Spain Cement Market Size, Share, Trends and Forecast by Type, End-Use, and Region, 2026-2034

Spain Cement Market Summary:

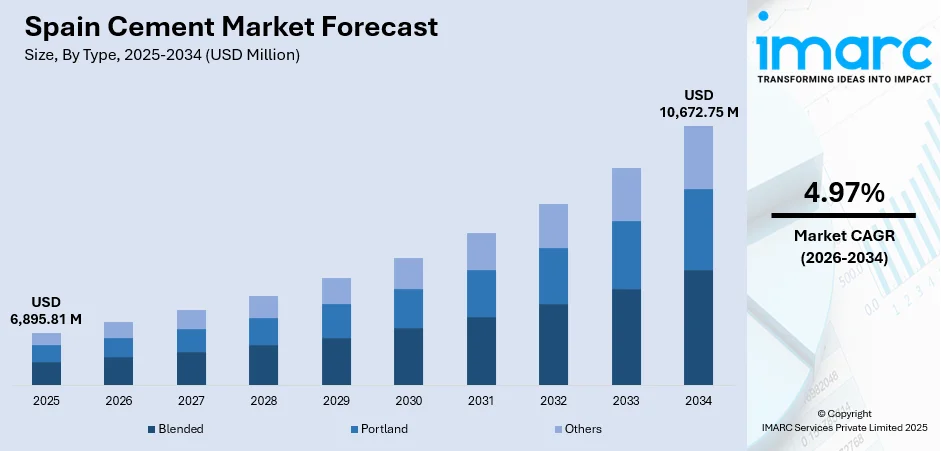

The Spain cement market size was valued at USD 6,895.81 Million in 2025 and is projected to reach USD 10,672.75 Million by 2034, growing at a compound annual growth rate of 4.97% from 2026-2034.

The market is driven by increasing infrastructure investments, rising residential construction activities, and the country's commitment to sustainable building practices. Growing urbanization, government-led housing initiatives, and the shift toward eco-friendly cement solutions are fueling demand across multiple construction segments. The National Recovery and Resilience Plan is accelerating modernization projects nationwide. Additionally, the integration of digital technologies in manufacturing processes and emphasis on low-carbon production methods are reshaping the industry landscape, contributing to a stronger Spain cement market share.

Key Takeaways and Insights:

- By Type: Blended dominates the market with a share of 55% in 2025, driven by its superior durability, reduced carbon footprint, enhanced workability, and strong alignment with European sustainability mandates promoting eco-friendly construction materials across residential and infrastructure applications.

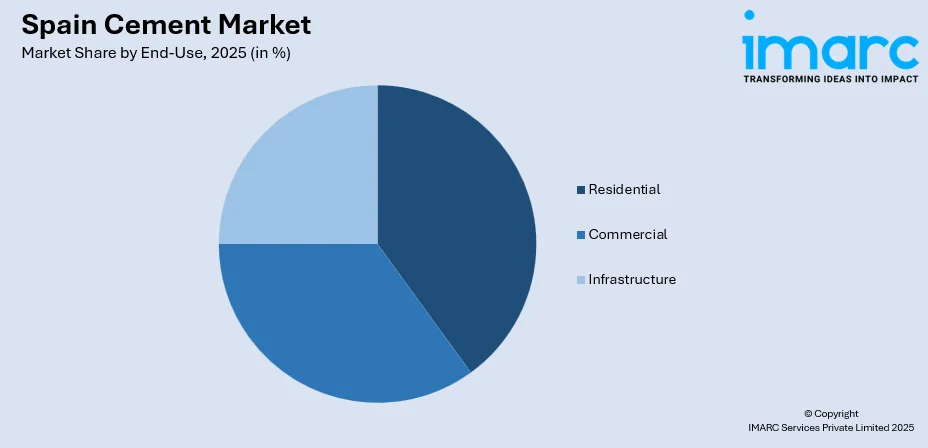

- By End-Use: Residential leads the market with a share of 40% in 2025, owing to rising housing demand, urbanization trends, building renovation requirements, and government-backed affordable housing initiatives addressing the persistent supply-demand gap in major metropolitan areas.

- Key Players: The cement market compete through production efficiency, sustainable product offerings, and strategic distribution networks. Companies focus on low-carbon solutions, innovative blends, and strong regional presence to meet construction demand while differentiating through quality, reliability, and environmental compliance.

To get more information on this market Request Sample

Spain's cement market is witnessing robust expansion underpinned by a confluence of favorable macroeconomic and policy-driven factors. The government's sustained commitment to infrastructure modernization, including transport networks, energy installations, and urban renewal projects, is generating consistent demand for cement-based construction materials. Rising urbanization rates and population growth in metropolitan areas are intensifying requirements for residential housing and commercial spaces. Additionally, European Union recovery instruments are channeling substantial funding toward sustainable construction initiatives. The industry is also benefiting from the growing adoption of green building standards, which prioritize durable and high-performance cement solutions. In June 2025, Molins received permits to build a hydrogen electrolysis facility at Sant Vicenç dels Horts, using 300 tpa hydrogen in clinker kilns, cutting 3,600 t CO₂, advancing 2030 sustainability goals. Moreover, favorable demographic trends and declining mortgage rates are further supporting housing market recovery and construction activity.

Spain Cement Market Trends:

Sustainable Production and Decarbonization Initiatives

The cement industry is undergoing a significant transformation toward sustainability, with manufacturers increasingly adopting alternative fuels derived from biomass and waste materials. Producers are integrating supplementary cementitious materials including fly ash and slag into their formulations, substantially reducing clinker content and associated emissions. In October 2025, Molins launched low-CO₂ cement using activated clay, cutting emissions and customer carbon footprint, backed by EU ERDF funds and Spain’s Ministry of Science, Innovation and Universities. Furthermore, carbon capture technologies are being piloted at multiple production facilities. The European Green Deal framework and national climate neutrality objectives are accelerating this transition, positioning low-carbon cement as a mainstream construction material that meets both environmental regulations and performance requirements.

Digital Transformation and Smart Manufacturing

Advanced digitalization is revolutionizing cement production across Spain, with manufacturers deploying Industry 4.0 solutions encompassing automation, real-time monitoring systems, and predictive analytics. Smart batching technologies enable precise material mixing while reducing waste and enhancing product consistency. In 2023, Votorantim Cimentos’ Spanish plants implemented ABB’s Industry 4.0 solutions, enhancing real-time monitoring, reducing emissions, optimizing energy use, and improving production quality across multiple sites. Automated control systems optimize energy consumption and improve operational efficiency throughout production cycles. Remote monitoring capabilities are enhancing workplace safety and enabling proactive maintenance scheduling. These technological advancements are helping manufacturers reduce production costs, improve quality control, and meet increasingly stringent construction standards across the national market.

Prefabrication and Modular Construction Adoption

The growing preference for prefabricated and modular construction methods is reshaping cement demand patterns throughout Spain. Precast concrete products and ready-mix solutions are gaining popularity due to their ability to accelerate construction timelines and ensure consistent quality. These methods offer significant advantages in addressing labor shortages and reducing on-site construction waste. Manufacturers are expanding their precast production capabilities to serve residential, commercial, and infrastructure projects. In June 2025, Molins invested EUR100m in precast concrete, acquiring Concremat, building a new automated plant in central Spain, and expanding urban landscaping operations, boosting production and supporting sustainable housing. Further, this trend aligns with broader industry objectives of improving construction efficiency while meeting sustainable building certification requirements and enabling faster project delivery.

Market Outlook 2026-2034:

The Spain cement market is positioned for sustained revenue expansion throughout the forecast period, driven by continued infrastructure investments and residential construction recovery. Revenue growth will be supported by government-funded modernization projects and European Union recovery instruments channeling resources into construction activities. The residential sector remains a consistent revenue contributor amid ongoing housing demand. Infrastructure-related revenue streams from transport, energy, and urban development projects will strengthen market performance. Additionally, rising demand for sustainable cement solutions and digital manufacturing advancements will positively influence revenue trajectories across all market segments. The market generated a revenue of USD 6,895.81 Million in 2025 and is projected to reach a revenue of USD 10,672.75 Million by 2034, growing at a compound annual growth rate of 4.97% from 2026-2034.

Spain Cement Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Blended | 55% |

| End Use | Residential | 40% |

Type Insights:

- Blended

- Portland

- Others

The blended dominates with a market share of 55% of the total Spain cement market in 2025.

Blended cement has emerged as the predominant product type within Spain's cement market, commanding the majority revenue share. This dominance stems from its superior technical properties including enhanced durability, improved workability, and better resistance to chemical exposure. The formulation combines traditional Portland cement with supplementary materials, delivering excellent performance characteristics for diverse construction applications. Manufacturers benefit from lower production costs due to reduced clinker requirements, while end-users appreciate the consistent quality and extended service life of structures built with blended cement products.

The rising emphasis on sustainable construction practices has further strengthened blended cement's market position across Spain. In June 2024, Heidelberg Materials Spain stopped clinker production at its Añorga plant, focusing on low-carbon cement grinding, including evoBuild®, advancing sustainable construction and accelerating the company’s CO₂ reduction roadmap. European environmental regulations mandating reduced carbon emissions in construction materials have accelerated adoption among contractors and developers. Blended cement's lower carbon footprint compared to ordinary Portland cement aligns perfectly with green building certification requirements. Additionally, the availability of industrial by-products used in blended formulations ensures stable supply chains. These factors combined make blended cement the preferred choice for residential projects, commercial developments, and infrastructure applications nationwide.

End-Use Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Infrastructure

The residential leads with a share of 40% of the total Spain cement market in 2025.

The residential construction segment dominates cement consumption patterns in Spain, representing the largest end-use category. Persistent housing shortages in major metropolitan areas including Madrid, Barcelona, and Valencia continue driving demand for new residential developments. Population growth, household formation trends, and urban migration patterns create sustained requirements for housing units. Cement serves as the fundamental building material for structural elements, foundations, and finishing applications in residential projects. Government initiatives promoting affordable housing construction and building renovations further support this segment's dominant market position throughout the country. In April 2025, Pedro Sánchez announced the PERTE for Industrialisation of Housing with €1.3 Billion public investment over 10 years, aiming to build 15,000 industrialised homes annually and boost Spain’s construction efficiency.

Favorable mortgage conditions and declining interest rates have reinvigorated Spain's residential real estate market, translating directly into cement demand growth. Foreign investment in premium residential properties, particularly along coastal regions, provides additional consumption stimulus. The segment also benefits from extensive building renovation requirements, as older housing stock requires modernization to meet contemporary energy efficiency standards. Developers increasingly specify high-quality cement products to ensure structural integrity and durability. These dynamics collectively position residential construction as the primary revenue contributor within Spain's cement market landscape.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Northern Spain presents a dynamic cement market characterized by robust industrial activity and infrastructure development. The region's ports and maritime industries drive consistent demand for durable construction materials. Urban centers including Bilbao and San Sebastian support residential and commercial construction requirements. Renewable energy installations, particularly wind power projects, generate additional cement consumption.

Eastern Spain, anchored by Barcelona and Valencia metropolitan areas, represents a major cement consumption hub within the national market. Coastal tourism development, residential construction activity, and port infrastructure projects drive substantial demand. The region's concentration of population and economic activity supports ongoing building requirements. Urban renewal initiatives and transportation network improvements generate consistent cement consumption.

Southern Spain offers significant cement market opportunities driven by tourism infrastructure development and residential construction. Coastal resort developments along Mediterranean and Atlantic shorelines require substantial cement-based construction materials. Andalusia's economic development initiatives encompassing renewable energy projects and agricultural infrastructure support demand growth. Historic building preservation requirements in cities including Seville and Granada create specialized cement product opportunities.

Central Spain, dominated by the Madrid metropolitan region, represents the largest cement consumption center within the national market. The capital's status as economic and political hub drives extensive commercial construction and infrastructure development. Government-funded projects including transport networks and public facilities generate consistent cement demand. Residential construction addressing housing shortages in Madrid supports sustained consumption levels.

Market Dynamics:

Growth Drivers:

Why is the Spain Cement Market Growing?

Robust Infrastructure Development Programs

The Spanish government's sustained investment in comprehensive infrastructure modernization is generating significant cement demand across the country. National development priorities encompass transport network upgrades including high-speed railway extensions, highway improvements, and port expansion projects. In November 2025, Puertos del Estado announced over €7 billion in planned investments for Spanish state‑owned ports from 2025 to 2029, aimed at improving port facilities and expanding connectivity. Energy infrastructure investments focusing on renewable power generation facilities and grid modernization require substantial cement-based construction materials. Urban development initiatives incorporating smart city technologies, water management systems, and public amenities further expand consumption requirements. The National Recovery and Resilience Plan channels considerable resources toward these infrastructure priorities, ensuring consistent project pipelines throughout the forecast period and maintaining steady cement demand.

Urbanization and Housing Market Recovery

Spain's ongoing urbanization trend is driving substantial residential construction activity, directly supporting cement market expansion. Metropolitan areas are experiencing population growth through domestic migration and international immigration, intensifying housing requirements. In September 2025, Bank of Spain revised its estimate of the country’s housing shortfall to around 700,000 homes, reflecting an even larger supply gap than previously thought. The existing supply-demand imbalance, where household formation rates significantly exceed new housing completions, creates persistent construction demand. Improved economic conditions and favorable demographic outlooks are encouraging real estate investment and development activity. Municipal governments are streamlining building permit processes to address housing shortages. These converging factors ensure the residential sector remains a primary demand driver, with developers requiring increasing cement volumes for new housing projects and building renovations.

Sustainability and Green Building Adoption

The accelerating shift toward sustainable construction practices is creating substantial opportunities within Spain's cement market. European Union environmental policies and national climate commitments are driving demand for low-carbon building materials across all construction segments. Green building certification programs including BREEAM and LEED increasingly specify environmentally responsible cement products for project compliance. Developers and contractors recognize that sustainable materials enhance property valuations and meet evolving buyer preferences. The construction industry's commitment to reducing carbon footprints encourages adoption of blended cements and alternative formulations. This sustainability-driven transformation positions environmentally conscious cement manufacturers favorably within the evolving market landscape.

Market Restraints:

What Challenges the Spain Cement Market is Facing?

Environmental Regulatory Pressures

Stringent emissions regulations and decarbonization mandates impose significant compliance burdens on cement manufacturers operating within Spain. Meeting evolving European Union environmental standards requires substantial capital investments in production technology upgrades and emissions control systems. Manufacturers must continuously adapt processes to align with increasingly restrictive carbon reduction targets. These regulatory requirements increase operational complexity and may constrain production flexibility, particularly for facilities requiring extensive modernization efforts.

Raw Material and Energy Cost Volatility

Fluctuating prices for essential production inputs including limestone, clay, and energy resources create margin pressures for cement manufacturers. Natural gas and electricity costs remain elevated compared to historical averages, impacting production economics significantly. Transportation expenses for raw material sourcing and finished product distribution compound cost challenges. These input cost dynamics can affect pricing stability and potentially influence demand patterns during periods of significant price adjustments.

Labor Availability and Skilled Workforce Constraints

Spain's cement industry faces challenges securing adequate skilled labor for manufacturing operations and technical positions. The aging workforce and limited pipeline of trained professionals entering construction materials sectors create recruitment difficulties. Specialized technical expertise required for modern production facilities remains scarce. These workforce constraints can impact production efficiency, limit capacity utilization, and potentially delay modernization initiatives requiring specialized personnel for implementation and operation.

Competitive Landscape:

The Spain cement market exhibits a consolidated competitive structure characterized by established domestic producers and international building materials conglomerates. Market participants compete across multiple dimensions including product quality, production capacity, distribution networks, and sustainability credentials. Manufacturers are investing substantially in technological modernization, carbon reduction initiatives, and production efficiency improvements to maintain competitive positioning. Strategic focus areas include expanding low-carbon product portfolios, enhancing digital manufacturing capabilities, and strengthening regional distribution presence. Companies are pursuing vertical integration strategies to secure raw material supplies and optimize supply chain operations. Customer relationships are cultivated through technical support services, customized product solutions, and reliable delivery performance. The competitive environment rewards operational excellence, innovation capabilities, and responsiveness to evolving construction industry requirements.

Recent Developments:

-

In January 2025, Votorantim Cimentos Spain joined Madrid World Capital (MWCC), reinforcing its commitment to innovation, circular economy, and decarbonised construction. The company also invested €3.2 million in a new clinker cooler at its Málaga plant to enhance thermal efficiency and lower-carbon cement production.

Spain Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End-Uses Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain cement market size was valued at USD 6,895.81 Million in 2025.

The Spain cement market is expected to grow at a compound annual growth rate of 4.97% from 2026-2034 to reach USD 10,672.75 Million by 2034.

Blended captured 55% share, supported by its enhanced durability, reduced environmental impact, and strong alignment with European sustainability requirements. Its performance benefits and regulatory compatibility continue driving widespread adoption across construction applications prioritizing efficiency and lower carbon emissions.

Key factors driving the Spain cement market include robust infrastructure investments through national recovery programs, rising residential construction activity addressing housing shortages, growing adoption of sustainable building practices, favorable demographic trends supporting urbanization, and integration of digital technologies enhancing manufacturing efficiency.

Major challenges include stringent environmental regulations requiring substantial compliance investments, volatile raw material and energy costs impacting production economics, labor availability constraints limiting operational capacity, complex permitting processes delaying construction projects, and competitive pressures from imported cement products with lower production costs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)