Spain Craft Beer Market Size, Share, Trends and Forecast by Product Type, Age Group, Distribution Channel, and Region, 2026-2034

Spain Craft Beer Market Overview:

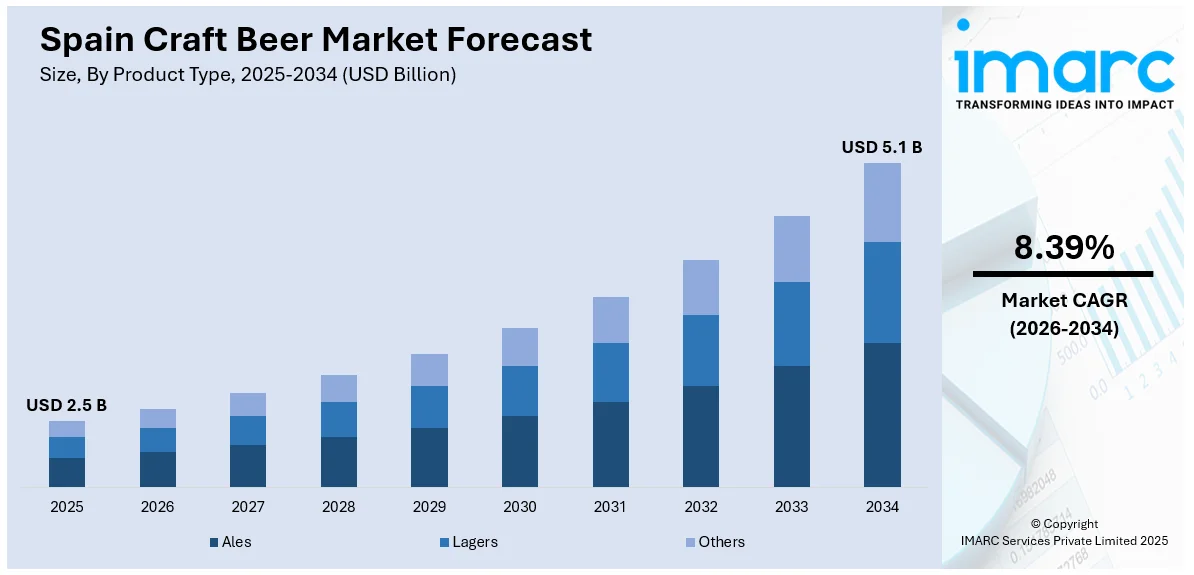

The Spain craft beer market size reached USD 2.5 Billion in 2025. The market is projected to reach USD 5.1 Billion by 2034, exhibiting a growth rate (CAGR) of 8.39% during 2026-2034. The market is showing robust growth, propelled by evolving consumer tastes and increasing demand for premium, local brews. Younger demographics are driving interest toward diverse flavor profiles and experimental styles, prompting microbreweries to multiply, especially in regions like Catalonia, Basque Country, Valencia, and Madrid. Distribution continues expanding through on‑trade venues, supermarkets, and nascent online channels. Strong tourism and vibrant beer festivals further fuel sector momentum. These dynamics are redefining the Spain craft beer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.5 Billion |

| Market Forecast in 2034 | USD 5.1 Billion |

| Market Growth Rate 2026-2034 | 8.39% |

Spain Craft Beer Market Trends:

Revival of Regional Brewing Traditions

Spain’s craft beer sector is experiencing a resurgence in regional brewing styles that pay homage to local heritage. Breweries are incorporating indigenous ingredients like Mediterranean herbs, mountain-sourced honey, and ancient grains to distinguish their offerings and connect with tradition. This renewed focus on terroir not only enhances flavor complexity but also deepens the cultural relevance of craft beer. Consumer interest in authentic, story-rich beverages is helping propel this movement. Many producers are aligning their identities with local landscapes and community roots, enhancing brand loyalty. Additionally, cross-regional collaborations are giving rise to hybrid beer profiles that reflect Spain’s rich diversity. In July 2024, the Barcelona Beer Festival attracted over 15,000 visitors—16% from abroad—highlighting regionally inspired brews alongside traditional styles, showcasing how deeply rooted local ingredients are reshaping national beer culture. Spain Craft Beer growth continues to benefit from these regional innovations, which are drawing both domestic connoisseurs and international visitors seeking immersive tasting experiences.

To get more information on this market Request Sample

Craft Beer Consumption Rises with Broader Beer Market

Spain’s overall beer market continues to grow, showcasing promising tailwinds for its craft segment. In 2024, national beer production rose to approximately in billions, with dedicated craft breweries contributing a rising share. Although representing a smaller volume share relative to mainstream brands, the craft sector is gaining visibility through specialty retail channels and e-commerce platforms. This rise supports ongoing Spain craft beer market growth, especially as consumers increasingly consider small-batch and premium-priced options. Taprooms and online retailers have become key discovery channels, offering access to diverse styles and educating consumers on tasting notes and brewing methodologies. Data from trend reports indicate a growing interest in barrel-aged stouts, wild ales, and hazy IPAs, highlighting a move toward more complex and artisanal taste experiences. This shift reflects changing preferences among urban demographics, whose appreciation for authenticity fuels growth through experimentation and discovery. Premiumization and a strong focus on product quality have become powerful drivers of consumer demand, even in casual retail settings.

Experiential Marketing Boosts Craft Participation

Spain's craft breweries are focusing on experiential initiatives to enhance consumer interaction and stand out in a crowded market. In 2025, experiences like brew-your-own beer classes, sensory tastings, and beer dinner pairings featuring local chefs are on the rise, providing immersive experiences that build brand awareness. Breweries are collaborating with local chefs for food-pairing meals and creating seasonal taproom events tied to cultural or artisanal heritage. The digital platforms are also being embraced to undertake virtual brewery tours, online tastings, and pre-orders of limited edition, reinforcing connection with domestic as well as international consumers. This helps to support Spain craft beer market with a focus on how the consumer experience is becoming a key foundation of brand strategy. With the creation of experience-driven moments outside the pint glass, the breweries are cultivating stronger loyalty and word-of-mouth growth. Online forums also are intensifying these experiences through peer reviews and social media, making craft culture more visible and accessible. In the end, the experience-led marketing phenomenon is creating a craft beer atmosphere characterized by regional pride, interactivity, and creativity.

Spain Craft Beer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, age group, and distribution channel.

Product Type Insights:

- Ales

- Lagers

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ales, lagers, and others.

Age Group Insights:

- 21–35 Years Old

- 40–54 Years Old

- 55 Years and Above

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 21–35 years old, 40–54 years old, and 55 years and above.

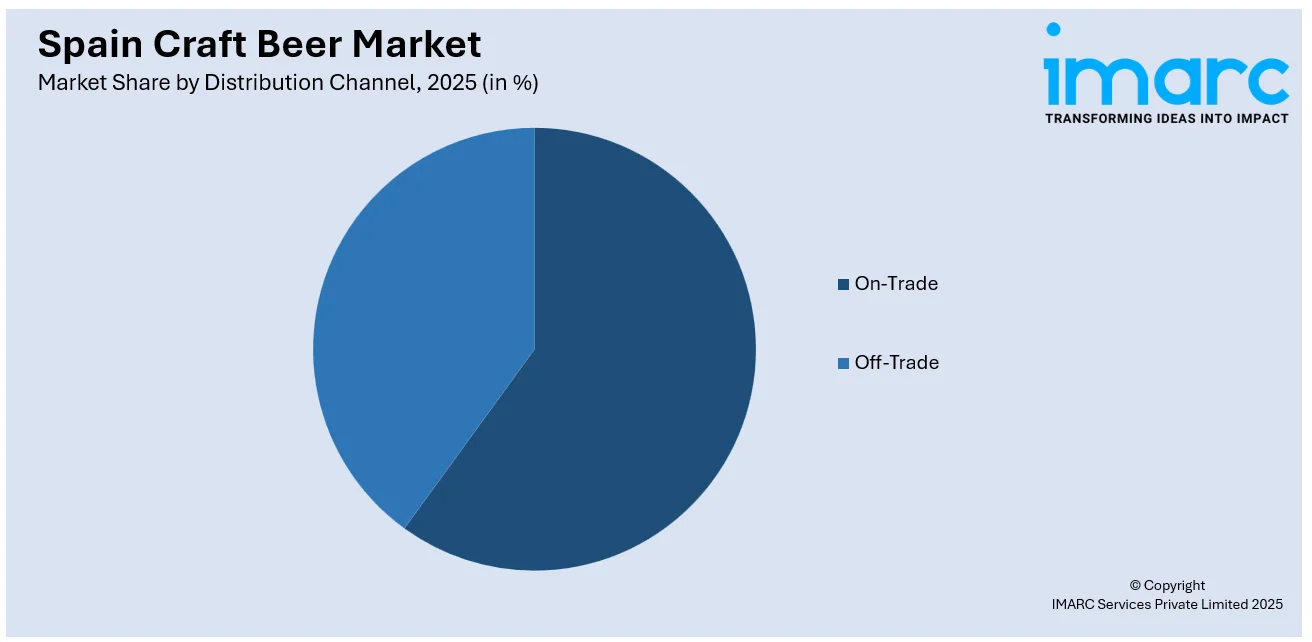

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- On-Trade

- Off-Trade

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes on-trade and off-trade.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Craft Beer Market News:

- April 2025: Hijos de Rivera, the Spanish brewer behind Estrella Galicia, has taken a majority stake in Basqueland Brewing, a respected craft brewery based in San Sebastián’s Hernani region. The partnership reinforces Hijos de Rivera’s “craft brewers project,” aiming to broaden its premium portfolio and support independent brewing initiatives.

- October 2024: Tucked into Madrid’s Vallecas district, Compañía de Cervezas Valle del Kahs (CCVK) is a family-run Spanish brewery operating in a former bleach factory. Founded by Dani and Silvia, both former professionals in marketing and art, it blends industrial roots with creative flair. After launching via nomadic brewing, their own spacious facility now produces a broad lineup of traditional and experimental beers, alongside collaborations with other craft brewers. CCVK exemplifies Spain’s burgeoning craft beer scene and its growing cultural resonance.

Spain Craft Beer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ales, Lagers, Others |

| Age Groups Covered | 21–35 Years Old, 40–54 Years Old, 55 Years and Above |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain craft beer market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain craft beer market on the basis of product type?

- What is the breakup of the Spain craft beer market on the basis of age group?

- What is the breakup of the Spain craft beer market on the basis of distribution channel?

- What is the breakup of the Spain craft beer market on the basis of region?

- What are the various stages in the value chain of the Spain craft beer market?

- What are the key driving factors and challenges in the Spain craft beer?

- What is the structure of the Spain craft beer market and who are the key players?

- What is the degree of competition in the Spain craft beer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain craft beer market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain craft beer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain craft beer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)