Spain Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End-User, and Region, 2026-2034

Spain Air Freight Market Overview:

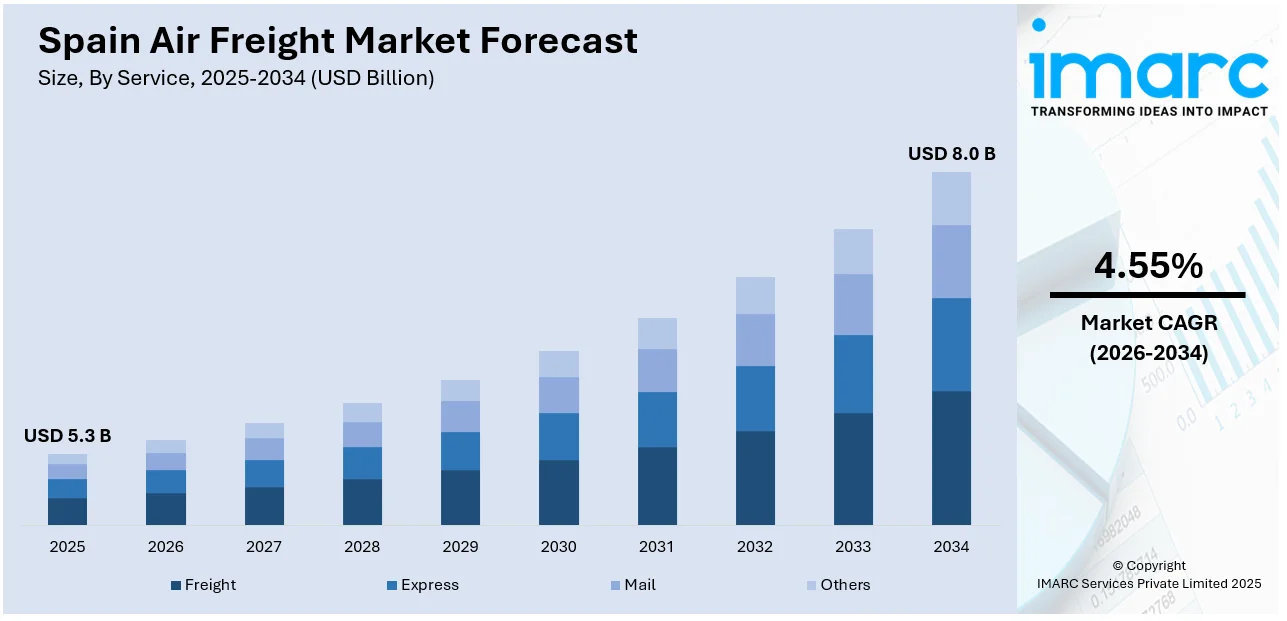

The Spain air freight market size reached USD 5.3 Billion in 2025. The market is projected to reach USD 8.0 Billion by 2034, exhibiting a growth rate (CAGR) of 4.55% during 2026-2034. The market is advancing steadily, supported by robust global trade flows, growing demand for express delivery, and the expansion of high-value industries like pharmaceuticals and electronics. Strategic investments in modernizing cargo terminals and enhancing digital logistics are optimizing operations. The country's geographic advantage strengthens its role in international air cargo routes, while sustainability initiatives are driving greener freight solutions. These positive developments continue to fuel the consistent rise in Spain air freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5.3 Billion |

| Market Forecast in 2034 | USD 8.0 Billion |

| Market Growth Rate 2026-2034 | 4.55% |

Spain Air Freight Market Trends:

Expansion of Cargo Infrastructure Enhances Capacity

Spain's air freight market is witnessing tremendous infrastructure development, and AENA's strategic investments at top-tier airports since 2024 have been instrumental in driving this growth. The modernization plan involves high-technology cargo terminals, increased apron capacity, and automating cargo handling procedures to enhance throughput and operating efficiency. Madrid-Barajas and Barcelona-El Prat airports are already beneficiaries of massive upgrades, whereas regional facilities like Valencia and Zaragoza are witnessing phased expansions. Also, new cargo community systems are being rolled out to simplify customs clearance and enable real-time tracking of shipments, ensuring effortless coordination among logistics operators, airlines, and customs. Spain's embracement of digital and physical enhancements makes it an essential gateway for trade flows between Europe, Africa, and Latin America. Such emphasis on modernization allows Spain to process higher volumes of high-value, temperature-controlled, and time-sensitive shipments with greater accuracy and dependability. The long-term improvements directly contribute to Spain air freight market growth, sustaining its competitive advantage in the changing global logistics network.

To get more information on this market Request Sample

Growing Adoption of Real-Time Tracking Technologies

Spain’s air freight sector is rapidly adopting real-time tracking technologies to enhance transparency, efficiency, and customer satisfaction. In mid-2024, Iberia Cargo introduced advanced shipment tracking systems at Madrid-Barajas Airport, enabling full visibility across the entire logistics chain. These solutions allow stakeholders to monitor cargo location, condition, and expected arrival times, which is particularly critical for sensitive shipments such as pharmaceuticals, perishables, and high-value goods. Integrated digital customs processing is also streamlining documentation workflows, reducing clearance times and minimizing manual errors. Additionally, predictive analytics are being used to forecast demand patterns, optimize warehouse operations, and better allocate resources during peak periods. Automated gate management systems are improving terminal flow, reducing delays, and supporting sustainable operations through lower emissions. As real-time tracking becomes a core feature across Spain’s freight infrastructure, it is redefining Spain air freight market trends, enabling greater reliability, operational precision, and long-term growth in an increasingly competitive global logistics environment.

Digital Booking Platforms Enhance Customer Convenience

The adoption of digital cargo booking platforms is becoming a transformative trend within Spain’s air freight industry. In April 2025, Air Europa partnered with Freightos’ WebCargo platform to introduce real-time digital booking capabilities. This system allows freight forwarders to instantly access pricing, available capacity, and directly book shipments for both domestic and international routes. Initially launched for key hubs like Madrid, Barcelona, and Valencia, the platform’s coverage is steadily expanding to include broader European and transatlantic connections. Beyond simple booking, the platform integrates automated documentation, real-time shipment status updates, and digital payment systems, simplifying end-to-end cargo management. This technology empowers shippers with greater flexibility, faster response times, and full transparency, improving overall logistics planning and execution. As digital booking becomes more widespread, it is reshaping Spain air freight market, fostering a more agile, customer-centric logistics ecosystem that aligns with evolving demands for efficiency, visibility, and responsive service in global trade.

Spain Air Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on service, destination, and end-user.

Service Insights:

- Freight

- Express

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes freight, express, mail, and others.

Destination Insights:

- Domestic

- International

A detailed breakup and analysis of the market based on the destination have also been provided in the report. This includes domestic and international.

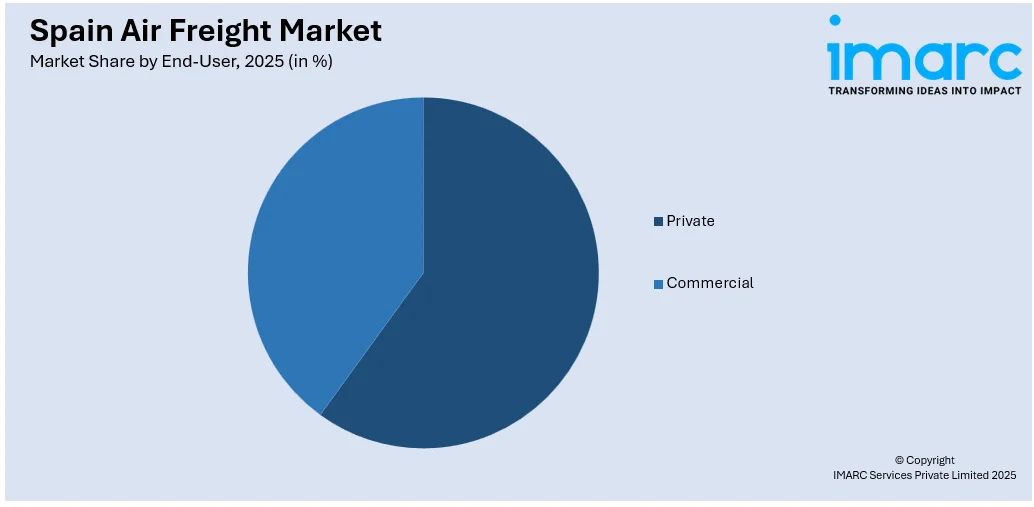

End-User Insights:

Access the comprehensive market breakdown Request Sample

- Private

- Commercial

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes private and commercial.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Air Freight Market News:

- In April 2025: Spanish carrier Air Europa has strengthened its digital strategy by integrating with WebCargo by Freightos, placing its cargo capacity on the leading online booking portal. Initially focused on Spanish export routes Madrid to Barcelona, Bilbao and Valencia the rollout grants freight forwarders real-time access to its 15 domestic and 40 international destinations across Europe, Latin America and North America. This move enhances booking efficiency, visibility, and route options via Madrid-Barajas, further driving digitisation in the Spain-Latin America corridor.

- In January 2025: Logwin Solutions Spain has expanded its Spanish footprint with the acquisition of World Pack Express and Alpha Automotive Solutions, both Barcelona-based, finalized in December. The move bolsters Logwin’s service, particularly in automotive, healthcare, express parcels, last-minute pickups, and bulky goods transport by leveraging enhanced fleet capacity and route reach. Pierre Sampermans, MD of Logwin Spain, emphasized the strategic synergies and improved efficiency to meet evolving customer needs while strengthening its Catalonia presence.

Spain Air Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End-Users Covered | Private, Commercial |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain air freight market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain air freight market on the basis of service?

- What is the breakup of the Spain air freight market on the basis of destinations?

- What is the breakup of the Spain air freight market on the basis of end-user?

- What is the breakup of the Spain air freight market on the basis of region?

- What are the various stages in the value chain of the Spain air freight market?

- What are the key driving factors and challenges in the Spain air freight?

- What is the structure of the Spain air freight market and who are the key players?

- What is the degree of competition in the Spain air freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain air freight market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain air freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain air freight market and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)