Spain Compound Feed Market Size, Share, Trends and Forecast by Ingredient Type, Animal Type, and Region, 2026-2034

Spain Compound Feed Market Overview:

The Spain compound feed market size reached USD 25.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 36.5 Billion by 2034, exhibiting a growth rate (CAGR) of 4.30% during 2026-2034. The Spain compound feed market is expanding due to rising livestock and aquaculture production, increased demand for sustainable feed ingredients, and regulatory shifts. Moreover, innovations in alternative proteins, precision nutrition, and environmental sustainability are driving growth, enhancing feed efficiency while ensuring compliance with evolving EU feed safety standards.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 25.0 Billion |

| Market Forecast in 2034 | USD 36.5 Billion |

| Market Growth Rate (2026-2034) | 4.30% |

Access the full market insights report Request Sample

Spain Compound Feed Market Trends:

Growing Demand for Sustainable Feed Ingredients

The Spanish compound feed market is moving towards alternative and sustainable feed ingredients driven by growing environmental concerns and changing regulatory environments. The manufacturers are taking up new sources of protein such as insect meal, algae meal, and single-cell proteins to impede reliance on traditional soybean meal and fishmeal. Firms like Tebrio are putting money into mass insect farming, and its Salamanca facility has the target of producing 100,000 tons of insect protein per year, a huge support for the feed sector. The application of insect protein minimizes the environmental impact and maximizes feed conversion efficiency in poultry and aquaculture industries. Additionally, the European Union’s Farm to Fork strategy is pushing feed manufacturers to lower carbon emissions by promoting circular economy models. Waste-derived feedstocks from agriculture and food industries are gaining traction, ensuring resource optimization. The integration of precision nutrition technologies is also allowing producers to customize feed formulations, improving livestock health and productivity while minimizing waste. As sustainability regulations continue to shape the industry, Spain’s compound feed sector is rapidly evolving to meet the growing demand for eco-friendly solutions, positioning itself as a leader in innovative feed production practices.

Expansion of Livestock and Aquaculture Sectors

Spain’s expanding livestock and aquaculture industries are key drivers for compound feed growth. The country ranks among the top pork producers in Europe, with exports accounting for a major share of its meat industry. Rising global meat consumption is fueling the need for high-quality compound feed to enhance livestock health and productivity. Feed formulations are being optimized with advanced additives like probiotics, enzymes, and organic acids to improve digestion and growth rates. Similarly, aquaculture is witnessing substantial expansion, with Spain being a leading producer of farmed fish such as seabass and gilthead seabream. The increasing reliance on formulated aquafeeds, enriched with sustainable protein sources, is boosting demand for specialized compound feed. Companies are focusing on feed innovation to meet the dietary needs of different species while complying with strict EU regulations on feed safety and sustainability. For instance, advancements in microencapsulated nutrients are improving nutrient absorption in aquatic species, reducing feed wastage. The shift towards performance-driven feed solutions is making Spain’s compound feed market more competitive, encouraging investment in research and development. With continued growth in livestock and aquaculture sectors, the demand for efficient and nutritionally balanced feed solutions is set to rise.

Spain Compound Feed Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on ingredient type and animal type.

Ingredient Type Insights:

To get detailed segment analysis of this market Request Sample

- Grains and Cereals

- Oilseeds and Derivatives

- Fish Meal and Fish Oil

- Supplements

- Others

The report has provided a detailed breakup and analysis of the market based on the ingredient type. This includes grains and cereals, oilseeds and derivatives, fish meal and fish oil, supplements, and others.

Animal Type Insights:

- Ruminants

- Swine

- Poultry

- Aquaculture

- Others

A detailed breakup and analysis of the market based on the animal type have also been provided in the report. This includes ruminants, swine, poultry, aquaculture, and others.

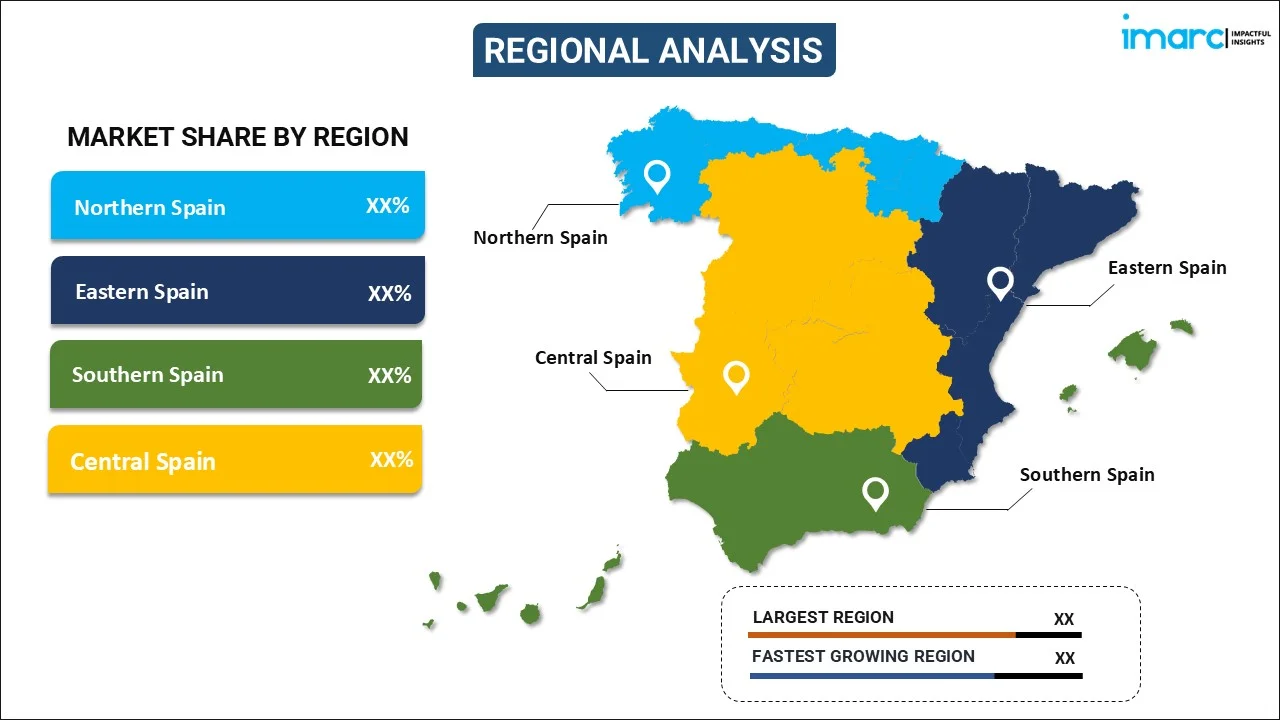

Region Insights:

To get detailed regional analysis of this market Request Sample

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Compound Feed Market News:

- February 2025: OCP Group increased its stake in Spain’s GlobalFeed S.L. to 75%, strengthening phosphate-based animal nutrition solutions. This move enhances innovation, sustainability, and customized feed production, driving growth and stability in Spain’s compound feed industry while expanding OCP’s presence in animal nutrition.

- January 2025: Tebrio began constructing the world’s largest insect farm in Salamanca, Spain, with a 90,000 m² facility. This project boosts sustainable protein and lipid production for animal feed, strengthening Spain’s compound feed sector with innovative, eco-friendly alternatives, enhancing supply stability and industry growth.

Spain Compound Feed Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Ingredient Types Covered | Grains and Cereals, Oilseeds and Derivatives, Fish Meal and Fish Oil, Supplements, Others |

| Animal Types Covered | Ruminants, Swine, Poultry, Aquaculture, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain compound feed market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain compound feed market on the basis of ingredient type?

- What is the breakup of the Spain compound feed market on the basis of animal type?

- What are the various stages in the value chain of the Spain compound feed market?

- What are the key driving factors and challenges in the Spain compound feed market?

- What is the structure of the Spain compound feed market and who are the key players?

- What is the degree of competition in the Spain compound feed market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain compound feed market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain compound feed market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain compound feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)