Spain Beauty Products Market Size, Share, Trends and Forecast by Type, Distribution Channel and Region, 2026-2034

Spain Beauty Products Market Size and Share:

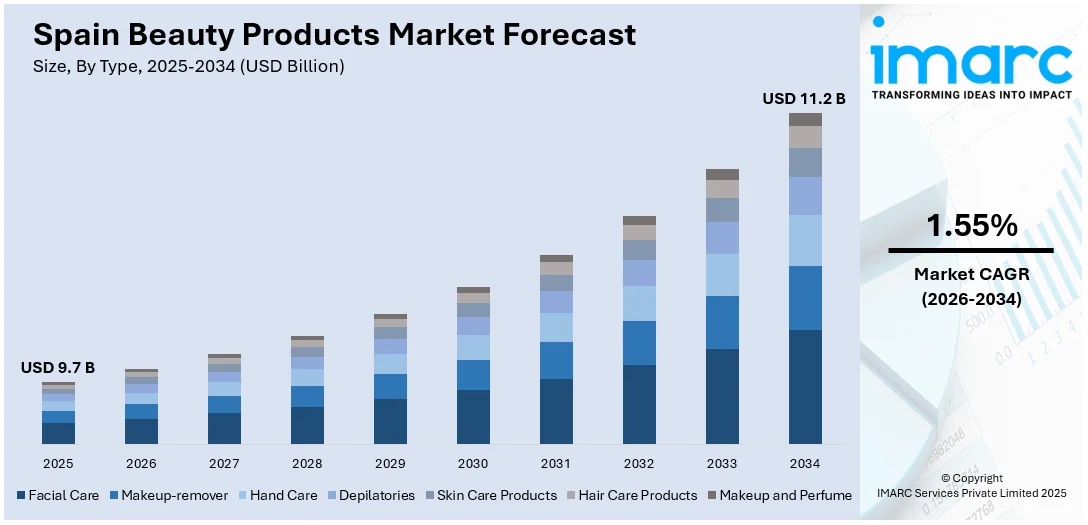

The Spain beauty products market size was valued at USD 9.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 11.2 Billion by 2034, exhibiting a CAGR of 1.55% from 2026-2034. The market is driven by the increasing demand for cosmetic formulations that are free from harmful chemicals like parabens, sulfates, and synthetic fragrances, along with the rising development of high-quality, effective, and luxurious beauty solutions, which contribute to greater revenue generation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 9.7 Billion |

| Market Forecast in 2034 | USD 11.2 Billion |

| Market Growth Rate (2026-2034) | 1.55% |

Personalized beauty solutions are positively influencing the beauty products market in Spain. They cater to diverse needs and preferences and improve both customer engagement and satisfaction. Brands emphasize providing customized recommendations for skincare, haircare, and cosmetics. This approach addresses individual concerns, such as skin type, tone, and specific conditions, creating a more tailored and effective beauty experience. Individuals feel empowered by using products that align well with their unique requirements. Additionally, this trend integrates seamlessly with Spain’s cultural appreciation for innovation and individuality. Subscription models that offer curated beauty kits based on user profiles are gaining popularity to make personalization accessible.

To get more information on this market Request Sample

The expansion of e-commerce platforms in Spain is changing how users discover and purchase their favorite products. Online platforms offer unparalleled convenience, enabling customers to shop for skincare, haircare, and cosmetics from the comfort of their homes. This ease of access appeals to Spain’s digitally savvy population, particularly younger users who value quick and efficient shopping experiences. E-commerce channels also provide an extensive variety of products, including international brands and niche offerings, that may not be easily available in physical stores. Apart from this, the integration of detailed product descriptions, reviews, and virtual try-on tools improves the shopping journey, allowing users to make informed decisions tailored to their beauty needs. Promotional strategies, including discounts and exclusive online deals enhance engagement and attract repeat purchases.

Spain Beauty Products Market Trends:

Rising demand for natural beauty products

The elevating requirement for natural and clean beauty products in Spain is encouraging manufacturers to produce safer and eco-friendly items. Users prefer formulations that are free from toxic chemicals, encompassing synthetic fragrances, parabens, and sulfates, and favor brands that prioritize transparency and sustainability. Companies respond by offering skincare, haircare, and cosmetics enriched with cruelty-free, organic, and vegan ingredients. The Mediterranean influence further promotes the use of locally sourced natural components, such as olive oil, aloe vera, and citrus extracts, enhancing product appeal. This trend aligns perfectly with the shift towards health and environmental awareness among the masses, fostering brand loyalty and attracting new customers. Key players invest in developing sustainable beauty products using natural ingredients. In February 2024, Lignovations, an innovative startup specializing in sustainable lignin-based solutions, revealed its partnership with UNIGOLDEN, a well-known manufacturer and supplier of cosmetics in Barcelona, Spain, to launch the ‘LignoGuard SPF Booster’ in Spain and Portugal. The item is derived from natural sources and provides scientifically validated antioxidant advantages, along with enhanced formulation stability, all while maintaining a dedication to environmental sustainability.

Growing investments in beauty brands

Investments in beauty brands to support innovations are impelling the market growth. Strategic investments, whether from private equity firms, venture capitalists, or multinational corporations, provide beauty brands with the financial resources requisite to proliferate operations, develop new products, and enhance their marketing efforts. These investments enable brands to introduce advanced formulations, sustainable packaging, and clean beauty solutions, catering to the evolving preferences of Spanish users. Investments also support research and development (R&D) activities, leading to the creation of personalized and high-performance products that cater to the high demand for quality and efficacy. Additionally, the listing of beauty brands in initial public offerings (IPOs) is injecting capital and visibility into the industry. An IPO also raises the profile of beauty brands and helps to establish user trust and brand loyalty. In May 2024, Puig, a Spanish fashion and beauty company, began trading on the Spanish Stock Exchange with an IPO of €2.6 billion. The IPO received more subscriptions than available shares throughout the price range, indicating robust inclination from both local and international investors. The company seeks to expand its collection of proprietary brands while concentrating on reinforcing its dominance in premium cosmetic items.

Integration of technology into beauty products

Beauty tech integration is merging advanced technology with personal care solutions to create a seamless and personalized user experience. Artificial intelligence (AI)-based platforms allow people to analyze their skin conditions and receive product recommendations, thereby improving efficacy and satisfaction. Augmented reality (AR) technology enhances the shopping experience by enabling users to visualize makeup products, such as lipstick or eyeshadow, virtually and helps them to make better purchasing decisions. Smart devices, such as facial cleansing tools and at-home laser treatments, enable users to maintain professional-quality care routines conveniently. Additionally, the rising adoption of mobile apps and online platforms for beauty consultations aligns with the increasing digital penetration in Spain to offer easy access to expert advice and curated product selections with the help of AI. In May 2024, celebrity cosmetic dermatologist, Dr Simon Ourian introduced his direct-to-user personalized AI technology skincare line in Spain. This customized vegan skincare range utilizes advanced AI technology for skin assessments to assist everyone in their unique journey.

Spain Beauty Products Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Spain beauty products market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type and distribution channel.

Analysis by Type:

- Facial Care

- Makeup-remover

- Hand Care

- Depilatories

- Skin Care Products

- Hair Care Products

- Makeup and Perfume

Facial care products account for a critical portion of the Spain beauty products market share. Spanish people focus on maintaining a healthy and glowing complexion. They use different products, ranging from cleansers and toners to serums and moisturizers, which offer anti-aging and hydration solutions. Moreover, innovations in sunscreens and overnight masks encourage individuals to utilize facial care items.

Makeup-removers are employed to ensure clean and healthy skin after a long day. Micellar water, cleansing oils, and wipes offer quick and efficient solutions. As people are understanding the importance of makeup removal for skin health, the demand for gentle and eco-friendly formulas is rising. Brands are also introducing sustainable packaging and multi-functional products to meet user preferences.

Hand care products in Spain gain traction due to the growing hygiene awareness and the need for soft and nourished hands. Hand creams infused with natural oils and anti-aging properties are particularly popular. People prefer protective and hydrating solutions to mitigate dryness issues resulting from frequent handwashing.

Depilatories are widely used in Spain and reflect the cultural emphasis on smooth and hair-free skin. From waxing kits and creams to razors, this segment caters to varied preferences. Easy-to-use and at-home solutions remain top choices, while professional-grade options also gain popularity.

The skin care products cater to users seeking radiant and healthy skin. From anti-aging creams and brightening serums to hydrating masks, this section takes care of diverse needs. People choose natural and organic ingredients, which encourages brands to develop clean beauty solutions. Seasonal skincare trends, such as sun protection in summer and hydration in winter, further promote the utilization of skin care items.

Hair care products in Spain are becoming essential, with users focusing on maintaining shiny and healthy locks. From conditioners and shampoos to hair styling products and masks, , this segment caters to various hair types and concerns. People like using sulfate-free and organic products that give gentle yet effective solutions.

Makeup and perfume are central to beauty culture in Spain, combining self-expression with sophistication. From bold lipsticks and versatile foundations to long-lasting fragrances, this segment caters to all age groups. Spanish users appreciate high-quality products and often choose local and worldwide luxury brands.

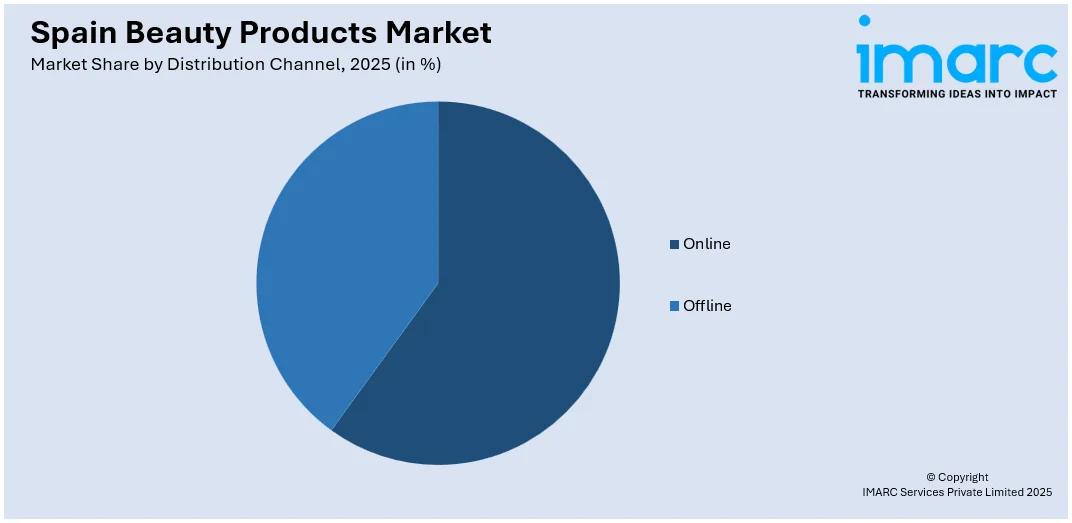

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

- Supermarket and Hypermarket

- Specialty Stores

- Drug Stores

The online distribution channels for beauty products in Spain offer convenience and variety. People enjoy browsing extensive product catalogs, reading reviews, and snagging exclusive deals from the comfort of their homes. Apart from this, popular e-commerce platforms and brand websites provide personalized recommendations and quick delivery. Loyalty programs and discounts also encourage customers to buy more items.

Offline channels (supermarket and hypermarket, specialty stores, and drug stores) are important, as many users prefer in-store experiences where they can test products and receive expert advice. Department stores and specialty shops offer curated selections and personalized services. Pharmacies are particularly trusted for skincare products, while supermarkets ensure accessibility for everyday essentials.

Regional Analysis:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Northern Spain is noted for its blend of urban and rural beauty product users. In cities like Bilbao and San Sebastián, people choose premium and eco-friendly products. Coastal areas also see a preference for sun care and hydrating products due to the maritime climate. Local boutiques and pharmacies play a big role, as they cater to user individuals’ needs.

Eastern Spain, including beauty hubs like Valencia and Barcelona, is known for its branded beauty products. The region’s vibrant lifestyle and strong fashion culture promote the use of trendy skincare, makeup, and hair care items. Users choose innovative and high-quality products, often influenced by Mediterranean beauty trends.

Southern Spain enjoys a sunny climate, which creates the need for sunscreen and moisturizing beauty products. In cities like Málaga and Seville, people prefer skincare items that combat heat and ultraviolet (UV) exposure. Traditional beauty practices are mixed with modern trends to develop new beauty products. Tourists visiting this region further increase the sales of locally inspired beauty products.

Central Spain, dominated by Madrid, has a high number of premium and international beauty brands. The cosmopolitan population in the capital prefers high-end skincare, luxury perfumes, and trendy cosmetics. Central Spain is also a leader in online beauty product sales due to its tech-savvy users. Moreover, retailers offer diverse product ranges in department stores and shopping malls.

Competitive Landscape:

Key players in the market are offering a comprehensive range of products across numerous categories. Leading companies are investing in innovations through continuous R&D activities. They are also introducing new formulations, packaging, and sustainable practices. They are expanding their presence in both online and offline channels that allow them to cater to diverse preferences. Apart from this, key players are teaming up with local influencers and celebrity endorsements to enhance brand visibility and user trust. These players also focus on adapting to Spanish beauty trends, such as eco-friendly packaging and organic ingredients. For instance, in June 2024, Evolus, Inc., a performance beauty company, revealed its new product, Nuceiva in Spain, designed to provide temporary enhancement in the look of moderate to severe vertical facial lines. This item is ready for direct purchasing and shipment to Spanish medical aesthetics healthcare providers.

The report provides a comprehensive analysis of the competitive landscape in the Spain beauty products market with detailed profiles of all major companies.

Latest News and Developments:

- March 2024: Lady Gaga’s make-up brand Haus Labs has been unveiled in Europe, including Spain. The company collaborated with retail platform, Sephora to offer its 125 products in twelve countries throughout the region, including France, Italy, Germany, Spain, Portugal, Sweden, Denmark, Switzerland, Greece, Romania, Poland, and the Czech Republic.

- May 2024: The cosmetics, perfumery, and make-up chain of the LVMH group, a European multinational holding company that specializes in luxury goods, has added two new brands to distribute across Spain and expand its catalogue. The first brand, Valentino Beauty’ offers makeup products, while the second brand, ‘Amika’, focuses on hair care.

- November 2024: The Colombian actress, presenter, and model, Sofia Vergara chose the Spanish laboratory, Cantabria Labs to develop and introduce a new brand, Toty. The lab would be utilized to create and produce an entire range of sun-protection beauty products.

- September 2024: Cosmewax, a leading contract manufacturing cosmetics company, accelerated its expansion with a new skincare factory, located in Puzol, Spain. The establishment successfully raised an investment of almost 11 million euros, which will enable the company to enhance its production capacity by 50%. The facility, spanning 5,100 square meters, will feature state-of-the-art technology and will adhere to top standards of quality and sustainability.

Spain Beauty Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Facial Care, Makeup-remover, Hand Care, Depilatories, Skin Care Products, Hair Care Products, Makeup and Perfume |

| Distribution Channels Covered |

|

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain beauty products market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Spain beauty products market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain beauty products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Beauty products are items, which help to enhance and maintain personal appearance and are used for skincare, hair care, and makeup. These products include items like facial creams, cleansers, shampoos, perfumes, nail polishes, and cosmetics, among others. Beauty products often contain a combination of both synthetic and natural ingredients aimed at enhancing skin texture, promoting hydration, or providing aesthetic enhancements.

The Spain beauty products market was valued at USD 9.7 Billion in 2025.

IMARC estimates the Spain beauty products market to exhibit a CAGR of 1.55% during 2026-2034.

The rising influence of social media platforms is encouraging people to make informed decisions while buying beauty products. Additionally, the growing demand for beauty products that serve multiple purposes, such as skincare-infused makeup, is supporting the market growth. Moreover, the increasing need for beauty and grooming products for men, with a focus on skincare, haircare, and fragrance, is impelling the market growth.

On a regional level, the market has been classified into Northern Spain, Eastern Spain, Southern Spain, Central Spain.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)