Spain ATM Market Size, Share, Trends and Forecast by Solution, Screen Size, Application, ATM Type, and Region, 2026-2034

Spain ATM Market Summary:

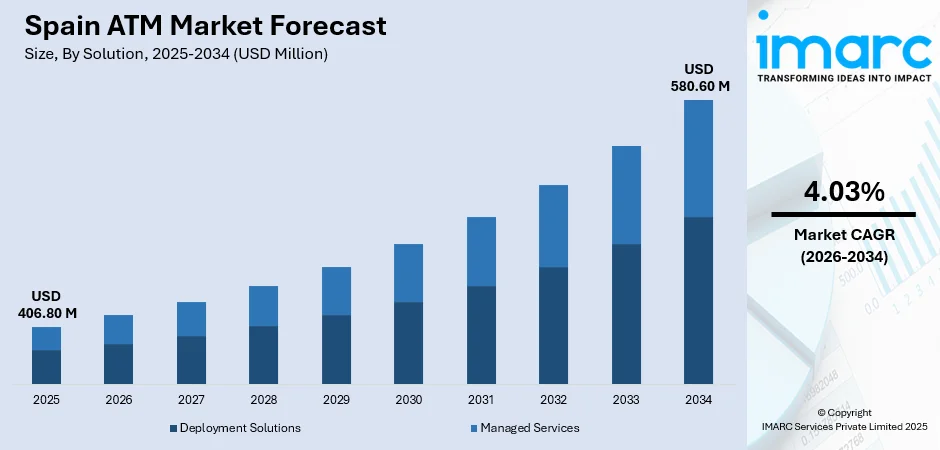

The Spain ATM market size reached USD 406.80 Million in 2025. Looking forward, the market is projected to reach USD 580.60 Million by 2034, exhibiting a compound annual growth rate of 4.03% during 2026-2034.

The Spain ATM market is experiencing steady growth driven by the increasing demand for self-service banking solutions and advanced technological integrations. Financial institutions across the country are investing in modern ATM infrastructure to enhance customer convenience and operational efficiency. The deployment of cash-recycling machines, biometric authentication systems, and contactless payment options is transforming the traditional ATM landscape. Government initiatives focused on financial inclusion in rural areas, combined with regulatory mandates for accessibility compliance, are further expanding the Spain ATM market share.

Key Takeaways and Insights:

- By Solution: Deployment solutions dominate the market with approximately 58% revenue share in 2025, driven by the extensive network of bank-operated ATMs across major financial institutions and the strategic placement of machines in high-traffic commercial and retail locations.

- By Screen Size: Above 15" leads the market with a 70% share in 2025, owing to enhanced user experience requirements, improved accessibility for elderly populations, and compliance with European Accessibility Act mandates for larger, more visible interfaces.

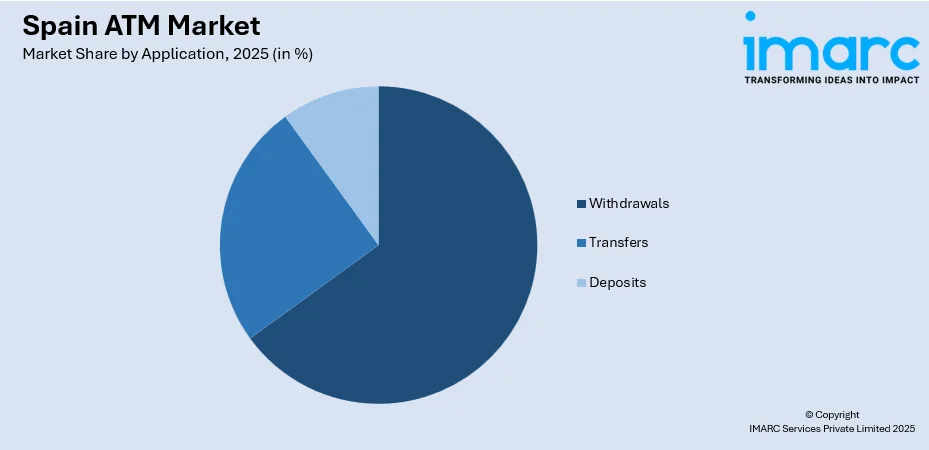

- By Application: Withdrawals represent the largest segment with approximately 65% market share in 2025, reflecting Spain's strong cash culture where cash transactions account for the majority of point-of-sale payments across retail and service sectors.

- By ATM Type: Conventional/bank ATMs dominate with a 50% share in 2025, supported by major Spanish banks maintaining extensive proprietary networks to serve their customer bases and maintain brand presence in urban and suburban areas.

- Key Players: The Spain ATM market exhibits moderate competitive intensity, with multinational technology corporations and financial institutions competing across deployment and managed services segments.

To get more information on this market Request Sample

The Spain ATM market is driven by the convergence of technological innovation and financial inclusion objectives. Financial institutions are upgrading their ATM fleets with advanced security features including biometric authentication and real-time fraud detection systems to address growing cybersecurity concerns. The expansion of ATM networks into rural and underserved communities represents a strategic priority, with major banks extending mobile branch services and installing cash machines in previously unbanked municipalities. The implementation of the European Accessibility Act in June 2025 is accelerating the modernization of ATM infrastructure to accommodate users with disabilities through features such as audio guidance, larger displays, and tactile interfaces. For instance, in January 2024, a leading Spanish bank announced the expansion of its financial services to 484 new rural towns, enhancing access through ATM installations and mobile branch deployments.

Spain ATM Market Trends:

Adoption of Advanced ATM Technologies

The Spanish ATM market is witnessing significant migration toward advanced technologies that enhance customer experience and security. Cash-recycling ATMs enabling both deposits and withdrawals are gaining prominence as financial institutions seek to optimize cash flow management and reduce operational costs associated with physical cash replenishment. Biometric verification systems utilizing fingerprint and facial recognition technology are increasingly being integrated into ATM networks, providing secure and seamless authentication while reducing fraud risks. Contactless payment capabilities are expanding, facilitating quicker and more convenient transactions without card insertion. These innovations streamline the ATM experience while delivering enhanced security measures to protect user information.

Expansion of Financial Services in Rural Areas

The expansion of ATMs in rural and underserved areas is gaining momentum as part of coordinated efforts to improve financial inclusion across Spain. Banking associations have implemented roadmaps to reinforce financial access in rural communities, prioritizing municipalities that previously lacked face-to-face banking services. Mobile branch networks traveling to remote locations are complementing fixed ATM installations, providing comprehensive banking services including cash deposits, withdrawals, bill payments, and account management. The integration of ATMs with digital banking platforms is creating seamless experiences for customers who lack access to traditional bank branches. This expansion is proving crucial in bridging the financial gap and enhancing banking service accessibility nationwide.

Accessibility-Focused ATM Modernization

The implementation of the European Accessibility Act through Spain's Law 11/2023 is driving significant modernization of ATM infrastructure to accommodate users with disabilities and elderly populations. New ATM installations must now feature multisensory information delivery including visual, auditory, and tactile outputs to serve users with varying abilities. Mandatory accessibility features include larger text displays, improved color contrast, audio guidance through headphone jacks, and height-adjustable interfaces for wheelchair users. Financial institutions are investing in ATM redesigns that prioritize inclusive user experiences, recognizing that cash access remains essential for aging communities and individuals who face challenges with digital banking platforms.

Market Outlook 2026-2034:

The Spain ATM market trajectory is supported by continued demand for self-service banking solutions, strategic expansion into underserved communities, and technological advancements in ATM security and functionality. Financial inclusion initiatives combined with regulatory requirements for accessible banking infrastructure are expected to sustain investment in ATM network expansion and modernization throughout the forecast period. The market generated a revenue of USD 406.80 Million in 2025 and is projected to reach a revenue of USD 580.60 Million by 2034, growing at a compound annual growth rate of 4.03% from 2026-2034.

Spain ATM Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Solution | Deployment Solutions | 58% |

| Screen Size | Above 15" | 70% |

| Application | Withdrawals | 65% |

| ATM Type | Conventional/Bank ATMs | 50% |

Solution Insights:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

Deployment solutions dominate the market with a 58% share of the total Spain ATM market in 2025.

The deployment solutions segment encompasses the physical installation and operation of ATM hardware across various location types, representing the core infrastructure of Spain's cash access network. Major Spanish banks maintain extensive proprietary ATM networks. The strategic placement of onsite ATMs within bank branches and offsite ATMs in retail locations, shopping centers, and transportation hubs ensures comprehensive geographic coverage for customers. The demand for deployment solutions is further strengthened by government and banking sector initiatives to address financial inclusion in underserved areas. Additionally, mobile ATMs are being deployed in rural communities through coordinated programs between financial institutions and public entities, helping to bridge the gap created by bank branch closures in sparsely populated regions.

Screen Size Insights:

- 15" and Below

- Above 15"

Above 15" leads the market with a 70% share of the total Spain ATM market in 2025.

The preference for larger screen ATMs in Spain reflects the evolving requirements for enhanced user interfaces, improved visibility, and accommodation of aging populations who benefit from clearer, more legible displays. Larger screens enable more intuitive navigation, better presentation of transaction options, and integration of advanced features such as video banking and marketing content, contributing to improved customer satisfaction and transaction efficiency across the ATM network. The implementation of the European Accessibility Act from June 2025 is accelerating the adoption of larger screen ATMs as financial institutions upgrade their fleets to meet new accessibility mandates. These regulations require multisensory information display, enhanced contrast ratios, and improved legibility for users with visual impairments.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Withdrawals

- Transfers

- Deposits

Withdrawals represent the largest segment with a 65% share of the total Spain ATM market in 2025.

Cash withdrawals remain the predominant ATM transaction type in Spain, reflecting the country's strong cash culture and consumer preferences for physical currency in everyday transactions. The withdrawal segment benefits significantly from Spain's thriving tourism industry. Foreign tourists frequently utilize ATMs to access local currency, particularly in popular destinations such as Catalonia, the Balearic Islands, and Andalusia. The tourism sector's strong performance, with projections indicating continued growth through 2025 and beyond, ensures sustained demand for accessible cash withdrawal services throughout Spain's extensive ATM network.

ATM Type Insights:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

Conventional/Bank ATMs holds the largest share with approximately 50% of the total Spain ATM market in 2025.

Conventional bank ATMs operated directly by major Spanish financial institutions form the backbone of the country's cash access infrastructure, offering customers branded, full-service banking terminals with comprehensive transaction capabilities. These ATMs are typically located within or adjacent to bank branches, providing customers with familiar interfaces and direct access to account services without third-party involvement. The dominance of conventional bank ATMs is supported by Spanish consumers' preference for conducting transactions at their own bank's machines to avoid interbank fees. However, the segment is experiencing gradual transformation as banks explore partnerships with independent operators and adopt ATM-as-a-Service models to optimize costs. Smart ATMs with cash recycling capabilities are increasingly being integrated into bank networks, enabling self-service deposits and reducing cash handling expenses while maintaining the trusted bank-branded customer experience.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Northern Spain maintains steady ATM coverage across the Basque Country, Cantabria, and Galicia, though rural depopulation in inland areas presents infrastructure challenges. Financial institutions are deploying mobile ATM units and partnering with local businesses to ensure cash access in remote municipalities.

Eastern Spain, encompassing Catalonia and the Valencian Community, represents a major ATM market concentration driven by Barcelona's financial hub status and Mediterranean coastal tourism. The region welcomed numerous international visitors in 2024, generating substantial demand for cash withdrawal services.

Southern Spain, anchored by Andalusia, serves both domestic populations and significant tourist flows to destinations including Seville, Málaga, and the Costa del Sol. Banks are investing in multilingual ATM interfaces and expanded networks at airports, hotels, and popular tourist attractions throughout the region.

Central Spain, dominated by Madrid, benefits from the capital's position as the country's economic and financial center housing major bank headquarters. The region combines high urban ATM density with ongoing initiatives to extend coverage to underserved municipalities in surrounding rural provinces.

Market Dynamics:

Growth Drivers:

Why is the Spain ATM Market Growing?

Rising Demand for Self-Service Banking Solutions

The growing preference for convenient and accessible banking services is driving substantial investment in ATM infrastructure across Spain. Financial institutions recognize that ATMs represent critical touchpoints for customer engagement, offering services beyond traditional branch operations. The deployment of advanced ATMs enables banks to extend service hours and geographic reach without the operational costs associated with maintaining physical branches. Consumers increasingly expect immediate access to financial services, and ATMs fulfill this demand by providing withdrawal, deposit, and transfer capabilities at any hour. The integration of ATMs with mobile banking applications further enhances convenience by enabling cardless transactions and personalized service offerings.

Technological Advancements in ATM Security and Functionality

Continuous innovation in ATM technology is expanding the range of services available through self-service channels while strengthening security measures. The implementation of biometric authentication systems, including fingerprint and facial recognition, provides secure alternatives to traditional PIN-based verification while streamlining the transaction process. Cash-recycling technology optimizes operational efficiency by enabling ATMs to accept deposited notes for subsequent withdrawals, reducing the frequency and cost of cash replenishment. Real-time monitoring systems powered by artificial intelligence detect suspicious activities and potential fraud attempts, enhancing customer confidence in ATM transactions. The adoption of contactless interfaces and mobile device integration supports evolving consumer preferences for touchless interactions.

Financial Inclusion Initiatives in Rural Communities

Coordinated efforts by financial institutions and government authorities to expand banking access in underserved areas are generating sustained demand for ATM deployments. Banking sector commitments to maintain presence in municipalities where financial institutions serve as the sole provider are driving ATM installations in previously unbanked communities. Mobile branch services complement fixed ATM networks by delivering face-to-face banking capabilities to remote locations on scheduled routes. The recognition that significant portions of the rural population, particularly elderly residents, depend on physical cash access has elevated financial inclusion as a strategic priority. These initiatives are reducing the necessity for residents to travel long distances for basic banking services while stimulating local economic activity.

Market Restraints:

What Challenges is the Spain ATM Market Facing?

Growing Preference for Digital Payment Methods

The accelerating adoption of mobile payment solutions, contactless cards, and peer-to-peer transfer platforms is gradually reducing consumer dependence on physical cash. Younger demographics increasingly favor digital wallets and instant payment applications for everyday transactions, diminishing the frequency of ATM usage among these population segments.

High Operational and Maintenance Costs

The operational expenses associated with ATM management, including cash replenishment, security monitoring, equipment maintenance, and regulatory compliance, present ongoing challenges for financial institutions. Rising labor and logistics costs compound the financial burden of maintaining extensive ATM networks, particularly in low-volume locations.

Infrastructure Limitations in Remote Areas

Deploying and maintaining ATM services in rural and remote regions faces significant infrastructure constraints. Limited broadband connectivity, power supply inconsistencies, and challenging logistics for cash delivery create operational barriers that increase deployment costs and reduce service reliability in underserved communities.

Competitive Landscape:

The Spain ATM market competitive landscape is characterized by the participation of multinational technology providers, domestic financial institutions, and specialized managed services operators. Market participants compete across multiple dimensions including technology innovation, service reliability, geographic coverage, and cost efficiency. Financial institutions are increasingly partnering with technology providers to deploy advanced ATM solutions while outsourcing operational management to specialized service companies. The market structure reflects a balance between in-house ATM operations by major banks and third-party managed services arrangements that optimize operational efficiency. Competitive differentiation is driven by the ability to deliver enhanced security features, superior user experiences, and comprehensive service coverage across urban and rural territories.

Recent Developments:

- In June 2025, A leading fintech company launched its first branded ATMs in Spain, deploying fifty machines in Madrid and Barcelona with plans to expand to 200 ATMs in the country. The initiative targets both domestic customers and international tourists with fee-free withdrawals and competitive foreign exchange rates, marking the first market for the company's physical ATM product in Europe.

Spain ATM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Screen Sizes Covered | 15" and Below, Above 15" |

| Applications Covered | Withdrawals, Transfers, Deposits |

| ATM Types Covered | Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain ATM market size was valued at USD 406.80 Million in 2025.

The Spain ATM market is expected to grow at a compound annual growth rate of 4.03% during 2026-2034 to reach USD 580.60 Million by 2034.

Deployment solutions dominated the market with approximately 58% revenue share in 2025, driven by the extensive ATM networks maintained by major Spanish banks.

Key factors driving the Spain ATM market include rising demand for self-service banking solutions, technological advancements in security and functionality, financial inclusion initiatives in rural areas, and regulatory requirements for accessible banking infrastructure.

Major challenges include growing preference for digital payment methods reducing cash dependency, high operational and maintenance costs for ATM networks, infrastructure limitations in remote areas, and the need for continuous investment in security upgrades to address evolving cyber threats.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)