services quickly without investing a lot of money in ICT infrastructures, such as data centers or servers. Additionally, several organizations are increasingly opting for multi-cloud environments and specialized cloud services, with individual clouds used for scaling client-facing systems, big data analytics, machine learning, etc. This, in turn, is also creating a positive outlook for the market. Moreover, significant investments in R&D activities to offer innovative solutions for analytics cloud, cloud platforms, high-performance analytics appliances (HANA), and the business technology platform (BTP), are expected to drive the South Asia cloud computing market in the coming years.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Southeast Asia cloud computing market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on service, workload, deployment mode, organization size and vertical.

Breakup by Service:

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

Breakup by Workload:

- Application Development and Testing

- Business Analytics

- Data Storage, Backup and Disaster Recovery

- Integration and Orchestration

- Collaboration and Content Management

- Others

Breakup by Deployment Mode:

- Public

- Private

- Hybrid

Breakup by Organization Size:

- Large Enterprise

- Small and Medium Enterprise

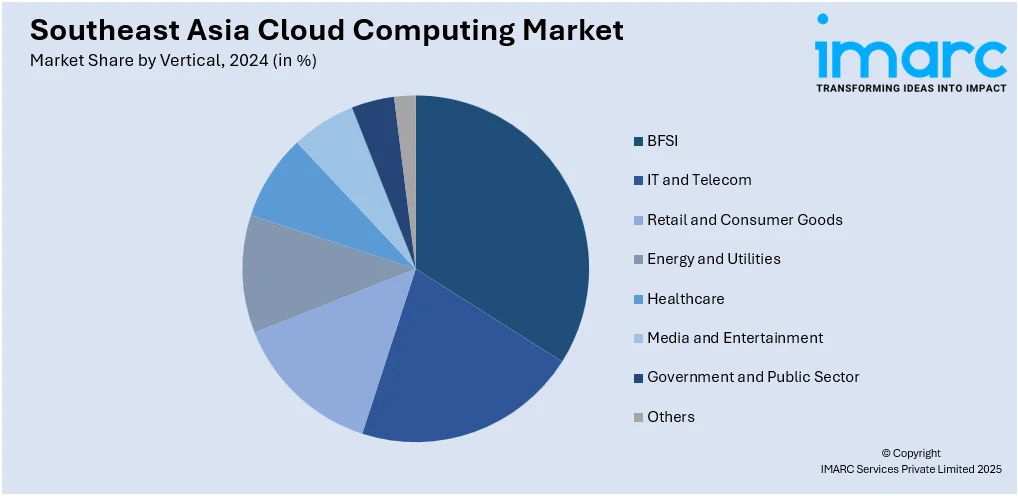

Breakup by Vertical:

- BFSI

- IT and Telecom

- Retail and Consumer Goods

- Energy and Utilities

- Healthcare

- Media and Entertainment

- Government and Public Sector

- Others

Breakup by Country:

- Indonesia

- Philippines

- Vietnam

- Malaysia

- Singapore

- Thailand

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined with some of the key players being Amazon Web Services Inc., Akamai Technologies, Inc., Alibaba Group Holding Limited, Cisco Systems, Inc., Dell Technologies Inc., Google LLC, Hewlett Packard Enterprise Company, Huawei Technologies Co. Ltd., and Microsoft Corporation, etc.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Service, Workload, Deployment Mode, Organization Size, Vertical, Country |

| Countries Covered | Indonesia, Philippines, Vietnam, Malaysia, Singapore, Thailand, Others |

| Companies Covered | Amazon Web Services Inc., Akamai Technologies, Inc., Alibaba Group Holding Limited, Cisco Systems, Inc., Dell Technologies Inc., Google LLC, Hewlett Packard Enterprise Company, Huawei Technologies Co. Ltd., and Microsoft Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

We expect the Southeast Asia cloud computing market to exhibit a CAGR of 10.49% during 2025-2033.

The rising deployment of cloud computing technology across various sectors, such as IT and telecom, healthcare, BFSI, etc., for application development and testing, data storage and backup, resource management, orchestration services, etc., is primarily driving the Southeast Asia cloud computing market.

The sudden outbreak of the COVID-19 pandemic has led to the growing adoption of cloud computing technology, as it allows collaborative teams to access formerly centralized data and analytics, during the remote working scenario across several Southeast Asian nations.

Based on the service, the Southeast Asia cloud computing market has been segmented into Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Among these, Software as a Service (SaaS) currently holds the majority of the total market share.

Based on the deployment mode, the Southeast Asia cloud computing market can be bifurcated into public, private, and hybrid. Currently, private exhibits a clear dominance in the market.

Based on the organization size, the Southeast Asia cloud computing market has been divided into large enterprise and small and medium enterprise, where large enterprise currently accounts for the largest market share.

Based on the vertical, the Southeast Asia cloud computing market can be segregated into BFSI, IT and telecom, retail and consumer goods, energy and utilities, healthcare, media and entertainment, government and public sector, and others. Currently, BFSI exhibits a clear dominance in the market.

On a regional level, the market has been classified into Indonesia, Philippines, Vietnam, Malaysia, Singapore, Thailand, and others, where Singapore currently dominates the Southeast Asia cloud computing market.

Some of the major players in the Southeast Asia cloud computing market include Amazon Web Services Inc., Akamai Technologies, Inc., Alibaba Group Holding Limited, Cisco Systems, Inc., Dell Technologies Inc., Google LLC, Hewlett Packard Enterprise Company, Huawei Technologies Co. Ltd., and Microsoft Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)