Spain Clothing and Jewellery Market Size, Share, Trends and Forecast by Product Type, Demographics, Distribution Channel, and Region, 2026-2034

Spain Clothing and Jewellery Market Overview:

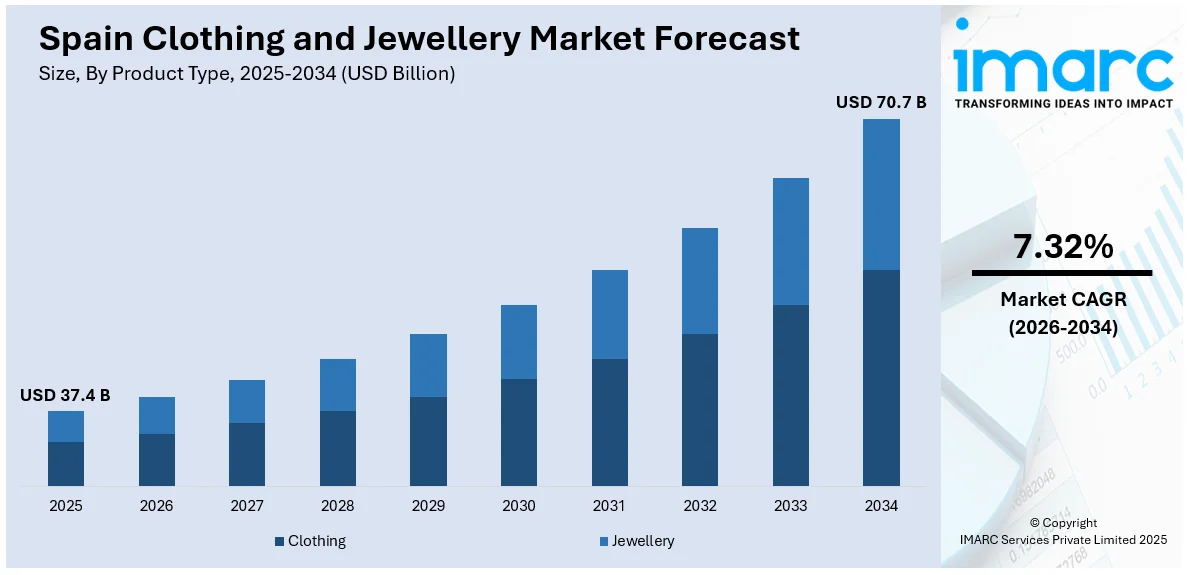

The Spain clothing and jewellery market size reached USD 37.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 70.7 Billion by 2034, exhibiting a growth rate (CAGR) of 7.32% during 2026-2034. The market is witnessing significant growth, driven by the rising demand for sustainable and ethical fashion and the digital transformation of retail and consumer engagement.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 37.4 Billion |

| Market Forecast in 2034 | USD 70.7 Billion |

| Market Growth Rate 2026-2034 | 7.32% |

Spain Clothing and Jewellery Market Trends:

Growing Demand for Sustainable and Ethical Fashion

The Spain clothing and jewellery market is experiencing a marked shift toward sustainable and ethically produced products, driven by changing consumer values and regulatory momentum across the European Union. Spanish consumers, particularly millennials and Gen Z, are increasingly prioritizing transparency in sourcing, production practices, and environmental impact. In response, leading domestic and international brands are integrating eco-friendly materials, such as organic cotton, recycled fabrics, and lab-grown gemstones into their product lines. For instance, as per industry reports, in October 2024, major fashion brands in Spain, including Inditex, H&M, and Primark, announced trial textile recycling from April 2025, addressing data showing only 12% of used clothes are separately collected, with 88% landfilled. Brands are also investing in circular economy initiatives, including clothing recycling, resale platforms, and take-back schemes. The jewellery segment is witnessing a parallel trend, with heightened demand for conflict-free and traceable stones, recycled metals, and minimalist designs that emphasize longevity over fast fashion. Government support for circular textile projects and upcoming EU regulations on product durability and digital product passports are reinforcing these changes. Retailers operating in Spain are adapting their strategies to include sustainability certifications and detailed product provenance as part of their marketing. This trend is not only redefining product development and branding strategies but is also influencing pricing models, as consumers show a growing willingness to pay a premium for verified sustainable goods that align with their ethical standards.

To get more information on this market Request Sample

Digital Transformation of Retail and Consumer Engagement

Spain’s clothing and jewellery market is undergoing rapid digital transformation, driven by evolving shopping behavior, mobile-first consumption patterns, and the expansion of omnichannel retail. E-commerce penetration in Spain continues to rise, with consumers increasingly engaging through mobile apps, virtual showrooms, and interactive platforms that blend online convenience with in-store experience. Clothing brands are leveraging artificial intelligence (AI), data analytics, and augmented reality to enhance personalized shopping experiences, optimize inventory management, and improve customer retention. The jewellery sector, traditionally reliant on in-store experiences, is adapting to digital tools such as virtual try-ons, 3D product visualization, and AI-powered customer service bots. This has helped to build trust in online purchases of high-value items and expand access to younger, tech-savvy demographics. Social commerce is also gaining traction, with platforms like Instagram and TikTok playing a growing role in driving brand visibility and consumer engagement. Moreover, domestic and global retailers are investing in logistics infrastructure to ensure faster deliveries and more flexible return policies. These changes are creating a more competitive and agile market environment, encouraging brands to continuously innovate in their digital strategies while maintaining strong brand narratives and seamless user experiences across channels. For instance, in September 2024, Inditex, the parent company of Zara, reported a 10.1% rise in H1 2024 net income to €2.8bn. Sales grew 7.2% to €18.1bn, with positive results both in-store and online.

Spain Clothing and Jewellery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product type, demographics, and distribution channel.

Product Type Insights:

- Clothing

- Men’s Wear

- Women’s Wear

- Children’s Wear

- Sportswear and Activewear

- Luxury and Premium Clothing

- Jewellery

- Fine Jewellery

- Fashion Jewellery

- Costume Jewellery

- Luxury Jewellery

The report has provided a detailed breakup and analysis of the market based on the product type. This includes clothing (men’s wear, women’s wear, children’s wear, sportswear and activewear, luxury and premium clothing) and jewellery (fine jewellery, fashion jewellery, costume jewellery, luxury jewellery).

Demographics Insights:

- Age Group

- Gender

- Income Level

A detailed breakup and analysis of the market based on the demographics have also been provided in the report. This includes age group, gender, and income level.

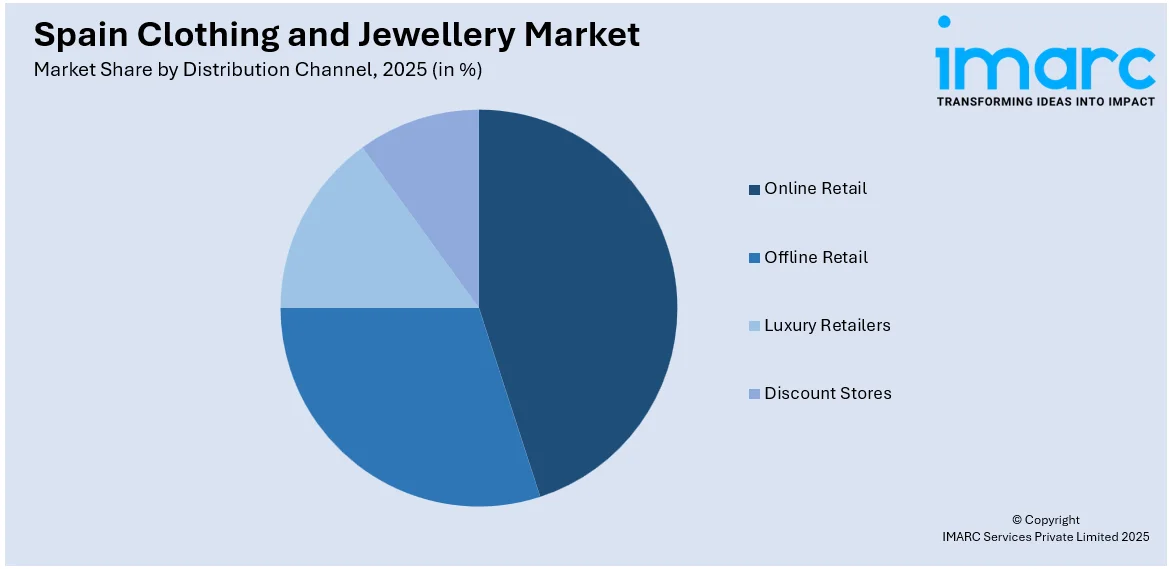

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Retail

- Offline Retail

- Luxury Retailers

- Discount Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online retail, offline retail, luxury retailers, and discount stores.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Clothing and jewellery Market News:

- In March 2025, The Federation of Spanish Footwear Industries (FICE) and ICEX announced the inauguration of the Balenciaga Shoes from Spain Tribute in Milan’s Palazzo Morando. Running until March 2, the exhibition coincides with Milan Fashion Week, celebrating Balenciaga’s legacy while showcasing the craftsmanship and innovation of Spain’s contemporary footwear industry.

Spain Clothing and jewellery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Demographics Covered | Age Group, Gender, Income Level |

| Distribution Channels Covered | Online Retail, Offline Retail, Luxury Retailers, Discount Stores |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain clothing and jewellery market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain clothing and jewellery market on the basis of product type?

- What is the breakup of the Spain clothing and jewellery market on the basis of demographics?

- What is the breakup of the Spain clothing and jewellery market on the basis of distribution channel?

- What is the breakup of the Spain clothing and jewellery market on the basis of region?

- What are the various stages in the value chain of the Spain clothing and jewellery market?

- What are the key driving factors and challenges in the Spain clothing and jewellery?

- What is the structure of the Spain clothing and jewellery market and who are the key players?

- What is the degree of competition in the Spain clothing and jewellery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain clothing and jewellery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain clothing and jewellery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain clothing and jewellery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)