Soy Sauce Market Size, Share, Trends and Forecast by Type, Packaging, Distribution, Application, and Region, 2025-2033

Soy Sauce Market Size and Share:

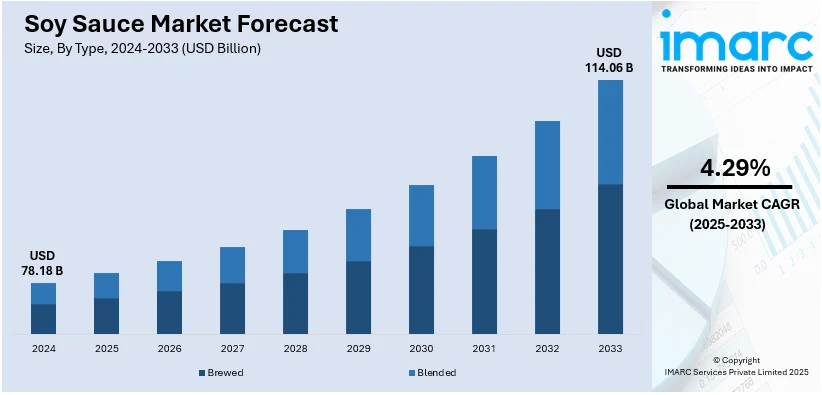

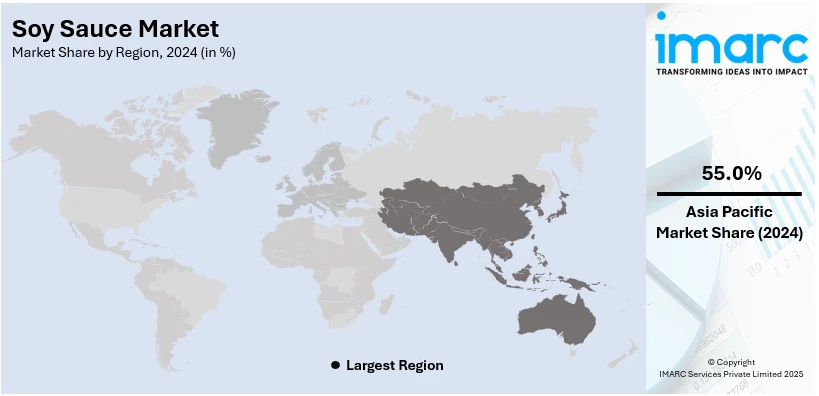

The global soy sauce market size was valued at USD 78.18 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 114.06 Billion by 2033, exhibiting a CAGR of 4.29% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 55.0% in 2024. The growing focus on healthy eating among the masses, increasing consumption of plant-based diets among health-conscious and vegan consumers, and rising number of restaurants serving Asian cuisine are some of the major factors propelling the soy sauce market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

| Historical Years | 2019-2024 |

|

Market Size in 2024

|

USD 78.18 Billion |

|

Market Forecast in 2033

|

USD 114.06 Billion |

|

Market Growth Rate 2025-2033

|

4.29% |

Soy sauce is a dark, savory condiment that is a mainstay of Asian cooking and is composed of fermented soybeans, wheat, water, and salt. It goes through a complicated process to develop its unique flavor and aroma. It has an umami-rich profile which contributes depth and complexity to soups, stews, and braises. It is a source of many essential amino acids, vitamins, and minerals. Soy sauce is applied broadly in cuisine since it enhances the flavor of diverse dishes. Soy sauce acts as a broad-spectrum seasoning and is also a major component of marinades, dressings, stir-fries, and dipping sauces. It can also be employed as a condiment used for adding flavors to sushi, sashimi, and other high-class dishes.

Currently, the growing popularity of Asian foods, such as Chinese, Japanese, Korean, Thai, and Vietnamese, is driving the growth of the market. Apart from this, the growing globalization of food culture owing to international tourism, migration, and social media is driving the growth of the market. Further, the rising usage of soy sauce in different restaurants, fast foods, and cafes to prepare savory dishes is providing a positive outlook for the market. Besides this, the augmenting presence of new soy sauce products, like low-sodium soy sauce, gluten-free soy sauce, organic and non-GMO types, and flavored soy sauces with add-ins such as garlic, ginger, and chili, is augmenting the growth of the market. Moreover, increasing numbers of e-commerce players selling high-quality soy sauce are further supporting the size of the soy sauce market.

The United States stands out as a key market disruptor, driven by evolving consumer preferences and increased awareness about diverse food cultures. While traditionally associated with Asian cuisine, soy sauce has gained significant popularity across various American food sectors, from Asian fusion to fast-casual dining. American consumers’ growing demand for plant-based and healthier food options has led to innovations in soy sauce, such as low-sodium, organic, and gluten-free varieties, catering to dietary preferences and health-conscious individuals. Furthermore, the rise in home cooking, driven by food blogs, social media, and cooking shows, has accelerated the adoption of soy sauce in everyday meals. The U.S. market also witnesses a surge in premium, artisanal soy sauces that offer distinct flavors, quality ingredients, and craft production methods, disrupting the traditional mass-market offerings. Additionally, with the growth of e-commerce, U.S. consumers can easily access global soy sauce brands, further transforming the market dynamics and driving global trends.

Soy Sauce Market Trends:

Rising Focus on Healthy Eating

The growing awareness about the maintenance of health and wellness among consumers is influencing their food choices. Soy sauce is perceived as a healthier alternative to other condiments due to its lower sodium content compared to table salt. In October 2023, Japanese foodmaker Ajinomoto launched its newest less-salt soy sauce, "Phu Si," targeting the healthy population in Vietnam. The soy sauce has 30% less salt compared to regular soy sauce, which coincides with growing demand for foods with lower salt content. Additionally, naturally brewed soy sauce contains beneficial compounds like antioxidants and phytochemicals, which are beneficial for reducing oxidative stress in the body. Besides this, soy sauce is used to make various healthy salad dressings and marinades for meat and tofu to provide a rich umami to the dishes. Soy sauce is also considered a good source of protein and a rich source of various minerals, such as magnesium, iron, and zinc, which are essential for various bodily functions. These factors are shaping the soy sauce market outlook.

Increasing Consumption of Plant-Based Diets

The soy sauce market is positively influenced by the rising shift toward plant-based diets and the increasing adoption of vegetarian and vegan lifestyles. The worldwide plant-based food market is projected to hit USD 77.8 Billion by 2025, as per industry reports, further propelling the demand for plant-based ingredients such as soy sauce. Soy sauce is a vegan-friendly condiment that adds umami flavors to plant-based dishes. Besides this, the rising demand for plant-based protein alternatives is promoting soy sauce as a versatile ingredient in vegetarian and vegan cooking. Soy sauce can also serve as a substitute for animal-based sauces and flavorings. Moreover, plant-based diets are preferred by health-conscious individuals as they are rich in antioxidants and minerals. Furthermore, they are easy to digest and prepare while offering the same flavors as any meat-based diet.

Growing Number of Restaurants and Fast-Food Centers

At present, there is an increase in the construction of restaurants and fast-food centers due to the rising demand for convenient food among the masses. There were 542,006 fast food restaurant businesses in the world as of 2023, which is a 0.9% increase from 2022, based on industry reports. These establishments offer convenient and diverse dining options for urban dwellers who may not have the time or ability to cook at home. Apart from this, individuals are ordering food online through apps and websites and getting their dishes delivered to home, which is fueling the business of restaurants and various fast-food centers. There is also an increase in the popularity of Asian food among the masses as they are flavorful and packed with nutrients. Furthermore, as the number of Asian eateries is increasing, the soy sauce demand is also rising.

Soy Sauce Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global soy sauce market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on type, packaging, distribution, and application.

Analysis by Type:

- Brewed

- Blended

Blended leads the market with around 53.8% of market share in 2024. Blended soy sauce is a type of soy sauce that is created by combining multiple varieties or types of soy sauce together. It is a popular condiment in many Asian cuisines, particularly in Japanese, Chinese, and Korean cooking. Blended soy sauce offers a unique flavor profile and several benefits that make it a versatile ingredient in various dishes. The blending of different soy sauce types allows for a harmonious balance of flavors. It involves combining different types of soy sauce, such as dark soy sauce, sweet soy sauce, and light soy sauce, in specific proportions to achieve a desired taste. This blending process results in a more complex flavor profile compared to using a single type of soy sauce.

Analysis by Packaging:

- Glass Jars

- Flexible Packs

- Plastic Jars

- Others

Glass jars lead the market with around 39.6% of market share in 2024. Glass jars provide efficient protection against air, moisture, and light, which can degrade the quality and flavor of soy sauce. The impermeable nature of glass helps to maintain the integrity of the sauce, preserving its original taste and aroma. Besides this, glass is non-reactive and does not interact chemically with soy sauce. This is important as soy sauce is acidic and can potentially react with certain packaging materials, such as plastic or metal, leading to changes in taste or quality. Glass jars also allow consumers to see the contents clearly. This is especially beneficial for soy sauce, as it comes in various colors and viscosities. The transparent nature of the glass allows customers to evaluate the quality, color, and consistency of the soy sauce before purchasing it.

Analysis by Distribution:

- Direct Sales

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Direct sales lead the market share in 2024. Direct sales enable soy sauce manufacturers to have full control over the distribution process, ensuring that the product reaches customers in optimal condition. They can directly monitor the storage, handling, and transportation of the soy sauce, reducing the risk of quality degradation or mishandling during distribution. Direct sales also allow for direct interaction and relationship-building with customers. This direct line of communication fosters trust and loyalty, enabling manufacturers to cater to customer needs more effectively and potentially increase customer satisfaction and retention. Direct sales provide an opportunity for soy sauce manufacturers to showcase their brand identity and share their unique stories with customers. Furthermore, they give manufacturers the flexibility to adjust their distribution strategies quickly in response to market trends or customer demands.

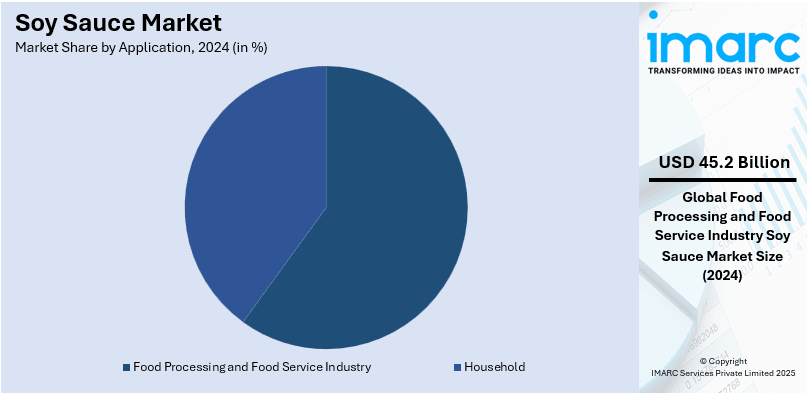

Analysis by Application:

- Household

- Food Processing and Food Service Industry

Food processing and food service industry leads the market with around 57.8% of market share in 2024. The food processing and food service industry relies on soy sauce as it has a rich, savory, and umami flavor. It adds depth, complexity, and a distinctive taste to various dishes. In the food processing industry, soy sauce is used as a flavor enhancer in a wide range of products, including marinades, sauces, dressings, seasonings, soups, and snacks. Its unique flavor profile helps create a balanced and appealing taste in processed foods. The food service industry requires soy sauce due to its ability to enhance flavor and add depth to a wide variety of dishes. It is used in a multitude of cuisines, from Asian-inspired dishes like stir-fries, sushi, and noodles, to fusion creations and even certain Western recipes. Chefs and cooks rely on soy sauce to infuse their dishes with a complex flavor profile and to balance other taste elements, such as sweetness, saltiness, and acidity.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 55.0%. Asia Pacific held the biggest market share due to the rising integration of soy sauce in a wide array of dishes to improve the taste. Another contributing aspect is the growing number of fine-dining restaurants offering premium-quality sushi and sashimi to consumers. In addition, the increasing availability of a wide variety of blended soy sauce is contributing to the growth of the market. North America is estimated to expand further in this domain due to the rising popularity of Asian cuisine in the region. Apart from this, the increasing emergence of fast-food centers and quick-service restaurants (QSRs) offering flavorful Asian dishes is supporting the growth of the market.

Key Regional Takeaways:

United States Soy Sauce Market Analysis

In 2024, the United States accounted for over 86.20% of the soy sauce market in North America. The United States leadership as the globe's top producer of soybeans and the world's second-largest exporter is among the major reasons for the increase in the U.S. market for soy sauce. Soybeans account for over 90 percent of the oilseed production of the country, as indicated in the USDA 2025 report, and represent a consistent and large supply of soybeans that is essential to the production of soy sauce. This robust production sector supports local producers of soy sauce by ensuring continual supplies of excellent quality soybeans for their manufacturing. In addition, the escalating demand for soya and vegan diets and an increased awareness level of the wellness implications associated with soy-based items are fueling the consumption of soy sauce within the U.S. Besides, as there is increasing demand for consuming Asian food and foodservice outlets to include soy sauce in their offerings, the United States market also has potential for growth. With continued expansion in healthy and natural condiment markets, the multifunctionality of soy sauce to serve as a flavor enhancer and offer health benefits further contribute to its increasing trend in the US.

Europe Soy Sauce Market Analysis

The French food delivery market is transforming at a rapid rate, as shown by 15 leading delivery apps with more than 120,000 downloads in 2022, according to industry reports. This growth in online ordering of food is a key driving factor for the Europe soy sauce market, as consumers increasingly seek convenience and diversity in their meals. Soy sauce, a staple in the majority of Asian foods, is becoming a trend condiment on many foods, and this has increased demand across the continent. As more consumers adopt the use of delivery services, exposure to food varieties expands, and with the fact that soy sauce is being employed as a main ingredient in traditional and fusion food, demand has risen. Moreover, the growing trend for healthier, plant-based, and vegan diets is also driving the consumption of soy sauce, being a plant-based condiment that is high in umami taste. This changing consumer preference combined with the rise in food delivery is driving the European soy sauce market.

Asia Pacific Soy Sauce Market Analysis

The Asia Pacific market for soy sauce is witnessing robust growth due to heightened investment in production capacity as well as an emphasis on innovation. For example, in September 2020, Kraft Heinz invested USD 100 Million in a new plant in Guangdong, China, with an estimated capacity of producing 200,000 tons of soy sauce per year. This investment underlines the mounting demand for soy sauce in the region. Furthermore, in August 2019, Kikkoman Corporation opened a new research and development facility in Japan, reaffirming Japan's dedication to improving the flavor and quality of soy sauce products. Consequently, the region is also witnessing an upsurge in new product launches, addressing varied consumer tastes. In addition, increasing demand for soy sauce in Asian nations such as China, Japan, and South Korea, together with the growing popularity of food from these regions all over the world, further drives the market. Greater production capacity and continuous innovation in taste and products drive a successful soy sauce market in the Asia Pacific region.

Latin America Soy Sauce Market Analysis

The Brazilian soybean output during the 2024-25 growing season will hit 169 million metric tons, industry reports suggest. The huge production volume makes Brazil a prominent figure in the international soybean market, and the outlook for the Latin America soy sauce market is favorable. Soybeans are an essential raw material in soy sauce manufacturing, and Brazil's increasing output guarantees a reliable supply to producers. With increasing demand for soy sauce in the region due to the increased popularity of Asian food and the rising trend of adopting plant-based diets, Brazil's strong production of soybeans backs the growth of the soy sauce market. The expanding middle-class population and changing consumer habits in Latin America also lead to the growing demand for various and tasty condiments such as soy sauce. This synergy of high soybean output and changing diet patterns makes Brazil a central figure in the Latin America soy sauce market growth.

Middle East and Africa Soy Sauce Market Analysis

In 2023, the United Arab Emirates (UAE) shipped out USD 708 Thousand worth of soybeans, ranking it as the 65th largest soybean exporter in the world, as indicated in the OEC report. The UAE's geographical location as a trade center in the Middle East facilitates its increasingly prominent role in the regional food sector, including the soy sauce market. Growing MEA demand for soy sauce results from the escalating consumer interest in Asian foods, driving an uptrend in soy-based condiment consumption. Also, the growing preferences in the region for healthy, plant-based diets favor consumption of soy sauce since it qualifies as a very versatile and vegan-friendly condiment. As food imports increase and domestic food processing capacity improves, the MEA soy sauce market is gaining advantage from increased availability and distribution of products. Soybean exports of the UAE combined with the popularity of soy products are key factors in the growth of the soy sauce market within the region.

Competitive Landscape:

Key market players are investing in product innovation to cater to evolving consumer preferences and dietary needs. They are also introducing new flavors, reduced-sodium options, organic and natural variants, and specialty or premium soy sauces to appeal to different customer segments. Top companies are working towards exploring organic farming methods and promoting fair trade practices. These initiatives help improve their brand image, meet consumer expectations, and contribute to environmental and social sustainability. Leading players are investing in quality control measures to maintain consistent and high-quality soy sauce products. They are also implementing rigorous testing procedures and quality certifications and are adhering to food safety standards. The market is highly competitive, with numerous players vying for market share. Soy sauce market price competition is a significant factor, as consumers are often price-sensitive when purchasing this common condiment. Manufacturers may engage in promotional activities, offer discounts, or introduce value-sized packages to attract customers and differentiate their products.

The report provides a comprehensive analysis of the competitive landscape in the soy sauce market with detailed profiles of all major companies, including:

- Bourbon Barrel Foods

- Foshan Haitian Flavoring & Food Corporation Limited

- Guangdong Meiweixian Flavoring Foods Corporation Limited

- Kikkoman Corporation

- Lee Kum Kee

- Nestlé S.A. (Maggi Sauces)

- Masan Group

- Otafuku Sauce Corporation Limited (Okonomi)

- Yamasa Corporation

Recent Developments:

- October 2024: Masan Group announced expansion of its retail-consumer platform to cater to local consumer demands. Since its listing in 2009, the company has enhanced its portfolio with strategic mergers and acquisitions. Key actions include the acquisition of a majority stake in Vinacafé Bien Hoa and the recent acquisition of the Phuc Long tea and coffee chain. The major milestone was in 2019 with the merger with VinCommerce, securing its foothold in the retail space.

- April 2024: Lee Kum Kee unveiled a brand campaign for its Supreme Soy Sauce with the theme of enriching dining experiences and emphasizing the pleasure of home cooking.

- In 2023: Kikkoman Corporation announced the reopening of the Kikkoman Soy Sauce Museum in Noda, Japan, where visitors will be presented with a wide range of information about the history and features of soy sauce.

- In 2023: Lee Kum Kee announced that they are partnering with renowned chefs to present the potential of authentic Asian sauces in THAIFEX.

Soy Sauce Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Brewed, Blended |

| Packagings Covered | Glass Jars, Flexible Packs, Plastic Jars, Others |

| Distributions Covered | Direct Sales, Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Applications Covered | Household, Food Processing, Food Service Industry |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bourbon Barrel Foods, Foshan Haitian Flavoring & Food Corporation Limited, Guangdong Meiweixian Flavoring Foods Corporation Limited, Kikkoman Corporation, Lee Kum Kee, Nestlé S.A. (Maggi Sauces), Masan Group, Otafuku Sauce Corporation Limited (Okonomi), Yamasa Corporation etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the soy sauce market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global soy sauce market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the soy sauce industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The soy sauce market was valued at USD 78.18 Billion in 2024.

The soy sauce market is projected to exhibit a CAGR of 4.29% during 2025-2033.

The soy sauce market is driven by growing global demand for Asian cuisine and international flavors. Health-conscious consumers fuel the demand for low-sodium, organic, and gluten-free options. Additionally, the rise of home cooking and premium, artisanal products, along with expanding distribution channels, further contributes to market growth.

Asia Pacific currently dominates the market driven by increasing demand for traditional and authentic Asian cuisine, with soy sauce as a key ingredient, along with the rising consumer preference for health-conscious options, including low-sodium and organic varieties.

Some of the major players in the soy sauce market include Bourbon Barrel Foods, Foshan Haitian Flavoring & Food Corporation Limited, Guangdong Meiweixian Flavoring Foods Corporation Limited, Kikkoman Corporation, Lee Kum Kee, Nestlé S.A. (Maggi Sauces), Masan Group, Otafuku Sauce Corporation Limited (Okonomi), Yamasa Corporation etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)